@Individual industrial and commercial households: preferential tax and fee preferential policies for relieving difficulties, please check

Author:Chinese government network Time:2022.07.27

Source: WeChat of the State Administration of Taxation

In order to implement the decision -making and deployment of the Party Central Committee and the State Council to implement new combined tax support policies, it is more convenient for small and micro enterprises and individual industrial and commercial households to understand the applicable tax and fees in a timely manner, the State Administration of Taxation for the taxes and fees of small and micro enterprises and individual industrial and commercial households The preferential policies have been sorted out, forming the content of preferential policy guidelines for small and micro enterprises and individual industrial and commercial households. Let's understand today: What tax and fees can individual industrial and commercial households enjoy

Individual industrial and commercial households' taxable income does not exceed 1 million yuan for some personal income tax for half levy

Enjoy the subject

Individual industrial and commercial household

Content

From January 1, 2021 to December 31, 2022, the annual taxable income of the individual industrial and commercial households does not exceed 1 million yuan, based on the current preferential policies, the personal income tax is reduced by half.

Enjoy condition

1. Do not distinguish the method of acquisition and enjoy it.

2. You can enjoy it when paying taxes.

3. Calculate the tax and exemption in accordance with the following methods:

Disables and exemptions = (The taxable amount that does not exceed 1 million yuan in taxable income from the operating income income of individual industrial and commercial households Uh) × (1-50%).

4. Fill in the tax deduction of tax and exemptions into the "tax reduction" column of the corresponding business income tax declaration form, and report the "Report Form for Personal Income Tax Disables and Disables".

Policy basis

1. The "Announcement of the General Administration of Taxation on the Implementation of the Promotional Policies for the Implementation of Small and Micro -Enterprises and Individual Industry and Commerce Tax" (No. 12, 2021)

2. "Announcement of the State Administration of Taxation on the Implementation of the Promotional Policies for the Development Tax of Small and Micro -Listing Enterprises and individual industrial and commercial households" (No. 8, 2021)

Individual industrial and commercial households reduce the "six taxes and two fees"

Enjoy the subject

Individual industrial and commercial household

Content

From January 1, 2022 to December 31, 2024, the people's governments of provinces, autonomous regions, and municipalities directly under the Central Government need to determine the actual situation of the region and macro -control. Tax, urban maintenance construction tax, real estate tax, urban land use tax, stamp duty (excluding securities transaction stamp duty), cultivated land occupation tax and educational subscriptions, and local education additional.

Individual industrial and commercial households have enjoyed resource tax, urban maintenance construction tax, real estate tax, urban land use tax, stamp duty, cultivated land occupation tax, educational additional additional, and local education attached to other preferential policies, which can be superimposed to enjoy this preferential policy.

Enjoy condition

Individual industrial and commercial households enjoy tax incentives in accordance with the actual situation of the region and macro -controlled regulation in accordance with the actual situation of the region and macro -control.

Policy basis

"Announcement of the General Administration of Taxation on Further Implementation of the" Six Taxes and Two Fees "reduction policy for small and micro enterprises" (No. 10, 2022)

Individual industrial and commercial households' phase -to -afford corporate social insurance premium policy

Enjoy the subject

1. Enterprises affiliated with difficult industries. Catering, retail, tourism, civil aviation, highway waterway railway transport 5 special trapped industries; agricultural and sideline food processing industries, textiles, textiles and clothing industries, papermaking and paper products, printing and recording media replication industries, pharmaceutical manufacturing, chemistry, chemistry, chemistry, chemistry, chemistry, chemistry, chemistry, chemistry, chemistry, chemistry Fiber manufacturing, rubber and plastic products, general equipment manufacturing, automobile manufacturing, railway, ships, aerospace and other transportation equipment manufacturing, instrument manufacturing, social work, radio, television, film and recording operations, Cultural and art industry, sports, and entertainment industry 17 difficult industries. In the above -mentioned industries, individual industrial and commercial households and other units of employees who participate in social insurance are submitted by reference to corporate measures.

2. All small and medium -sized enterprises who have a temporary difficulty in production and operation in areas affected by the epidemic situation, and individual industrial and commercial households who are insured by units. Public institutions and social groups, foundations, social service agencies, law firms, accounting firms and other social organizations such as the basic pension insurance for enterprise employees are implemented.

3. Individual industrial and commercial households and various flexible employees who participate in the basic endowment insurance of enterprise employees.

Content

1. Enterprises that are affiliated with difficult industries may apply for the payment part of the basic endowment insurance premiums, unemployment insurance premiums, and work injury insurance premiums (hereinafter referred to as three social insurance premiums) units. The period of retracting the insurance premium and unemployment insurance premium of work injury does not exceed 1 year. During the slow payment period, it is exempted from late fees.

2. All small and medium -sized enterprises who have a temporary difficulty in production and operation in areas affected by the epidemic situation, and individual industrial and commercial households who are insured by units can apply for the payment part of the three social security premium units, and the implementation period of the slow payment will be reduced to the end of 2022, during the period, and the period, during the period, period, period, period, period, period, period, period, period, period, period, period, period, period, period, period, period, period, period, period, period, period, period, period, period, period, period, period, period, period, period, period, period, period, period, period, period, period, period, period, period, period, period, period, period, period, period, period, period, period, period, period, period, period, and the period. Exempted stretches.

3. Individual industrial and commercial households and various flexible employees who participate in the basic endowment insurance of the enterprise employee are difficult to pay for the payment in 2022, and the payment of the payment will be applied voluntarily. The payment base is self -selected within the upper and lower limits of the local personal payment base in 2023, and the accumulated calculation of the payment period.

The specific implementation is subject to local implementation measures.

Policy basis

1. "Notice of the State Taxation of the Ministry of Human Resources and Social Security of the Ministry of Finance of the Ministry of Finance of the Ministry of Human Resources and Social Security on doing a good job in doing skills to prevent unemployment and preventing unemployment work" (Ministry of Human Resources and Social Security [2022] No. 23) 2.Notice of the General Office of the General Administration of Taxation on the Periodic Implementation of Special Payment of Enterprise Social Insurance Policy "(Human Resources and Social Affairs Department [2022] No. 16)

3. "Notice of the State Administration of Taxation of the Ministry of Finance of the Ministry of Human Resources and Social Security of the Ministry of Development and Reform Commission of the Ministry of Development and Reform of the Ministry of Human Resources and Social Security on the Scope of Implementation of Periodic Substitute Social Insurance Policy" (Ministry of Human Resources and Social Security [2022] No. 31)

- END -

All rectification!

May 19 this yearThe Jiangsu Provincial Consumer Protection Commission on the new e...

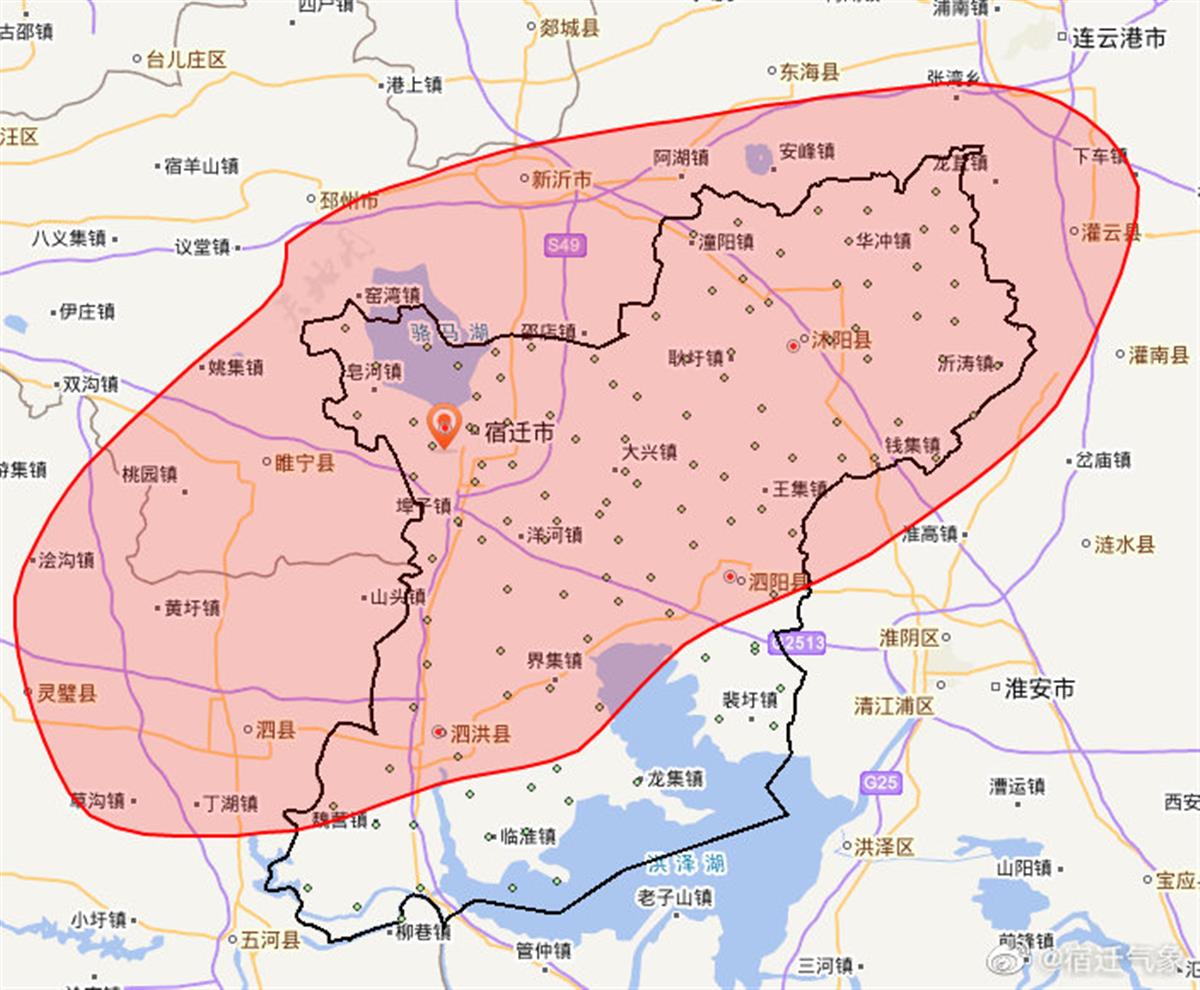

Jiangsu Suqian has a tornado, and other places are suspected to be confirmed by the tornado.

Jimu Journalist Zhang QiVideo editing Hu Zhiqi