Alibaba plans to be listed in the two major listing of New York in Hong Kong, and will be included in the Hong Kong Stock Connect

Author:Dahe Cai Cube Time:2022.07.26

[Dahe Daily · Dahecai Cube] (Reporter Chen Wei intern Zhang Rui) On July 26, Alibaba Group issued an announcement: the board of directors has authorized the group management to submit an application to the Hong Kong joint exchange, and it is planned to add Hong Kong to the main listing land.

After the Hong Kong Stock Exchange completed the audit process, Alibaba will double the main listing on the main board of the Hong Kong Stock Exchange and the New York Stock Exchange. At that time, Alibaba Hong Kong stocks are expected to meet the qualifications of Hong Kong stocks, and that mainland investors will directly invest in Ali to be more convenient.

At the same time, Alibaba Group issued a 2022 fiscal annual report.

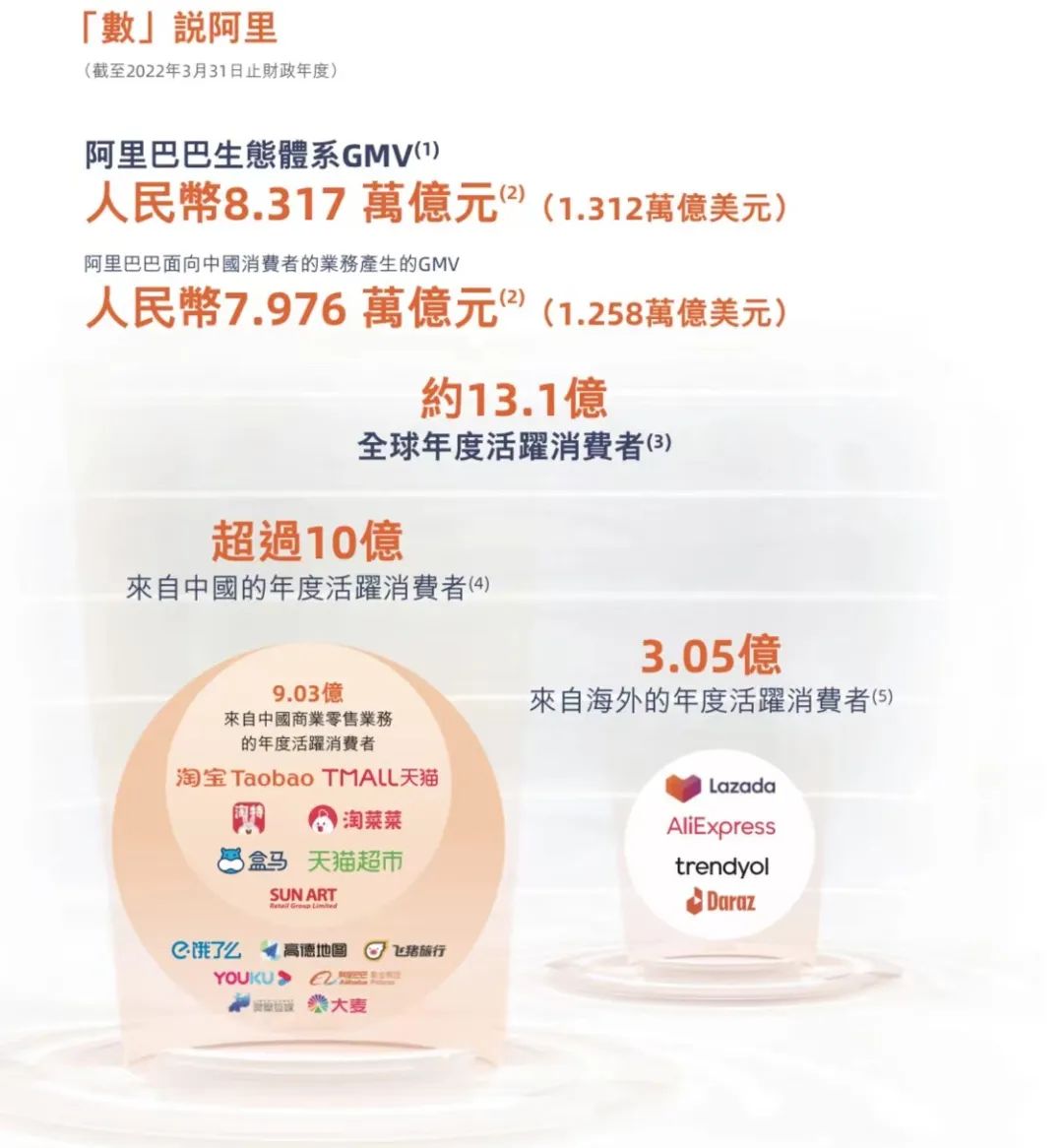

In the fiscal year as of March 31, 2022, Alibaba's global active consumers around the year were 1.31 billion, and the total turnover of Ali's ecosystems was 8.317 trillion yuan at the same time.

Ali will be listed in the two major two in New York, Hong Kong

The Alibaba announcement shows that the related processes of the newly added place to Hong Kong are expected to be completed by the end of 2022. Since then, Alibaba's depository stocks listed in the United States and ordinary shares listed in Hong Kong can continue to be converted to each other. Investors can continue to choose to hold Alibaba shares in one of them.

Zhang Yong, chairman and chief executive officer of Alibaba Group's board of directors, said that the purpose of increasing Hong Kong as its main listing is to make more extensive and diverse investors, especially Alibaba digital ecological participants in other parts of China and Asia Pacific. Share the growth and future of Alibaba.

"Hong Kong and New York are also important financial centers in the world. Opening, diversified, and highly internationalized are the common traits of the two." Zhang Yong said.

Alibaba and Hong Kong are far away. It can be said that Hong Kong is the starting point for Alibaba to go to the world.

Alibaba's B2B business was listed on the Hong Kong Stock Exchange in 2007. In 2014, when Alibaba planned to go public as a whole, the preferred destination was also the Hong Kong Stock Exchange, and the relevant road shows were carried out.

With the reform of the Hong Kong Stock Exchange in 2018 to facilitate the listing of domestic Internet companies, in November 2019, Alibaba was "secondary" in Hong Kong.

The return to Hong Kong will consolidate Hong Kong's international financial center status

In fact, after the second time Alibaba was launched in Hong Kong, most of Alibaba's circulation stocks have been transferred to Hong Kong to register. Public data shows that in the first half of this year, Alibaba Group's average daily transaction volume in the Hong Kong market was about $ 700 million, and the average daily transaction volume in the US market was about 3.2 billion US dollars.

As the main market for Alibaba's business, China and the Asia -Pacific region have always received great attention from Chinese and Asia -Pacific funds. This time, the newly added Hong Kong to the market as the main list of listings, the success of the water at the technical level, is also in line with the market expectations of the market for a period of time.

In the recent period, the "double main" listing has become the mainstream model of China stock market returning to Hong Kong. At present, 9 Chinese stock companies such as Knowledge, Shell, Xiaopeng, and ideal have been realized in the United States and Hong Kong.

After the two major listings, related companies can better cope with the uncertainty of a single market, so as to better cope with the challenges brought by changes in the external environment.

According to the "Global Financial Center Index" (GFCI), Hong Kong is currently the third largest financial center in the world, ranking second only to New York and London.

Analysts believe that more and more high -quality companies represented by Ali's "dual main" listing on the Hong Kong Stock Exchange will significantly increase technical indicators such as the profitability and scientific research investment of the Hong Kong Stock Exchange. At the same time, it is expected to improve Hong Kong The pricing capacity and liquidity of the securities market, including more high -quality transactions, will also strengthen its attractiveness to the global market, which will help Hong Kong to further consolidate and enhance the status of international financial center.

At the same time, the choice of "dual main" listing of China -stock stocks does not affect its listing status in the United States. The pricing of Chinese stocks and US stocks and Hong Kong stocks is independent. For a long time, overseas funds have promoted the development role of Chinese technology companies. A number of Chinese stock companies such as Ali have also been listed in the United States, which has also enhanced global capital to understand Chinese companies and Chinese markets.

1.31 billion global active users in the Ali economy

On the morning of July 26, Alibaba Group issued a 2022 fiscal annual report.

The annual report shows that in the fiscal year as of March 31, 2022, Alibaba's global active consumer of the year was 1.31 billion, of which exceeded 1 billion from the Chinese market and 305 million from overseas. The total turnover of Ali Ecology was 8.317 trillion yuan in the same period, of which the Chinese market accounted for 7.976 trillion yuan, and the international market accounted for $ 54 billion.

Alibaba's total revenue in fiscal 2022 was 853.1 billion yuan, an increase of 19%from 717.2 billion yuan in fiscal year in 2021. The total revenue growth was mainly due to the growth of China's commercial, cloud business, and international commercial income. In the case, the growth of total revenue still reached 14%.

The net profit of Alibaba in fiscal year in 2022 was 47.079 billion yuan, a decrease of 67%year -on -year. In this regard, Ali explained that it was mainly that Alibaba invested in the investment in Taote and Taotai, which increased costs for user growth, and supported merchant measures to invest in business measures. Cause.

In the annual letter of shareholders, Zhang Yong, chairman and chief executive officer of Alibaba Group, systematically elaborated on the face of external changes and uncertainty, Alibaba's thinking about the future.

"In the past year, under the changing international and domestic situation, we faced a lot of" questions of the era 'together. The basic principles of our response are' firm confidence, positive response, and ourselves. "Zhang." Zhang. "Zhang." ZhangYong said, "We firmly have confidence in China's economic development, confidence in the future of the digital economy, and the confidence of people's unchanged pursuit of a better life. As long as these general trends are clear and firm, Ali has the foundation of existence and development, and can be able to be able to exist and develop, and can be able to be able to exist and develop.Make your own contribution to society's development. "In the past year, Ali has made a series of changes in organization and culture.Zhang Yong wrote in the letter: "Although these change effects need to be manifested longer, we believe that we are on a correct road."

Responsible editor: Tao Jiyan | Review: Li Zhen | Director: Wan Junwei

- END -

Damei Jining | Liao He Ye Shi

Figure: Jining City Photographers AssociationAuthor: Li Junhua

Putting the health and safety of residents in the highest position -Ganzichong Community actively promotes the construction of a normalized "immune -free community"

In the epidemic prevention and control examination, Louxing District Changqing Street Ganzhong Community actively promoted the construction of a normalized epidemic -free community, reality and feed