Big action!Ali applies for the main listing of Hong Kong and New York!The three major signals are clear. What is the meaning behind it?

Author:Broker China Time:2022.07.26

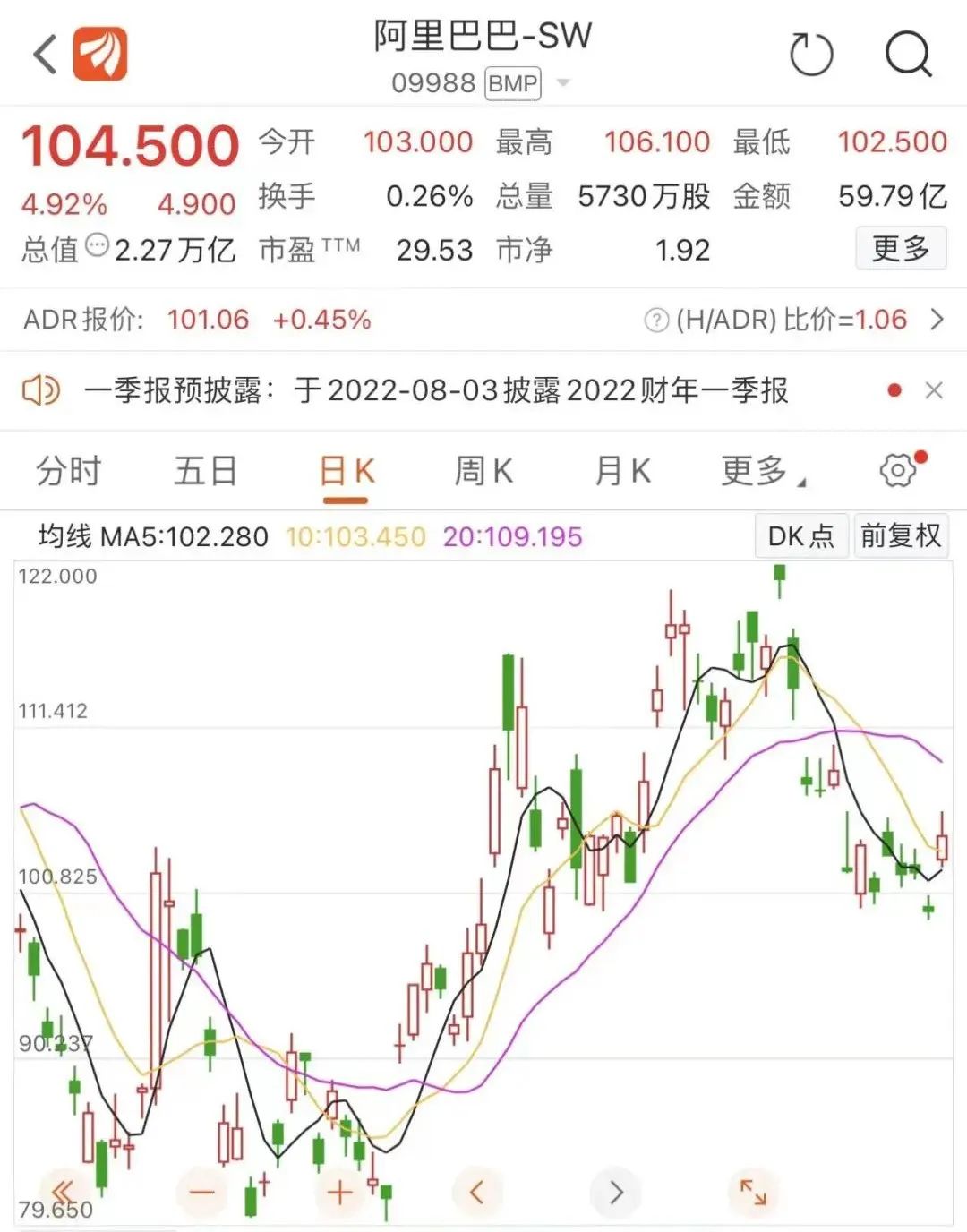

Affected by this news, the stock price of Alibaba's Hong Kong stocks rose sharply, and the market rose by more than 6%, and then maintained a high level of shock. As of the closing, it was reported at HK $ 104.5/share, and the closure of 4.92%. The Hong Kong stocks Hang Seng Technology Index rose more than 1.3%, and JD Group, Meituan, and Tencent Holdings rose.

Some analysts believe that after the implementation of dual major listing, it is expected that international investors will allocate Ali Hong Kong stocks, which may inject new liquidity into the Hong Kong stock market. At the same time, Ali Hong Kong stocks are expected to be included in the Hong Kong Stock Connect, which facilitates that mainland investors will directly share their growth dividends.

Ali also released the 2022 fiscal year report showed that as of March 31, 2022, the annual fiscal year, Ali Global Active Consumers was about 1.31 billion, and completed more than 1 billion milestones in domestic purchase users in the field of consumer business. Two years in advance, two years in advance Complete this goal.

Although Ali is not the first Chinese stock company to apply for dual listing, from the perspective of market value and transaction volume, Ali's choice has a stronger signal significance. At least three clear signals are passed by this move:

First, the two major listings are gradually becoming mainstream. Related companies can better cope with the uncertainty of a single market, so as to better cope with the challenges brought by changes in the external environment.

Second, back to the huge Chinese market, it has become the bottom of the development of enterprises, and also facilitates domestic investors to share their growth dividends.

Third, the Hong Kong Stock Exchange has actively reformed in recent years, and its competitiveness and attractiveness in the global financial market have continued to improve. In fact, the increase in market liquidity and pricing capacity brought by Chinese stock companies such as Ali, which helps Hong Kong to further consolidate and enhance the status of international financial center.

Zhang Yong, chairman and chief executive officer of Alibaba Group's board of directors, said that the purpose of this decision is to make more extensive and diverse investors, especially Ali's digital ecological participants, to share Ali's growth and future. Ali is full of firm confidence in China's economy and future.

Ali applies for Hong Kong and New York, the main listing

According to the announcement, Alibaba is currently listed on the second listing of the main board of the Hong Kong Stock Exchange. It will apply for Hong Kong in accordance with the Hong Kong listing rules as the main list of listing. It is expected that it will take effect by the end of 2022.

After the Hong Kong Stock Exchange completed the audit process, Ali will be listed on the main board of the Hong Kong Stock Exchange and the New York Stock Exchange. Since then, Ali's depository stocks listed in the United States and ordinary shares listed in Hong Kong can continue to be converted to each other. Investors can continue to choose to hold Ali shares in one form.

Different from the second listing, companies with dual major listing will also have two first listing sites, and stocks of the two markets cannot be circulated across the market, and their stock price performance is relatively independent. From the perspective of the company, dual listing helps to expand the basis of shareholders and enhance the global market influence. It is convenient for subsequent financing and can further expand its business to other markets.

It is understood that since the second listing in Hong Kong in 2019, most of Alibaba's circulating shares have been transferred to Hong Kong to register. Data show that in the first half of 2022, Alibaba's average daily transaction volume in the Hong Kong market was about $ 700 million, and the average daily transaction volume in the US market was about 3.2 billion US dollars.

This means that as the main market for Ali's business, Ali has always received great attention from Chinese and Asia -Pacific funds. This time, the newly added Hong Kong to the market as the main list of listings, the success of the water at the technical level, is also in line with the market expectations of the market for a period of time.

Ali said in the announcement that the company's expected dual listing status will help expand the foundation of investor and bring new liquidity, especially to reach more investors in China and other parts of Asia.

Choosing the main listing in Hong Kong also reflects Ali's confidence in the future of the Chinese market. When publishing relevant news, Zhang Yong emphasized that Ali is full of firm confidence in China's economy and future.

Decision beyond business

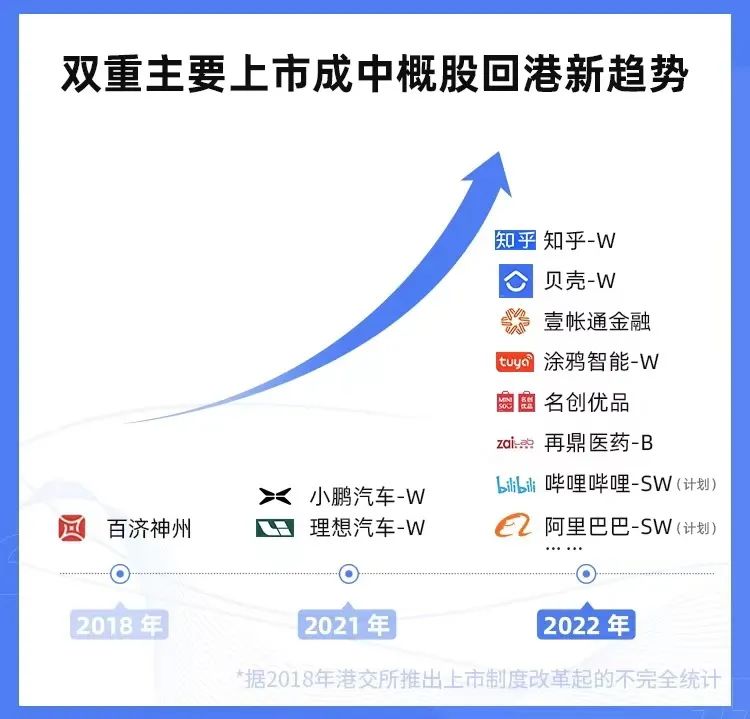

After the reform system of the Hong Kong Stock Exchange's listing system in 2018, more and more Chinese technology companies choose to list in the United States and Hong Kong. "Listing" mode.

In the recent period, the double main listing has become the mainstream model of China stock market returning to Hong Kong. Up to now, 9 of the 9 of the 9 in the 9th companies such as Zhihu, Shell, Xiaopeng, and ideal have achieved dual listing.

Objectively speaking, in the current background, this choice can effectively avoid overseas regulatory risks for China stock companies, and will undoubtedly provide more choices for mainland investors, so that Chinese investors can better share the dividends of China's economic growth, Improving the efficiency of resource allocation in the domestic capital market is the best business choice to fully protect the interests of domestic and foreign investors. But observing the choice of Alibaba's company is definitely not enough from a business perspective.

Many people should remember that Alibaba in 2014 at the IPO of the New York Stock Exchange. But before, Alibaba has always regarded Hong Kong as its first choice for its first listing place, and has launched related road shows in Hong Kong.

However, at the time of the conditions at the time, Ali failed to log in to the Hong Kong Stock Exchange as expected, and Ali moved to the New York Stock Exchange. On the eve of listing in the United States, Alibaba still publicly stated that in the future, we will return to the domestic capital market and share the company's growth with domestic investors.

In 2018, the Hong Kong Stock Exchange launched the reform of the listing system, which also created more favorable conditions for the listing of a large number of domestic Internet companies including Ali. In November 2019, Alibaba was launched in Hong Kong. Since then, most of Alibaba's circulation stocks have been transferred to Hong Kong to register. At this point, the increase in Hong Kong as its main listing has been successful. Behind this is Alibaba's special feelings for Hong Kong.

For Alibaba, the Chinese market is the main market for its core business. It is listed in Hong Kong's doubles, which means that it can be closer to the Chinese market investor in Ali's Chinese market. But for Ali, this is not only a good business decision, but also the general trend beyond business logic. The development of enterprises has obtained the ability to create business value, and always calibrate its own social value compass.

As the shareholder letter said, as a platform enterprise, it is naturally social. The extensive cooperation of various participants on the Ali platform not only brings various business forms innovation, but also creates huge employment opportunities. Although this year has brought great uncertainty due to the new crown pneumonia's epidemic, it is expected that more than 5,800 fresh university graduates are expected to join Ali. In 2021, with the national historic poverty alleviation, Alibaba's poverty alleviation fund has also been upgraded to rural revitalization funds, and it has comprehensively helped rural revitalization from three directions: industrial revitalization, talent rejuvenation, and science and technology revitalization. In the second half of last year, Alibaba proposed the "Top Ten Actions to help common prosperity", hoping to use multi -business linkage, long -term planning, considering business value and social value, starting from Zhejiang, in terms of technological innovation, economic development, employment, and disadvantaged groups of care In terms of, there are steps and rhythm to implement the actions. Through many years of accumulated commercial infrastructure and capabilities, Alibaba also fulfills the need for consumers to protect consumers in the anti -epidemic confession.

Zhang Yong believes that long -termism that cannot form ability precipitation is nihilism, and business that cannot create value will not develop healthy and sustainable. "The more in the era of uncertainty, the more we must actively seek real valuable changes."

Understanding these may better understand Alibaba's choice.

The orientation effect that cannot be ignored

As a high -quality leading company with a market value of over 2 trillion Hong Kong dollars, Ali has also had a strong iconic significance for the double listing of returning to Hong Kong this time.

Chen Duan, director of the Digital Economy Innovation and Innovation Development Center of the Central University of Finance and Economics, believes that a new economic enterprise of Ali's volume choosing a double listing of the two places will form a guiding effect.

This guiding role is not only reflected in the return of more Chinese stock companies to choose to return to the dual listing model of the two places, but also has the strategic position of improving the pricing power of the Hong Kong securities market in the new economic field and consolidating Hong Kong as an international financial center as the strategic position of the international financial center. Positive value.

According to the "Global Financial Center Index" (GFCI), Hong Kong is currently the third largest financial center in the world, ranking second only to New York and London, and its development potential is huge. Bloomberg data shows that benefiting from the interconnection mechanism such as the Hong Kong Stock Connect and other interconnection mechanisms has gradually improved. As of the 30 days of February 16 this year, the average daily turnover of the Hong Kong stock market jumped to about $ 25 billion, which has greatly surpassed the London Exchange, which is equivalent to the same period of the same period. 60 % of the New York Stock Exchange.

Analysts believe that Ali's choice of double listing in Hong Kong will significantly raise technical indicators such as the profitability and scientific research investment of the Hong Kong Stock Exchange. For the Hong Kong Stock Exchange, more high -quality transaction targets including Ali will also strengthen its attractiveness to the global market.

In addition, a new round of Chinese stocks that may be triggered by this will also drive the activity of Hong Kong and Mainland's capital markets in China and increase the enthusiasm of investment in private capital. "This will play an indispensable role in the downward trend of China's economy due to the epidemic and other reasons." Said Zheng Zhigang, a professor of financial at the School of Finance of the School of Finance and Finance of Renmin University of China.

It is worth noting that the choice of double major listing of China -stock companies does not affect its listing status in the United States. For a long time, overseas funds have a significant role in the development of Chinese technology companies. A number of Chinese stock companies such as Ali have been listed in the United States, which has also enhanced the global capital of Chinese companies and Chinese markets.

Hong Kong diplomatic relations are well -known for opening, tolerance, development and innovation. The series of reforms and innovation measures will help to enhance the reputation of Hong Kong as the preferred place of listing as an enterprise. It also greatly encourages more Chinese stocks and its two -way to go. Analysts believe that benefiting from these reforms and innovation measures, Alibaba's main listing in Hong Kong will also significantly increase technical indicators such as the profitability and scientific research investment of the Hong Kong Stock Exchange. For the Hong Kong Stock Exchange, more high -quality transaction targets including Alibaba, including Alibaba, will further enhance its attractiveness to global high -quality enterprises and capital.

Responsible editor: tactics

- END -

[China Tax News] Deputy Secretary of the Huangshan Municipal Party Committee and Mayor Sun Yong: In -depth participation in taxation from GDP to GEP

Open -column wordsChina Tax News opened a new column of Secretary Mayor Tax in a e...

Zhuhai Meteorological Observatory issued heavy rain red warnings [Class/particularly serious]

At 09:25 on June 08, the Zhuhai Meteorological Observatory will upgrade the Jinwan District and Hengqin Guangdong -Australian Deep Cooperation Zone to upgrade the orange warning of heavy rain to red w