More than 3 trillion yuan!Combined tax support policy helps enterprises to relieve the effectiveness

Author:Guangming Daily Time:2022.07.25

Since the beginning of this year, my country has implemented a new combined tax support policy, helping companies to help companies with real gold and silver, and helping to stabilize the macroeconomic market. "As of July 20, the newly added tax reduction and tax rebate and slow tax rates exceeded 3 trillion yuan. It mainly included three parts: First, the VAT reserved tax for the VAT has been refunded to the taxpayer account since this year , Exceeded the scale of tax refund last year. Second, the number of new tax reductions and reductions in the country in the first half of the year was 507.4 billion yuan, of which the new tax reduction was 409.7 billion yuan, and the new cost reduction was 97.7 billion yuan. Slowly cost 553.3 billion yuan, "said Wang Daoshu, deputy director of the State Administration of Taxation.

According to Wang Daoshu, the combined tax support policy drives the gradual improvement of small and micro enterprises, supporting the sales of industries in difficulties to accelerate the recovery, and help the industrial economy operations stabilize and rebound. As of July 20, small and micro enterprises have obtained tax reductions and tax reductions and tax rebates of 1.25 trillion yuan. Retailing, catering, tourism, transportation, etc. Evo -affected industries that have a greater affected industry will increase tax reduction and reduction. The tax rebate and slow tax rate of 542.8 billion yuan, industrial enterprises added tax cuts and fees and tax rebates of 1.37 trillion yuan. According to the VAT invoice data, in June, the sales revenue of small and micro enterprises across the country increased by 5.8%year -on -year, an increase of 3.2 percentage points from May; the sales revenue of wholesale and retail industry, accommodation and catering industry, and transportation industry increased by 7.5, 19.1, respectively 5.8 percentage points; the sales revenue of industrial enterprises across the country increased by 10%year -on -year, an increase of 2.5 percentage points from May.

Research on tax refund promoting enterprise operations to accelerate recovery

The large -scale value -added tax retain tax refund is the main content of the new combined tax support policy, and it is also an important measure to stabilize the macroeconomic market. Starting from April 1st, based on the implementation of the full refund and increased tax tax on small and micro enterprises and manufacturing industries, the national tax system in accordance with the relevant arrangements of the State Council's stable economy and measures in accordance with the State Council. From the day, the total of 7 industries such as wholesale and retail industries have implemented a full refund and increased tax retained tax policy to allow more market entities to enjoy policy dividends.

Cai Zili, the director of the General Auditer and Revenue Planning Department of the General Administration of Taxation, told reporters that the value -added tax for the taxpayer's account this year has retired from the taxpayer account with a total tax refund of 1877.2 billion yuan since April. Small and micro enterprises are the main body of benefit. Among the taxpayers who have obtained tax refund since April, the number of small and micro enterprises accounts for 93.7%.

The dividend of the large -scale value -added tax deduction policy has continued to release the "timely rain" and increased cash flow to more market entities, which has played a positive role in boosting confidence in the development of market entities and stimulating the vitality of the market entity. "It is mainly reflected in three aspects: First, to promote the accelerated recovery of enterprise operations. VAT invoice data shows that in the second quarter, the national enjoyment of retained tax refund enterprises purchased raw materials and other expenditures increased by 12.3%year -on -year, with an increase of 5.7 percentage points higher than the tax -free enterprise; The sales revenue of tax refund enterprises increased by 6.1%year -on -year, 1.8 percentage points higher than tax -free enterprises. The company's height is 9.5 percentage points; the sales revenue of specialized new small giant companies that apply for tax refunds increased by 16.5%year -on -year, an increase of 10.5 percentage points higher than the tax -free enterprise. The third is to help support the development of foreign enterprises. The tax refund has exceeded 5 million yuan, and it is mainly concentrated in large and medium -sized enterprises in manufacturing, which has played an important role in stabilizing foreign investment expectations. "Cai Zili said.

Deepen service to quickly release policy dividends

The tax bonus should be delivered to the market entity in a timely manner, and it is inseparable from strong policy implementation and services. This year, the taxation department's "Copy Public Taxation Spring Wind Action" is detailed in the innovation propaganda counseling model, the channels for communicating with tax enterprises, and convenient tax payment and payment to better enhance the sense of obtaining the taxpayer's payment.

Through the local recruitment platform, telephone, SMS and other methods, the tax department deepen precision services. Actively carry out the "connecting chain" to help enterprise activities, use tax big data to help enterprises supply and demand to docking and re -production, further unblocking the industrial chain and opening up the supply chain. Since May, 3331 companies have helped 3331 companies to realize the purchase and sales transaction value of 9.059 billion yuan.

"At the same time, we have a prominent classification policy, and we will carry out special actions to develop the development of small and micro enterprises with the National Federation of Industry and Commerce, and carry out more than 20,000 activities such as policy training and counseling, online preaching, and public welfare lectures. Nearly 20 million households are paid; the service month activities of SMEs with the Ministry of Industry and Information Technology will benefit more than 9.5 million taxpayers. Propaganda and payment service activities in the construction site, vigorously promote the online 'one -window office', offline 'one -hall joint office'.

At the same time, the taxation department has accelerated the progress of export tax refund, and the average processing time of the normal export tax refund of all export companies will be reduced to 6 working days. "We optimize and improve the system's functions, accurately push the policy, and follow up closely. In the first half of the year, the total number and tax refund of the national first and second export enterprises accounted for more than 70%. Within three working days, the policy dividend was quickly released, and the pressure on corporate funds was effectively relieved. "Xie Wen, director of the General Administration of Taxation and Labor Taxation, pointed out. Strict check and fierce deception to retain tax refund illegal acts

Since the implementation of the large -scale tax refund policy on April 1, in order to prevent the "red envelope" of the tax refund policy falling into the criminal "pocket", the national tax audit department has continuously increased its crackdown on fraudulent tax refund violations and keeps fighting early. Small, with a fast -moving high -voltage situation with fast and fast check. Jiang Wufeng, deputy minister of the Inspection Bureau of the State Administration of Taxation, revealed that as of July 20, 5,558 tax refund enterprises were found to be suspected of fraud or obtained illegally obtaining tax refund enterprises, involving reserved tax refund and recovery of various types of tax losses of 8.928 billion yuan.

In order to fierce the tax refund, the taxation department increased its strikes, highlight the key points, and investigate the case of leaving tax refund cases for the gang -style, cross -region, and virtual invoicing. "We give full play to the role of the State Administration of Taxation, the Ministry of Public Security, the Supreme People's Procuratorate, the Customs General Administration, the People's Bank of China, and the Six departments of the State Administration of Foreign Exchange jointly crack down on the role of fraudulent tax fraud work and continuously increase the joint crackdown. As of July 20, , Six departments in various places jointly crack down on 153 tax refund gangs, and jointly investigated and handled 1091 households suspected of accepting virtual invoicing to deceive tax refund enterprises, recovering tax refund and other tax losses of 1.267 billion yuan. "Jiang Wufeng said.

In the process of allowing the tax refund policy to be stable, the tax department insisted on the blade inward, seriously investigating and dealt with tax personnel to lose their duty and violate the law and discipline. According to Liu Yali, director of the Party Construction Work Bureau of the State Administration of Taxation, the State Administration of Taxation has strictly investigated the entire process and links of the implementation of the internal and wrong policies, enhanced strict investigations, and paid close attention to the implementation of the tax refund policies to implement, inside and outside Objects to violate the laws such as taxation and personal discipline, and discover together, investigate and deal with them, punish them in accordance with the law, and never tolerate. The taxation department will further strengthen supervision and discipline, and make every effort to ensure that the Party Central Committee and the State Council's major decision -making deployment will be effective.

(Reporter Chen Chen)

- END -

Fancheng Power Supply Center: Integrity and Real Effective Enhancement Service level

Xiangyang Net News (correspondent Fu Jiabing) Recently, the Discipline Inspection Center of Fancheng Power Supply Center of Xiangyang Power Supply Company, Hubei, organized the staff of various statio

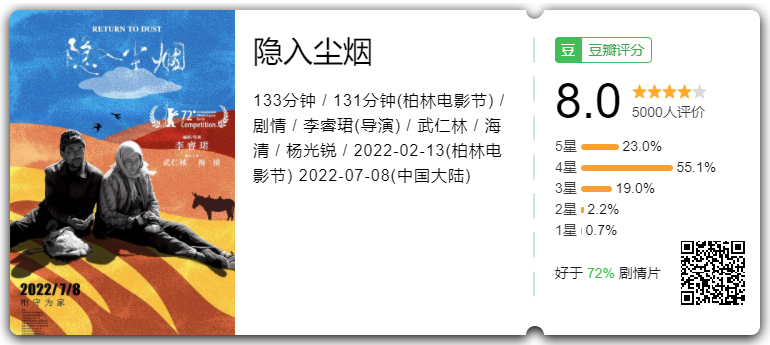

News 丨 [Hidden Dust tobacco] Open points

Among the two movies released today, [Hidden Dust tobacco] has taken the lead, Dou...