The new growth point of the "cake" performance of the courier market fierce battle stock is to be solved

Author:Golden sheep net Time:2022.07.25

M & A incidents, increased concentration, and slower industry growth

■ Writing: New Express reporter Lin Guanghao

■ Figure: Liao Muxing

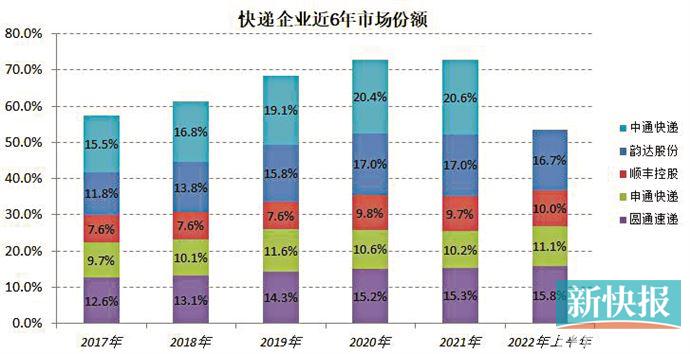

In June, the courier industry ushered in volume and price. The leading companies in A -share express companies SF Holdings, Yuantong Express, and Shentong Express have doubled their net profit in the first half of this year, and SF, with the highest growth rate, is expected to increase by 220%to 240%year -on -year. At the same time as net profit increased, the market share of the three companies in the first half of the year increased compared with last year. Correspondingly, the concentration of the national express industry has reached the highest value of nearly 7 years in the first half of the year.

This year, the Rabbit merged Bai Shi to swept the Best, which has attracted much attention. In May, the average daily single volume of the extremely rabbit exceeded 40 million for the news. Immediately afterwards, Kyoto, as the only company in the "Tongda Department", released the "618" record, saying that at that time, 45 million were on the single volume station for several consecutive days. However, Shentong's share has been at the bottom of the "Tongda Department" for five consecutive years, and was tied by SF in January this year. On the other side, Yunda and Yuantong also launched a rare industry in April.

In recent years, industry mergers and acquisitions have increased, market growth has slowed, and express delivery companies have found new growth points in the share of share rankings. Some analysts believe that the market's future observation perspective will gradually shift from share to sustainable improvement.

The Rabbit By the Best By the Best of Taoism, the "Tongda Rabbit" is still prematurely said.

"Now the extremely rabbit is developing a little bit quickly, but this will not give it more to eat below." A Yunda Courier in Guangzhou told the new Express reporter.

In mid -to -late June, there was a market news that the Rabbit disclosed at a large customer exchange meeting of the month that the average daily votes on the entire network in May had exceeded 40 million. According to the data, the extremely rabbits have surpassed the Shentong of 1.003 billion pieces of the month, and the second to 1.485 billion pieces of Yunda with 1.485 billion pieces. From the perspective of many courier, this is the result of the integration of Ji Rabbit and Best this year.

The reporter learned that Ji Rabbit Express was officially opened in China in March 2020. At that time, the extremely rabbit quickly started in China with a low -cost strategy. Cooperative merchants often made a lot of merchants for e -commerce platforms. Established in 2007, Best Group was originally one of the leading domestic express delivery companies. However, in recent years, the main courier business has been losing money for many years, and its market share has become increasingly minimal. According to the data, the market share of the Best Express in 2020 was 10.29%, and in the mid -2021, it fell to 8.2%.

The reporter noticed that the integration of Ji Rabbit and Best has always attracted much attention in the industry. The reason is that the two are the "protagonists" of low -cost dumping in the industry last year. The final result of the competition was that the Rabbit announced in October last year that it acquired the courier business of Best in Best. At that time, some people in the industry analyzed that the average daily single volume of the two was 45 million after the integration of the two, ascending to the industry second, second only to Zhongtong.

According to public reports, at present, the internal direction of the extremely rabbit is that at the end of this year's revenue and expenditure, we also hope to increase the proportion of Taobao's business volume in the overall business volume. Its recent mid -term goal is to tie the industry's "Tongda Department" first echelon.

It is understood that the number of express delivery generated by "Amoy" merchants in 2020 accounted for about 41%of the overall express delivery volume of Best. The reporter learned from several practitioners that the extremely rabbit has successfully access to the "Tao" business this year. Zhang Gong, chief analyst of the transportation industry of the Ministry of Securities Research and Development, told a reporter from the New Express that the rabbit may use the opportunity to integrate with Best to get rid of the label of "Pinduoduo" and expand his living space.

However, some people in the industry believe that Ji Rabbit has not yet threatened the status of "Tongda Department". "The extremely rabbits are all doing. They are also big customers of e -commerce. The extremely rabbit is about 1.3 yuan each, and Shentong is about 1.5 yuan per piece. Zhongtong and Yuantong have the highest unit price." Express reporter, "One penny, a penny, lost money, and the service is not good.

New Express reporters learned from a number of consumers and e -commerce merchants that most people's impression of the extremely rabbit is "Pinduoduo's express merchants", "low price", and "difficult service quality". A merchant who operated by Pinduoduo and the Taobao platform told reporters: "The price of extremely rabbits, Shentong, and Yunda are relatively cheap, but sometimes they do not send it, or they will directly throw the courier at the door, which will bring a lot of complaints. "A merchant who had operated business on Ali's 1688 wholesale platform said that extremely rabbits and other small brands have advantages in price." Express needs long -term cooperation, cheap price, but in the process of cooperation OK. "

The reporter sorted out the announcement of the State Post Office and found that since the second quarter of 2021, the Rabbit became the survey of the satisfaction of express service satisfaction. In the following three express delivery service public satisfaction rankings, the extremely rabbit was at the bottom.

A franchisee who had contracted a number of courier companies' business told the new Express reporter that the price of the rabbit to the e -commerce platform merchants was low in order to grab business. Sometimes the extremely rabbit also distributes the remote areas where Zhongtong and Shitong do not distribute, which is "hard -working". According to the franchisee, after the overall volume increased, the extremely rabbit began to reduce the salary of the courier, and at the same time, the fees were also declining.

The consequences of the low price grabbing market can be seen in the management and management of extremely rabbits. During the "618" period this year, Ji Rabbit was exposed to more than 300,000 yuan in wages in Jiangsu's outlets, which led to the stagnation of express delivery business in the area and a large number of courier accumulation.

The reporter noticed that since this year, the title of "Tongda Rabbit" has frequently appeared in the industry. For a while, it seemed that the extremely rabbit found a seat in the "Tongda Department".

"Now there is still a distance from the" Tongda Rabbit "." Zhao Xiaomin, an expert in the express logistics industry, pointed to the new Express reporter that it should wait until one year after the rabbit was listed, and the possibility of changing. At present, the data of the extremely rabbit has not been tested by the market. "The high -end rabbit distance 'is still a bit far away. From the perspective of the model, the quantity is decisive." Zhao Xiaomin said that according to the plan of the extremely rabbit, this year is to be listed, and this year The time to achieve the Hong Kong IPO this year is very urgent. "No listing, it's a bit far away when talking about other things."

Zhang Gong told a reporter from Xin Express that the capital market is concerned about the cost of single tickets and profits of the enterprise. The extremely rabbit needs to reduce the cost of the two transportation networks of the Baishi, so that the cost of the single ticket to reach the "access system" Level. Because the development of courier companies requires the investment process of heavy assets, if the extremely rabbit is successfully listed in the future, the extremely rabbit as a post -invested rabbit will not have a great impact on the "Tongda Department".

Zhang Gong further pointed out that in recent years, the regulatory authorities have clearly called the price war in the express delivery industry. That is to say, in the future, there will be no new "players" to copy the polar rabbit "burning money" to grab share to enter the domestic express market.

Shentong's "Tongda Department" at the bottom for 5 consecutive years, which was surpassed into "reasonable" by the extremely rabbit

Unlike new "players" such as extremely rabbits, "Tongda", as a pioneer of domestic e -commerce express, is more like a "guardian" at this moment. Some brokerage research reports pointed out that the "Tongda Department" has a high share in the field of e -commerce express. At present, Shentong has become the first breakthrough.

After the market reported that the above -mentioned Shentong single volume was surpassed by the extremely rabbit, Shentong seemed to be "anxious." On June 9th, Shentong officials first released the first wave of war reports of "618" this year, saying that in the first three days of June, the Shentong Express revenue increased by more than 30 % compared to the same period in 2021. On June 22, Shentong announced that it was promoted by the promotion of "618". In recent days, its single volume continuously stood by 45 million orders, a year -on -year increase of 30%.

It is worth noting that other head express companies have not disclosed the "618" data this year. Some market participants believe that this move may be a counterattack that the single volume is surpassed by the rabbit in May, but because the market cycle of two time periods is different, the comparability is limited.

"The business volume is the most important. For other express companies, the business volume may not be ranked first." Zhao Xiaomin pointed out that because of the low base of Shentong, the problem of the amount must be solved, so that the market expectations can be solved.

In fact, from the first market share to the end of the "Tongda Department" today, Shentong has gone through 8 years. According to data from Huachen Securities Report, the market share of Shentong Express in 2014 was as high as 16.5%, ranking first in the "Tongda Department"; in 2015, Shentong's share was 12.4%, which was surpassed by Yuantong and Zhongtong. Beyond. As of 2021, Shentong has been at the end of the "Tongda Department" for five consecutive years.

In this regard, Huachuang Securities believes that the Shentong franchisee model has achieved the previous share leader, and it has also been partially restricted and caused the missing efficiency to improve the scale of the dividend.

In the first half of this year, Shentong's share rose from 10.23%last year to 11.09%, which was 4.69 percentage points from the first 15.78%Yuantong, and still ranked at the end of the "Tongda Department". From this point of view, it seems reasonable to be surpassed by the extremely rabbit.

Perhaps because of the share of the share for several years, Shentong began to "open a word." In December last year, after the analysis of the development of the industry, President Wang Wenbin said that Shentong will adhere to the steady progress and adhere to long -termism. Top.

According to Shentong official micro -disclosure, in June, Shentong opened a journey of "listening" for the president's outlet. The reporter learned that Shentong continued to pass confidence to the grass -roots outlets during the "listening" process.

Investors also realized that there is not much time left to Shentong. In August 2019, Shentong Original controlling shareholder Chen Dejun, Chen Xiaoying, and Chen Xiaoying and Alibaba signed the "Equity Agreement". The agreement stipulates that Ali has the right to purchase the company's shareholders equity stipulated in the agreement within three years from December 28, 2019. In September 2020, Ali obtained 10.35%of Shentong Express, and indirectly held a total of 25%of the shares of the Shentong Express listed company. If Ali travels before December 27 this year and completes the corresponding equity transfer, at that time, a total of 46.0%of the shares of Shentong will be held to become the actual controller.

Since the beginning of this year, the investor platform has discussed whether Ali's exercise has been exercised. Some people look forward to Ali re -sit on the "boss" position by integrating resources; some people are worried that the founder of Shentong will leave the field and Shentong will become the next hundred generations.

In fact, Ali's penetration of Shentong has already begun. Wang Wenbin was originally the general manager of Ali Cainor Network. In February 2021, "Airborne" Shentong. Therefore, in the eyes of many investors, Ali is more oriented. Now more people pay attention to the average price of Alibaba's rights is 20.8 yuan/share. Too low exercise stock prices are easy to trigger a full tender offer to purchase and delist. On July 22, Shentong Express closed at 12.62 yuan, with a total market value of 19.32 billion yuan. The stock price increased by 66.27%in the past year, and this year increased by 38.83%.

Note: Shentong Express's net profit in 2021 increased the year-on-year growth rate of -2603.16%. Because it was too large from other data, it was not displayed in the figure. As of July 22, 2022, Zhongtong Express and Yunda shares have not disclosed the performance data of the first half of 2022. Data source: Wind Note: As of July 22, 2022, Zhongtong Express has not released business volume data in the first half of 2022. Data Source: Company Announcement

Express companies in the first half of the year were "shuffled", each with each other

When Shentong and Ji Rabbit conducted a "ranking battle", the industry ranking in the first half of this year was released. Data show that in June, the business volume of the national express service enterprise completed 10.26 billion pieces, an increase of 5.4%year -on -year; business revenue was 97.67 billion yuan, an increase of 6.6%year -on -year. The reporter noticed that the number of express delivery in the industry in June reached a new year.

Yuantong Express, Shentong Express, and SF Holdings have announced their performance forecast in the first half of the year, and their profitability has performed well. Specifically, Yuantong Express achieved net profit of 1.771 billion yuan, an increase of 174.24%year -on -year; SF Holdings's net profit returned to the mother is expected to be 2.43 billion yuan to 2.58 billion yuan, a year -on -year increase of 220%to 240%; Shentong Express is expected to achieve net net net net; The profit was 170 million to 200 million yuan, a year-on-year increase of 216.20%to 236.71%.

Regarding the achievement of turning losses in the first half of the year, the Shentong Express said that during the reporting period, the coordination and scale of the entire network appeared, which greatly increased the business volume and market share.

The reporter found that the market share of the three courier companies in the above -mentioned performance pre -profits increased from 2021. Rudong rose from 15.28%to 15.78%; SF rose from 9.74%to 9.96%; Shentong grew the largest, from 10.23%to 11.09%. During the same period, only Yunda declined, from 16.99%to 16.68%. In general, the total market share of the four companies in the first half of this year has increased, from 52.24%in 2021 to 53.51%. The four companies rank in turn are Yunda, Yuantong, Shentong, and SF. Although the overall remains unchanged, there have been many transcendences among companies in half a year.

Yunda, which has ranked second in the industry for 39 consecutive months, has been overtaken this year. Affected by the epidemic, the industry's single volume in April fell 11.9%year -on -year, of which Yunda decreased by 19.37%year -on -year, and the market share of 15.13%of Yunda was overtaken by 16.66%. Until June, Yunda returned to the second industry with a share of 15.73%. In the first half of this year, the average growth rate of the industry's business volume was 3.7%. Except for Zhongtong's not disclosed data, the "Tongda Department" was only lower than the industry average.

On the other hand, when Yuantong's April share realized the anti -overtime, some people in the industry believed that Yuantong had the strength of "grabbing two". The reporter noticed that in recent years, Yuantong has accelerated the construction of differentiated products and service systems, and has also increased the layout of the aviation freight market. According to the financial report, the revenue of Yuantong Aviation business increased by 36.96%year -on -year, and the gross profit margin decreased by 0.94 percentage points.

Zhao Xiaomin pointed out that with the gradual decrease in the influence of the epidemic, it is a problem faced whether international aviation business can still maintain the advantage of the past two years. In addition, the total market value of Yuantong Express has risen from more than 30 billion yuan in 2021 to the current nearly 70 billion yuan. From the perspective of the capital market, Yuantong has severely overdrawing performance, and the future strategy is very important.

In addition to the "Tongda Department", SF has tied to Shentong this year. In January, SF's business volume was 989 million, which was the same as Kyoto. The reporter learned that the last SF month's business volume was higher than that of Shentong last year. Some brokerage research reports pointed out that the increase in SF shares is affected by the driven by e -commerce.

For a long time, SF has contributed to the main revenue, but in recent years, SF has built an economic express product in overtime. In 2020, Fengfeng was established, which mainly served the economy -oriented e -commerce market. In 2021, SF upgraded the e -commerce special to e -trading. However, increasing revenue of low -cost economic express products failed to block the decline in net profit. In 2021, SF's net profit of the express transportation department responsible for the economic express business was 3.83 billion yuan, a year -on -year decrease of 54.89%, and the net interest rate fell from 6.59%in 2020 to 2.65%. SF said that it is mainly due to increasing investment in network construction and an increase in various resource costs. At the same time, the proportion of economic express products in the product structure increased. Because it has not yet reached a better cost -effective level, it puts a certain pressure on profitability.

In recent years, SF's market share has slowed down. 9.96%in the first half of this year has been the highest value of SF in the past 7 years.

Industry observation

The e -commerce express is entering the balance stage, and the profitability of the industry's sustainable improvement will be more concerned.

Behind the competition for the market share of express delivery companies is the courier market with a high concentration. Data show that in recent years, the CR8 of the CR8 of the express delivery and package service brand concentration index has generally shown an upward trend. In the first half of this year, it reached 84.7, the highest value in the past 7 years. The report from the Foresight Industry Research Institute pointed out that in 2017, due to the sharp slowdown in market growth, the development of the industry entered a period of integration, and some small and medium -sized enterprises were gradually eliminated, resulting in the market concentration gradually increased.

Since last year, there have been increase in mergers and acquisitions in the express delivery industry. This year, Jingdong Logistics will also acquire Debon. Some people in the industry believe that due to barriers to the express delivery market, the difficulty of entering the game in the market has increased. With the completion of market transactions, the integration and acquisition of the express delivery industry will continue. At the same time, the development of the courier market is also slowing. Data show that the growth rate of domestic express delivery industry's income growth in the past 7 years has generally declined year by year. In the first half of this year, the revenue of express delivery business increased by 2.9%year -on -year, and the growth rate decreased by 23.7 percentage points year -on -year.

From the perspective of the industry, whether it is a rabbit attack "Tao system", SF accelerated sinking, or "Tongda" densely shifting to differentiated competition, more is a means of seeking existing stocks in the express delivery market. The above -mentioned Zhongtong franchisee said that although the companies themselves have the main business and clearly have clear positioning, they all want to divide the other party’s "cake". "E -commerce express is not optimistic this year. point."

The "Interpretation of the 2022 618 All -Network E -commerce Sales Data" released by Star Map data pointed out that the total sales of comprehensive e -commerce platform this year reached 582.6 billion yuan, an increase of only 0.7%over the same period last year.

Zhang Gong pointed out to the reporter of the New Express that statistics from the State Post Office show that it is estimated that 80%of the express delivery business volume serves e -commerce. In other words, the changes in the express delivery industry in recent years are essentially driven by the development of e -commerce, because the new format has built a new increase. If there is no large -scale format change in the future, the express delivery market continues to be deduced and developed under the current pattern of multiple e -commerce platforms.

"Express leading companies must not only face the pressure of traditional business growth, but also continue to expand new businesses. They cannot only work in their own 'one acre and three -point". "Zhang Gong told the new Express reporter that if you only pursue one item Business, first, will cause waste of production capacity, and the other is that the original business will have bottlenecks, and the third is that when new service needs appear, it may be eliminated without keeping up in time.

The recent research report released by Huachen Securities pointed out that the e -commerce express delivery has entered a balanced pattern. It can no longer have the foundation of the price war within an foreseeable time. ability. The balancing period is a window period for leading companies to seek further increase in pricing capabilities.

Zhang Gong further pointed out to a reporter from the New Express that the development model of express delivery companies determines that it is more difficult to seek increment than digging the existing stock. For the future growth of the industry, one is to cut into the production process of the enterprise in the process of industrial upgrading, and better bind it with the B -side customers; the second is the sinking of the express market to improve the service system that adapts to rural e -commerce; Develop international logistics business such as cross -border e -commerce; fourth is the development of the adverse logistics business of e -commerce.

- END -

Love donation helps Zhaizi community epidemic prevention

On July 17, a brand of electric bus Pingshan distributing stores donated two elect...

It's up again!The pension of retirees in Zhumadian City welcomes "18 consecutive rises"

Liu Jinxia, all media reporter of the Daily GroupIt's too happy! The pension has risen every year, from the original 900 yuan to the current more than 2,000 yuan, our lives are guaranteed! Today...