Captive stock recovery: Century Huatong's market value rose 2.31 billion yuan, Huicheng Technology's stock price rose 61.15%of the "Entertainment Week Review List"

Author:Huaxia Times Time:2022.07.23

China Times (chinatimes.net.cn) reporter Yu Yujin Beijing reported

After two weeks of decline, this week (July 15th-July 22nd), the cultural and entertainment index (CITIC) (CI005848.WI) rose 6.75%. In particular, Huicheng Technology (002168.SZ) has gained 5 daily limit boards this week.

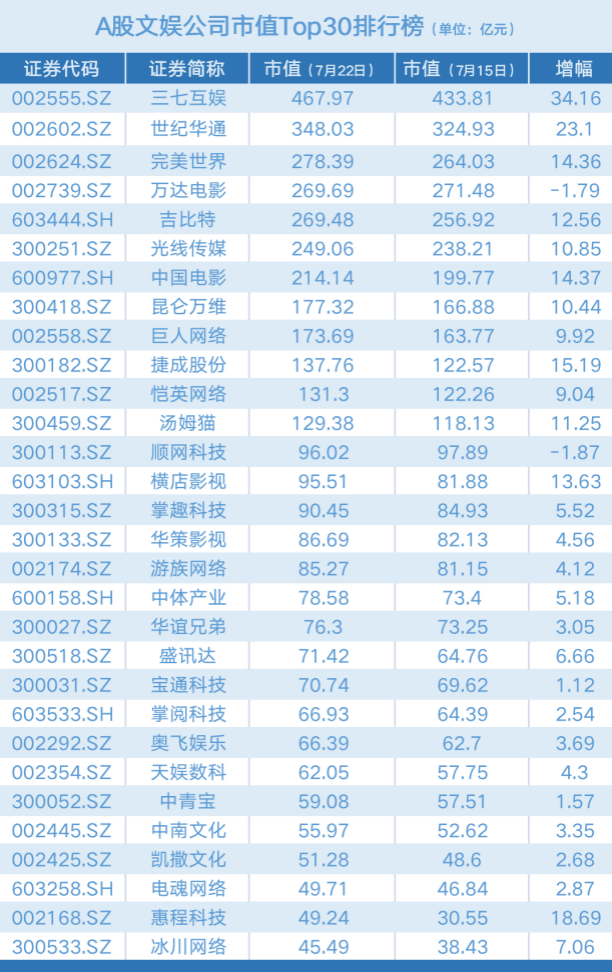

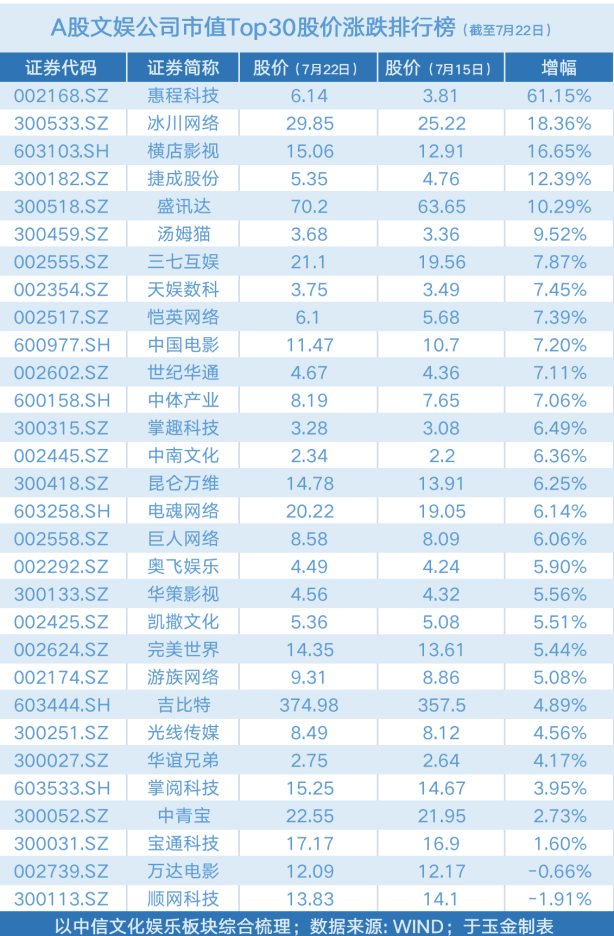

Specifically, in the TOP30 list of A -share entertainment companies, only Wanda Film (002739.SZ) and Shunwang Technology (300113.SZ) shares have declined slightly, and the remaining 28 companies have recorded up. Sanqi Mutual Entertainment (002555.SZ), Century Huatong (002602.SZ) and Huicheng Technology's market value of 3.416 billion yuan, 2.31 billion yuan, and 1.869 billion yuan, respectively. The stock prices of Cheng Technology, Glacier Network (300533.SZ) and Hengdian Film (603103.SH) rose 61.15%, 18.36%, and 16.65%, respectively, the top three companies with the largest stock price increase this week. Huicheng Technology and Glacier Networks rose into the list with a large market value.

In addition, according to the professional version of the lighthouse, as of 21:34 on July 22, the total box office (including pre -sale) of the Chinese film summer file in 2022 officially exceeded 4 billion. "Life Event" leads over 1.5 billion yuan in the box office. "Jurassic World 3" and "Detective War" followed closely, ranking two to three in the summer box office list. On July 29, "Lone Moon" will be released, and "Tomorrow's Battle" will be released until August 5th. Many love movies in the Qixi Festival will be set. The box office record of the year is also increasingly worth looking forward to.

Liu Zhenfei, a senior analyst at the Cat Eye Research Institute, analyzed the reporter of "Huaxia Times" that "At present, the box office of 2022 wants to surpass 2021. In addition to the long -tail play of the old film, it is more dependent on the sustainability of the new film film to the market for the market. Movement; From the perspective of the supply of the film, the number of second half of the summer this year is more and the type is richer; from the perspective of the overall epidemic prevention situation this year, it is more stable compared to last August. The total box office results will exceed 2021 summer. "

Gaming stock recovery

The market value of Sanqi Mutual Entertainment rose 3.416 billion yuan this week, the company with the largest market value this week.

The performance trailer recently disclosed by Sanqi Interactive Entertainment showed that its expected profit in the first half of the year was 1.6 billion yuan to 1.7 billion yuan, a year-on-year increase of 87.42%-99.13%. A year-on-year increase of 143.13%-158.81%.

The reason why net profit rose was that the life cycle of the main game products operated in the first half of this year and the same period of the previous year this year was different. Promote the steady development of the company. At the same time, the development of Sanqi Mutual Entertainment ’s overseas business has been accelerated again. In the first half of this year, the operating income of Sanqi Mutual Entertainment’ s overseas market is expected to increase by more than 40%year -on -year.

On the evening of July 18, Sanqi Mutual Entertainment stated that the company intends to increase its capital to the first phase of the Entrepreneurship Investment Fund (Limited Partnership) (hereinafter referred to as the "Tong Song Fund"). The first phase of the same song was initiated by Geor Co., Ltd. and Qingdao Tongge Entrepreneurship Investment Management Co., Ltd. (hereinafter referred to as "Tongge Venture Capital").

The total target of the first -phase fund of the same song is 556 million yuan, and Sanqi Interactive Entertainment intends to increase the capital as a limited partner of not more than 50 million yuan. Tongge bedside cabinet intends to increase capital of 4.56 million yuan as an ordinary partner. Goer plans to increase capital of 301 million yuan as a limited partner. The new game of the game is intended to increase the capital of 100 million yuan as a limited partner.

For the purpose of investment, Sanqi Mutual Entertainment said that through the investment of advanced manufacturing, intelligent connected cars, augmented reality/virtual reality, and unlisted entrepreneurial enterprises in the field , Intelligent Connected Automobile, Augmented Reality/Virtual Reality, and the layout of enterprises in the field of semiconductor realization to achieve capital appreciation.

The market value of Huatong this week has also risen by 2.31 billion yuan. The performance trailer disclosed by the World Huatong this year shows that its net profit attributable to shareholders of listed companies is 500 million to 700 million yuan, a decrease of 71.43%-79.59%over the same period last year.

Regarding the decline in performance, Century Huatong explained that in the first half of 2021, the company confirmed the non -recurring profit and loss of 1.682 billion yuan (mainly due to the income of equity transfer). main reason. In addition, the company's automotive parts business is affected by local epidemic conditions; the construction and delivery of Internet data center projects have also been affected to a certain extent.

If the non-recurring profit or loss is not considered, the net profit after deducting non-recurring profit and loss of the shareholders of listed companies in the first half of this year Huatong was 430 million yuan to 630 million yuan, a decrease of 17.94%-43.99%from the same period last year.

Huicheng Technology's stock price rose 61.15%

The five daily limit boards have made Huicheng technology stock prices that are not ideal rising 61.15%, becoming the most dazzling star in entertainment stocks this week. On July 22, Huicheng Technology deviated from the Dragon and Tiger List due to the increase in the price increase of the closing price within 3 consecutive trading days. Huicheng Technology closed at 6.14 yuan on the same day, an increase of 10.04%, a renewal rate of 10.25%, and a turnover of 489 million yuan. The top 5 business departments with the largest amount of buying are Guosheng Securities Ningbo Sangtian Road Sales Department, Guoxin Securities Shenzhen Science and Technology Park Branch, Dongxing Securities Hefei Wuhu Road Sales Department, East Asia Qianhai Securities Shenzhen Branch and Guo Jin Securities Chengdu Xindu The cumulative net purchase of the Malaysian West Road Sales Department was 83.2448 million yuan.

Huicheng Technology announced on July 20 that the company's stock price was discouraged that the company did not have disclosure and did not disclose the information.

Although Huicheng Technology's stock price has soared, Huicheng Technology's fundamentals are very unsatisfactory. Huicheng Technology was listed on the SME board of the Shenzhen Stock Exchange in 2007. Its business scope is the production of high -molecular insulation materials such as cable branches, ring network cabinets and other related power distribution equipment, power cable accessories, and the production of related products. In 2012 and 2015, the company's business scope successively increased high and low voltage electrical appliances, box -type substations, power automation products, equity investment, asset management, investment consulting, etc.

In 2016, after Wang Chao, a private equity leader, entered the Lord, Huicheng Technology's business scope increased intelligent power distribution, new energy vehicle charging pile industrial chain, industrial automation and control, information and security monitoring system, and intelligent secondary equipment. On December 20, 2017, Huicheng Technology completed a cash acquisition of 77.57%of the equity of Cocoa. Demon became a subsidiary of Huicheng Technology Holdings. The business sector formed a two -wheel drive development pattern of "high -end intelligent manufacturing, Internet games".

However, Huicheng Technology, which was injected asset, did not improve its performance in terms of performance. From 2016 to 2019, Huicheng Technology's net profit attributable to shareholders of listed companies was 76 million yuan, -108 million yuan, 336 million yuan, and 135 million yuan.

In 2020, due to the provision of the controlling subsidiary Dimmeng's reputation for impairment, Huicheng Technology's losses were as high as 960 million yuan. Entering 2021, Huicheng Technology was still losing money, with a loss of 223 million yuan in 2021. Among them, the current flow of the controlling subsidiary Dimmeng's main game has declined during the product cycle, resulting in 75.28%year -on -year revenue of game business.

Huicheng Technology also ushered in the new controlling shareholder and actual controller in 2021. On August 1, the controlling shareholder of Huicheng Technology changed from Zhongchi Huicheng to Lvfa City Construction. The actual controller was changed from Wang Chaoyong and Li Yifei to Chongqing Laoshan District Finance Bureau.

Huicheng Technology disclosed on July 15th's performance forecast show that in the first half of this year, the net loss attributable to shareholders of the company was 40 million yuan to 60 million yuan. For losses, Huicheng Technology explained that from January to June 2022, the operating income of the company's electrical business and charging pile business increased year-on-year. The year -on -year decline is caused by the impact of the company's operation, management and financing related expenses on net profit.

Editor -in -chief: Editor -in -chief Huang Xingli: Han Feng

- END -

Zhejiang Shaoxing Xinchang deployed to promote the promotion of garbage classification and improvement of party and government agencies

Recently, the Xinchang County Organ Affairs Service Center re -summarized the deve...

#The new bureau will make the party flag flutter at high on the medical insurance front

Medical security is an important livelihood project. It is a major institutional a...