The Central Bank Digital Currency Research Institute responded!Digital RMB invasion of privacy?Can't buy gold or foreign exchange?The answer is here

Author:Dahe Cai Cube Time:2022.07.24

Can digital RMB buy gold and foreign exchange? Can digital RMB effectively protect user privacy?

At present, digital RMB pilot testing is being progressing steadily, but some discussions on digital RMB are misunderstood.

Mu Changchun, director of the Institute of Digital Currency of the People's Bank of China, clearly stated at the Fifth Digital China Construction Summit's Digital RMB Industry Development Sub -Forum on July 24 that digital RMB infringed on user privacy, digital RMB cannot buy gold and foreign exchange.

Digital RMB can buy gold and exchange foreign exchange

Regarding the saying that digital RMB cannot buy gold and buy foreign exchange, Mu Changchun made it clear that this statement was incorrect.

He said that digital RMB is the legal currency in the form of digital form, exchanged with real RMB 1: 1. Paper money and coins can be bought, digital RMB can be bought. Paper and coins can buy gold and exchange foreign exchange. Digital RMB is also available.

There is also a saying that digital RMB invades user privacy. With the digital RMB, everyone is a little ant with a GPS. Where did you go? What hotels did you live? Clearly. Mu Changchun focused on the "false saying" at the meeting.

He said that, first of all, controllable anonymous as an important feature of digital RMB, on the one hand, reflects the positioning of M0 to ensure the public's reasonable anonymous transactions and personal information protection needs; Illegal and criminal acts such as tax evasion to maintain the objective needs of financial security.

"Digital RMB, as a legal digital currency issued by the People's Bank of China, will fully respect privacy and personal information protection, and on this basis to prevent risk prevention to prevent criminals from being used." Mu Changchun said that it needs to be emphasized that in the real thing Under the premise of cash, the public can still obtain the complete anonymity provided by the physical cash, and will not be deprived by the issuance of digital RMB.

Mu Changchun said that controllable control does not mean control and dominance, but to prevent and control risks and crack down crimes. This is an objective need to safeguard public interests and financial security. The controllable anonymity of digital RMB will provide a positive role in providing a better and safer payment service for the public.

Digital RMB design should meet the reasonable needs of personal anonymous transactions

"Digital RMB is positioned in M0, and it should meet the need for anonymous payment." Mu Changchun specifically explained from the following four aspects: the design of digital RMB needs to protect personal privacy; The authorization shall not inquire or use personal information; the design of the wallet arranging matrix of the digital RMB follows the principle of "small anonymity, a large amount can be traced in accordance with the law"; digital RMB only collects necessary personal information according to customer wishes.

Mu Changchun said that in the era of big data, consumers attach increasing importance to personal privacy protection. Although electronic payment represented by mobile payment is more convenient than traditional cash payment, consumers still choose cash transactions. One important reason is that cash transactions have anonymity and natural protection for consumers' privacy. Digital RMB is mainly positioned in cash (M0) in circulation, that is, cash in digital form, design should meet the reasonable needs of personal anonymous transactions and protect consumer privacy.

Specifically, one is to meet the habits of daily small cash payment to ensure the confidentiality of relevant payment transactions; the second is that when anonymous objects should be clearly defined to ensure that consumers use digital RMB for transactions, their personal information is not by merchants and other unfinished unpaid. Third -party acquisition authorized by law; the third is to strengthen the use and protection of personal information to ensure that the basic information of customers collected by the operating institution, transaction and consumer behavior information generated will not be leaked.

Moreover, the "double -layer operation" system of digital RMB is conducive to ensuring that it is not allowed to query or use personal information without authorization in accordance with the law.

Mu Changchun explained that the digital RMB adopts the "double -layer operation" system, and the People's Bank of China exchanges digital RMB to the operating institution, and the operating agency provides the public with exchanged circulation services. Operation agencies collect the personal information necessary for services and operations, and the personal information generated by wallet services is collected and stored by the operating agency.

"Only when the suspected illegal and suspicious transactions are triggered, the relevant authority can inquire and use user personal information to the operating institutions in accordance with the law. At the same time, strictly control the scope of use and use in laws and regulations, and take safety protection measures." Mu Changchun said that without authorized inquiries or personal information, it will be held legal responsible in accordance with the law.

In addition, based on the design of the double -layer operation system and the wallet matrix, digital RMB follows the principles of autonomy, transparency, and minimizing, and collects and handle the necessary personal information directly related to the purpose of the user. The user has the right to close the relevant authority at any time. The Digital RMB APP will immediately stop the processing activities of personal information to fully protect the user's autonomous management authority.

If the degree of anonymity is too high, it will provide criminal soil for criminals

"The freedom of no constraint is not true freedom." Mu Changchun said that if you only pay attention to personal privacy protection and ignore the risks brought by financial products and services in the digital age, the central bank's digital currency will be The use of illegal crimes has serious consequences.

According to him, in order to maintain financial security and stability, the central banks and international organizations of various countries and international organizations have taken precautions to prevent risks as important prerequisites when exploring the anonymity of central bank digital currencies. It will be rejected by one vote. Moreover, in recent years, new forms of illegal and criminal activities such as the Internet and telecommunications have intensified. At present, more than 1 million criminals engaged in cyber fraud activities across the country have caused more than 100 billion yuan in direct economic losses each year. Various types of online gambling cases have also emerged endlessly. In 2019, public security organs from various places detected more than 7,200 criminal cases of online gambling, and the freezing funds involved in the freezer were more than 18 billion yuan.

Mu Changchun said that under the traditional bank account system, banks need to open an account for users to verify real -name, and continuous customer due diligence measures will be taken during the duration of the business. However, even with these risk prevention and control methods, criminals are still unable to avoid criminals such as criminals such as banks and telecommunications fraud.

"The user information of the central bank's digital currency collection is less than the traditional bank account and electronic payment, which is more portable than physical cash. If the anonymity is too high, it will provide new criminal soil for criminals. A large number of illegal transactions will flow from electronic payment. The central bank's digital currency has become a tool for telecommunications fraud, online gambling, money laundering, drug trafficking, and even criminal crimes of terrorist organizations. It will not meet the requirements of international organizations such as FATF. "Mu Changchun said.

Ensure that digital RMB controlled anonymous requirements are effectively implemented

For the next plan, Mu Changchun said that it is necessary to strengthen legislation and improve the design of the top -level system. It is also necessary to strengthen technology applications and improve risk prevention and control capabilities.

Mu Changchun said that in order to ensure the effective implementation of digital RMB controllable anonymous requirements, four corresponding arrangements need to be made in the design of the top -level system.

The first is to establish an information isolation mechanism. Clarify the independence of operating agencies to carry out digital RMB operation business, and standardize the use of digital RMB customer information by setting up digital RMB customer information isolation mechanisms and use restrictions.

Digital RMB operating institutions need to establish and improve customer information protection internal control and customer information protection monitoring working mechanism. Only when illegal crimes such as money laundering, terrorist financing and tax evasion may be applied for obtaining relevant customer information for risk analysis and monitoring to fulfill the performance and performance to fulfill the performance to fulfill the performance and perform to fulfill the performance and perform to fulfill the performance of the performance to fulfill the implementation of the risk analysis and monitoring. "Three anti" obligations.

The second is to clarify the legal conditions of digital wallet query, freezing, and deduction. Only legal authorities authorized by law can inquire, freeze, and deduct user digital renminbi wallets based on legal reasons, otherwise the operating institution has the right to refuse.

The third is to establish a corresponding punishment mechanism. The regulatory authorities can take penalties for operating institutions that deal with digital RMB customer information in accordance with the law to strengthen supervision.

The fourth is to improve the regulations and systems such as anti -money laundering and anti -terrorist financing. Combining the relevant principles of FATF and the characteristics of digital RMB, research and issue regulatory regulations such as digital RMB anti -money laundering and anti -terrorist financing in a timely manner.

Responsible editor: Wang Shidan | Audit: Li Zhen | Director: Wan Junwei

- END -

Regarding the solution to the implementation opinions of the implementation of the television drama production license (B) approval of seven government services

In order to deepen the reform of the city's decentralization service, continue to ...

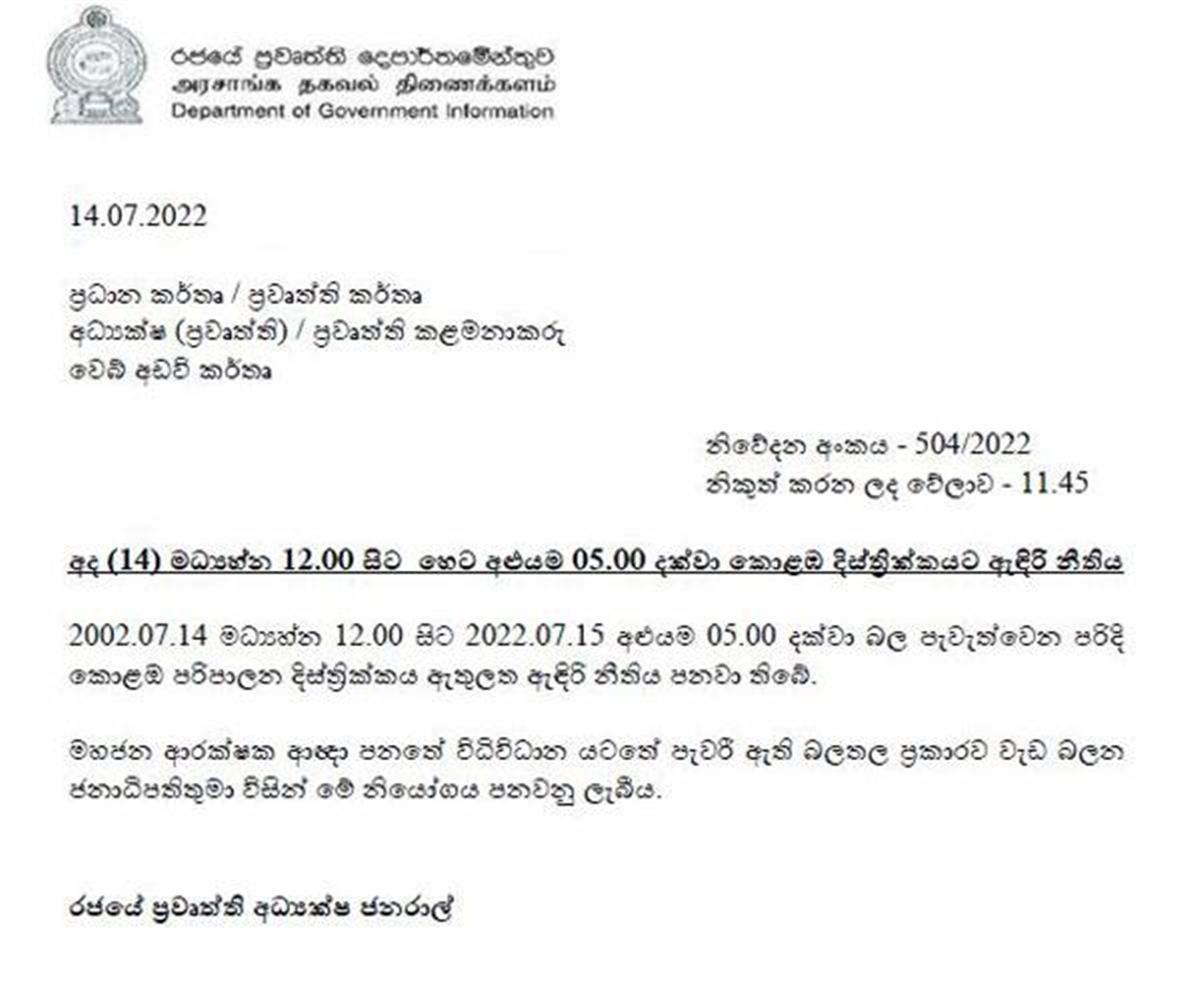

The Capital of Sri Lanka began to have a comprehensive curfew, and the president's resignation letter has not arrived

Jimu Journalist Hu LiAccording to the news of the Daily Mirror on July 14, the Sri...