Shao Neng's major shareholder shares have been auctioned by the auction of Baoneng.

Author:Securities daily Time:2022.07.27

Reporter Li Yuzheng

Shao Neng's shares are "going to Baoneng". On July 26, Shao Neng issued an announcement saying that the company's supervisor Bianfeng resigned from the company's supervisor due to personal reasons, and he would no longer hold any position in the company after his resignation.

From the annual report disclosed by Shao Neng, it can be seen that the other identity of the border peak is the general manager of the general manager of Human Resources Management Center of Shenzhen Baoneng Investment Group Co., Ltd. and the general manager of the Human Resources Center of Baoneng Logistics Group. Therefore, he is also regarded by the market as one of the spokespersons of Baoneng's shares in Shao Neng.

Behind Bianfeng's resignation, the equity of Shao Neng shares held by Baoneng under the crisis of liquidity is in the judicial auction process. Judging from various factors, Baoneng's passive "big retreat" in Shao Neng shares may be inevitable.

Mandatory auction of judicial

Baoneng defeated Shao Neng shares

Baoneng's layout of Shao Neng traces back to 2015. Public information shows that at that time, Bao Neng was a subsidiary of Qianhai Life, which continued to increase his holdings and replaced Shaoguan Industry as the largest shareholder of Shao Neng. On March 2, 2020, Qianhai Life Signed the "Shares for Transfer Agreement" to transfer the 216 million shares held to Shenzhen Hualitong Investment Co., Ltd. (hereinafter referred to as "Huali Tong"), which was the latter. Core company Yoshenghua 100%shareholding.

After Baoneng's enrollment, Shao Neng changed from state -owned assets to unreal controllers. According to the financial report, as of the end of the first quarter, Hua Neng's top three shareholders Hua Litong, Shaoguan Industry, and Shenzhen's daily promotion shares were 19.95%, 14.43%, and 7.07%, respectively. However, such an equity structure will soon be broken.

On July 22, Shao Neng issued an announcement saying that according to the Shenzhen Intermediate People's Court, some of the company's largest shareholders Hua Litong and the third largest shareholder of Shenzhen Risheng will be auctioned by judicial auctions. Among them, about 142 million shares under Huali Tong will be forced to re -auction from 10:00 on August 24th to 10:00 on August 25th, accounting for 13.11%of Shao Neng's total share capital, accounting for 65.69%of the shares held by Huali Tong. References are referenced. The starting price is about 720 million yuan, corresponding to about 5.08 yuan/share, and the completion of the judicial auction will lead to changes in the largest shareholder of Shao Neng shares; all 76.793 million shares held by Shenzhen Risheng Institute will also be auctioned.

This is not the first time that the equity of Shao Neng's shares held by Huali Tong has been auctioned. Previously, from June 16th to June 17th, the Shenzhen Intermediate People's Court auctioned about 142 million shares held by Hualitong, and Shenzhen Fangfu Industrial Co., Ltd. (hereinafter referred to as "Fangfu Industrial") won the competition for 1.305 billion yuan. Corresponding to about 9.22 yuan/share, but Fang Fu Industrial did not pay the remaining auction price, and the auction failed to be sold. To this end, Fang Fu Industrial also paid the price of 60 million yuan in margin.

Some analysts believe that Fang Fu Industrial's "own person" for Bao Neng Department, by changing the time to change the time of money, hinders the change of Shao Neng's largest shareholder, and the Shao Neng shares held by Baoneng Department Forced auction is one of the direct reasons for the company's supervisor Bianfeng.

It is worth noting that after the resignation of Bianfeng, Shao Neng's Baoneng executives also include Luo Xiaoyong, chairman of the company's board of supervisors, Director Tian Yuanyuan, and director Yu Xiaofan.

Chen Yuan, a senior partner of the equity partner of Beijing Yingye (Shanghai) Law Firm, said in an interview with the Securities Daily reporter: "Once the equity of Shao Neng shares has completed the judicial auction, the Huali Tongkai shares will only account for about 6%. In the future, it is necessary to pay attention to whether the new executives of Shao Neng shares are related to Baoneng Department. If the newly appointed executive has nothing to do with Baoneng system, then the Baoneng system will lose control of Shao Neng to a certain extent. Former executives still need to perform their duties. "

Under the change of equity

Where is Shao Neng's shares going?

Behind the defeat of Shao Neng's shares, Baoneng Department is several debt disputes. According to Shao Neng's announcement, as of March 24, Huali Tong as a creditor's rights guarantor, with its 141 million Shao Neng shares as a mortgage, as a mortgage, it was The debt is responsible for liability. The 141 million shares pledged to Cinda Financial Rental have been frozen. In addition, Huali led to Shenzhen Qianhai Oriental Entrepreneurship Financial Holdings Co., Ltd. to borrow 500 million yuan. The borrowing date was December 31, 2022, and the repayment was 43 million yuan. Due to overdue interest, the institution announced the expiration.

In fact, Waltone's encounter is just a microcosm of the liquidity crisis of Baoneng. Recently, Nanyang A announced that receiving a notification from Chongqing Yiyu Financial Leasing Co., Ltd., the company's company Zhongshan Runtian holding 67.65 million shares of Nanyang A has been ruled by the court to dispose of prices. In addition, according to Zhongju Hi -tech announcement, due to debt disputes, Zhongshan Runtian's passive reduction of Zhongju High -tech shares, the equity ratio all the way from 24.92%in the end of 2020 to 17.84%on July 18, 2022. At this point, the equity of the three core listed companies under Baoneng Department has faced dilemma.

For Shao Neng's shares, the company's development or facing a series of obstacles under the decentralized and uncertain equity structure. In fact, in recent years, Shao Neng's shares lack a fixed voice, and the development has not been smooth.

Taking last year as an example, the financial report showed that the company's revenue fell by 20.03%to 3.966 billion yuan in 2021. After deducting the non -deductible, the net profit of the mother was 10.8395 million yuan, the first loss since 2008, and the profit of 201 million yuan in the same period of 2020.Several major businesses of Shao Neng, including electricity, precision (intelligent) manufacturing, ecological plant fiber products, and trade. Last year, the gross profit margin fell year -on -year, among which the business of ecological plant fiber products loses money.In terms of capital structure, Shao Neng also faces a lot of capital pressure.According to Wind data, as of the end of the first quarter of this year, Shao Neng's currency funds were 521 million yuan, while short -term borrowing reached 932 million yuan, non -current liabilities due within one year, 758 million yuan, and long -term liabilities reached 5.097 billion yuan, highAt the end of the first quarter, net assets.From the end of 2019 to the end of 2021, Shao Neng's cash expiration debt ratio decreased from 45.88%to 16.91%.

- END -

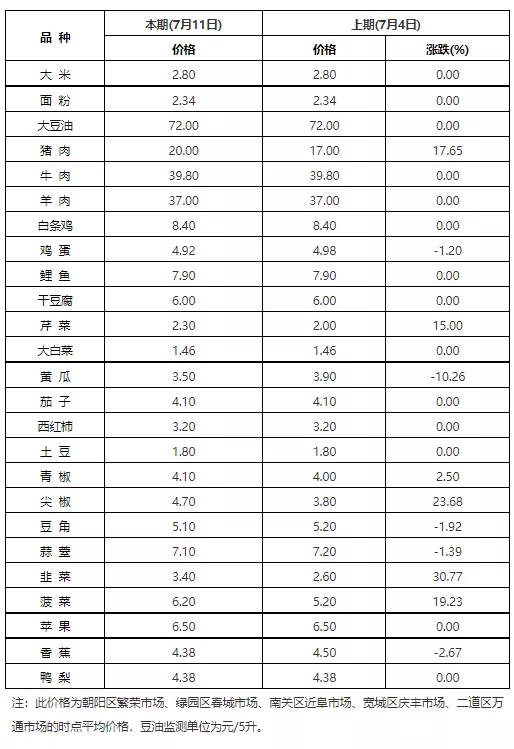

Changchun City announced the price of important people's livelihood commodities

According to the monitoring data of the five major farmers' markets, the city's im...

The health reminder of the Ordos Centers for Disease Control and Prevention!

Ordos Centers for Disease Control and Prevention CenterRelease health reminderAccording to the National Health and Health Commission, at 0-24 on July 6, 31 provinces (autonomous regions, municipalitie