China stocks collectively exert their collective efforts.There are signs of recovery in the three major fields, and the faucet welcomes the valuation of valuations

Author:Daily Economic News Time:2022.07.24

With the collective adjustment of the track stocks and the repetition of the domestic new crown epidemic, this week's A -share market is dominated by shocks. Although the Shanghai City can maintain an upward trend, the two major indexes of Shenzhen City have fallen and the GEM index has fallen. With each brand 100 index, under the strong leadership of China Stocks, it has achieved rising against the trend, rising by 1.12%throughout the week to close at 949.21 points.

Photo source: Photo Network_401009812

Market participants pointed out that with the advent of the reporting period, the development status of Chinese stocks can be fully seemed. In the context of the valuation return, the investment value of the second half of the year has gradually emerged.

Overall strong index welcomes rebound

Entering mid -to -late June, each brand 100 index has been adjusted. This week, driven by China stocks, the index rose 1.12%weekly to close at 949.21 points. Shenzhen Index and GEM Index.

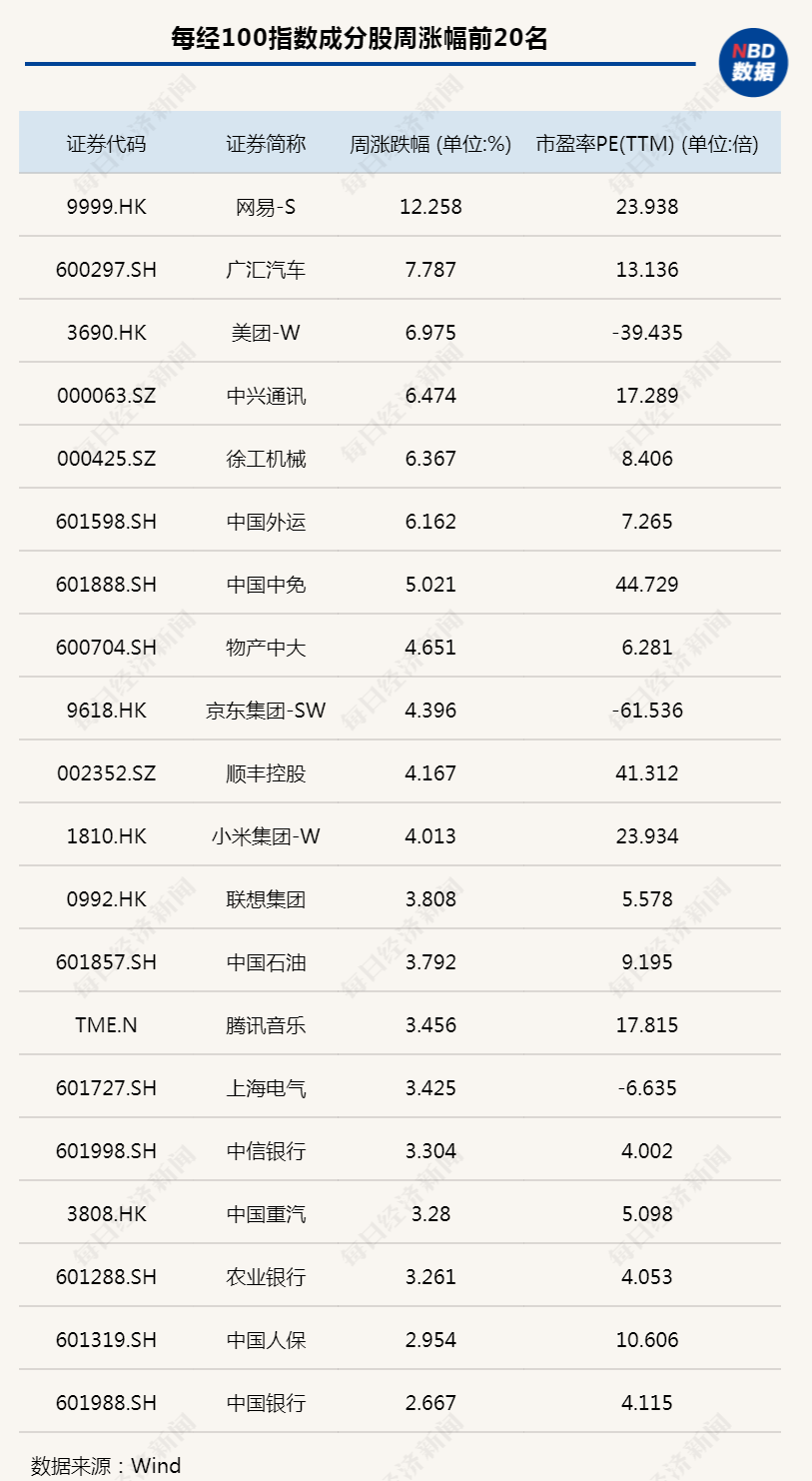

From the perspective of individual stocks, more than 60 stocks in ingredients have increased, of which Netease (HK09999, HK $ 151.1, a market value of HK $ 496.2 billion) has increased by 12.26%in a single week. Communication, XCM Gong Machinery, China Foreign Transport, and China ’s China -free increases exceeded 5%; in addition, Chinese stocks such as JD.com, Xiaomi, Tencent Music, Tencent Holdings, and Baidu also have a good increase.

From the perspective of valuation, although the overall valuation has been repaired again after the overall valuation of the overall valuation, the overall valuation level of the constituent stock is only 10 times, and the price -earnings ratio will soon break 10, which is still at a historical low.

Tianfeng Securities recently pointed out that in the context of stable economy, local services and e -commerce retail companies may play platform value in steady growth and employment. Specifically, platforms that are expected to weaken with the local epidemic and the fundamentals of the fundamentals, such as Meituan, JD.com, and Pinduoduo; the supply industry supply improves the "home dividends". The short -term fundamentals are strong. Netease, Tencent; the online advertising industry is waiting for the improvement of demand, and the dynamic valuation is significantly compared with the historical level/significant cost reduction and efficiency, such as Alibaba, Baidu.

"China Internet" is significantly significant

"Daily Economic News" reporter noticed that in 2022, the State Council officially announced the "Fourteenth Five -Year Plan" Digital Economy Development Plan. This is the first national special plan in China's digital economy. The main economic form after the industrial economy, and formulated detailed roadmaps and main goals for the healthy development of the digital economy. This undoubtedly clarifies its support for the digital economy and Internet -related industries.

Founder Securities pointed out that from the perspective of the development of various fields of the Internet this year, the signs of goodness became more and more obvious:

In terms of e -commerce, Tmall, JD, and Pinduoduo still receive the list of 2022 "618". The sales of the entire platform reached 582.6 billion yuan, an increase of 0.7%over the same period last year. Good situation.

In the field of local life, takeaway users have continued to enhance. According to statistics from the National Information Center, since 2017, online takeaway revenue has increased in the proportion of national catering industry revenue. In 2017, it accounted for 7.6%, and the proportion of 2021 reached 21.4%, reflecting the gradually developing user habits of takeaway, and users' viscosity on takeaway services continued to increase. At the same time, according to the China Internet Information Center, as of December 2021, the number of online takeaway users in China reached 544 million, corresponding to 52.7%among Chinese netizens, compared with 340 million online takeaway users in December 2017, The penetration rate is 44.5%, which also maintains growth.

Photo source: Photo Network_500500748

In terms of the game industry, the number of programmers who continue to grow has made Chinese mobile game talents continuously, thereby leading the world's Internet mobile game track worldwide. According to Sensor Tower, the top 2 global glory and peace elites in 2019, 2020, 2021 and 2022 are the glory and peace elites of the king. As the overseas game giants used to despise the mobile game market, the mobile game talents were relatively scarce, resulting in relatively high labor costs of mobile games; the domestic market was fiercely competitive and trained many mobile game talents. Domestic manufacturers.

On the other hand, the game version number is re -distributed, which not only has substantial benefits for the game company that gets the new version number. For the head products of the head company, its research and development completion is relatively high. Bring substantial growth to performance.

Internet leading brand effect is huge

In each of the 100 indexes of the brand, almost all the leading companies in the sub -segments in the Chinese Internet territory are invested by the company. In addition to Tencent and Ali, there are Pinduoduo, Meituan, Netease, JD.com, etc. Strong brand value effect.

First, the Meituan (HK03690, the stock price of HK $ 191.7, and a market value of HK $ 1186.1 billion) as an example. According to the data, Meituan started with group purchase services and gradually expanded to the vertical field and build a local life service ecosystem, which became the leader of Chinese service e -commerce. Among them, the store wine brigade has become a stable cash cow business. The essence of the store wine and travel business is based on LBS providing product information, discount discounts and certainty to earn commission revenue and advertising marketing income. In status, the online hotel reservation room is the first in the industry. The competition barriers are stable, and the development space of the takeaway market is still broad. The leading position of the Meituan industry will be maintained for a long time. Considering the increasingly effective effect of takeaway, the improvement of the profit margin of Meituan takeaway operations is very promising. Guosheng Securities stated that the current consumer market of Meituan cards, its existing scale, advantages, accumulation of leading competitors, strong iterative capabilities, and has a premium advantage and barriers. Under the disturbance of the epidemic, the company not only gives full play to its consumers to consumers The value of participants such as merchants, riders, and other aspects also assume social responsibility. At the same time, actively adjust the operating efficiency of each business and achieve high -quality development. For business profits, the company's value is still undervalued.

Another example is JD Group (HK09618, the stock price of HK $ 247, and a market value of HK $ 771.5 billion). The company is the largest retailer in China according to the transaction volume. It is based on its own retail business. Comprehensive technology companies in retail, fintech and other businesses. With the supply chain capacity as the core, the company continues to create a good shopping experience through product quality, logistics speed, and customer service quality, forming a unique reputation of "self -employment, genuine, fast".

Through the continuous heavy asset investment in the self -operated warehousing and logistics system for decades, and the continuous deep cultivation of upstream supplier resources, it has achieved efficient distribution speed and high reputation of product quality, and will be "fast" and "good". The advantages are fully played in categories based on standard products, forming unique competitiveness in the fiercely competitive retail market.

Cinda Securities analysis said that JD Group benefited from the long -term trend of consumption upgrades, and based on its own characteristics, it will be avoided in the fierce industry competition. In the future, there will be a high probability of maintaining or increasing the industry share. The company's active buyer and GMV growth space is clear. The profit margin is expected to continue to improve with the release of operating leverage and the optimization of business structure. The performance growth is strong and sustainable. It is the first choice for China's retail and e -commerce industry.

Daily Economic News

- END -

Cross -regional defense 丨 Xing'an League Forest Fire Division fully do a good job of preparation for preparation for preparation of flood prevention

In order to thoroughly implement the spirit of mobilizing the deployment meeting o...

Build a happy home with love -the king of the civilized family of Henan Province Mei Rong Family

Wang Meirong took care of her mother -in -law.Zhoukou Daily · Zhou Dao client rep...