During the year, the issuance scale of convertible bonds exceeded 130 billion yuan, and the public offer holding a market value of nearly 280 billion yuan hit a record high

Author:Securities daily Time:2022.07.26

Reporter reporter Zhou Shang 者

Since 2017, the structure of the A -share re -financing market has continued to optimize, and the attention of convertible bonds has continued to rise.

Since the beginning of this year, the convertible bond market has continued to expand, and the issuance scale exceeds 130 billion yuan. At present, the size of the convertible bonds of the Shanghai and Shenzhen cities has reached 776.143 billion yuan, an increase of 75.556 billion yuan from the beginning of the year. At the same time, in the second quarter, the market value of public funds holding convertible bonds was 278.132 billion yuan, a record high.

Convertible bond issuance scale

Continue

According to Wind data statistics, "Securities Daily" reporters have issued convertible bonds of 73 listed companies since this year, with a total issuance scale of 131.963 billion yuan, accounting for 29%of the total scale of A shares. Among them, in the first half of the year, 59 listed companies issued convertible bonds, with a total issuance scale of 117.536 billion yuan.

With the continuous growth of the convertible bond market, the phenomenon of excessive speculation and hype has gradually emerged. In order to regulate the transaction of the listed company's convertible company's bonds, protect the legitimate rights and interests of investors, and safeguard the market order and social public interests, on June 17, the Shanghai and Shenzhen Exchange publicly solicited opinions on the implementation rules of convertible bond transactions, including setting up an ups and downs. Restrictions, increased abnormal fluctuations and severe abnormal fluctuation standards, new types of abnormal trading behavior, etc. On July 1, the Shanghai and Shenzhen Exchange publicly solicited opinions on the guidance of convertible bonds, and further improved business processes and information disclosure requirements such as listing and listing, conversion, redemption, and return on convertible bonds.

On July 21, a total of 3 convertible bonds were listed. Due to the large increase in the opening, the trading was temporarily suspended during triggering. The Shanghai Stock Exchange stated that it will be supervised in accordance with regulations, and the abnormal trading behavior of the abnormal transaction behavior of the normal transaction order of the market and misleading investors' normal transaction decisions is strictly identified. Among them, in response to the abnormal trading behavior of a small number of investors in the trading of N Huirui (Hainrui Convertible) transactions, the Shanghai Stock Exchange adopted self -discipline supervision measures according to regulations.

Although convertible bond supervision continues to upgrade, relevant measures do not affect the financing function of the convertible bond market, and will not weaken the service support for the real economy, especially small and medium -sized private listed companies. Since the beginning of this year, the peak of convertible bond issuance concentrated in February and March, with the issuance scale of 29.905 billion yuan and 40.621 billion yuan; the issuance scale in May alone was less than 10 billion yuan, which was 6.572 billion yuan. It has risen to 16.088 billion yuan, and has also issued 14.427 billion yuan since July.

Among them, since the implementation of the implementation rules of the Shanghai -Shenzhen Exchange on June 17th, the implementation rules for convertible bond transactions have been solicited publicly. 21 listed companies have completed the issuance of convertible bonds, with a total scale of 21.17 billion yuan, and the issuance speed is stable. Statistics of Guoxin Securities show that as of July 25, there were 182 convertible bonds, with a total scale of 287.44 billion yuan, of which 16 have been approved, and the total approval scale is 11.53 billion yuan. 100 million yuan.

Public offering in the second quarter

The market value of convertible bonds increased by more than 9% month -on -month

Since the beginning of this year, the convertible bond market has continued to fluctuate. In the second quarter, the CSI convertible bond index increased by 4.68%, while the first quarter declined by 8.36%. According to Wind data, the market value of public fund holding convertible bonds in the second quarter was 278.132 billion yuan, an increase of 9.14%over the first quarter, a record high.

"In the second quarter, the market value of public fund holding convertible bonds accounted for a total of 35.88%of the market value of convertible bonds, which reversed the momentum of the proportion of public fund holdings in the first quarter." Xu Liang, chief analyst of the fixed income of Debon Securities Institute, said Since 2019, the market value of public funds holding convertible bonds has shown a stable upward trend. On the one hand, due to the expansion of the convertible bond market, on the other hand, the proportion of public funds has increased. Essence

At present, the conversion rate of convertible bonds has declined slightly. As of July 25, the average conversion rate of convertible bonds was 51%, and a total of 50 convertible bonds had exceeded 100%. On June 17, the average conversion rate of convertible bonds was 56%, and the premium premium rate of 53 convertible bonds exceeded 100%.

"The conversion rate of the convertible bond market is at a high level, and the price center has rebounded slightly." Zhou Guannan, the leader and chief analyst of Huachuang Securities' fixed income group, believes that in the future, the driver still comes from the main shares, which can focus on the performance of the interim report and benefit Periodic products fall in the direction. First, continue to pay attention to industries such as automobiles and new energy vehicles under the implementation of consumer policies; second, the main focus of high -end performance has a high degree of attention to grow high -level growth sectors, new energy vehicle industry chains, military industry and other industries Convertible bonds; the decline in the recent period of benefit of the price of cyclical products mainly pays attention to the midstream manufacturing sector. From the perspective of price, the growth industry leading convertible bonds still have the value of allocation.

Sun Binbin, chief analyst of the fixed income of Tianfeng Securities, said that it has been 5 years since the accelerated issuance of the convertible bond market in 2017. More partial debt convertible bonds may usher in the expiration of the "big test". In the context of domestic real estate and consumption, and the concentration of mature industries has increased, there may be risk of breach of contract with poor competitiveness and difficulty in operating strategy.

- END -

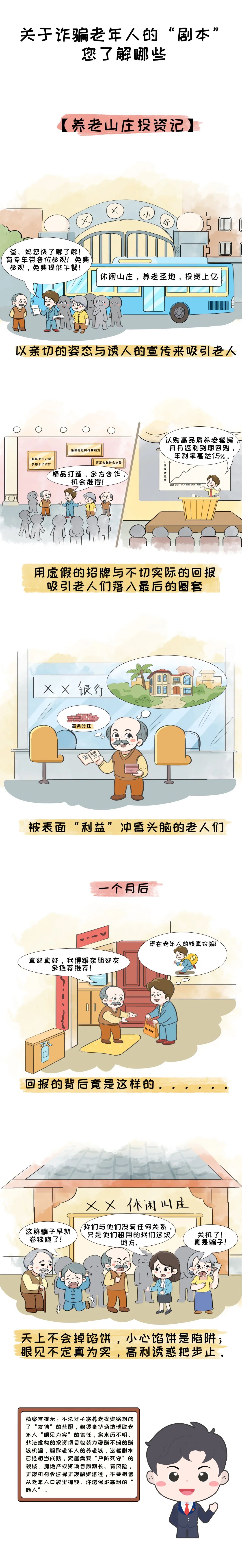

Common "script", everyone turns ~

In recent years, the pension scams have emerged endlesslyIllegiter uses the elderl...

After 426 days, Tim finally won again

Bastard, Sweden, is a city without a night in the summer. Dominic Time is bright w...