Texas focuses on high -quality development of enterprises, unblocked financial live moisturizing real economy

Author:Texas Daily Time:2022.07.25

On July 15th, in Hanyuan Green Energy Co., Ltd., the workers, the workers made the collection of farm and forestry waste collected into biomass compression blocks to improve renewable energy power generation capacity. "Thanks to the support of CCB's Texas Branch, we used the subsidy of renewable energy power generation projects to handle pledge loans. 90 million yuan in financial live water provided guarantee for the production and operation of the enterprise and the collection and storage of raw materials." Lu Yizhen, general manager of the company, introduced.

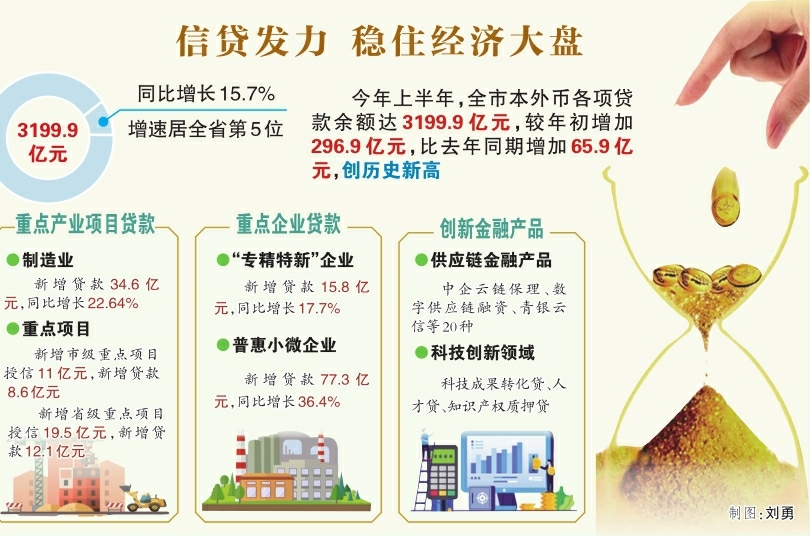

Economy is the body and finance is blood. The financial regulatory authorities and banking institutions of our municipality implemented the decision -making and deployment of the Central and Provincial Party Committee and Municipal Party Committee. Live in the economic market. In the first half of this year, the balance of various domestic and foreign currencies in the city reached 319.99 billion yuan, an increase of 15.7%year -on -year. The growth rate ranked 5th in the province, an increase of 29.69 billion yuan from the beginning of the year, an increase of 6.59 billion yuan from the same period last year, a record high.

Focus on key industries and fields tailoring "policy packages"

On July 12, Zhonghe Environmental Protection Equipment Manufacturing Co., Ltd. is stepping up the production of a group of environmental protection equipment. Not long ago, Sun Fengxia, the company's financial leader, was still unable to do insufficient funds. "Due to factors such as the new crown pneumonia's epidemic situation, the raw materials are tight this year, and the purchase of corporate procurement is urgently needed. After understanding the situation, the Texas Rural Commercial Bank recommended us the total 'total' batch guarantee business to the total '. It's time to get the account, and the company's urgent urgency. "She said happily.

Sun Fengxia's "total pair" batch guarantee business is one of the effective measures for the city's solution to corporate financing guarantee problems this year. It endorses the government, and the municipal finance arrangements will be 50 million yuan for risk compensation and guarantee subsidies. Essence

"The first feature of Silver Huting 'for the total' batch guarantee business is fast. The guarantee agency 'seeing loans is guaranteed', and no repetitive survey can be done. From fundamentally, the business must be reviewed and issued a guarantee letter of guarantee. Traditional silver -shaped cooperation methods; the second feature is the provincial guarantee premium that meets the guarantee conditions, which greatly improves the loan acquisition rate and loan amount of corporate loan. "Yang Man, deputy head of the Financial Department of the Municipal Finance Bureau.

In order to do a good job in work, our city has set up a special work class, strengthened incentives and guidance, established normalized tracking and scheduling supervision mechanisms, forming a fiscal risk compensation mechanism, and enhanced the anti -risk and guarantee capabilities of government financing guarantee companies to help More enterprises are effective in financing. As of the end of June, the total size of the new government financing guarantee business in our city reached 3.536 billion yuan, with a cumulative landing business of 3,191 places. All counties and cities have achieved lending, and 35 banks have signed cooperation agreements.

The city held a meeting of the promotion of financial services in the real economy of financial services, and issued documents such as the "Urgent Notice on Further Increasing Credit Development and Doing a Good Affairs of Financial Services Stable in Economic Hiring", set up municipal financial services to stabilize economic work classes, and give full play to financial services to make full use of financial services Serving the role of cooperative mechanisms such as industrial economy, rural rejuvenation, business, etc., study and formulate work measures for key areas of financial services, guide bank institutions to continue to expand the scale of loans, and make a set of policies to support the real economy "combined fist".

Focus on advanced manufacturing. The "Implementation Opinions on the High -quality Development of Financial Services Manufacturing" was issued to clarify ten work measures for the development of manufacturing enterprises, and continued to increase the investment in manufacturing loans.

Focus on "specialized new" enterprises. Establish a list of "Specialized Special New" small and medium -sized enterprises sharing mechanisms, sort out the list of national specialized new "small giants" enterprises and provincial and municipal "specialized new" enterprises, innovative SMEs, and push the enterprise to various banking institutions The financing demand and scheduling on a regular basis are carried out to carry out the docking of normalized banking and enterprises.

Focus on key projects. The municipal local financial regulatory bureaus, the People's Bank of China Texas Central Branch and other units carefully arranged the financing needs of key projects in the city, established financing service accounts for key projects, and promoted bank -enterprise docking.

Innovative products "precise drip irrigation" in time for corporate relief difficulties

Bowang Hardware Tool Products Co., Ltd. is a company in our city engaged in hardware cables and loading and unloading products. They have stabilized for many years and have good reputation. The epidemic caused the company's upstream and downstream customers' mobile funds. In May this year, 5 million yuan of loans were about to expire, and the pressure on funds was high. The customer manager of Texas Bank actively came to docking. After learning that the enterprise had the needs of renewal, he thoroughly understood the business status and development prospects of the enterprise. According to relevant policies, the enterprise was included in the seamless renewal "white list" and formulated a renewal business plan for the renewal business plan for it to make a renewal business plan. The enterprise has no repayment of the renewal business, and the loan period is extended for 1 year.

Affected by the epidemic, many companies have tightened funds in production and operation, and temporary repayment problems have occurred. The city has increased financial benefits to enterprises to help enterprises, take the lead in carrying out seamless renewal work in the province, and establish a seamless "whitelist". Under the premise of compliance with credit management and controlling risks, on the one hand, guide banks to take the initiative to connect with small and medium -sized enterprises for one month in advance, stabilize the expected funding expectations, and ensure that qualified loans should be "renewed, loan due to dreamed of loan"; On the other hand, by optimizing the process of reconnecting business processing process and reasonable compression of loan acquisition time, it continuously improves the efficiency of expired loan sequels, reducing the cost of corporate reverse loans and "bridge funds", and promoting the smooth flow of financial resources. All banking institutions actively adopt seamless connections of renewal loans without repayment loans, annual review of medium -term mobile funds loans, and borrowing. Products improve the convenience of renewal business. Since the beginning of this year, the city's banking institutions have handled 4,255 renewal business, with an amount of 11.012 billion yuan. In order to help small and medium -sized enterprises and individual industrial and commercial households to minimize the impact of the epidemic, the city has launched a special operation of financial empowerment of "specialized new" SMEs, and launched "organizational bank+exclusive credit products". The special guidance quota of the fine special "special guidance quota will give qualified enterprises with fully discount support. On the basis of the loan discount policy for the manufacturing inclusive small and micro enterprises implemented in the early stage, the benefits of the interest discount policy will continue to expand the beneficiary coverage of the discount policy. The new operating loan applied and obtained by the bank is given a discount at an annual interest rate of 1%.

While helping enterprises to relieve difficulties, bank institutions in our city also targeting more than 40 kinds of products such as talent loans, intellectual property loans, project subsidy pledge loans, etc. for the diversified financing needs of enterprises, innovative financial products, and improved their service efficiency. "Precise Drip irrigation".

Optimize service one -to -one tutoring and escorting enterprise full life cycle

On July 11, the financial counseling team of Qihe Sub -branch of Construction Bank came to Shandong Guangpu Medical Technology Co., Ltd. to understand the demand for corporate funds. In June of this year, when entering the enterprise to publicize the financial inclusive policy, it was learned that the enterprise lacked the lack of mobile funds. The site applied for the 1.388 million yuan in credit fast loans, which effectively alleviated the temporary difficulty of corporate funds.

Over the city's optimized financial services, and formulate the "Management Measures for the Selection of Texas Financial Counseling Services Specialist Specialist", select 34 professionals to establish and improve the service special database from the aspects of securities, insurance, guarantees, laws, and finance. ; Organized a number of activities such as financial counseling to help enterprises to open the door and help enterprises' rescue operations. At present, 117 counseling teams in the city have been connected with 3,869 financial counseling companies one by one to solve the financing demand of 356 companies to solve 4.708 billion yuan;市建立金融辅导政策传导机制的实施方案》,打造“金融辅导1分钟”视频政策宣导品牌,从全市金融系统评选出12名金融辅导政策宣讲员,实现政策宣导全覆盖、个性化定制、 "One -to -one" docking.

Our city gives full play to the function of smart financial comprehensive service platforms, adds a "financial supermarket" sector, actively promotes financial institutions to settle in the platform, and provides "direct" financing services for small and micro enterprises to promote financing and expansion of small and medium -sized enterprises. In -depth excavation of the potential of data elements, the platform cooperates with the city's Rural Commercial Bank to develop personalized customized products "Huide E loan" to achieve business online batch second loans, and effectively solve the problems of enterprises and individuals' financing difficulties. As of the end of June this year, the platform had settled in 47 financial service institutions, released 131 financial products and services, and accepted 914 enterprises through the platform certification, and provided a total of 9.127 billion yuan in financing services.

Establish 17 units including Texas Vision Information Technology Co., Ltd. and Qilu Equity Trading Center Co., Ltd. as alliance units to establish a specialized new "Little Giant" service alliance. Eight major areas such as guarantee services, financial tax consulting services, legal and rights protection services, innovation and entrepreneurial counseling services, informatization digital e -commerce services, logistics, and other services have improved the quality of service for small and medium -sized enterprises for "specialized new" SMEs.

□ Reporter Tang Xiaoying Correspondent Liu Jing Zhang Qin

- END -

Fengshun County Meteorological Observatory lifted the yellow warning of heavy rain [III level/heavie

Fengshun County Meteorological Observatory June 08 at 08:41 to remove Fengshun County heavy rain yellow warning

"Large community" concept starts with the implantation of "small scenes"

There are medicated meals, physiotherapy, and health care industries related to Ch...