Selling institution sniper Niming Youpin Company said that the short -selling report "has no basis"

Author:Cover news Time:2022.07.27

Cover Journalist Zhu Ning

Mingchuang Youpin announced on the morning of July 27 in the Hong Kong Stock Exchange that the short -selling agency Blue ORCA Capital had no basis for allegations in a short -selling agency report and included misleading conclusions and interpretations of relevant company information. The board of directors of Mingchuang Youpin (including the Audit Committee) is reviewing such allegations and considers to take appropriate action to protect the interests of all shareholders.

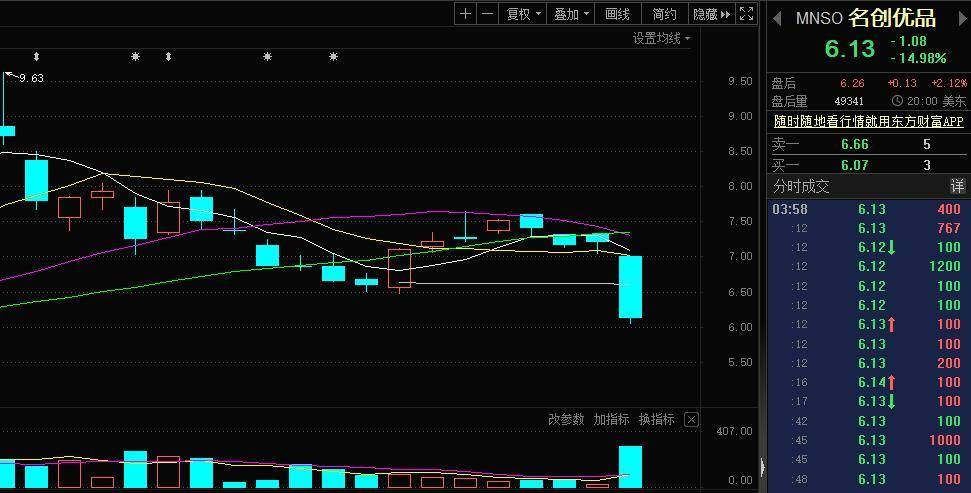

On July 27th, as of press time, the Hong Kong stocks of Mingchuang Youpin fell 10.01%to the HK $ 12.580 per share; the name of Mingchuang Youpin US stocks fell 14.98%yesterday to US $ 6.13 per share.

Surprising institutions question

Blue ORCA Capital, known as short -term, has shortly made a lot of Chinese stocks in the US stock market and the Hong Kong stock market in recent years, but most of them are short -time. Famous creation.

On July 25, Blue ORCA Capital disclosed the short position of the company. Blue ORCA said that hundreds of famous stores did not operate an independent franchise network, but "a personal secret ownership and operation that is closely related to the chairman of the chairman."

The report disclosed by Blue ORCA Capita shows that "famous and Chuangyou claims that its 99%of stores in China are operated by independent franchisees. This basic narrative is a lie. After 7 months of investigation, we found that 620 stores were high by $ MNSO high. Tube or people who are closely related to Ye Guo, chairman of $ MNSO, have a close relationship. "

At the same time, the report also showed that shortly after listing, the famous Chuang Youpin and his chairman (Ye Guofu) established a joint venture of the British Virgin Islands to establish a huge Chinese headquarters. Although only 20%of the equity of a joint venture is held, Mingchuang Youpin will use all the original 346 million yuan deposits to purchase land.

In this short -selling report, there is also an interview with the former manager of Mingyuyoupin. The interview stated that the revenue and profits of the stores of Mingchuang Youpin are declining, and long -term franchisees are also abandoning and leaving the market.

In the end, Blue ORCA Capital concluded that because investors believe that the famous and high -profile business model of light assets and high profits, Mingchuang Youpin was traded at 1.4 times the price. However, Blue ORCA proves through due diligence, "Famous and Chuangyou is more like a declining physical operator, and we think we should re -valuation."

Mingchuang Youpin landed in the NYSE in October 2020, and once hit a historical high of $ 34.8/share, with a total market value exceeding the $ 10 billion mark. But since March 2021, Mingchuang Youpin's stock price has begun to turn around. As of the closing of July 26, the stock price of Mingchuang Youpin Meimei was closed at $ 6.13, and the interval declined by more than 80%. On July 13 this year, when Mingchuang Youpin landed on the Hong Kong Stock Exchange, the first trading day failed to touch the issuance price. Behind the plunge of U.S. stocks and the break of Hong Kong stocks is the fact that the revenue growth rate of Famous and Chuangyin has significantly stagnated, and in the past three years, it has a cumulative loss of nearly 2 billion yuan in the past three years.

Blue ORCA Capital has made multiple air stocks many times

The profitability of the short -term institution is actually very simple. Most of the cores such as the financial data of listed companies, related related transactions, high valuations, and executive behavior as a breakthrough. And sell it, and then the short -term institution issued an investigation report to expose the company's operating problems, thereby suppressing the stock price stock indexes, etc. After the company's stock price plummeted, the stock price purchased the stocks and returned to the broker. Through such a process, a large amount of money in the shortcomings made a lot of money.

The simple logic of making money has given a large room for short -to -short, and many short -selling institutions have also appeared. The short -selling agency of this incident, Blue ORCA Capital, was called "killing whale" in the industry. The well -known American short -term short -known Grax co -founder Anda.

The short -selling institution pays a lot of attention to China Stocks, and most of the Chinese stock companies are mostly in the rapid development of the industry, so they will moderately use the loose regulations of US stocks to regulate listing and financing, but in fact, the company's own profitability is actually uncertain, so therefore There may be virtual performance and other conditions. On May 24, 2018, Blue ORCA Capital made the first time to successfully do the Snacks of the Sky (1910.HK), which was successfully made, and the latter's stock price fell by more than 80 % since then.

However, as the compliance of listed companies in China has continued to strengthen in recent years, the short -term institution is almost impossible to choose a problem by turning the financial report. Although frequent air stocks are frequently made, the overall record is difficult to say "optimism", including "Sniper" such as Pinduoduo and China Feihe.

On the morning of July 8, 2020, Blue ORCA Capital released a short report on Chinese Feihe. Facing the short of Blue ORCA Capital, China Feihe publicly responded that Not accurate and misleading. Feihe also said that the company reserved the right to take legal measures on Blue ORCA Capita reporting related matters.

At that time, the stock price of Feihe rose rapidly after a short fluctuation of the day, and finally closed at HK $ 16.96/share, and the stock price rose 7.21%on the day. In the end, Blue ORCA Capital failed to short the Chinese flying crane operation. In the event of short -selling, actively counterattack with facts

When the short -term enterprise is short, the core is to make huge profits, and the reason why the company's short -term institutions are successfully shorted, mostly due to the problems of the company's operations. These or large or small problems are amplified by the short or small. Faith, which triggers the stock price plunge.

How to face the malicious shortness of these short -selling agencies? What should the enterprise should make and counterattack after being short? Some researchers told reporters that at present, Chinese companies generally use emergency suspension, resolute denial, and increase their stock prices in the face of such incidents. In fact, they are still passive. In this process, the most important thing is to respond to it, and use all available media platforms and investors to conduct fast, frank, and efficient communication to explain the questioning of the short -selling institutions with data and facts. Copy and counterattack.

The researcher emphasized that the short -selling agency is to seize the loopholes of the enterprise to "make an article". If the enterprise itself does not have a big problem, then there is no need to be afraid. Therefore, as an enterprise, it is necessary to optimize the business model, to limit the abuse of authority through internal checks and balances, and to truly do it. Responsible for external investors.

- END -

Summer Safety | Mianyang City Fire Fighting Development of Outside School Training Institutions!

Summer comingThe increase in various types of training institutionsBuild an off -s...

Yueyang: Poet writers of the 13th village of Caifeng Ecological Ecology feel the charm of rural revitalization

Yueyang Radio and Television New Media July 27th (Reporter/Ning Ping) The Thirteen...