Limit the implementation of the new rules of the north direction "fake foreign capital" today

Author:Daily Economic News Time:2022.07.24

On June 10 this year, the CSRC announced that the "Decision on Modification" was implemented from July 25, 2022.

According to the revised "Regulations", starting from Monday (July 25), the northbound fund will not allow incremental "fake foreign capital" to enter. After one year, the existing "fake foreign capital" will only be able to only be possible. Selling A shares, unable to buy, the transaction authority of non -holding investors in the Mainland will be canceled in time by Hong Kong brokers.

Data source: Reporter sorted out the visual Chinese map Yang Jing map

From the perspective of the industry, the withdrawal of "fake foreign capital" helps to maintain the long -term stable operation of the market. Earlier, the scale of "fake foreign capital" transactions was generally not high, and the impact on A shares was very limited. Secondly, the "fake foreign capital" does not change "true foreign capital", especially long -term funds that continue to flow into A shares.

According to the "Daily Economic News" reporter observation, at present, the northern direction funds include two types: configuration funds and trading funds. According to statistics from the Western Securities Strategic Team, the structure of the northbound capital is mainly long -term allocation funds. As of July 20, the value of the configuration funds holding the stock market was about 2 trillion yuan, accounting for 83%.

Modification mainly involves two aspects

At the end of last year, the Securities Regulatory Commission announced on the official website that it was planned to modify the "Several Provisions of the Mainland and the Hong Kong Stock Market Transaction Interconnection Mechanism" (hereinafter referred to as the "Regulations") and publicly solicited opinions from the society.

On June 10 this year, the CSRC announced that the "Decision on Modification" has been reviewed and approved for the 2nd Committee Meeting of the China Securities Regulatory Commission on March 24, 2022, and is now announced. It will be implemented from July 25, 2022.

The amendments to the "Regulations" mainly involve two aspects: First. Article 13, paragraph 1 of the Regulations to: "Investors enjoy the rights and interests of stocks purchased by the interconnection mechanism of the interconnection of the stock market through the mainland and the Hong Kong stock market in accordance with the law. Investors of Shanghai Stock Connect and Shenzhen Stock Connect do not include mainland investors. "From July 25, 2022; 2. Mainland investors in Shanghai Stock Connect and Shenzhen Stock Connect have been implemented for a year Mainland investors, which have been opened before the implementation of the Shanghai Stock Connect and Shenzhen Stock Connect, can continue to buy A shares through the Shanghai Stock Connect and Shenzhen Stock Connect before July 23, 2023. After July 24, 2023, the A shares held by the above investors can continue to be sold.

According to the revised "Regulations", starting from Monday, the northbound funds will not allow incremental "fake foreign capital" to enter, and Hong Kong brokers will no longer open a new Shanghai -Shenzhen stock transaction authority for mainland investors. One year later, the existing "fake foreign capital" will only sell A shares, not to buy, and the transaction authority of non -holding mainland investors will be canceled in time by Hong Kong brokers.

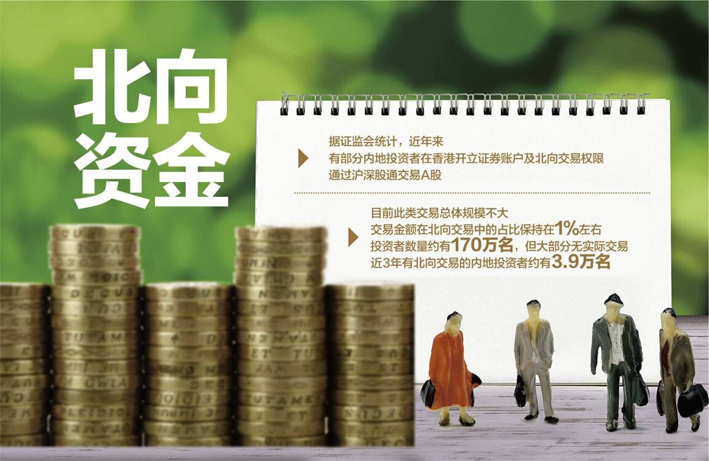

According to statistics from the CSRC, in recent years, some mainland investors have opened securities accounts and trading permissions in the north in Hong Kong, and traded A shares through Shanghai -Shenzhen Stocks. At present, the overall scale of such transactions is not large, and the proportion of transactions in the north -directional transaction remains about 1%. There are about 1.7 million investors, but most of them have no actual transactions. In the past three years, there are about 39,000 mainland investors with north -oriented trading.

It is worth noting that the Securities Regulatory Commission found that most of these mainland investors have opened mainland securities accounts and can directly participate in A -share transactions. In this regard, the CSRC believes that the two channels of transactions have the risk of cross -border violations, which also causes the market to have a lot of so -called "fake foreign capital" in the market, which is not conducive to the smooth operation and long -term Shanghai -Shenzhen -Hong Kong -connected. develop.

The inflow trend will not be much affected too much

According to CHOICE statistics, since the opening of the Shanghai -Hong Kong Stock Connect in 2014, the northbound funds have net into A shares every year, and from 2017 to 2021, the scale of A shares in the annual inflow of A shares exceeds 100 billion yuan. In 2021, the scale of the net inflow of Northbound funds in the whole year reached 432.17 billion yuan, a record high.

However, in 2022, Northbound funds slowed down the pace of flowing into A shares. As of the closing of July 22, the scale of the net inflow of A shares in the north in 2022 was 49.58 billion yuan, only about 1/10 of the A -share scale in 2021. Among them, since July, the net outflow of the northbound capital outflows of 22.217 billion yuan.

In 2022, the scale of the flow of funds in the north is not as good as previous years. Is it related to the revision of the "Regulations"?

A few days ago, Yi Bin, chief strategist analyst of Western Securities, said in an interview with reporters: "From the perspective of market level, the main factors that affect foreign capital inflows are still economic fundamentals and different liquidity of monetary policy concepts. Modifying the trend of foreign capital inflows does not have much effect, but it may cause pulse impact at some time. As of July 21, the cumulative net inflow scale of northbound funds has been 47.9 billion yuan, which is significantly lower than the level of about 430 billion yuan last year. It is also lower than 210 billion yuan in 2020. Behind the significant slowdown in the flow of funds in the north direction is mainly affected by global liquidity and macro fundamentals. On the one hand, the Fed has entered the interest rate hike period this year. In the context, global liquidity shifts, US debt yields continued to rise in the first half of the year, and the US dollar index rose 11%during the year; on the other hand, it was disturbed by the epidemic since March, which constituted a certain impact on the confidence of funds. The trend of northbound capital preferences is relatively small due to the trend of institutional amendments. But on the other hand, due to the continuous improvement of the regulatory system, at the time of the change of new and old rules, it often brings short -term fluctuations in the capital structure and will also have a certain impact on the market. "In fact, the reporter of" Daily Economic News "found that in recent years, there may have been saying" fake foreign capital "in the A -share market in the A -share market. One year later, the "fake foreign capital" will officially begin to gradually evacuate A shares. What impact will this have on A shares?

In Yi Bin's view, the withdrawal of "fake foreign capital" helps to maintain the long -term stable operation of the market. In terms of scale, the scale of "fake foreign capital" transactions is generally not high. According to the proportion of the CSRC disclosed only about 1%, the impact on A shares is also very limited. Secondly, the "fake foreign capital" does not change "true foreign capital", especially long -term funds that continue to flow into A shares.

In mid -July this year, at the media exchange conference held by the United States Union Group, Huang Senwei, a senior market strategist of the United Board, said on the phenomenon of the recent net outflow of the northbound capital. It is still relatively low in A -share calculations, about 5%. Other markets, such as South Korea, are much higher. So in the long run, we think that foreign capital will continue to flow into A shares. We think it may be a relatively short phenomenon. "

The proportion of trading funds is not high

Although foreign investment usually gives people a label of "value investment" and "long -term investment", in fact, there is no shortage of short -term situations in northern direction.

According to CHOICE data, as of July 22, a total of 1985 A shares were held in north. In the last quarter, a large fluctuation of the A -share market has appeared. Overall, as far as the A shares of the northbound capital of the north at the end of the first quarter of this year, the warehouses of the northbound capital have been relatively stable since the second quarter. However, in the past more than a quarter, some stocks have changed significantly.

For example, at the end of the first quarter of this year, the shareholding ratio of Poly Technology (SH603197, a share price of 64.20 yuan, and a market value of 13.338 billion yuan) held a 10%. At the end, the shareholding ratio of Northern Fund to Quanfeng Automobile (SH603982, the stock price of 28.34 yuan, and a market value of 5.7 billion yuan) was 8.66%. As of the close of July 21, the shareholding ratio fell to 0.83%; at the end of the first quarter of this year, the northbound capital The shareholding ratio of China Foreign Transport (SH601598, a stock price of 3.79 yuan, and a market value of 24.4 billion yuan) holds 10.17%. As of the close of July 21, the shareholding ratio fell to 2.07%; (SH600968, the stock price is 2.49 yuan, and the market value is 25.311 billion).) The shareholding ratio of 6.91%is 6.91%. As of the close of July 21, the shareholding ratio fell to 1.6%; at the end of the first quarter of this year, the northbound capital (SH601156, the stock price was 18.00 yuan The shareholding ratio of 28.576 billion yuan) was 4.92%. As of July 21, the shareholding ratio fell to 0.6%.

According to the "Daily Economic News" reporter's observation, since the second quarter, the northbound capital chooses has reduced holdings of the above stocks during the rebound process, and some stocks have reduced their holdings faster.

For example, within 7 trading days from May 20th to 30th, the shareholding of the northbound capital against Quanfeng Automobile (SH603982, the stock price of 28.34 yuan, and a market value of 5.703 billion) shall be rapidly decreased from 8%to 1.4%; on June 27, the north direction The shareholding ratio of the development of funds was 10.5%, but only one day after one day, the shareholding ratio dropped significantly to 1.9%. Similar situations still occurred in China Eastern Logistics early June this year.

At the same time, the stocks with large warehouses in the north since the second quarter include Hangke Technology, Berchu Electronics, Mai Weiyi, Jinfeng Technology, Huaxi Biology, Oriental Biology, Gudewei, etc. Among them, the shareholding ratio of Northbound Fund to Oriental Biological (SH688298, the stock price of 116.20 yuan, and a market value of 19.522 billion yuan) has increased significantly from 3.28 % at the end of the first quarter of this year to 12.38 % on July 21. Rushing and falling.

Many studies have found that the north -direction funds include two types: configuration funds and trading funds.At present, what is the proportion of allocating funds and transaction funds in the northbound capital?In this regard, Yi Bin told reporters: "In the study, we found that the structure of the northern direction of funds is mainly long -term allocation of funds. If we use foreign custody agencies to split, long -term funds are custody in foreign bank seats, transaction -type fundsMost of the foreign securities firms are custody. As of July 20, the market value of trading funds in the north -direction capital was about 420 billion yuan, accounting for about 17%of foreign capital;83%. ".

Regarding the fast forward and fast outings of Northbound funds in the short term, Zhu Liang, the investment director of Lianbo Huizhi, believes: "Because foreign capital has different investment cycles, some are short and some long, it depends on the strategy of each fund, but the strategy of each fund, but the strategy of each fund, but the strategy of each fund, but the strategy of each fund, but the strategy of each fund, butThere is no representative. I think the overall situation is still net inflow. "

Daily Economic News

- END -

Putuo launched the national low -carbon daily series of environmental protection activities

The National Low -Carbon Day has gone through ten years, and adherence to green an...

Digging the two major online music giants in the incremental market compete for "get on the car"

China Commercial Daily (Reporter Zhao Yiru) NetEase Cloud Music Space Audio is about to be launched, aiming at smart car scenarios. Coincidentally, Tencent Music Entertainment Group (hereinafter ref