Surprising!After a group of enterprises went to Hong Kong, the exchange could not be found!

Author:Daily Economic News Time:2022.07.27

Recently, some enterprises have publicly announced that they have been listed on the "Hong Kong Exchange" and announced their equity code, and even some companies have issued joy for "listing".

At first glance, these companies seem to have rushed into the capital market. However, opening any transaction software to search for its "stock code", and no results are found. What is going on?

That's right, a lot of enterprises go to Hong Kong, but they are not listed in the traditional Hong Kong Stock Exchange, but they are listed on the China Stock Exchange.

What is even more surprising is that around this "China Stock Exchange", a industrial chain has been formed -the establishment of a "China Stock Exchange" company in Hong Kong to provide a paid listing service for enterprises; on the one hand On the one hand, I turned back to help the enterprise propaganda.

After the successful listing, these companies have publicly publicized that they have been listed on "Hong Kong Listing", "Hong Kong Exchange", "China Stock Exchange Listing" ...

One group of enterprises go to Hong Kong to list

Successfully listed on the Hong Kong Exchange;

Equity code HK10717;

Together with the equity dividend together;

Native

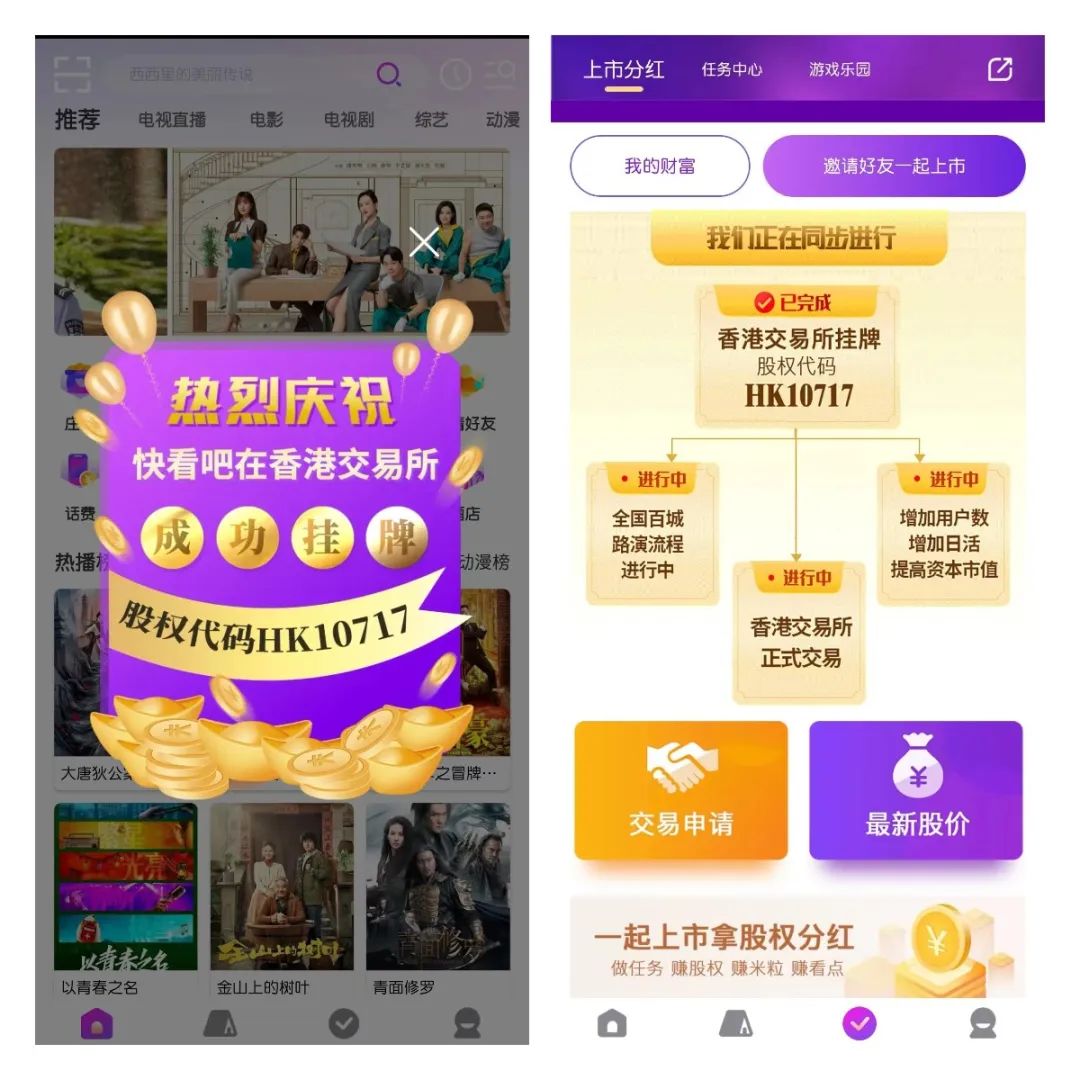

This is the promotional information in the "Come on" app.

Image source: Look at the app screenshot

At first glance, the company seems to have rushed into the capital market. However, open any authoritative trading software or search for its "equity code" on a regular exchange website, and you can't check the results. What is going on?

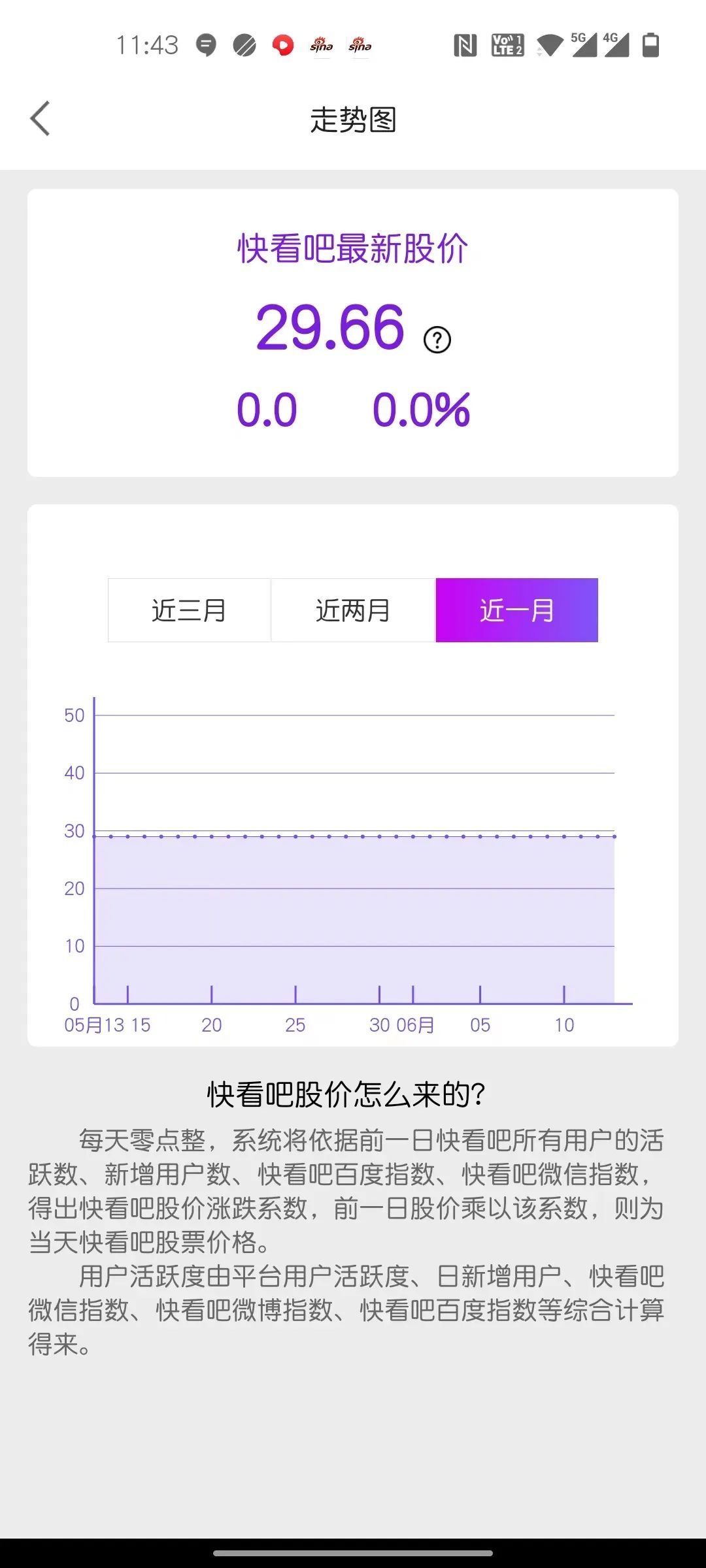

With this doubt, the reporter further explored the "Come on" APP.

This app has several major modules "Homepage, Video, Manor, Mission, Mine". The homepage mainly presents film and television, variety shows, novels and other content, but in the "task" module, the reporter found that he wrote information such as "Hong Kong Exchange Listed" in a prominent position, and also attached the latest stock price. But it is amazing that this "stock price" is not the stock price we understand, but the coefficient of obtaining the coefficient of the active number, the number of new users, the Baidu index, and the WeChat index based on all the users of the APP. "Stock price" obtained.

Image source: Look at the app screenshot

Through the website search, the reporter found several information titled "Warm Congratulations to" Congratulations to "Congratulations to" Hurry to Watch the Film and Television "to successfully list the Hong Kong China Exchange. According to the information, on December 22, 2021, the chairman, executives and market elite partners of Shaanxi Xinren Tiandi Information Technology Co., Ltd. participated in the corporate listing ceremony in Shenzhen, with the corporate code HK10717. According to the introduction of the APP user protocol, you can see that the operating main company of the APP is Shaanxi Xinren Tiandi Information Technology Co., Ltd.

Hunan Souqing E -commerce Co., Ltd. also mentioned on Weibo that it was successful in Hong Kong on August 30 last year.

Picture source: company official Weibo

The reporter found that some companies announced their public accounts, APPs, or websites to be listed on the China Stock Exchange, and on the Internet, most of the communication information has quietly brought the words "listing".

Picture source: network screenshot

Picture source: company WeChat public account

Some companies even issued a good news for "listing":

Picture source: company WeChat public account

The little -known China Exchange surface surface

That's right, a lot of enterprises go to Hong Kong, not all the Hong Kong Stock Exchange in the traditional sense, but the little -known China Stock Exchange.

After the listing was successful, some companies began to publicize that they had "listed on the market in Hong Kong" and "listed on the China Stock Exchange".

Who is this China Stock Exchange?

The China Stock Exchange website shows that its full name is "China Exchange (Hong Kong) International Financial Services Co., Ltd.", which is referred to as HSEEX in English, and was established in Hong Kong on November 7, 2017. Open the website, you can see such a slogan: creating the most popular capital service platform in SMEs in the world, helping Chinese enterprises global development. The website uses traditional Chinese.

According to the website, the China Stock Exchange mainly provides professional international capital services to Hong Kong and Mainland SMEs (non -listed enterprises), provides information release, listing services, mainland equity transactions, and providing personalized service platforms for SMEs.

Image source: "China Stock Exchange" website screenshot

It can be seen from these introductions that the China Stock Exchange is indeed providing a listing service for enterprises, but it carefully bypasses the word "listing".

The "Promise Book" provided by the China Stock Exchange website shows that companies listed on the China Stock Exchange shall promise not to use the name of HSEEX or using the HSEEX listing display to mislead the third parties. Words or expressions such as code "code" "equity code".

What are the companies listed on the China Stock Exchange?

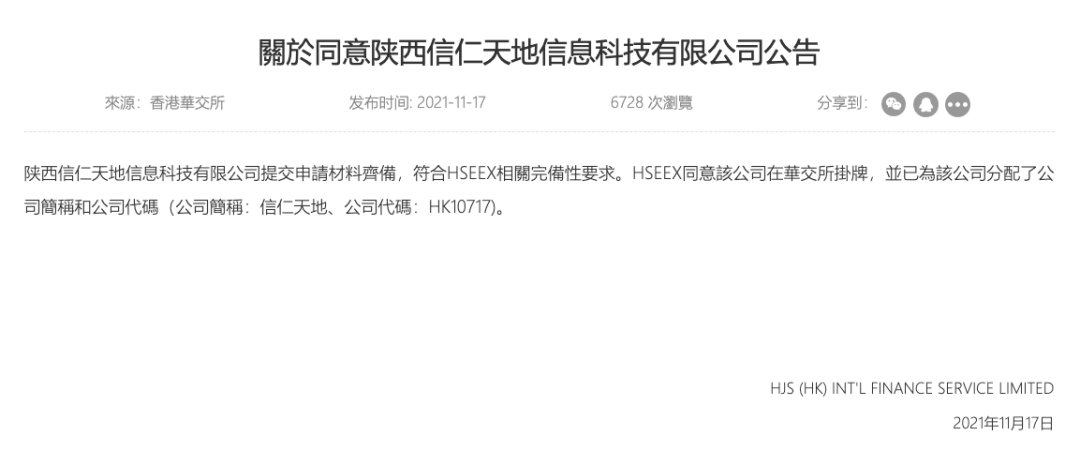

The reporter consulted the "Listing Announcement" column of the China Stock Exchange website. The "Come on" APP main company mentioned above Shaanxi Xinren Tiandi is also among them.

The "Announcement of Agree to Agree Shaanxi Xinren Tiandi Information Technology Co., Ltd." stated that "Shaanxi Xinren Tianki Information Technology Co., Ltd. submits application materials to be available to meet HSEEX's relevant completion requirements. HSEEX agrees to the company's listing on the China Stock Exchange and has allocated to the company. The company's abbreviation and company code (Company abbreviation: Xinren World, Company Code: HK10717). "The announcement time was November 17, 2021.

Picture source: Screenshot of the China Stock Exchange website

According to statistics, as of press time, the total number of listed companies displayed by the China Stock Exchange website has exceeded 60. Among these listed companies, there are electric bicycle sales companies with both registered capitals with only 100,000 yuan, as well as agricultural development companies with a registered capital of 200 million yuan. The reporter learned that according to the China Stock Exchange website, it implemented a "wide application".

Any enterprise that can be transferred in accordance with the law can apply for listing on the China Stock Exchange. The type of listed enterprise is not limited to the joint -stock company, and also includes a limited liability company and other types. It is not limited to the company's registration place and its industry and ownership component. If it is not within the scope of the acceptance, only the mainland individual industrial and commercial households, the wholly -owned enterprise, and the wholly unlimited company in Hong Kong.

In terms of processes, the China Stock Exchange website clearly mentioned that if companies want to be listed on the China Stock Exchange, please choose the appropriate recommendation agency.

As for the relationship between the China Stock Exchange and the recommendation agency, it is said that the members of the recommendation agency should diligently, honesty, and trustworthy, and assist them in the listing procedures on the basis of voluntary listing of enterprises. Do not mislead the company to listed on the China Stock Exchange with any improper means. The China Stock Exchange reserves the right to cancel the qualifications of the recommendation agency to violate the rules.

Why do these companies choose to listed on the China Stock Exchange, and what can they hang through?

According to the corporate information disclosed by the China Stock Exchange website, the reporter randomly dialed the phone number of several listed companies. On the phone, these companies said to the listing.

Some companies said that they have received capital injection and listed without spending money; some companies say that they directly connect with the China Stock Exchange and spend about 10,000 yuan; some companies have spent more than 100,000 yuan through the intermediary.

According to a reporter's investigation, it is true that many companies listed on the China Stock Exchange's on -site photos, including gongs, interviews, and collective photos. The reporter noticed that one of them was a photo of Shaanxi Xinren Tiandi: more than ten people wearing a red scarf, standing side by side on the stage, pulling a red banner with traditional Chinese characters: Shaanxi Xinren Tiandi Information Technology Co., Ltd. Successfully landed in the Hong Kong China Stock Exchange, corporate code: HK10717.

As for why they choose to be listed on the China Stock Exchange, some companies say that in order to expand their popularity and expand the cooperation circle, they also say that they have received some cooperation inspections through this channel after listing; Enterprise staff believes that the listing effect is not easy to evaluate. "You don't expect that the value is too high. It (China Stock Exchange) also confiscates how much you don't have you, mainly to increase the exposure of the enterprise, and then push the business out. This is the most important. "

The intermediary claims at a minimum of 100,000 to be listed on the China Stock Exchange

What are the recommendations for the China Stock Exchange's listing business? The reporter flipped through the previously collected listed company pushing articles and noticed that the institution of Shenzhen Qianhai Zhongtian Enterprise Consultation Management Co., Ltd. (hereinafter referred to as "Qianhai Zhongtian Capital").

With "Qianhai Zhongtian Capital" as the keyword, the reporter found its website.

According to the website, Qianhai Zhongtian Capital focuses on providing listing and equity investment and financing services for small and medium -sized enterprises across the country. The company relies on the Stock Exchange and the Stock Exchange. It has experts and business elites in various fields of 1100+ finances to help companies successfully list more than 1,000. Specify a sponsor service provider.

“前海中天资本主要为企业提供从进入资本市场到上市IPO的一整套全方位解决方案。服务内容包括:挂牌上市、企业估值、股权投融资、股权激励、商业模式梳理、顶层架构设计、 Capital operation services such as financial consultants, legal advisors, mergers and acquisitions and reorganizations. "Its website wrote.

On the website's conspicuous position, the reporter did not find the information related to the Huajiao Office. However, in the "Zhongtian Dynamic" column, I saw an article of "XX Company's Successful Listing Hong Kong". The information in the picture shows that the "listed" location of the company is the China Stock Exchange.

Image source: Shotshot of Qianhai Zhongtian Capital Website

Does the business scope of this intermediary service provider involve the China Stock Exchange? In order to further understand the relevant situation, the reporter dialed the hotline of the hotline published by Qianhai Zhongtian Capital Website as a small and micro enterprise employee in the first half of this year. Contact.

"We are exclusive 'sponsoring agencies', and we can do it." When he heard that reporters wanted to find a channel, Zhang Qiang said "no problem."

However, if you want to be listed on the China Stock Exchange, you need to pay a certain fee. "Depending on the situation of the company, if your corporate financial report is particularly complicated, the price may be higher. If the company is particularly 'clean', it will declare directly when it comes, about 80,000 to 100,000." Zhang Qiang told reporters.

In the exchange, Zhang Qiang also emphasized that this cost is settled at one time. After the corporate listing of the China Stock Exchange, no cost will be charged. "We will write well in the contract and do not pay for life."

Just in the company

Hold a listing ceremony?

In order to further understand the process of the China Stock Exchange and the relationship between Qianhai Zhongtian Capital and the China Stock Exchange, the reporter continued to consult Zhang Qiang.

After the reporter expressed his intention to list the China Stock Exchange, Zhang Qiang took the initiative to recommend a "super special" service solution. The so -called "super special session" means that without going to Hong Kong, a listing ceremony can be held at the location of the enterprise. "If you want to do it now, we can go directly to your home to do a super special session. We can come to the exclusive sponsorship and apply directly to the Hong Kong China Stock Exchange." When the reporter asked what materials needed to prepare for docking Zhang Qiang bluntly said: "You can rest assured, if you do a special session, we will cover everything you have with the strongest means." At the same time, he also said that after preparing the materials, Zhongtian Capital will be a exclusive sponsor. Write a sponsor letter from the individual to sponsor and open a green channel.

Zhang Qiang said that the sponsor will use all means to help the enterprise. "We all do it for others, and we will help you make the enterprise regularly." In order to dispel reporter's concerns, in the telephone exchange, Zhang Qiang also also also Mentioned a saying that helps companies integrate huge sums of money.

In order to clarify the specific service content of "Super Special", the reporter asked Zhang Qiang to provide two contract templates for special activities, one is the "Hong Kong OTC Listing Service Agreement", and the other is the "Capital Operation Counseling Service Agreement" , Party B of the two contracts is Zhongtian Capital Holdings (Shenzhen) Co., Ltd. As for the difference between the two contracts, Zhang Qiang admits: one with financing, one without financing.

Picture source: taken by reporter every reporter

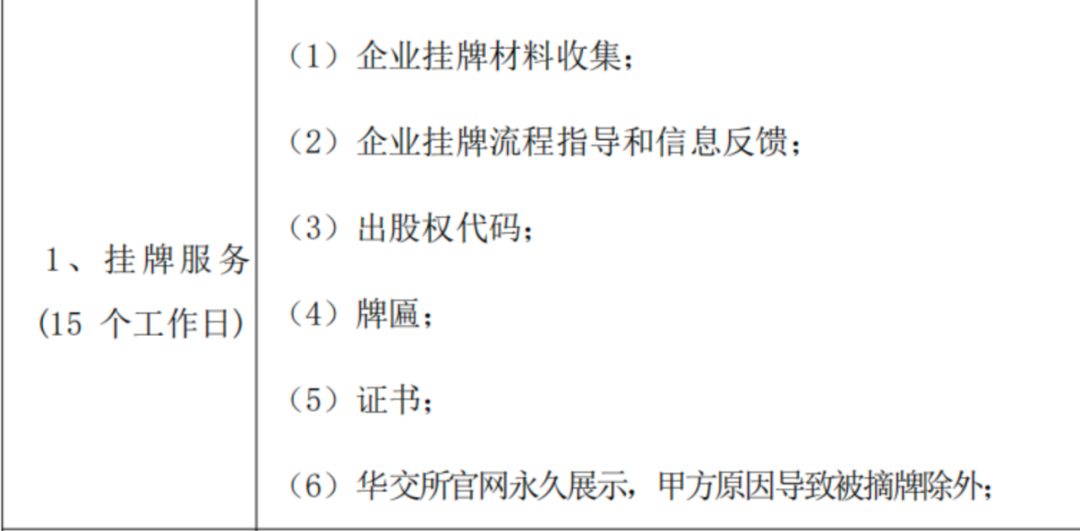

The reporter saw that in the "Hong Kong OTC Listing Service Agreement", which is "without financing", Party B's service content mainly includes listing services, special listing ceremonies, media promotion, special promotional videos, Nasdaq large screen, corporate IPO, corporate IPO Counseling, cost is 500,000 yuan.

In the "Capital Operation Counseling Service Agreement" of "financing", Party B's service content has increased the three items of the business model plan and listing path planning, the top -level architecture design, and financing roadshow planning on the basis of the former. More expensive, for 1 million yuan. However, Zhang Qiang revealed that there is room for discussing. He also mentioned that if special activities have the nature of financing, Zhongtian Capital will charge 3 to 5 "financial consultants" fees after the company's financing is successful.

It is worth mentioning that in terms of listing propaganda, both agreements provide "Nasdaq's large screen" service.

The big screen of Nasdaq is one of the advertising screens standing in the New York Plaza, and below it is the only way to enter the Nasdaq Exchange. According to Zhang Qiang, it is true to put advertising services on the Nasdaq's large screen. "We have the American team to help you do there."

The reporter learned through the intermediary that the XYZ Holdings Group (pseudonym) had advertised on the Nasdaq large screen and promoted it in China. The reporter found the relevant promotional video on the Douyin platform, and saw the name of XYZ Holding Group on the list of listed companies on the China Stock Exchange.

Is it so easy to board the Nasdaq big screen? Although Zhang Qiang did not disclose the specific price, the reporter also searched on the Taobao platform that it could provide a shop that could provide Nasdaq's large -screen service. According to the shop customer service staff, the quotation of Nasdaq's large -screen services is 20,000 to 40,000 yuan per minute.

Recently, the reporter once again called the service hotline provided by the Qianhai Zhongtian Capital Website. The staff who answered the phone said: "I am the front -end customer service ... our business is the listing of the Shanghai equity custody trading center." When the reporter said that he saw a lot When Mainland companies were recommended by the China Stock Exchange through Qianhai Zhongtian Capital, the other party replied: "We don't know."

不过根据此前获得的前海中天资本提供的《香港OTC挂牌服务协议书》以及《资本运营辅导服务协议书》显示,在乙方服务内容中,第一项挂牌服务中第六条显示,华交所The official website permanently displayed, and Party A's reasons were all delisted.

Image source: Screenshot of the agreement provided by Qianhai Zhongtian Capital

At the bottom of the China Stock Exchange:

Is a private Co., Ltd.

So, how many gods are this "eclectic" absorbing the China Exchange of listed companies?

According to the China Stock Exchange website, its company's main body is the China Exchange (Hong Kong) International Financial Services Co., Ltd., which is affiliated to Hong Kong China Business Financial Holding Holding Group Co., Ltd. (hereinafter referred to as "Huashang Financial Holdings").

According to the information of the Hong Kong Special Administrative Registry, the China Stock Exchange (Hong Kong) International Financial Services Co., Ltd. is a private stock company, which was established on November 7, 2017. The company's major shareholder is Huang, Huang, holding 99%of the shares, and the registration site is located in a community in Nanshan District, Shenzhen, Guangdong Province.

Huashang Financial Holdings is also a private joint -stock company. It was established on July 9, 2019. Its wholly -owned controller is the same name as Huang Mou, a major shareholder of the China Stock Exchange (Hong Kong) International Financial Services Co., Ltd., and the same name is registered.

In the exchange with reporters, Zhang Qiang once revealed that the China Stock Exchange was charged by Huashang Group. According to the information provided by Zhang Qiang, Huashang Group is a company called "China China Business Group Co., Ltd.".

The reporter inquired at the Registration Office of the Hong Kong Special Administrative Region that China China Business Group Co., Ltd. was a private stock company. It was established on February 10, 2009. The company is in a "registered" state. According to the website information of Huashang Group, China Business Group was founded in 2014. It has three major sectors: Huashang Association, Huashang Industrial, and Huashang Finance. Among them, the China Stock Exchange is one of the five core services provided by the China Business Association. In the introduction, the China Stock Exchange is described as "China's first global equity and stock market allocation service platform. It is listed on different needs of domestic enterprises and listed on different capital markets around the world to achieve the docking of industrial and capital."

China Business Investment Association Organization Architecture Picture Source: Screenshot of Huashang Group Website

In order to further understand the situation, the reporter dialed the contact number given by the China Stock Exchange website at the time as an enterprise.

This is a call number belonging to Hong Kong. After the phone is connected, the other party confirms that it is the China Stock Exchange. When the reporter asked the China Stock Exchange in Hong Kong as an enterprise employee, the recipients answered the phone with the Mandarin with a strong Cantonese voice: "Our company is in Hong Kong and Shenzhen." When the reporter asked the company listing services, the other party was listed, the other party was Let reporters leave contact information and arrange professionals to help reply.

After waiting for a long time, the other party finally gave a contact information for the "China Stock Exchange in the Mainland". Through this contact, the reporter contacted the contact Wang Ming (pseudonym). Wang Ming told reporters that the China Stock Exchange is an off -site equity trading center for privately, which can help enterprises carry out equity financing and equity listing. Later, Wang Ming informed the address.

On -site visit:

Staff teach you how to speak

In the first half of the year, the reporter came to Smart Square. As soon as you get out of the elevator, you can see a red background board of the "Hong Kong China Stock Exchange Enterprise Listing Ceremony", and the company's office area occupies the entire floor of the office building.

This is full of the signed background board that the organizer of the Hong Kong China Stock Exchange's enterprise listing ceremony is the Hong Kong China Exchange and Zhongtian Capital; the support unit is Huashang Group and Dafu Capital.

Picture of the internal and external environment of the China Exchange: Photo by a reporter

The reporter continued to walk in and saw the logo of the Chinese Business Group. In addition, at the front desk, the word "Shenzhen International Financial Research Association Listed Companies Club" is also marked.

Picture of the front desk of Huashang Group: Photo by reporter every reporter

After entering the office area, after showing that he was a customer who wanted to list the China Stock Exchange, the on -site staff did not introduce the business to reporters as soon as possible, but asked the reporter who's resources. After getting the determined docker, he took the reporter to the office and saw another staff member.

"We are established in Hong Kong. We are all true, compliant and legal." In the exchange, the staff member told reporters that the China Stock Exchange is similar The listing fee is 30,000 to 60,000. The listed company will get its own equity code from the China Stock Exchange and will also be awarded. For enterprises with bells for propaganda, they will charge another fee, with a fee of about 20,000 yuan.

However, he reminded that in foreign propaganda, companies need to master a certain skill skills. "You say that it is listed on the China Stock Exchange, which is compliant and legal. To tell you clearly, we are an off -site equity trading center. "

He said that listing on the China Stock Exchange is just a stepping stepping tile in the capital market, which can help enterprises increase their popularity. You dock. We can also help you go to local equity financing. Let's do sales for you. "

In his introduction, the China Stock Exchange is not only a listing place, but the system behind it also plays the role of a counseling agency. According to the overall situation of the enterprise, it can evaluate the place where the enterprise is suitable for listing. The enterprise "buy shells" is listed, and provides multiple services such as project roadshow and summit docking.

At the office floor of the China Stock Exchange, the reporter saw the place where the enterprise was listed and was within the office area of the China Stock Exchange. In addition, on the wall of the office area, some financial institutions cooperated with the China Stock Exchange. According to him, some of these institutions are used to financing loans, and some of them are cooperative agencies when listed companies do market value management. "There are more than 600 listed companies that have hatched. There are companies that are financed or listed. "

The Hong Kong Securities Regulatory Commission said that there is no licensed information from the China Stock Exchange

What kind of platform is the China Stock Exchange with a number of service content with a number of service content?

The website mentioned that the China Stock Exchange mainly provides professional international capital services for small and medium -sized enterprises in Hong Kong and the Mainland, providing information release, listing services, mainland equity transactions, and providing personalized service platforms for SMEs.

Wang Ming once mentioned earlier said that the China Exchange is an off -site equity trading center established by the China Exchange.

According to the previous agreement provided by Zhang Qiang, it is not difficult to see that for customers, Qianhai Zhongtian Capital also defines the China Exchange as an OTC market.

OTC, the full English name Over-The-Counter, refers to the trading market outside the field, or the counter trading market. Different from the electronic transaction that concentrated in the open market, there is no concentrated unified trading system and place on the off -site trading market, which is a non -public market transaction. In my country, the overseas trading market provides a possibility of circulation transfer for securities that cannot be listed on the stock exchange. For example, the Shanghai Equity Custody Trading Center, which was unveiled in July 2010, provided financial services such as restructuring, non -public issuance, stock registration, stock transfer, etc. for non -listed SME markets.

In order to further verify the nature of the China Stock Exchange, the reporter contacted the Hong Kong Securities Regulatory Commission through email as an investor to ask if he knew the company.

The Hong Kong Securities Regulatory Commission clearly stated in the mail reply: According to the Council of the Association's "Public Records of the licensed and registered agencies", the Association did not have the licensed information of the "China Stock Exchange (Hong Kong) International Financial Services Co., Ltd.". Therefore, the association cannot provide any relevant information.

In addition, the Hong Kong Securities Regulatory Commission also emphasized in the email that companies or individuals who engage in regulatory activities in Hong Kong, including securities, futures and banks other than leverage foreign exchange markets, must receive or register with the securities and futures affairs supervision committees. And reminded, "Avoid trading with unlicensed companies."

Hong Kong Securities Regulatory Commission replied to email picture source: mail screenshot

The reporter noticed that on the official website of the Hong Kong Securities Regulatory Commission, a questioning guide for "Do you need to receive a license or register?" The guide shows that if any company belongs to the "Company Regulations" (chapters 622), the private company referred to in Article 11 of Article 11, its shares or claims, are not included in the definition of the term "securities". Therefore, the "private equity capital" or "entrepreneurial funds" investment portfolio that does not involve securities is not required to conform to relevant issuance regulations.

In order to further understand the supervision of equity trading activities outside the Hong Kong Stock Exchange, the reporter also called the Hong Kong Securities Regulatory Commission Media Inquiry Office. The staff who answered the phone said: "If it is simply asking, there is no supervision of overseas transactions in Hong Kong. . There are several regulatory activities under the Hong Kong Securities Regulatory Commission. The seventh of which is automatic quotation. For example, when some new stock IPOs are involved in automatic (equity) quotation function, then it is theoretically supervised by the CSRC. "

At the same time, the other party also told reporters: "Generally speaking, private companies are not supervised by the Securities Regulatory Commission. If it involves the business below the Regulations, then related projects may be supervised by our supervision."

For the China Stock Exchange, some people in the industry also analyzed reporters.

An industry insider who has more than 30 years of work experience in Hong Kong said that Hong Kong has not been a second -level OTC market (Secondary OTC Market) like Shanghai Equity Custody Trading Center, nor has it heard of "Hong Kong OTC" or "Hong Kong Equity Trading Center "This kind of trading venue. "Even if there is no trading center, if two private people do buy and sell, of course, privately can be dealt with. If a trading center is set up, many people want to go in to buy and sell, and I believe that the Hong Kong Securities Regulatory Commission will not allow it."

Ye Shangzhi, chief strategist of Shanghai Securities Co., Ltd., said to reporters through WeChat: "There are off -site transactions in Hong Kong, but I have never heard of the platform platform that is recognized by the public." In addition, for the field of Hong Kong The supervision of foreign equity trading activities, Ye Shangzhi believes that "the reason, if it is not traded on the platform of the Hong Kong Stock Exchange, it will not be supervised by the (Hong Kong) Securities Regulatory Commission."

As for whether a company registered in Hong Kong serving equity trading activities should be supervised, Lawyer Xu Junjian of Dacheng (Hong Kong) Law Firm told reporters through WeChat: "If you want to engage in equity trading business, you must get approval in advance."

Regarding the situation of the Hua Jiaotai, recently, the reporter officially called the consultation phone announced by the official website of the China Stock Exchange. The staff who answered the phone said: "The corresponding license is that we are here in Hong Kong." When the reporter asked the specific license name, the other party said it was inconvenient to disclose. In the exchange with reporters, the other party clearly claimed that the China Stock Exchange belonged to the OTC of Hong Kong.

Lawyer: It must not be used without authorization

"Stock Exchange" or similar title

It is worth noting that the name of the company's company contains the word "exchanges "-" China Stock Exchange (Hong Kong) International Financial Services Co., Ltd. ". However, during the interview, the reporter found that when he heard the "exchanges", many people thought of the exchanges invariably. Secondly, rhetoric such as "listing" and "recommendation agencies" appearing on the China Stock Exchange's website is also easy to connect with the three boards and four board markets in the Mainland.

So the question comes, is there any "transaction" of the China Stock Exchange?

The introduction of the China Stock Exchange website only mentioned "providing information release, listing services, mainland equity transactions, and providing personalized service platforms for SMEs." The business content displayed on the website includes the "listing ceremony", "road show counseling", "mergers and acquisition services", "investment and financing services", "member activities" and "capital business school". In addition, although the website has the basic information display of "listing" enterprises and the offer of these companies, there is no trading rules.

Image source: "China Stock Exchange" website screenshot

According to the reporter's description, Lawyer Yin Hao of the Han Sheng Law Institute thought of similar cases he had dealt with, and said on the phone: "It may be a display, not trading, or may not be able to trade. Public transactions and non -public transactions. "Lawyer Lu Wulwang, a senior partner of Beijing Dacheng (Guangzhou) Law Firm, said through WeChat:" If only the equity quotation information is displayed, then it is actually a information providing an institution. Providing open bidding and matching transaction services means that the buyer and the seller still have one -on -one negotiations and transactions. This still belongs to the nature of 'private equity', and it should not involve special supervision approval issues. "

Lawyer Xu Junjian, who is familiar with the law of the Hong Kong Special Administrative Region, said that in Hong Kong, whether it is publicly traded or not, if it involves the shares of a listed company, it will be supervised. If you only provide information (such as the latest stock price) and no other services, you can not be subject to supervision.

Another question worthy of attention is whether the company name has the word "exchanges", and is it standardized to use "listing" and other rhetoric?

The reporter called the Registration Office of the Hong Kong Special Administrative Region. The other party said that if the company's name is related to the trading venue, it must be approved by the Hong Kong Securities Regulatory Commission (that is, obtaining relevant licenses). As for the case of the China Stock Exchange, "it is possible that the company's name is not obviously a trading venue, so it was approved at the time."

Lawyer Wang Zhibin, Shanghai Minglun Law Firm, told reporters via the phone that Hong Kong's policies are different. There is no problem in violation of local law. But if its main business is in the Mainland, it needs to comply with mainland laws and regulations.

Lawyer Huang Yongchang, Hong Kong He Yaodi Law Firm, said in an interview with reporters that according to Article 34 of the Hong Kong Securities and Futures Regulations (Chapter 571), in addition to the "Exchange Company" defined by the Securities and Futures Regulations, ) Outside, no one shall use or use the "Stock Exchange" or "Unify Exchange" or other similar titles without being authorized by the Hong Kong Securities Regulatory Commission. Violations of this provision will constitute criminal crimes, with a maximum fine of 200,000 Hong Kong dollars and 2 years in prison. As for the fact that the financial financial market information that belongs to factuality, it does not involve any behavior of promoting securities or providing investment opinions. Regulated by the Hong Kong Securities Regulatory Commission.

As for the propaganda terms such as "listing" and the substantive content of their representatives, the reporter verified the regular off -site trading center.

The staff of the Shanghai Equity Custody Trading Center (hereinafter referred to as the "Shanghai Stock Exchange") said: "There are listed companies in our market and display enterprises. The display enterprise is just displayed. Transaction. Only listed companies can conduct online transactions here, because it has a complete information disclosure. "

The staff of Shanghai stocks also said that the companies listed and displayed have code. The listed enterprise must be a joint -stock company, and its equity transaction is carried out online. Unless there are reasonable reasons such as court judgment, inheritance, or transferred to the transfer of free transfer, the listed company can transfer offline equity transfer. At the same time, private equity transfer must be registered for non -trading transfer afterwards to maintain the information of the listed enterprise with the consistent information of Shanghai stocks. For enterprises that only perform information display, their equity transfer behavior is not limited by Shanghai stocks.

Lawyer Yin Hao believes that the mainland officials have not clearly defined "listing", and other exchanges outside the three stock exchanges are generally called "listing". Some are listed for display, and some are listed for transactions. "The main purpose of the company's listing on the four boards is to show, so many institutions can see that it will increase the opportunity to get financing."

"In the United States, there are also listed companies and off -site trading markets (companies). Their English is Listed, (in terms of statement) generally there is no difference. What is the core? What can they do, whether they are legal trading agencies. "Attorney Yin Hao added.

Lawyer Wang Zhibin said: "The business of being listed in the Mainland or recruiting business in this name requires corresponding qualifications, including the approval of the Securities and Futures Commission. Management. If its customers are from the Mainland, but they are financing in Hong Kong and transferred to equity in Hong Kong, its trading land is in Hong Kong. This depends on the relevant laws and regulations of Hong Kong. "

Reporter | Pan Ting Zhang Yi Song Qinzhang (Internship)

Edit | Chen Xing

Coordinating Edit | Yi Qijiang

Vision | Cai Peijun

Video Edit | Bujing

Capture | Chen Xing

Daily Economic News

- END -

"Science and strong body enjoy parent -child time" Parent -child fitness exercises (6)

In order to implement the national health strategy and health Chinese actions, pla...

Accurately predict more than 100 deaths, the furry death died this year

The cat named Oscar just woke up and opened one eye to scan his territory. It look...