What signal?The first day of Shanghai Tuzu sold 15 land, with a maximum premium of 9.67%... In the first half of the year, the region was the highest in the area in the first half of the year

Author:Broker China Time:2022.07.26

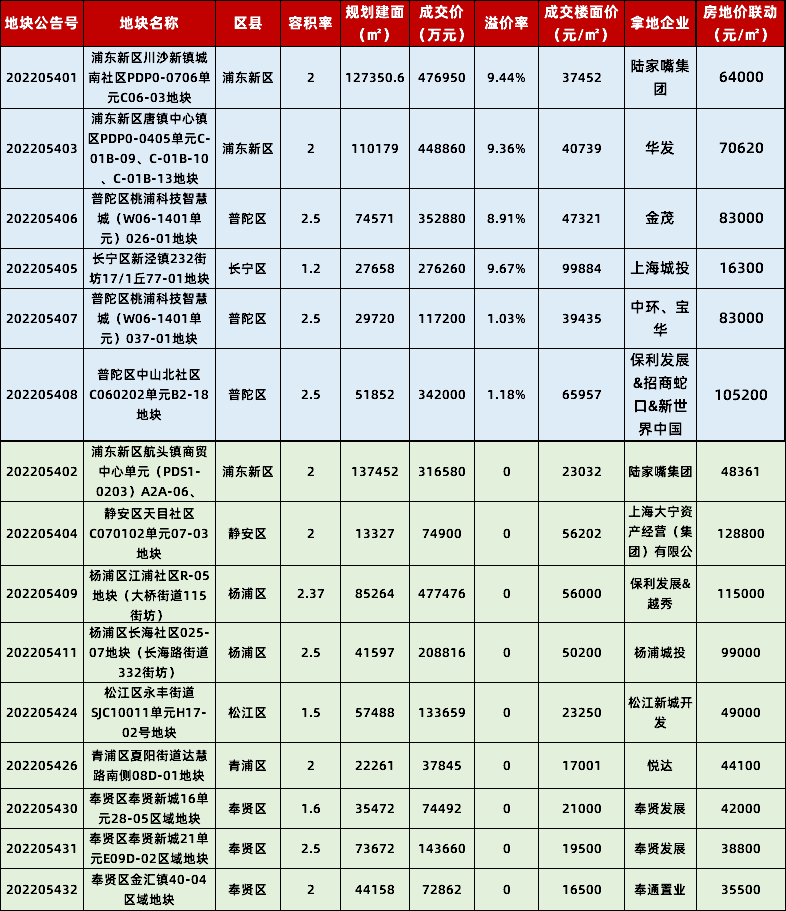

On July 25, the first day of the concentrated soil auction in Shanghai, all 15 plots were sold, with a total transaction value of about 35.5 billion yuan.

Among them, 9 of the land were sold for only one company's offer. Of the six land bidding on the spot, 4 land entered a phase of quotation.

Among the premium plots, the long -term premium rate of the Changning plot won by Shanghai City was 9.67%. The transaction building price was also the highest, nearly 100,000 yuan/square meter.

In addition, the total transaction price of the Yangpu area by Poly+Yuexiu consortium has the highest total transaction price, which is 4.775 billion yuan, the transaction building price is 56,200 yuan/square meter, and the real estate linkage price is 115,000 yuan/square meter.

Industry insiders believe that the first day of the concentrated soil auction in Shanghai is relatively high. In the current adjustment period of the real estate market, the risk aversion trend of investment in real estate companies is relatively obvious. Core cities are still sought after by housing companies. Fast and full profit space, full of attractiveness to housing companies.

Shanghai two -wheeled soil shooting on the first day of winning 35.5 billion yuan

It is understood that the second round of concentrated soil auction in Shanghai was from July 25 to July 28. A total of 12 areas of 12 areas were launched, with a total of 1.093 million square meters, and the total price of the starting shot was 68.17 billion yuan.

On July 25, a total of 15 land completed the transfer, of which only one company participated in the auction of the land, involving Pudong New District, Fengxian, Jing'an, Yangpu, Songjiang, Qingpu and other areas. Six on -site bidding, 4 auctions to the suspension price into the "one quotation" stage, which also involved a number of areas such as Pudong New District, Putuo, and Changning. About 35.5 billion yuan in the same day.

Among them, the most concerned about the newly attracted the number of housing companies to participate in the on -site bidding. In the end, Shanghai City won the plot for 2.763 billion yuan, with a premium rate of 9.67%, and the transaction building price was as high as 100,000 yuan/square meter. The plot became the first day of the soil auction and the highest floor price rate and the highest floor price. The landlord price of the land reached 163,000 yuan/square meter.

In addition, the premium rate of the two plots of Pudong New District ranked second and third. Among them, Lujiazui won the Sichuan -Sand New Town plot for 4.77 billion yuan, with a premium rate of 9.44%and a transaction building price of 37,500 yuan per square meter. , Housing linkage price of 64,000 yuan/square meter; Huafa's center plot with a competition of 4.489 billion yuan, with a premium rate of 9.36%, a transaction building price of 40,700 yuan/square meter, and a real estate linkage price of 70,600 yuan /Square meter.

In addition, the fourth place in the premium rate is a block of Putuo District, which was won by Jinmao with 3.529 billion yuan, with a premium rate of 8.91%, a transaction building price of 47,300 yuan/square meter, and a real estate linkage price of 83,000 yuan/square meter. Essence

The other two plots of Putuo District were won by Poly+Investment+New World Union and Central+Baohua Union, respectively. The transaction price was 3.42 billion yuan and 1.172 billion yuan, respectively.

Of the nine plots of the reserve price, the Yangpu plot sold by Poly+Yuexiu consortium has the highest transaction price at 4.775 billion yuan, the transaction building price is 56,200 yuan/square meter, and the real estate linkage price is 115,000 yuan/square meter. Meter. This is also the highest price of the first day.

Zhang Kai, the head of the Land Division of the Middle Finger Research Institute, believes that on the first day of the concentrated soil auction in Shanghai, the popularity was relatively high. In the current period of adjustment of the real estate market, the risk aversion trend of investment in housing enterprises is relatively obvious. Core cities are still sought after by housing companies. Shanghai's overall exfoliation speed and sufficient profit margin are full of attractiveness to housing companies.

Zhang Kai believes that Shanghai's preferential policies have played a role in promoting. In the "Zhangjiang" area, there are a large number of high -quality, high -quality, and enterprises that enjoy preferential policies. The area of Tangzhen Central Town in the New District comes from the area. In the future, with the integration of the production and cities of the area, demand is expected to further improve, and housing companies will also accelerate the rhythm of the layout here.

In the first half of the year, the Yangtze River Delta urban agglomeration has the highest popularity

Judging from the concentrated land supply transactions in 22 cities in the first half of this year, state -owned state -owned enterprises are the main power of land.

According to statistics from the China Finger Research Institute, in the first half of 2022, the amount of local state -owned enterprises+central enterprises accounted for 71%of the amount of land acquisition. Among them, in the first round of soil auction, the amount of land acquisition of local state -owned enterprises accounted for 43%, and the proportion of local state -owned enterprises in the second round accounted for further 47%, and the phenomenon of support was significant.

From the perspective of the total amount, the top 20 land acquisition in the first half of 2022 is mainly a large state -owned state -owned enterprise and a stable private enterprise in the regional head. The total amount of land acquisition of state -owned enterprises reached 72.1%of TOP20 housing companies, accounting for over 70%, and the proportion of mixed ownership companies accounted for 14.7%, and private enterprises accounted for 13.2%.

Specifically, in the first half of 2022, in the first half of the year, the relatively high -level and active real estate enterprises through the 22 -city concentrated land and landing land. Wait to January to June to concentrate the amount of land and obtain land equity exceeding 30 billion yuan; on the other hand, although the overall enthusiasm of private enterprises is not enthusiastic, such as Binjiang and Longhu, such as Binjiang and Longhu Forefront. In the first half of the year, Binjiang's land acquisition basically came from Hangzhou's first two rounds of concentrated land supply, while Longhu decentralized investment in first- and second -tier cities such as Beijing, Chongqing, Chengdu, Hangzhou, and Hefei.

Regional deep cultivation enterprises actively obtain land in cities with competitive advantages. For example, Binjiang alone won more than 20 high -quality plots in Hangzhou in the first half of the year, while effectively increasing the soil storage, it was effectively increasing, and it was a solid foundation for the continuous cultivation of the Hangzhou Camp. From the perspective of the city, the Yangtze River Delta urban agglomeration has the highest popularity.

The Middle Finger Research Institute pointed out that in the top five cities in the first half of the real estate enterprises in 2022, except for Beijing, Hangzhou, Shanghai, Suzhou, and Ningbo were all core cities in the Yangtze River Delta urban agglomeration.

On the one hand, Hangzhou, Suzhou, and Ningbo have completed two rounds of concentrated land supply in the first half of 2022, and the number of land launch is high. For example, Hangzhou has launched 105 plots through two rounds of concentrated land. Outside, all the rest of the plot are sold; on the other hand, the Yangtze River Delta urban agglomeration has the highest economic volume, the business environment is superior, and the population continues to inflow. The investment in real estate companies in this region can effectively ensure that subsequent project sales are sold out and reasonable. Profit margins.

The Middle Finger Research Institute believes that with the gradual emergence of the policy effect in the second half of the year and the recovery of sales and the improvement of the financial environment, it will boost the confidence of housing companies to some extent.

Responsible editor: tactics

- END -

Yumen City People's Court: The judge carefully mediates the "burden reduction" of enterprise development

In order to effectively protect the legitimate rights and interests of the enterprise and reduce the burden for the development of the enterprise. Recently, the Yumen People's Court tried a dispute...

Wang Yi talked about the three revelations of the successful practice of the "Declaration of the South China Sea"

Xinhua News Agency, Beijing, July 25 (Reporter Cheng Xin) On July 25, State Counci...