17 violations!Some banks were severely fined nearly 8 million

Author:China Fund News Time:2022.07.25

China Fund reporter Li Zhi

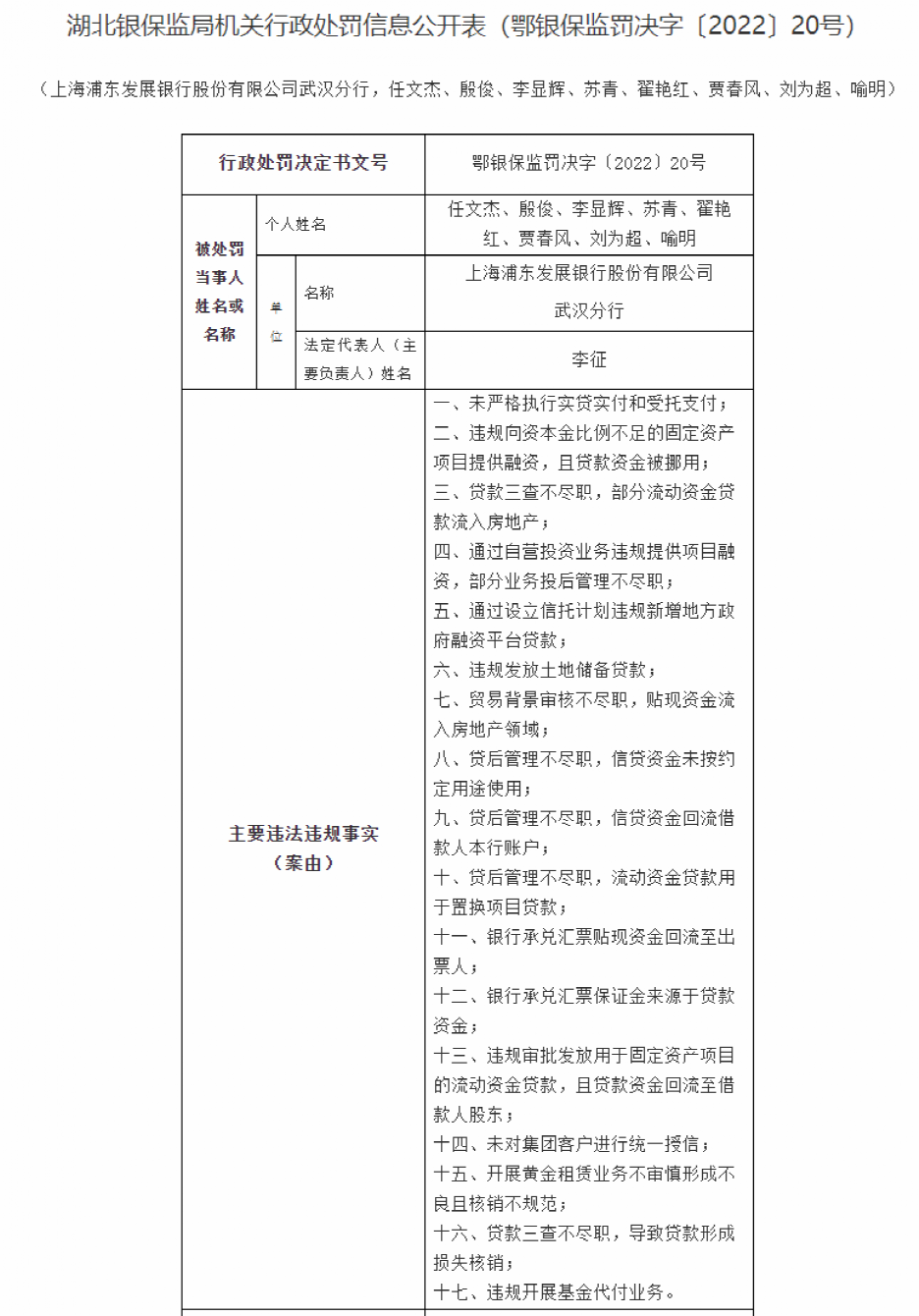

A disclosure of an administrative penalty information to the 17th violations of the bank. Recently, Pudong Development Bank Wuhan Branch was "17 crimes" due to the incomplete duties of the loan, and the eight relevant persons in charge were also warned or fined.

Due to 17 violations of laws and regulations

Pudong Development Bank Wuhan Branch was fined 7.85 million yuan

Recently, the Hubei Regulatory Bureau disclosed by the Banking Regulatory Commission Hubei Regulatory Bureau's Decision [2022] No. 20 administrative punishment information public table shows that there are 17 major facts involved in the Wuhan Branch of SPDB, including: the real loan is not strictly implemented by real loans. Pay and support payment; provide financing to fixed asset projects with insufficient capital ratios in violation of regulations, and loan funds are misappropriated; three loans are not due to due diligence, some mobile funds loans flow into real estate; Later management is not full; new local government financing platform loans are added through the establishment of a trust plan; land reserve loans are issued in violation of regulations; the trade background review is not exhausted, and discounted funds flow into the real estate field; after -loan management is not available, credit funds are not used as agreed; Unpleasant post loan management, credit funds return borrower's account account; incompetence after loan management, mobile funds loan for replacement of project loans; bank acceptance bill discount funds return to the issuer; bank acceptance bill margin comes from loan funds; Illegal approval and issuance of mobile fund loans used for fixed asset projects, and loan funds return to borrower shareholders; do not provide uniform letter of group customers; carry out the gold leasing business without prudent formation and poor check -up; As a result, the loss of loans for loss of loss; illegally carried out fund payment business.

Therefore, the Hubei Supervision Bureau of the Banking Insurance Regulatory Commission shall impose a fine of 7.85 million yuan in accordance with Article 46 (5) and Article 48 (2) of Article 46 of the People's Republic of China.

At the same time, the responsible person Ren Moujie, Li Mouhui, and Su were warned and fined 50,000 yuan respectively; the responsible person Jia Moufeng warned and fined 100,000 yuan; 10,000 yuan; the responsible person Zhai Mouhong, Liu Mouchao, and Yu warned.

Frequent regulatory tickets

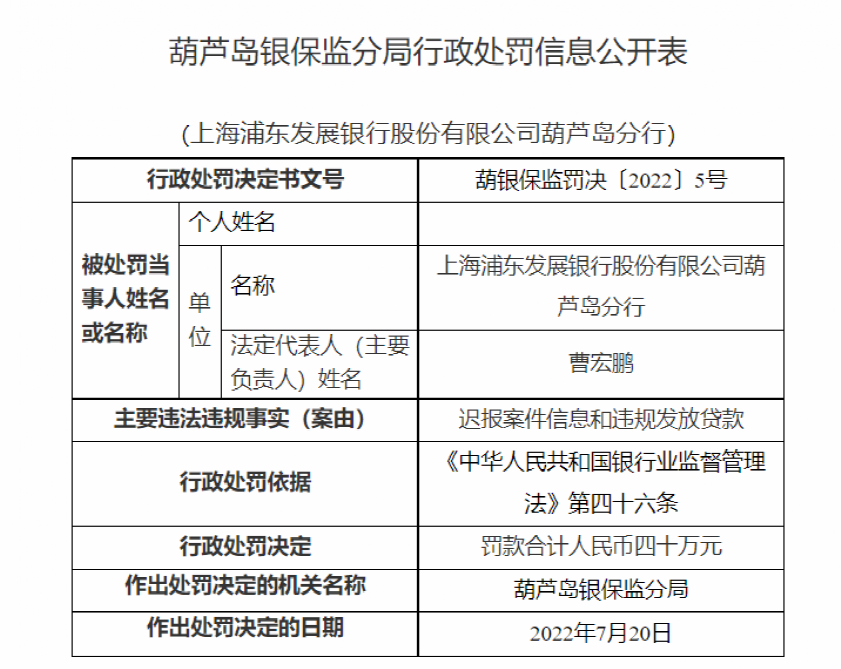

Recently, many management issues involved in Pudong Development Bank have been exposed one after another. In the past month, the bank has received multiple regulatory tickets. According to the public account of administrative punishment information disclosed by the Liaoning Regulatory Bureau, Pudong Development Bank Huludao Branch was fined RMB 400,000 by the Huludao Banking Insurance Regulatory Bureau for late reporting case information and lending loans in violation of regulations.

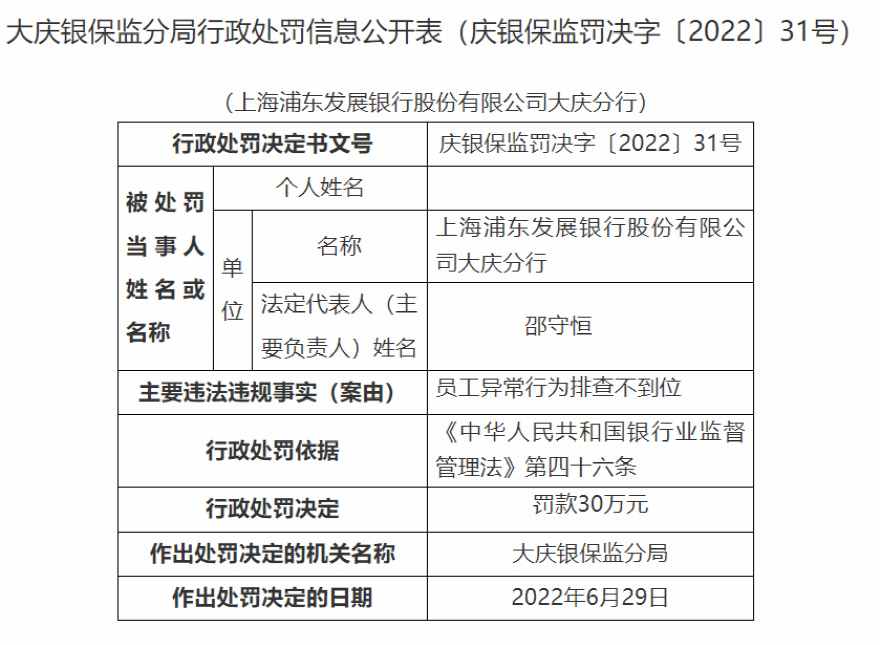

In addition, on July 7, the official website of the Heilongjiang Regulatory Bureau of the China Banking Regulatory Commission disclosed that the Pudong Development Bank Daqing Branch was fined 300,000 yuan. The administrative penalty letter shows that the main violations of the Daqing Branch of Pudong Development Bank include the failure to investigate the abnormal behavior of the employee, and the relevant person in charge was also warned. The organs that make a penalty decision are the Daqing Banking Insurance Regulatory Bureau.

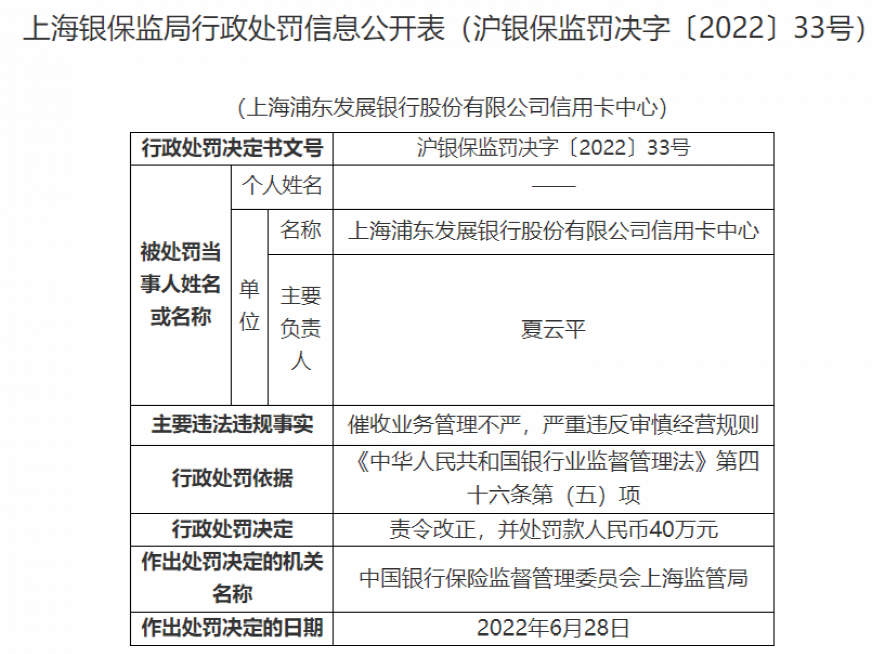

On June 30, the public information on the administrative punishment information of the Shanghai Banking Regulation Bureau showed that the SPDB Credit Card Center was ordered to be corrected by the Shanghai Banking Insurance Regulatory Bureau due to the lack of strict management of the collection of business and seriously violated the rules of prudential operations and fined RMB 400,000.

Due to violation of anti -money laundering related regulations

Pudong Development Bank Xining Branch was fined 2.125 million

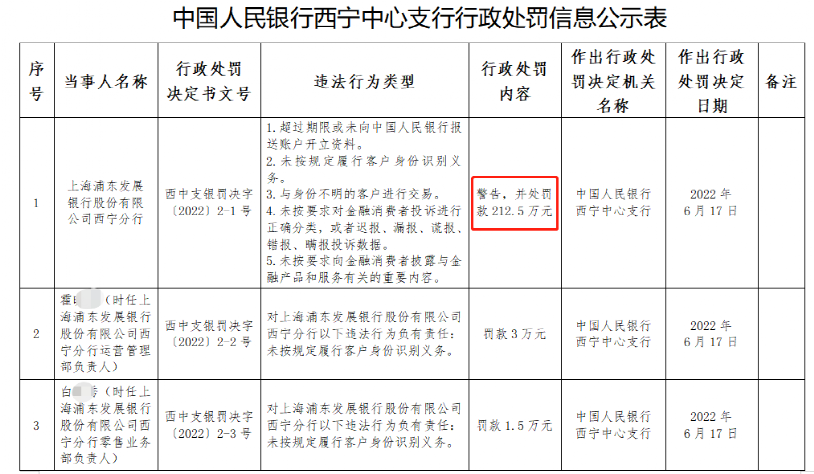

In addition, another branch of Pudong Development Bank has also been punished by regulatory penalties to collect millions of tickets. On June 27, the public punishment information publication form of the People's Bank of China Xining Center Sub -branch showed that Pudong Development Bank Xining Branch was warned by the Central Bank Xining Center Sub -branch and fined 2.125 million yuan.

According to disclosure, Pudong Development Bank Xining Branch mainly involves the following five violations of laws and regulations: exceeding the period or not submitted to the account of the People's Bank of China to open information; failure to fulfill the obligation of customer identity in accordance with regulations; It is required to correctly classify the complaints of financial consumers, or to report late, missed reports, lies, misunderstandings, and concealing complaints; not disclosed to financial consumers as important content related to financial products and services as required. There are also five relevant responsible persons were fined.

Edit: Captain

- END -

Chancheng Guangfa "Hero Post", invited youths across the country to start a business

Young people gather in the city, and they win the future when they win the youth. ...

Wang Wenbin introduced the 14th meeting of leaders of the BRICS countries

QAccording to the Foreign Ministry spokesman's office, at the regular press conference of the Ministry of Foreign Affairs on June 24, the CCTV reporter asked questions: On June 23, the 14th meeting...