The euro plummeted?That's right, the United States is calculating it!

Author:Banyue talk about new media Time:2022.07.26

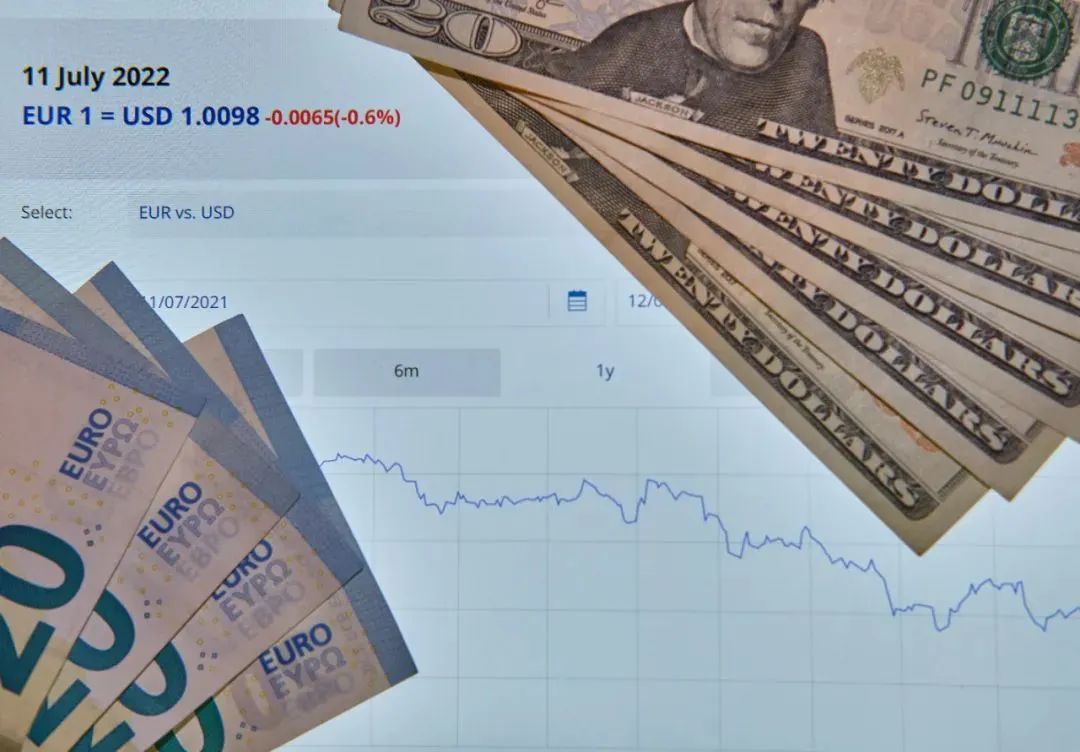

Since the beginning of the year, the exchange rate of the euro to the US dollar has fallen by more than 10%, and a few days ago, it has fallen below the 1 to 1 mark, setting a minimum record in nearly 20 years. This round of euro exchange rate continues to decline, on the one hand, it reflects the negative spillover effect of US monetary policy adjustments to Europe, and on the other hand, it once again confirms a fact -the United States provoking confrontation and turbulence in Europe in Europe. Sacrifice.

Since March this year, the Fed has continuously tightened the monetary policy due to high inflation and other factors. once. Due to the tightening pace of the European Central Bank's currency policy in the same period, the pace of tightening the currency policy lags behind the Fed, and the United States and Europe have continued to increase, which led to more international capital flowing from Europe to the United States, which exacerbates the trend of the euro decline. The negative overflow effect of US monetary policy adjustment reminds people of the "famous saying" of former US Treasury Secretary Connery-"US dollar is our currency, but it is your trouble." Forecast

This is the euro and dollar banknotes shot in Madrid in Madrid, Spain on July 11. Xinhua News Agency reporter Meng Dingbo Photo

The deepening reason for the decline in the euro exchange rate is that the upgrade of the Ukraine crisis has seriously impacted the European economy. The market is concerned about the long -term prospects of the European economy and insufficient confidence.

Citi Group Currency Analyst Ibrahim Labari believes that the market is not only worried about the short-term decline in the European economy, but also that the European economy has fallen into trouble for a long time. Essence The Nobel Prize winner and American economist Paul Cruggman recently published an article saying that the core reason for the sharp decline in the euro exchange rate is that investors have greatly reduced their expectations for European competitiveness and euro long -term value.

The root cause of the Ukrainian crisis is the source of the U.S. to safeguard the conflict between the United States and deliberately provoking conflict in Europe. As we all know, creating "controllable turbulence" is an important "magic weapon" for the United States to maintain its hegemony. By promoting the Ukrainian crisis upgrade, the United States can suppress Russia, but also to make turmoil in Europe to ensure the dominance of European security and other affairs. When many European countries have deeply trapped the dilemma of energy shortage and high inflation, the United States also took the opportunity to become big winners in the fields of energy, military industry.

Deputy Minister of Economic Development, the former Ministry of Economic Development in Italy, said that NATO's continuous expansion under the leadership of the United States is one of the roots of the Russian conflict. However, the cost of conflict is mainly tolerated by Europe. "The motivation for the rapid ending of this conflict does not exist, because it is Europeans to bear a greater price." not

On March 24, 2022, the staff of the EU headquarters in Brussels, Belgium, organized the US flag. NATO, the Seventh -way Group and the EU summit were held in Brussels, Belgium on the 24th. Xinhua News Agency reporter Zhang Ye Zhang

The euro is not the first time that the United States has been harmed due to chaos in Europe.

In 1999, less than 3 months after the euro was officially released, the United States led NATO to launch the Kosovo war. Paul Wilffins, the director of the Institute of International Economic Relations of the University of Potsdam, Germany, pointed out that this war not only caused humanitarian disasters in the South League, but also caused the euro to be depreciated by the euro, shaking the confidence of international capital for the euro Essence Wilffins pointed out that the birth of the euro has been regarded by the outside world as an important challenge for the European market by de -US dollar hegemony. The United States led Kosovo's war, and the suppression effect of the euro was clearly visible.

Another typical example is the "change" of the United States behind the European debt crisis.

In October 2009, the Greek government exposed debt problems, the three major international rating agencies Moody, S & P, and Fitch responded to The Greek sovereign credit rating was lowered, and the crisis was the first to erupt in Greece. Since then, the sound of exaggerating the crisis and singing the euro has risen in the United States. At that time, the chairman of the European Commission Barozo said that the sovereign credit rating of a country is only in the hands of the three institutions, and the three institutions are from the same country, which is unreasonable. Swen Gagold, the Secretary of State of the Federal Economic and Climate Protection Department of Germany, pointed out that the European debt crisis that contributed to the United States caused great injuries to the euro, and the international use of the euro has not yet recovered to the level before the 2008 international financial crisis.

History is the best mirrorbook, and reality is the best textbook. Through historical and reality, you can see the calculation of the United States behind the decline in the euro, which is conducive to letting the world see through the true face of the United States -in order to maintain the global hegemony, even the interests of allies will be sacrificed.

Source: Xinhua News Agency (ID: xinhuashefabu1)

Responsible editor: Zhang Ziqing

School pair: Guo Yanhui Meng Yahe (intern)

- END -

Evaluation of Extraordinary | The first desert railway ring runs through, and there is a miracle where there is a dream

Xu Hanxiong, a polar news commentatorOn June 16, the operation from Xinjiang Hetia...

Hubei health code has important changes!

Pay attention!Now unlock the Itinerary Poke logoNo need to show the itinerary card...