Multi -countries have shot to buy overseas coal prices soaring in domestic coal companies to continuously increase production and keep supply and stable prices

Author:Securities daily Time:2022.07.27

On July 25, the National Development and Reform Commission posted on the official WeChat public account that since this year, the price of overseas power coal has continued to rise, with the price of Power Coal 1#at Newcastle Port in Newcastle, Australia, From $ 107/ton at the beginning of the year, rising to about 195 US dollars/ton in mid -July, rose by about 80%.

Yang Jie, a researcher at the Easy Coal Research Institute, told the Securities Daily that the one -month export ban in Indonesia at the beginning of the year led to the staged supply and demand and emotional tension in the international market, superimposed geopolitical conflicts, and overseas coal prices continued to rise in the first half of the year.

The reporter noticed that when overseas coal prices were at a high level, domestic coal prices were seriously inverted and imported coal volume dropped sharply. At the same time, domestic coal supply is also tight, and coal companies continue to increase production.

The proposal released by the China Coal Industry Association on July 25 proposed that strictly implemented the mid -to -long -term contract system and the policy -keeping price policy, and promoted the smooth operation of the coal market. Keeping coal prices in a reasonable range stipulated in the state, stabilizing market expectations, and promoting the stable operation of the coal market's long cycle.

Overseas coal prices continue to rise

"The international energy market is intensified. After the European Union prohibits the procurement of coal from Russia, some European countries have shifted to Indonesia, South Africa, and Australia and other countries. Su Jia told a reporter from the Securities Daily that in the context of high demand, international coal supply is very limited. Due to factors such as strong domestic demand and rainfall in Indonesia, the superposition of South African coal transportation is limited by railway capacity, which has exacerbated the overall international market as a whole The situation where the supply is in short supply has led to high coal prices.

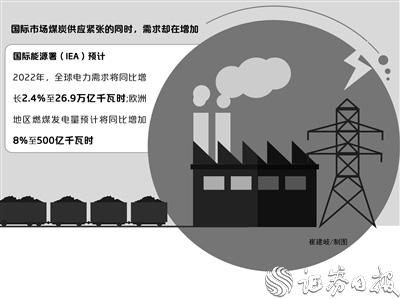

While supply is tight, demand is increasing. According to the International Energy Administration (IEA), in 2022, global power demand will increase by 2.4%year -on -year to 26.9 trillion kWh. In 2022, coal -fired power generation in Europe is expected to increase by 8%to 50 billion kWh year -on -year. The great improvement of electricity demand has further exacerbated the tension of coal supply.

Yang Jie said that in order to ensure domestic energy stability, European countries had to use coal as alternative energy. However, under the influence of carbon neutralization, global coal fixed asset investment has declined year by year, and the demand for coal consumption in European countries is concentrated in the high -calorie field, which has led to soaring coal prices.

At the same time, since the beginning of the year, South Korea, India, and Japan have snapped up coal and further exacerbated the structural shortage of the global coal market supply. In this context, coal supply of overseas markets is still tight, and overseas coal prices may still be high in the second half of the year.

Xue Dingcui, a coal analyst of Shanghai Steel United Coal Coke Institute of Coal Coke, also told a reporter from the Securities Daily that it is expected that in the context of international coal supply countries to prioritize domestic supply and demand -countries restarting coal power generation and the demand for coal use, coal prices or It will continue the trend of high shocks.

"Insufficient railway capacity in some countries is difficult to solve in a short period of time, and the supply of coal supply in the international market continues to be short -short. It is expected that international coal prices will continue to fluctuate at a high level in the second half of the year." Su Jia said.

Increasing production and insurance supply has achieved significant results

Overseas coal prices have risen sharply, and the direct impact of the domestic coal market is that imported coal prices are inverted and imported coal has continued to decrease.

On July 13, the June import data released by the National Bureau of Statistics showed that the imports of coal and lignite in June were 18.982 million tons, a month -on -year decrease of 33.14 %, and a decrease of 7.63 % month -on -month. The number of coal imports in June showed a large decline.

Su Jia said that international coal prices are high, and domestic coal prices are mostly operated in a reasonable range under the support of national stabilized prices. The coal prices at home and abroad are serious. Chinese users are more inclined to purchase domestic trade coal. Here In the context, my country's imports in the first half of the year decreased by 17.5%year -on -year.

Starting in June, my country began to enter the peak of summer, and the amount of coal was greatly increased, and coal companies were continuously increasing production to ensure supply.

On July 25, when the National Energy Group introduced the key tasks in the first half of the year, the Group achieved 300 million tons of coal output in the first half of the year, an increase of 6.2%year -on -year, and sales of 390 million tons. The average monthly coal of production exceeded 50 million tons, and thermal power generation accounted for about 17%of the country.

The video conference on the continuous promotion of coal production increase in coal production increase recently held by the National Energy Administration pointed out that in the first half of the year, the coal output of enterprises above designated size was 2.194 billion tons, an increase of 11%year -on -year. The level has been greatly improved, and the supply of coal production insurance has achieved significant results.

The China Coal Association also stated that it is necessary to accelerate the release of advanced coal production capacity and ensure that coal mines can be produced as well as the premise of ensuring safety production and increased production.

In this regard, Yang Jie also told reporters that my country ’s increase in production and insurance in the first half of the year can help power companies to alleviate the pressure brought about by overseas coal prices and inverted imports of imported coal. Safety. Therefore, even if international coal prices rose sharply in the fourth quarter, the impact on the country will be weaker than last year.

"High coal prices and high demand will promote the growth of global coal production by 5%this year, but the increase in production in various countries is different. China and India, including six major coal production countries, account for 85.5%, which is strong." CITIC Futures An analyst said.

Reporter Li Chunlian

- END -

Mortal micro -light | help a little, warm a piece

Help a little, warm, there are always some warmth encounters.

More than 3 trillion yuan!Combined tax support policy helps enterprises to relieve the effectiveness

Since the beginning of this year, my country has implemented a new combined tax support policy, helping companies to help companies with real gold and silver, and helping to stabilize the macroeconomi