Not only do you have no interest, you also have to pay "penalties"?The era of negative interest rates in Europe has just ended.

Author:Qianjiang Evening News Time:2022.07.23

We have witnessed history. On July 21, local time, the European Central Bank announced the interest rate resolution, which raised the three major interest rates to 50 basis points to exceed the 25 basis points that were previously expected. The interest rate hike was the first time in 2011, and the interest rate hike also hit the largest value in nearly 22 years. The interest rate hike also announced that Europe has ended for eight years of negative interest rates. Analysts said that the interest rate hike was mainly to cope with the increasingly serious inflation phenomenon of the euro zone. Click here for details

For ordinary Chinese people, it is difficult to understand what kind of scene is the negative interest rate of bank deposits. The author of this article has lived in countries with relatively good European economy for many years. What is the relationship between ordinary people and banks under negative interest rates? Do people get the bank with money? How to manage money? What is the mortgage car loan? Now, let's listen to her life in Europe in the era of negative interest rates.

The European Central Bank headquarters in Frankfurt. Tintin

Five years ago, I worked at the international office of a business school in Germany and received a domestic banking team. Some of them asked me curiously, how much interest would they have in the bank in Germany? I was asked suddenly.

In the impression, it seems that the Germans and even the majority of European countries have never saved money to collect interest, and they are not very concerned about the deposit interest rate of their accounts.

In my own account, the deposit interest rate is as low as that it can be ignored. Over time, I have almost forgotten that depositing money to collect interest is also a very important way for financial management in China.

Street in Berlin, Germany.

Before writing this article, I checked again and found that the interest rate of my current account has fallen to zero. Fortunately, I have a certain amount of income every month, otherwise according to the regulations, the bank will charge a few euros of management fees a month.

Not only can save money not to make interest, but also pour bank money, which is unimaginable in China.

Not only the bank I opened an account, but the deposit interest rate of other banks is also terrible. Even if you look at several neighboring countries, the best interest rate I have found is 0.8%provided by a Bank of Italian banks for regular deposits of less than 100,000 euros. This is the data a year ago. Intersection

In Europe, the Germans are famous for their money.

According to statistics, there are 2.3 trillion euros in the account of more than 80 million German people, which is not much worse than the Chinese who like the most favorite. In the latest survey, only 17%of the Germans were moonlight, and they did not save money at all. More than half of the Germans will store 50 to 400 euros a month.

Of course, due to high taxes and high consumption, only 1%of Germans who can save more than 1,000 Euros per month.

In addition to love to deposit money, the German attitude towards investment is also famous. Many people just deposit money instead of making any other financial investment. I am afraid of debt when buying a house, and I am afraid of falling stocks. Especially now I do n’t know if there is a bubble in house prices, and the stock market is also turbulent.

I have seen a street interview with a German media. Many people say that even if the bank has no interest, it will be so stored and do not do financial management.

Some people are selling small products in the local flea market in Berlin.

If the zero interest rate can still be tolerated, the management fee for deposit collection is really "persuasive."

In recent years, German banks have launched the charging policy in order to maintain profits. Unless the account has the money to account for a monthly account, it will charge a management fee of more than 5 euros, and it will be dozens of euros a year. Therefore, in addition to the bank accounts necessary for daily life, other unnecessary unnecessary accounts have been canceled. According to reports, after the German commercial bank announced the charging last year, the termination account of the termination of the contract suddenly increased by 9 times. The cancellation rate of the online bank COMDirect was 250%of the 11 -week average.

Supermarket in Berlin, Germany.

Today, most countries in Western Europe and Nordic have entered the era of cashless payment, and Germany is still a cash country.

In addition to depositing banks, Germans also like to deposit cash at home. Needless to say, the most unexpected thing is that the euro has been circulating in Germany for 20 years. According to the statistics of the German Central Bank, German folk still holds about 5.77 billion marks of banknotes and 6.61 billion Mark coins.

According to the law, these German Mark can no longer be used on the market, but it can be exchanged indefinitely at the German Central Bank. Every year, some people find Mark in drawers, sacks, shopping bags, and even books, and then run to the central bank for exchange.

In 2019, a young man was going to sell a large amount of money to sell the house of the death uncle's house, but accidentally found that the house was hidden in the house 3.5 million Mark. Hengcai, the house does not need to be sold. In 2020, the German Bank of Germany exchanged a total of 53.4 million Mark's old currency. In addition, a considerable number of Germans were not in a hurry to exchange Mark into euro, and kept it in their hands.

A construction site in Berlin. In terms of income, local house prices are not expensive, but there are not many young German people who are willing to buy a house.

While the deposit interest rate is low, the financing interest rate is also low. The benefits of ordinary people are that the interest rate of buying a house is much lower than that of China.

Taking a mortgage of 10 years of binding interest rates as an example, the loan interest rate 20 years ago was about 6%, and it maintained at 3%to 4%10 years ago. In the past five years, the interest rate binding of the mortgage in 10 years has fallen to 1%to 2%. At the same time, due to the influx of a large number of foreign immigrants, the supply and demand balance of the rental market is broken, especially in large cities like Berlin, it is often difficult to find a room.

As a result, the rich from Eastern Europe, immigrants from China and India, including a small number of Germans, bought houses and boarded the car.

However, there are many German friends around, even if they have the ability to pay, they would rather continue to rent a house.

I asked two German friends who had a stable work in the 30s around me, why not buy a house belonging to their own when low down payment and low interest rate.

According to their economic conditions, you can buy a small set of about 300,000 euros, which may be cheaper than rent. One of them told me that I didn't want to carry a debt on the house when I was so young, and I would like to change the city to live in the future!

Although another one wanted to buy a house, she could only buy small units according to her economic conditions, and she wanted to buy at least three rooms and one living room in one step, and lived comfortably.

The outbreak of the Russian and Ukraine War this year, European inflation has intensified, and bank loans have generally become more cautious. Especially in the past two months, Germany's mortgage interest rate has also risen to 3%at once.

Because of raw materials, house prices are still strong, and there is no trend of price reduction. Of course, it was not easy to buy a house a few years ago. Many people missed the chance to get on the car. Not only that, because of the rise in prices, saving money becomes more and more difficult.

Of course, when it comes to the eight years of negative interest rates in Europe, it is basically the trouble of rich people.

For example, in the era of negative interest rates, many large banks in Europe have announced that 0.5%of interest rates are levied on accounts with more than 100,000 euros of deposits as penalties. In other words, if you have 100,000 euros on your account, you will have to hand over 500 euros to the bank in one year, which is more than 10 times more expensive than ordinary people to hand over to the bank.

Some banks even reduce the threshold for this penalty to 50,000 euros. In this way, people with a lot of deposits have to pay for less money, or have to deposit the money on different bank cards, and pay only management fees.

However, these penalties policies are not so great for rich people who have wealth. A rich friend once told me that after making money, he took it to invest, and only more than 10,000 euros daily turnover was retained on the bank account. As for the specific investment, others are like a bottle.

- END -

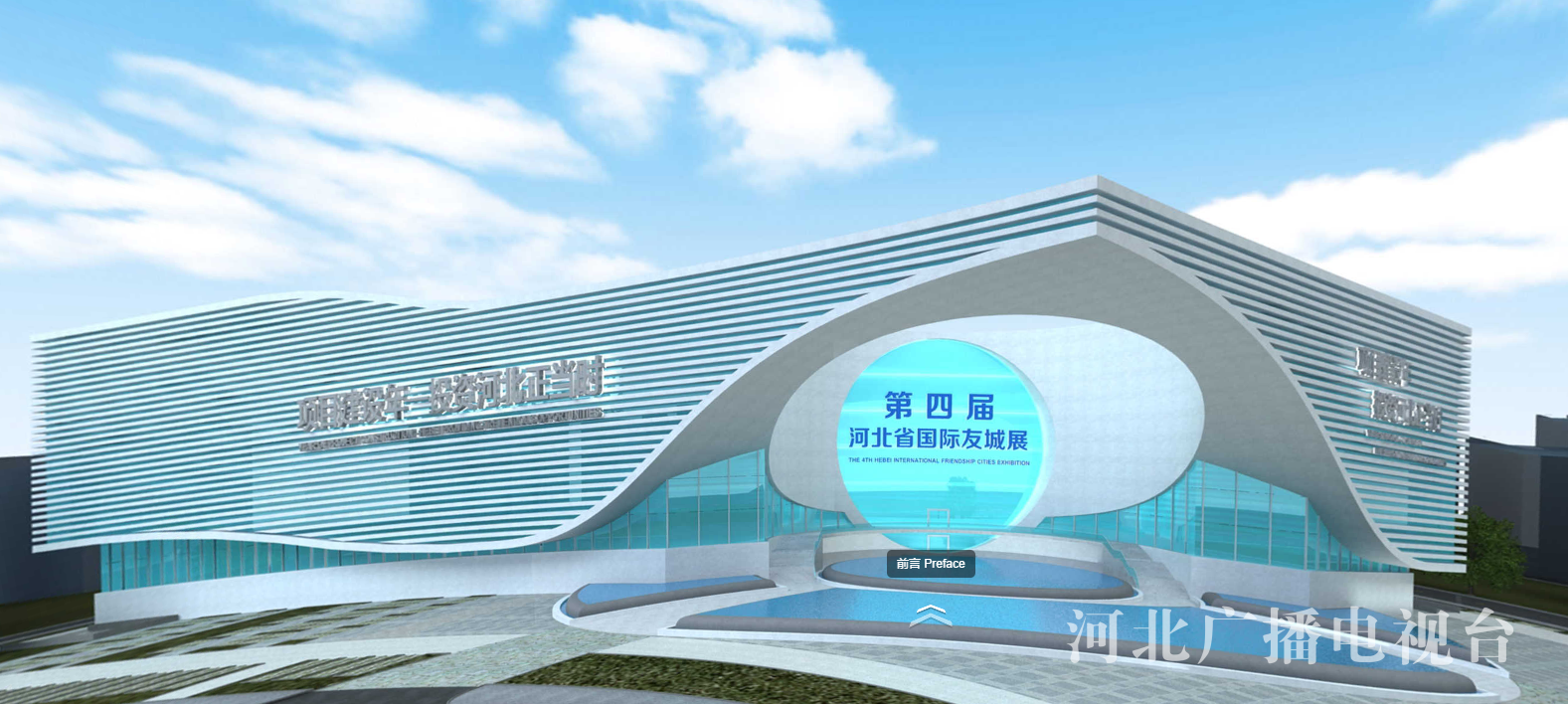

Focusing on the Grandma Club | Walking on the 4th Hebei International Friendship Exhibition of Hebei Province

The client reported that from June 26th to 28th, the China Langfang International ...

Jiangshan Meteorological Observatory lifted heavy rain yellow warning [Class III/heavier]

Jiangshan Meteorological Observatory, June 10, 2022 08:25 to relieve the rainy yellow warning signal: At present, the heavy rain cloud group has been removed from our city, and the yellow warning sign