The decline in the property market has narrowed, when will we rebound

Author:China News Weekly Time:2022.07.27

not

The property market is in a deep game

Judging from multiple indicators, the real estate industry is still in a downward momentum.

However, there have been some positive changes in the market. Recently, the property market rescue measures have been introduced in many places across the country. For example, encourage institutions and institutions to organize groups to buy houses, 150,000 yuan in housing subsidies at one time, and 1,000 yuan for each house for intermediary agencies.

In addition, referring to the momentum of the newly -built commercial housing transaction volume in 70 cities across the country, the momentum of 6%on the 20th of June in the first 20th of June, the transaction volume in July this year is expected to exceed July last year.

The director of the City and Real Estate Research Center of Renmin University of China, the Director of the Real Estate Research Center of the Renmin University of China, told China News Weekly that in the context of the housing housing, the property market policies needed for many places. Policy support.

So, is the decline in the property market bottom? When will there be a rebound?

Multiple indicators have changed positively

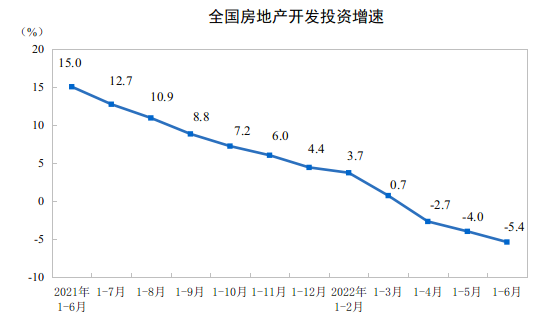

From January to June this year, the national real estate development investment was 6831.4 billion yuan, a year -on -year decrease of 5.4%. This speed increased by 20 percentage points lower than the positive growth of real estate development in January-June 2021, which was more than 40 percentage points lower than 38%from January to February 2021.

Since last year, in one and a half years, the growth rate of real estate development investment in the country has continued to decline until negative growth.

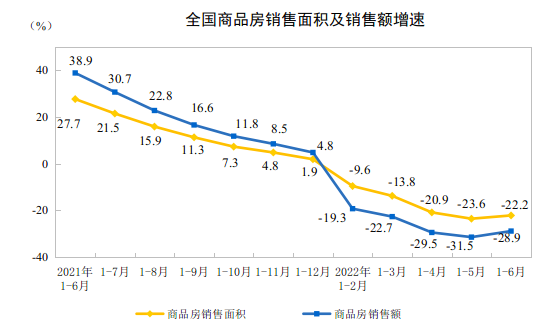

At the same time, from January to June, the sales area of commercial housing was 689.23 million square meters, a year -on -year decrease of 22.2%; the sales of commercial houses were 6607.2 billion yuan, a decrease of 28.9%. Since the beginning of this year, the sales area and sales of commercial housing have been in a state of negative growth.

Can the decline in the property market stop? Will China's real estate industry continue to bottom out?

In fact, multiple indicators have changed positively.

The Zhonghai Yunlu Mansion, located in Changchun City, obtained the latest batch of pre -sale certificates on June 22. The sales staff of the project told China News Weekly that there were 30 sets of households with evidence, with a unit price of about 15,000 yuan/square meter. For one month, 8 sets of sold in the market have been sold, and the transaction has been active.

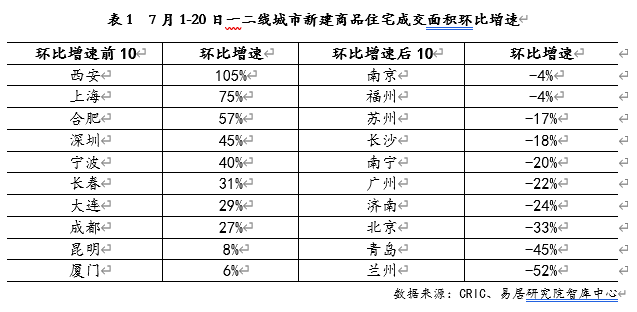

The monitoring data of the Yiju Research Institute showed that the transaction area of new commercial housing in Changchun in June was 700,000 square meters, which rose 206%month -on -month. In July, the transaction of new commercial housing in Changchun in the first 20 days continued to rise, up 31%from 20 days from June.

The latest monitoring also shows that 70 cities across the country (different from the statistics of the State Bureau of Statistics) newly -built commercial residential transactions are 14.06 million square meters, an increase of 6%from the first 20th of June. Among them, the transaction area of 21 new commercial housing in 21 first -tier and second -tier cities was 8.17 million square meters, a month -on -month growth rate of 5%; 49 third -tier and fourth -tier cities' new commercial residential residential transactions were 5.89 million square meters, with a month -on -month growth rate of 6%.

Yan Yuejin, the research director of the Think Tank Center of the E -House Research Institute, told China News Weekly that the data of the data showed a good situation of "small -month increase" on the 20th of July, fully showing that the real estate market has the driving force and foundation of good development.

In June, the transaction area of commodity housing nationwide was 15.54 million square meters. This is the month that has the most transaction since this year. Although the transaction volume of 193.88 million square meters last year fell 22%year -on -year, it exceeded 115.16 million square meters in July last year. Transaction volume.

With reference to the majority of newly -built commercial housing transactions in 70 cities across the country, the momentum of 6%on the 20th of June by 20 June, the transaction volume in July this year is expected to exceed July last year.

In addition, according to the National Bureau of Statistics, in June, the sales prices of 70 large and medium -sized cities increased the number of commercial housing prices from the previous month. There were 31 and 21 new commercial housing and second -hand houses, an increase of 6 over the previous month.

Lian Ping, the chief economist and dean of Zhixin Investment, told China News Weekly that the property market experienced the downward cycle in the first half of 2022, especially the second quarter may be the most difficult stage this year. The real estate market is expected to improve in the second half of the year.

Some experts also pointed out that the characteristics of the market are not obvious, and the current property market is still bottoming out.

Sacrifice for the rescue of the city everywhere

In order to boost real estate consumption, all parts of the country have sacrificed the rescue moves.

Taking Changchun City as an example, in May and July this year, the city has issued the new policy of the property market twice in a row.

On May 5th, the General Office of the People's Government of Changchun City issued a policy document for the stabilization of the property market, which proposed that the minimum down payment ratio of personal housing loans for provident fund for the first time is not less than 20%; The initial payment ratio is not less than 30%; and the interest rate of personal housing consumption is reduced by providing more preferential personal housing loans.

On July 8th, the General Office of the People's Government of Changchun City issued the "Several Measures to Further Promote the Steady Development of the Real Estate Market", which proposed that the first set of down payment ratio of the first -demand housing commercial loan from not less than 30%was restored to 20%, and the two sets of improvement properties were improved. Housing loan down payment ratio is restored from not less than 40%to 30%; supports concentrated batch purchase of commercial housing, supports institutions, state -owned enterprises, institutions, colleges, scientific research institutes, and social groups to contact with real estate development enterprises to organize commercial housing concentrated batch batches Buy activities.

Judging from the two policies issued by Changchun City, the support is gradually becoming greater; in addition, supporting agencies and state -owned enterprises and institutions have been rare for many years.

In fact, in the new policy of the stabilized property market this year, Sichuan Pakistan, Huanggang, Hubei, and Pu'er in Yunnan mentioned in many places that it encouraged institutions and institutions to organize house purchase group purchase activities. Among them, Huanggang proposed that "a discount of 3%of the group purchase of more than 20 people, the development enterprise will not be less than 3%of the total personal housing funds." Yan Yuejin said that buying a house for groups will generally help buyers, which will help activating the real estate trading market and help the property market market.

In addition, on July 25, it was reported that the West Lake District Finance Bureau of Wuhan City issued the "Program for Pre -housing allocation of monetization subsidies". For employees of administrative institutions that distribute monetized subsidies for housing, they were in the East and West Lake District before December 31, 2022, 2022 Inside buying a house, one -time pre -pre -issued housing allocurrency subsidies of 150,000 yuan.

According to Lian Ping, from the perspective of the property market policies introduced in the first half of the year, the efforts are mainly concentrated on the demand side. Taking financial policies as an example, since the fourth quarter of 2021, the housing financial environment has improved, but it is mainly focused on the "residential" interest rate level. The "real estate enterprise end" financing environment has not substantially improved.

However, the release of the demand side is not continuous. Monitoring data shows that 20 days before July, cities such as Lanzhou, Qingdao, and Beijing have a relatively large -scale reduction of speeds, decreased by 52%, 45%, and 33%year -on -year respectively. In addition, some key cities such as Nanjing, Suzhou, Guangzhou, etc. have also declined to varying degrees.

Wen Bin, chief economist of China Minsheng Bank, told China News Weekly that this is a pulse -type heating. The continuity and amplitude of real estate sales recovery are not strong. Weak market confidence.

In terms of greatness, in the long -term rapid development, the real estate industry has accumulated more deep -seated contradictions, including high inventory and high financial risks. It is still facing greater adjustments to adjust, and the entire industry is also facing the possibility of transformation and development.

When will the market open a new cycle

In June, among the 70 large and medium cities, the sales prices of new commercial housing and second -hand housing rose 21 cities year -on -year cities, respectively, respectively, which were reduced by 2 and 1 respectively.

In response, the Chief Statistical Division of the National Bureau of Statistics, the Chief Statistics of the National Bureau of Statistics, said that the sales price of commercial housing continued to decline year -on -year, and the number of cities decreased year -on -year.

House prices in some cities fell to two years ago. Compared with 2020, the price of new houses in 17 cities is less than two years ago, and the price of second -hand housing fell back to 34 cities two years ago. Among them, the price of new houses in Beihai City fell 9.6%compared to two years ago. The price of second -hand housing in Mudanjiang fell 15.8%compared to two years ago, which were new cities with the largest decline in new and second -hand housing.

According to the central bank's announcement, residents' deposits increased by 10.33 trillion yuan in the first half of the year. At the same time, residential loans increased by 2.18 trillion yuan, short -term loans increased by 62.9 billion yuan, and medium- and long -term loans increased by 1.56 trillion yuan.

In this regard, Great said that overall, people's willingness to buy a house is not strong, which is mainly affected by factors such as previous prices, insufficient demand, weak confidence, and epidemic.

Yan Yuejin said that the recent first -tier cities such as Beijing, Guangzhou, and third -tier cities such as Wuxi and Quanzhou have fallen, indicating that the market game is still continuing, and the property market still has large uncertainty.

Lian Ping said that for the real estate industry, the release of demand and support supply is equally important, which is related to market expectations. In the second half of the year, whether it is to serve the needs of the steady growth of the macroeconomic or support the healthy operation of the real estate market itself, it is necessary to give home buyers and real estate companies sufficient support from both ends of supply and demand.

Lianping suggested that given the main risks of the real estate market, the main risks are still gathered in real estate companies, and some real estate companies are expected to continue to face the three major risks of operating losses, liquidity shortages, and debt defaults. Therefore, it is necessary to further release the demand for housing, increase its efforts to create a loose real estate company's financial environment, accelerate the pace to increase the support of housing companies and non -silver financial support, further rationally loose the rules of soil auction, and establish and improve the risk monitoring system.

Lian Ping believes that the current real estate market is relatively limited. In the second half of the year, real estate policies still have more space. Loose policies and their expectations will further support the real estate market to gradually recover to normal track. The market may start a new round of commercial cycle.

Author: Liu Debing ([email protected])

Edit: Li Zhiquan

- END -

Harbin to the middle of the rain on June 24 to the high rain in the middle of the rain to the highest temperature of the heavy rain 25 ℃

Harbin Meteorological Observatory released the weather forecast for the city during the day to the city at 5:00 on June 24:On the 24th: Magnolia, Tonghe, Founder, Yilai to heavy rain, other areas are

What subsidies and rescue benefits can be applied for by difficult people?Will the social security retaining policy affect pension distribution?look here!

Policy Q AOn the afternoon of June 17, the State Council's June 17th Rentance of ...