IPO observation 丨 "Eating the Sea by the Sea" Nichun

Author:Red Star News Time:2022.07.26

On May 12, 2021, the starting application of the GEM of the GEM (hereinafter referred to as "Ri Nikhun") was accepted by the GEM of Ririshun Supply Chain Technology Co., Ltd. It is planned to raise 2.771 billion yuan for intelligent logistics centers and intelligent storage equipment projects. Substitutions are CICC and China Merchants Securities. Today, it has been more than a year in the past. What is the situation of the IPO road of Ri Shishun?

The Red Star Capital Bureau noticed that as of March 4 this year, Sunshunshun had completed the response to the second round of review inquiry. However, since the financial information recorded in the application document has passed the validity period, the Nikushshun IPO audit has been suspended from March 31, and the financial data was not updated until June 29, and the audit was resumed. Earlier, Nikko was suspended by the Shenzhen Stock Exchange on September 30, 2021 for the same reason.

In the two rounds of review and inquiries, the Shenzhen Stock Exchange all questioned the main business and the positioning of the GEM and the independence of the company's operation. In addition, Nichun -Shun has also received the attention of 54 administrative penalties caused by the goodwill impairment risk of business expansion and during the reporting period, and has also received the attention of the Shenzhen Stock Exchange.

GEM positioning is questioned

Supply chain management service enterprise or traditional transport and logistics enterprises

Sunshun said in the prospectus that the company is China's leading supply chain management solution and scene logistics service provider. The company mainly provides enterprise customers with full -process supply chain management services. The business scope covers consumer supply chain services, manufacturing supply chain services, basic logistics services and other types, and provides customers with ecological innovation services.

From 2018 to 2021 (reporting period), Ri Rishun operating income was 9.587 billion yuan, 10.346 billion yuan, 14.036 billion yuan and 17.163 billion yuan, respectively, with net profit attributable to 225 million yuan, 273 million yuan, and 422 million yuan, respectively. And 568 million yuan. During the reporting period, the company's operating income came from the main business.

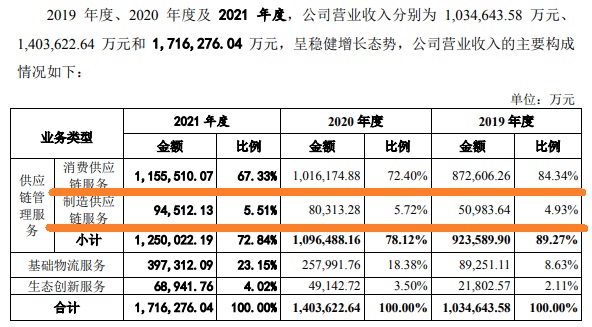

The prospectus shows that during the reporting period, the operating income of the company's supply chain management services was 7.702 billion yuan, 9.236 billion yuan, 10.965 billion yuan, and 12.50 billion yuan, respectively, accounting for 80.34%, 89.27%, and 89.27%, and respectively. 78.12%and 72.84%.

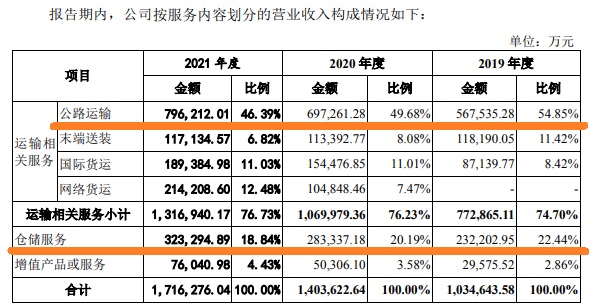

However, in the first round of review and inquiry of the Shenzhen Communications Institute, from 2018 to 2020, the operating income of Rihiko is mainly derived from the two nodes of transportation and warehousing in the supply management solution. 80.64%, 77.29%and 69.87%. The Shenzhen Stock Exchange requires the differences and connections between the main business and traditional logistics companies.

In addition, the Shenzhen Stock Exchange pointed out that the important awards in the Nikko Shun are awarded by the logistics industry. The Shenzhen Stock Exchange requested that Ri Rishun explained the reasons and reasonableness of the company as the logistics industry, whether it meets the relevant requirements of the GEM.

In the reply at the time, the company said that the company was significantly different from traditional transportation and logistics companies in terms of industrial policy, industry standards, technical routes, business models, and R & D investment. The company's core technology is mainly implemented through digitalization and informatization. It is currently mainly used in the consumer supply chain, manufacturing supply chain, and transportation network. The above-mentioned business segments achieved income from 2018-2020 and 2021, respectively. 9.236 billion yuan, 1.2.013 billion yuan, and 6.819 billion yuan, accounting for 80.34%, 89.27%, 85.59%, and 86.05%of the company's main business revenue, respectively. However, because the company's different business segments have resource sharing in R & D, sales, and management, it is difficult to calculate the net profit of the aforementioned sector alone.

Sunshun Shun said that the company is a typical supply chain management service company and has obtained industry identification issued by the China Logistics and Procurement Federation. The company's business model is consistent with the core characteristics of the modern logistics industry, which is in line with the national economic development strategy and industrial policy orientation. The company achieved a compound growth rate of 21%from 2018 to 2020, which is an innovative creation enterprise with growth. The company complies with relevant regulations on the positioning of GEM.

In the second round of review and inquiry, the Shenzhen Stock Exchange continued to have technical levels and characteristics of various aspects such as warehousing transportation, intelligent logistics equipment, and system software integration. Sexual questions were questioned.

Discovering business independence

Haier and Ali customers have higher gross profit margins than the company's overall gross profit margin

The prospectus shows that Ri Rishun Shanghai is the controlling shareholder of Rijun Shun and directly holds 56.40%of the company's shares. Haier Group indirectly controlled 56.40%of the shares of the company through Japan, and it was the actual controller of the company. From 2018 to 2021, the company's revenue from related parties Haier's customers accounted for 38.48%, 42.03%, 33.13%, and 30.60%, respectively; the proportion of Mao profit contributions was 29.77%, 44.99%, 41.48%, and 41.90%.

Alibaba Group made strategic investments in Nissan in 2013, holding a total of 29.06%of the company's shares. From 2018 to 2021, the company's revenue from related parties Ali customers accounted for 20.37%, 20.42%, 15.80%, and 15.00%, respectively; the proportion of Maori contributions was 21.03%, 22.57%, 21.36%, and 21.15%. In other words, the business from the two major related parties from the Haier and Alibaba series occupies half of the revenue of Rihisushun.

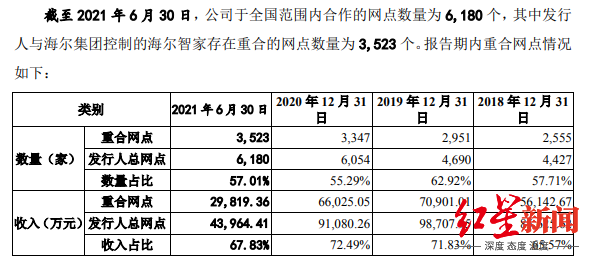

In addition, from 2018 to 2020 and in the first half of 2021, the proportion of the number of Haier Zhijia re-controlling outlets controlled by the Harr Group and Haier Group accounted for 57.71%, 62.92%, 55.29%, and 57.01%, respectively. The income income accounted for 65.57%, 71.83%, 72.49%, and 67.83%, respectively.

According to the latest prospectus released by Rimi Shun, as of the end of 2021, the number of outlets with the company with Haier Zhi's family was 2,935. Compared with 3523 at the end of June 2021, the number of re -coincidences decreased by 588.

Ri Rishun also has the situation of the actual controller of the rental person and its control enterprise. House rental is mainly used for office and warehousing business; existing that some employee wages are issued through Haier Group Financial Co., Ltd. Essence

Back to Haier and Ali, it has many benefits to Japan and Japan, but it has also caused the outside world to worry about its independence.

After asking the independence of Nichun -Shun in the first round of review and inquiry of the Shenzhen Communications Institute, in the second round of review and inquiry, Nichun Shun supplemented the fairness of the affiliated transaction price with the Haier and Ali department. It is highly high or whether the relatively high operating independence of Nikko and Shishun is dependent on the controlling shareholder, actual controller and important shareholders; whether there are issues such as regulating income, profits or costs through affiliated transactions.

In the response, Ri Rishun said that the company's business is independent of the controlling shareholder, actual controller and important shareholders, and related transactions do not affect the company's business independence. The company cooperates independently with Haier customers and Ali customers based on their business needs and commercial interests, and there is no major dependence. The company has established a relatively complete internal control system. Major affiliated transactions have passed the approval procedures such as the board of directors and the shareholders' meeting. There are no cases of regulating income, profits or costs through related transactions. The related parties between the company and the affiliated parties, the matters of the business settlement and salary of the business settlement and salary of the company's financial limited liability company have been completed.

However, the reply from Ririshun showed that from 2019 to 2021, the gross profit margin of the company provided services to Haier customers was 9.50%, 10.50%, and 10.66%, respectively. 11.34%, 10.97%. It can be seen that the gross profit margin of the two major related parties on the day and day has been on the rise, and since 2019, it has been higher than the company's overall gross profit margin: from 2019 to 2021, the overall gross profit margin of the day and Japan has gradually decreased. They were 8.88%, 8.38%, and 7.78%, respectively.

The acquisition of the "Dark Thunder" for the reputation for hundreds of millions of dollars

More than 140 transport lawsuits or arbitration, 54 administrative punishment entangled

From the perspective of performance, the development momentum of Japan and Japan is indeed good, especially in 2020, the company's revenue and net profit have increased significantly. This is inseparable from the performance of the performance of the business expansion through the extension of Nikkun, but this also laid the "dark thunder" of goodwill impairment.

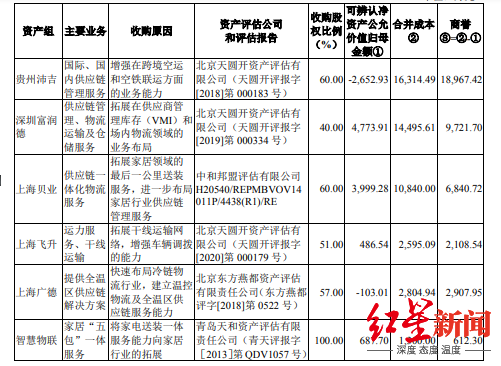

The prospectus shows that before the reporting period, the company acquired Peiji, Guizhou, formed 190 million yuan in goodwill, and in 2018, 2019, and 2021, the provision of the impairment of business reputation was 59.5638 million yuan, 69.739 million yuan, and 60.436 million yuan. ; In 2020, the company's reputation for the formation of the goodwill for the formation of Shanghai Guangde before the report was 29.0795 million yuan; in April 2019, the company acquired Shanghai Feisheng to form a goodwill of 210.854 million yuan. During the reporting period Honorary impairment preparation; in July 2019, the company acquired Shenzhen Furunde to form a goodwill of 97.217 million yuan.

As of the end of 2021, the total amount of goodwill in the daily accounts was 193 million yuan, and the current company's net profit was 568 million yuan. This means that the goodwill value of Nikkei accounts for more than 30 % of net profit.

In the past three years, the cumulative loss of goodwill impairment has reached 159 million yuan. If the operating performance of these related subsidiaries cannot reach the expected level, Ri Rishun is facing the risk of further impairment of goodwill.

In addition, the big acquisition also brought many lawsuits and management problems to Ri Rishun.

The review inquiry shows that in 2020, the fraud at Guizhou Panjiang Investment Holdings (Group) Co., Ltd. (hereinafter referred to as "Panjiang Group") Jiji Previous) 60%of the equity, applying for arbitration along the China International Economic and Trade Arbitration Commission every day, requesting the revocation of the equity transfer agreement, and compensation for RMB 187 million in Ryhisshun. The case is still under trial.

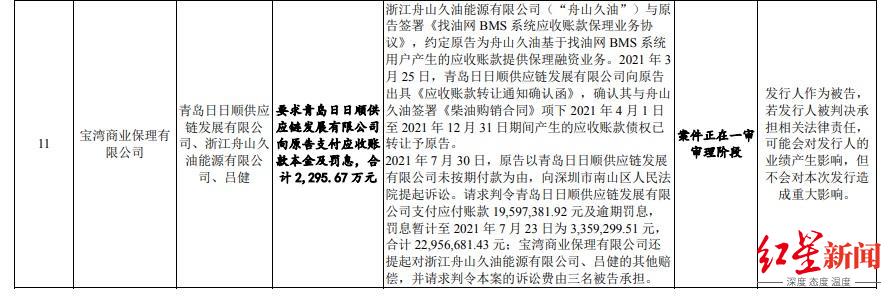

On the same day, the company conducted a self -inspection of the operation of Peiji, Guizhou in early 2020. It was found that Panjiang Group disclosed the total assets, net assets and net assets and net assets and net assets and net assets and net assets (February 28, 2018) to the company. The bad book value of debt has a significant impact on the financial data of Peiji in Guizhou, which has led to the purchase of Peiji equity in Guizhou every day. During the reporting period, the total profit of Pei Ji of Guizhou was -24.798 million yuan, -2283,535,35,75,100 yuan, and -11.932 million yuan, respectively. The prospectus shows that as of the end of 2021, there were 73 domestic holding subsidiaries, 2 overseas holding subsidiaries, and 1 stock participating company. As of the latest prospectus signing date, Ri Ri Shun and its subsidiaries are undergoing or have not yet been implemented. A total of 11 major lawsuits and arbitration cases with a single controversy of more than 5 million yuan. 1 item.

Nikko as a major lawsuit related to the defendant

In addition, from 2019 to 2021, more than 140 lawsuits or arbitration related to cargo transportation occurred by Rimi Shun and its subsidiaries, of which 106 were the defendants. The total payment amount is 2.8244 million yuan.

From 2019 to 2021, a total of 54 administrative penalties were punished, of which a single penalty amount exceeded 10,000 yuan or more, with a total of RMB 2.550 million and a single penalty of 37 items of less than 10,000 yuan. Essence Among the administrative penalties with a amount of more than 10,000 yuan, most of them are related to the safety production and fire safety matters of subsidiaries.

Whether the Ri Rishun IPO can go smoothly, the Red Star Capital Bureau will continue to pay attention.

Red Star News reporter Ren Zhijiang

Edit Yu Dongmei

- END -

I heard the "flood" and moved, this town does a good job of flood prevention and drainage!

In the past few days, there have been continuous rainfall weather in our district....

Guazhou: Technology adds motivation to agricultural development

Guazhou County is based on the key blocking point of opening industrial developmen...