Yihan Think Tank: Is the real estate rating down terrible?

Author:Securities daily Time:2022.07.25

Since the second half of 2021, with the continuous pressure of the real estate industry, the credit rating of the three international rating institutions has been reduced in ears, and it always provokes the tight heartstrings of investors and buyers.

First of all, what is the credit rating? what's the effect?

Credit rating is an indicator of the risk of breach of contract. Generally, in the bond market, the rating agency is a professional evaluation made by the rating agency as a third party's debt repayment and willingness of the debtor. Large rating agencies are currently the mainstream and influential international rating agencies. A few rating agencies, including the three major rating agencies, have obtained the permission of the US government for rating business. At the same time, the government reports and financial markets direct reference and dependence on rating results. Therefore, they naturally give these institutions' great authority and influence.

The rating agency uses a symbol system to represent the rating results. The rating results can be classified as investment-level and speculative levels, representing the two basic judgments of the agency's risk of breach of contract. For the three major rating agencies, the BAA3/BBB-and above are the above. Investment level, the following is speculative, of which CAA1/CCC+and the following represent different degrees of default risk.

For issuers, the higher the credit rating can bring more sufficient subscription and lower financing costs. For investors, on the one hand, it is expected that the risk of breach of contract for credit rating can warn the target as a reference for investment decisions. On the other hand, due to the linked to credit rating of some bonds, it is related to the recycling of investment income.

Secondly, why is the credit rating of real estate companies now attracted much attention?

This comes from the unprecedented liquidity crisis and unprecedented fragile confidence in the entire real estate industry. Since the beginning of the thunderstorm of large -scale housing companies since the second half of 2021, the industry has encountered an unprecedented deep crisis. The industry liquidity crisis has led to the spread of debt defaults and project delivery. In this context, the confidence of investors and buyers is also fragile. Therefore, investors, buyers, and media are highly sensitive to negative news related to real estate, especially negative news related to debt repayment. In this context, the results of the rating agency with "authority" halo naturally attract widespread attention. It is taken for granted by many groups.

In the end, is we paying more attention to this wave of widespread and profound rating. Is it terrible? How should we rationally look at the rating and the future and the future of the real estate industry?

1. The real estate rating experienced the fourth trough, and the early warning effect of the rating was insufficient

1. The status quo of real estate rating: overall trough, 30 % to 40 % of the company's rating is not ideal

When we look at the current real estate industry rating, we will find it in an unprecedented trough. With E50 enterprises as samples, less than 30 % of companies that can reach investment -level rating are currently underlying. They are mainly state and central enterprises and individual private enterprises. This may not change much compared with the past, but at the same time, 30 % to 40 % of the company's rating enters the C -shaped head or below or below or below. The revocation of rating in the past year is indeed very rare.

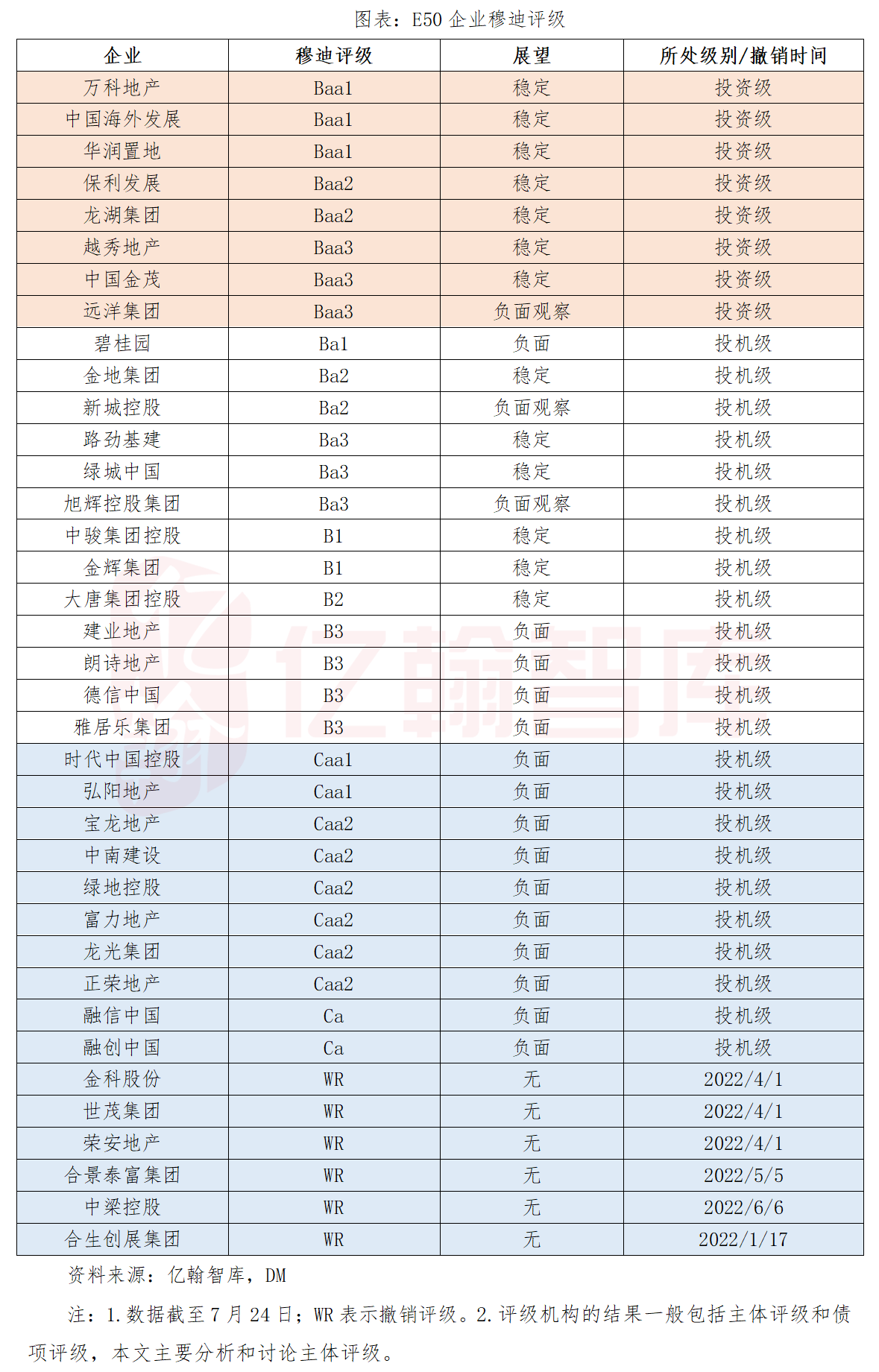

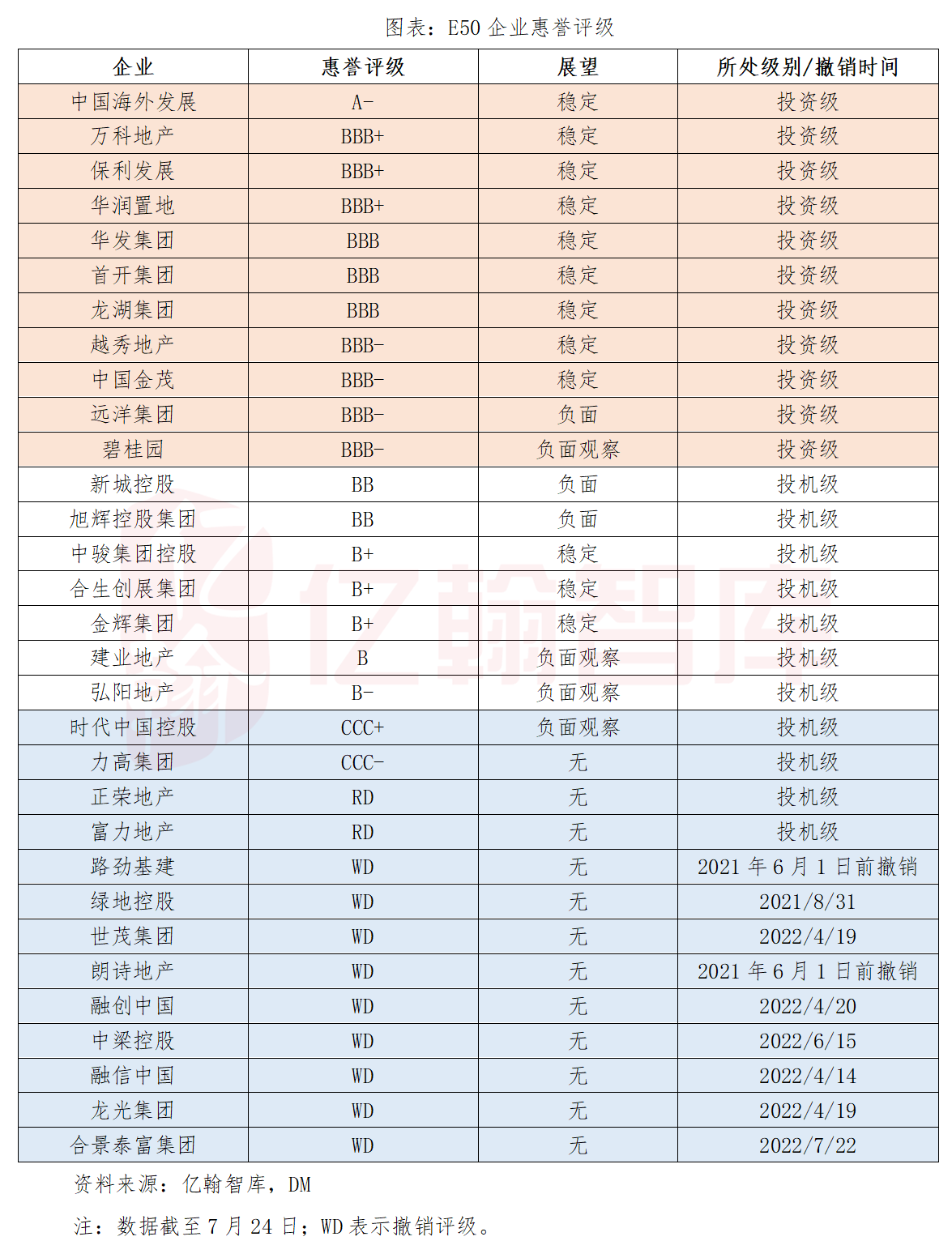

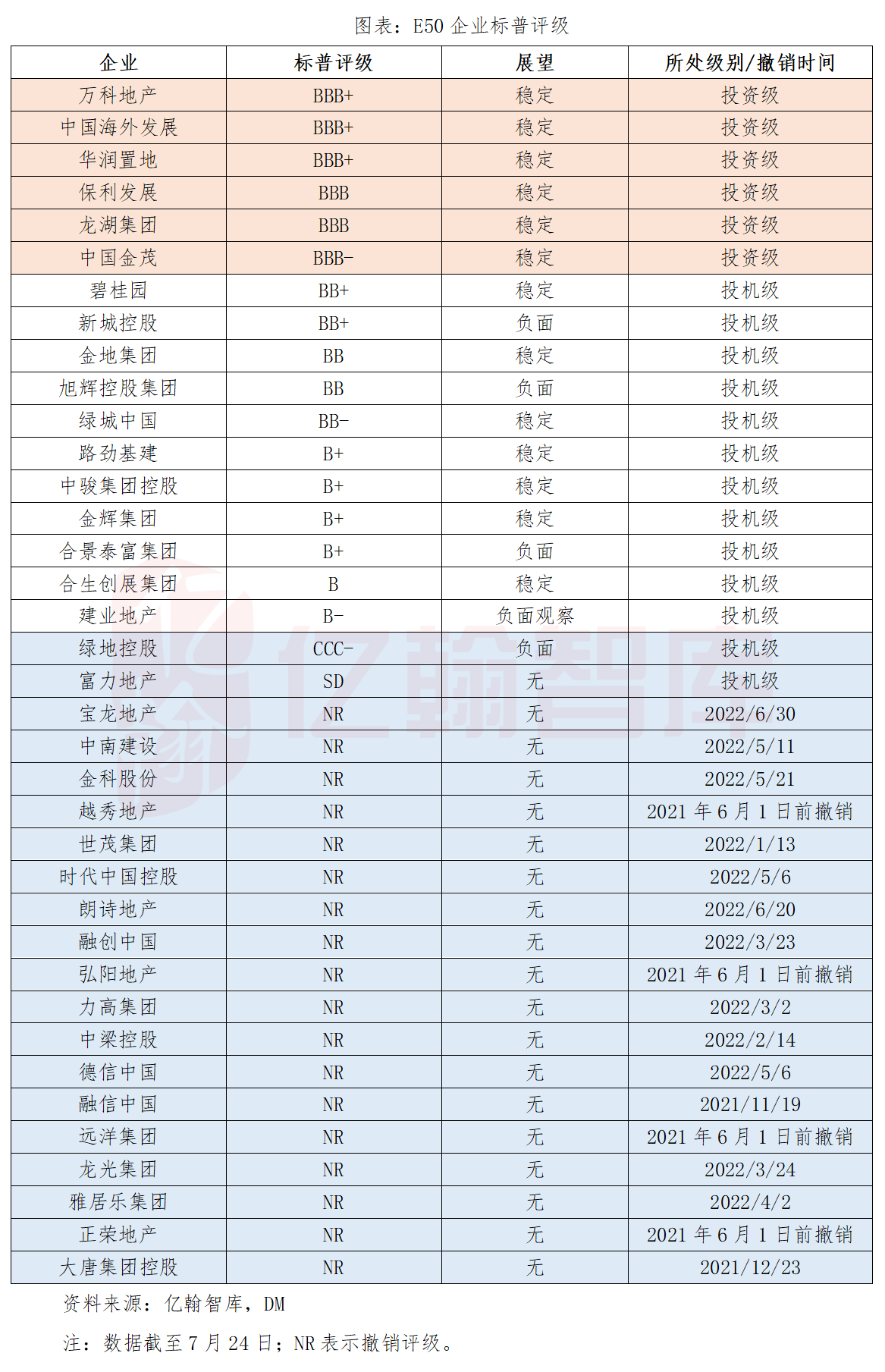

Specifically, among E50 companies, 21%of Moody's enterprises are investment levels, of which only one private enterprise in Longhu; 35%of Fitch is the investment level, of which only two private enterprises of Longhu and Country Garden; 16%of the S & P enterprises are investment levels, of which Only a private enterprise in Longhu.

In contrast, Moody's 43%of the corporate rating is located at the C -shaped head or below or the rating of the rating in the past year. The proportion of Fitch and S & P has reached 35%and 43%, respectively.

2. Real estate rating adjustment: high frequency adjustment, insufficient early warning effect

As important as the status quo, what kind of rating adjustment process does the real estate industry have gone through? Looking back at the rating adjustment of the three major institutions since June 2021, we found that it presents the following four characteristics:

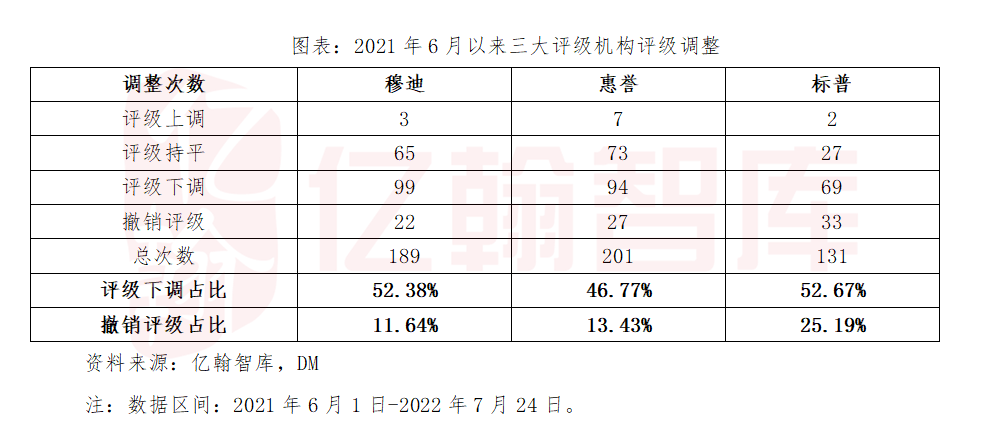

(1) High frequency adjustment: For the real estate industry, Moody's and Fitch's rating adjustment since June 2021 is close to or reached 200 times. Among them, the rating adjustment of individual enterprises is only a few days apart. Regular adjustments of the institution for several months or half a year have formed a sharp contrast.

(2) Development to the mainstream: In the rating adjustment actions of the three major institutions, the proportion of rating and the cancellation of rating and the cancellation of rating will be 60 % to 70 %.

(3) A few enterprises survive: State -owned and central enterprises, Hong Kong -funded enterprises, and individual private enterprises can maintain rating, and no other enterprises are spared to be lowered or raised continuously. Taking Salon as an example, China State -State -owned enterprises such as China Shipping, Poly, as well as Hong Kong -owned enterprises such as Swire Real Estate and Kowloon Warehouse can maintain rating, while private enterprises can only maintain rating in Longhu, Country Garden and Xuhui, while other private enterprises are almost spared.

(4) The reason for the reduction is basically similar: the basis for lowering the rating of rating agencies is mainly to believe that the company's sales and narrowing channels have reduced the flexibility of the company's liquidity.

(5) Insufficient forward -looking for adjustment: Compared to the good risk and early warning effects we expect, we find that the forward -looking forwarding of the three major institutions is not good. Essence Taking Baolong Real Estate as an example, on July 4, it announced the exhibition period of two US dollars of high -end notes that expired during the year, but Moody's and Fitch's rating 4 days ago and 5 days ago were B3 and B. It announced that it was announced nearby to Class C for a few days. Therefore, it is more similar to a trigger result compared to the early warning effect.

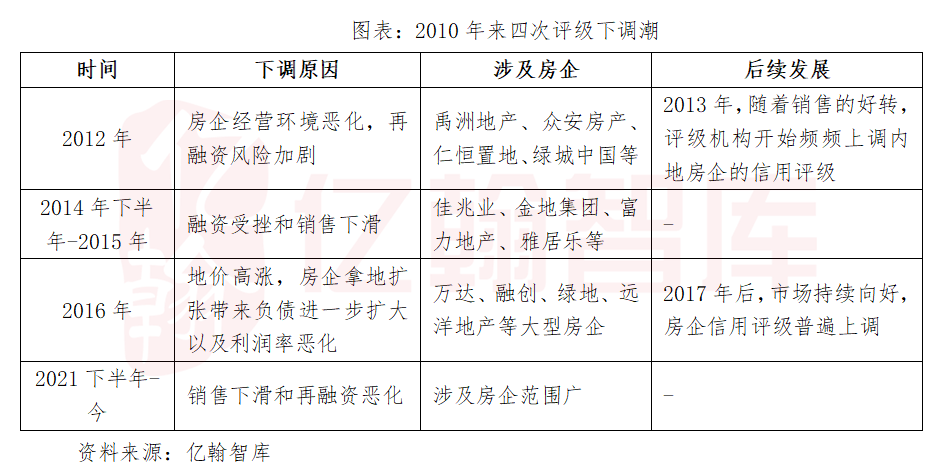

3. History of rating adjustment: four down tide, rating adjustment basically follows the real estate cycle

Extending the time line, we found that the tide of rating has undergone three times in 2010, and the cycle of rating has basically followed the real estate cycle. Specifically, the tide of the first three ratings occurred in 2012, the second half of 2014-2015, and 2016. Except for 2016, the first two were consistent with the real estate downturn cycle. At the same time, the reasons for the reasons for rating from the second half of 2012, the second half of 2014 to the first half of 2015 and 2021 are basically the same, but because the industry liquidity problem is more severe, the breadth and depth of depth are more significant.

2. How to view the tide of rating of the three major institutions?

The right to speak and influence of the three major rating agencies is undeniable, but we believe that in the current trough period of the industry, especially rationally treating rating down, not exaggerating the role of rating down; more importantly, through profound analysis and historical review, We found that behind the authority of the three major institutions is the departure of the original intention of risk warning, and the consequences of triggering and exacerbating risks. Faced with the bumps in the future, we look forward to that it can inform passengers who have got on the car in advance, but the last thing to wait is likely to brake a shot when they are close to the bumps.

1. Will companies with rating degradation be defaulted? Will low -rating companies go bankrupt?

First of all, if we choose to largely believe in the results of rating agencies, we must ensure that the meaning and consequences of the rating results are truly understood.

How to understand rating down?

First, it depends on the direction, but also depends on the adjusted results. It is also the rating of the rating. After the lowering is reduced, it is in A -shaped, B -shaped heads, or on the C -shaped head to represent the completely different judgment of the rating agency. Taking Country Garden as an example, Moody's rating was lowered on June 22, from BAA3 to BA1. Although there was a lot of public opinion at the time, we saw that this time it was only 1 level, and the BA1 was only one step away from the investment level rating. Zhiyao, this adjustment from other down to C -shaped heads cannot be equal to the same amount.

Second, it depends on the results and depends on the reasons behind the adjustment. We should make our own judgment on the authenticity of the reason, whether it can lead to the corresponding risk of breach of contract, and the impact of the reason for its decision -making.

If the company is lowered to C -shaped or below, does it mean that the company will definitely go bankrupt? In fact, although the rating is easy to drag enterprise into the vicious circle of breach of contract, if it is considered that low rating must mean that the company's bankruptcy is too arbitrary. The broken capital chain of the enterprise does not mean that the company itself must be poor. Enterprises may have a certain scale of high -quality assets and long -term accumulated competitive advantages. Through the exhibition period of debt, with the improvement of the industry situation and the company's own efforts, the company has the own efforts. It may pass the difficulty, return to the normal cash flow state, and correspondingly, the corporate rating will be increased.

2. Is the rating bearing the risk of early warning or exacerbating risk?

When we affect the nervousness for the continuous reduction of the rating, have we seriously thought about it, why do we believe in the results of the rating results like a certain kind of oracle. Is the authority of the three major institutions really reliable?

In fact, when we look back at the history of rating, we will find that the three major rating institutions in history have had severe mistakes, causing serious financial turmoil, and the outside world's questioning and criticism of the three major rating institutions have never stopped.

In 2008, the three major rating agencies in the financial crisis were an important promoter of the crisis. By July 2007, S & P and Fitch's rating of more than 70 % of the secondary loans at the AAA level, the same level as the U.S. Treasury bonds. The wrong credit endorsement promoted the expansion of the scale of sub -loan. The outbreak of the crisis was pushed, and after July 2007, it began to reduce the rating of sub -loans on a large scale, which caused the financial market to fluctuate. The three major rating agencies after the crisis were sued by the market or government. Among them, S & P finally paid a total of $ 77 million in a total of $ 77 million to achieve a settlement, while Moody's paid was as high as $ 864 million.

The rating of the three major rating agencies in the European debt crisis in 2009 has been criticized by political factors. 2009年,三大评级机构先后下调希腊、葡萄牙等国的主权信用评级,使得这些遭遇公共债务问题的国家越陷越深,伴随着美国从金融危机中恢复,欧元的强势地位开始扭转,避险The funds of funds have also begun to return to the United States, so the lowering action of rating agencies is considered to be the political driving of the United States to compete for currency leadership and debt resources.

We look forward to the authority of the three major rating agencies from its strict neutral positions, scientific evaluation models, and sensitive forward -looking for risks, but the facts may be that their authority comes from their natural power and monopoly position.

(1) The two major defects of the rating agency: pseudo -neutrality, the rating method is inaccurate

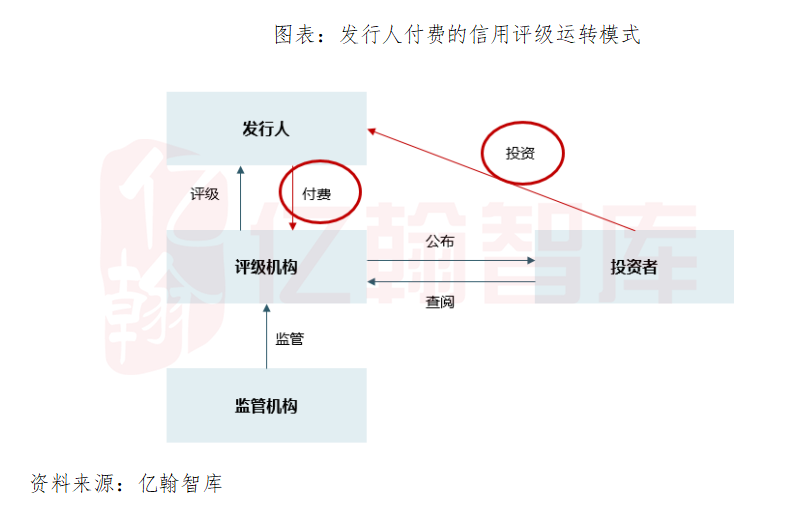

We should let go of the three major rating agencies down the altar to realize that it is essentially a commercial institution, and it is paid by the evaluate. Although its evaluation method is mysterious, the defects are self -evident.

1) The neutral position of the rating agency is doubtful

The nature and business model of rating agencies make it difficult to maintain a real neutral position. Unlike the general impression, the three major rating institutions are not international organizations with public welfare, but profitable private commercial institutions, and more importantly, in the current model, the rating is paid by the appraisal of the issuer, that is, the issuer, and the issuer, that is, the issuer is paid. At the same time, the rating business foreign institution also has a consulting business for the evaluated person. In this context, the extent of the rating results will be affected by the shareholders of the rating agency or the appraisal of the paid. The outside world is unknown. 2) The evaluation method of the rating agency is not necessarily appropriate

The three major rating agencies have their own rating models and are updated regularly. Among the basic models they published, Moody's more valued the financial situation of the enterprise, and the bestitarian is more localized. Considering China's pre -sale system and pre -sale fund supervision policy S & P focuses on the analysis of cash flow in terms of financial status.

However, it is clear that a fixed model is difficult to timely and accurately reflect the actual situation of many companies' changes in time. We believe that its evaluation model has at least the following four defects:

First, the timeliness and integrity of rating data are insufficient. The data sources of rating agencies include provided by the evaluate, open channels, and other non -public channels. In terms of the unique channel of providing data from the evaluate, it is difficult to timely and comprehensively grasp the corresponding indicators of the evaluated person in time. Symmetric problems still exist.

Second, the one -sidedness of the rating model, such as the model inevitably ignore the impact factors that are difficult to quantify, and it is easy to see only the problem, but the response and efforts of the enterprise are not considered.

Third, the sterection of the rating model, a static quantity surface is inevitable distortion, and it is difficult to adapt to changes in the specific situation of specific enterprises.

Fourth, the inertia of rating ideas, that is, in 2017, the Ministry of Finance refuted by Moody's and other institutions in 2017, mentioned the cyclical evaluation method. This idea makes the rating very vulnerable to the environment. Optimistic, and the environment is inclined to excessively react.

Of course, we do not require rating agencies and rating results to be perfect, but the problem is that such an institution and results with obvious defects have long occupied authoritative and dominant positions.

(2) The original intention of risk prediction is fault, but instead exacerbate risk evolution

As we have seen in this round of real estate industry rating and the 2008 financial crisis, although the original intention of the rating is to warn the risk in advance, the reality is that the rating or artificial or objective can not achieve this effect, and because of its authoritative authority, it is authoritatively or objective, and because of its authoritative authority, it is authoritative or objective, and because of its authoritative authority, it is authoritative. Status, over -reaction to risk neglect and lag, often causes and exacerbate risks.

For real estate companies that are experiencing liquidity crisis, the lowering of rating may drag the enterprise into the vicious circle and make the enterprise deeper and deeper. On the one hand, the lowering of the rating can make the factors that cause the downgrade to continue to deteriorate, including further corporate financing channels further. Debid makes re -financing more difficult, and the demand for vulnerability to make sales prospects is even more optimistic, which leads to the continued reduction of rating, thereby forming a vicious cycle of contraction of debt repayment channels and lowering rating. Accelerating the expiration of the stock debt, and this is easy to trigger more debt's cross -breach clauses, so that the scale of corporate defaults is increasing, the debt crisis is getting deeper, forming a vicious cycle of breach of contract.

All in all, we should realize that the current tide of rating of the real estate industry is more about the lag and possible reflection of the downlink cycle of the real estate industry, rather than the pre -judgment of the future risks of the real estate industry, although it does itself itself will indeed be itself. Bring the deepening of crisis and the turmoil of the market.

Third, not to break or stand, the more crisis, the more rational the crisis should

1. Is the rating down the tide terrible?

Back to the initial question, is the dense rating of the three major rating agencies be terrible? We believe that from the perspective of predicting the future, it is not terrible, because the rating does not do well in early warning risk. We cannot blindly believe that a tool claims to have this function because it is difficult to predict in the future; From the perspective of risks, the tide of rating is really terrible. Such a system with obvious defects and a huge error continues to occupy the authority and monopoly position of the financial market.

After the financial crisis in 2008, the reform of the United States has been promoted to the reform of the credit rating industry one after another, including exploring the credit rating model of investors paid, increasing the number of authoritative credit rating agencies, requesting rating agencies to take responsibility for major mistakes, enhance supervision of credit rating agencies for supervision of credit rating agencies And reducing the direct references of the rating results in government documents, but unfortunately, because a few rating agencies are still the "watchmen" of the financial market certified by the state, and the market has a deep market foundation in the three major rating agencies. Therefore, the international credit rating so far so far The market situation has not changed much.

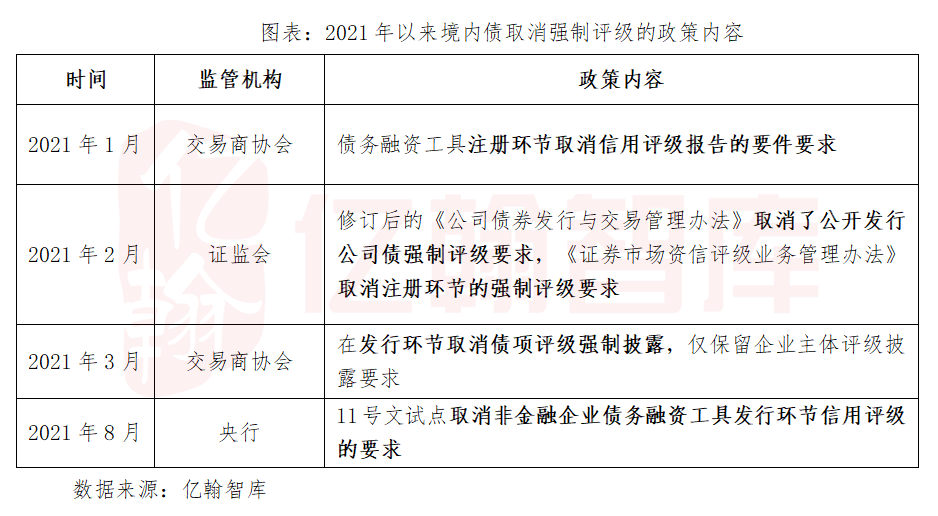

Although we expect the authority and influence of the three major rating agencies to not change in the short term, this does not mean that we must accept such institutional arrangements. Enterprises can choose to issue US dollar bonds in a non -rated way. On the one hand, the Chinese -funded US dollar debt mainstream issuance rules REGS does not force rating, and as of early 2022, nearly half of the stock of Chinese -funded US dollar bonds was issued in a non -rated way. On the other hand, in 2021, my country has begun to trial debt financing instruments to register or issue a system that does not force rating. This will promote the market -oriented reform of the domestic credit rating market from the source and promote the rating agency to return to the original intention of credit rating. 2. Breaking is not the purpose. After the pain, the real estate industry will usher in better development

Since the second half of 2021, when the real estate industry has continued to undergo pressure. When the negative news and the sound of singing decline are no wonder, have we thought about where such a crisis came from and where should we eventually go?

The so -called non -broken or not, breaking is never the purpose. The state of strict supervision of the state in the real estate industry lies in rectification, not suppression. In the past, the real estate industry's high turnover, high leverage, and high debt models were indeed easy to accumulate risks. Therefore, the purpose of regulatory intervention was to break the inertia of the old model, interrupt the accumulation of risks in advance, and guide the industry and enterprises to turn to healthy and sustainable new models.

In the process of conversion of the new model, the industry inevitably experienced pain, but after we believe in the adjustment of the industry, the real estate industry can be rejuvenated and play an important role in economic development and social employment, especially under the "double carbon" strategic goal of strategic goals Take the main promotion role. For corporate competition pattern, both state and central enterprises and private enterprises will still be important market forces, but it may be structurally from the original three seven to seven -three. At present, private enterprises that are stable in business still have a place in the future.

Regardless of whether investors, buyers, or ordinary public, the development of the real estate industry is closely related to us. Therefore, we should rationally treat the pain in the current real estate industry, support the problem and solve the problem, rather than exaggerate and let the panic; for the industry People should be firm in confidence and believe that after the pain of the industry, it will usher in a more stable development.

(Article Source: Yihan Think Tank)

(CIS)

- END -

[Reminder] Reminder of Yanji Disease Prevention and Control Center reminds: Do a good job of protecting the epidemic prevention during the summer vacation

At present, the situation of preventing and controlling the prevention and control of many places across the country is relatively stable, but the epidemic situation in individual areas is still sever

Technology makes community governance more fine

Nanqiao Community is located at the core of the 4A ancient city scenic spot of Duj...