From "follow -up" to "making markets", brokerage escort science and technology boards has been picked up, and the "win -win effect" gradually enlarged

Author:Capital state Time:2022.07.23

From the initial establishment of the "doorkeeper" responsibility of the sponsor sponsored by the brokerage firms, to the recent "lifting tide" of the science and technology board, the city business system was launched to enhance the liquidity of the sector. The "win -win effect" is gradually being enlarged.

On July 22, 2022, the science and technology board ushered in the third anniversary of the opening board.

In the past three years, the number of listed companies in science and technology board has reached 437, with a total fund -raising amount of more than 630 billion yuan, and the total market value exceeds 5.6 trillion yuan.

At the same time, as the main position of China's "hard technology" attribute enterprise and an important "test field" for the reform of the capital market, the recently entered stage of the implementation of the science and technology board stock transaction to the market system has also entered the implementation stage. Brokers with deep binding with science and technology boards have once again become the focus of market attention.

From the initial establishment of the "doorkeeper" responsibility of the sponsor sponsored by the brokerage firms, to the recent "lifting tide" of the science and technology board, the city business system was launched to enhance the liquidity of the sector. The "win -win effect" is gradually being enlarged.

Oriental Securities previously pointed out that the marketing system of science and technology board stocks officially opened the prelude to the history of A shares (previously only in the field of bonds/products/ETF/New Third Board), and the rights market is to do the market. The securities firm is of great significance. It will not only enrich the choice of self -employed business, but also effectively reduce the volatility of self -operated investment performance and improve the stability and toughness of the overall performance of the broker.

Six securities firms followed the floating profit of more than 100 million yuan, and 7 follow -up yields doubled

In order to strengthen the prudent principles of the sponsor's pricing process in the science and technology board, the "follow -up" system requires the main underwriters who participate in the science and technology board sponsorship shall participate in the stock start strategy of the stock start strategy in accordance with a certain amount of investment ratio and the form of an alternative investment subsidiary. The process, the lock -up period for the shares is 24 months.

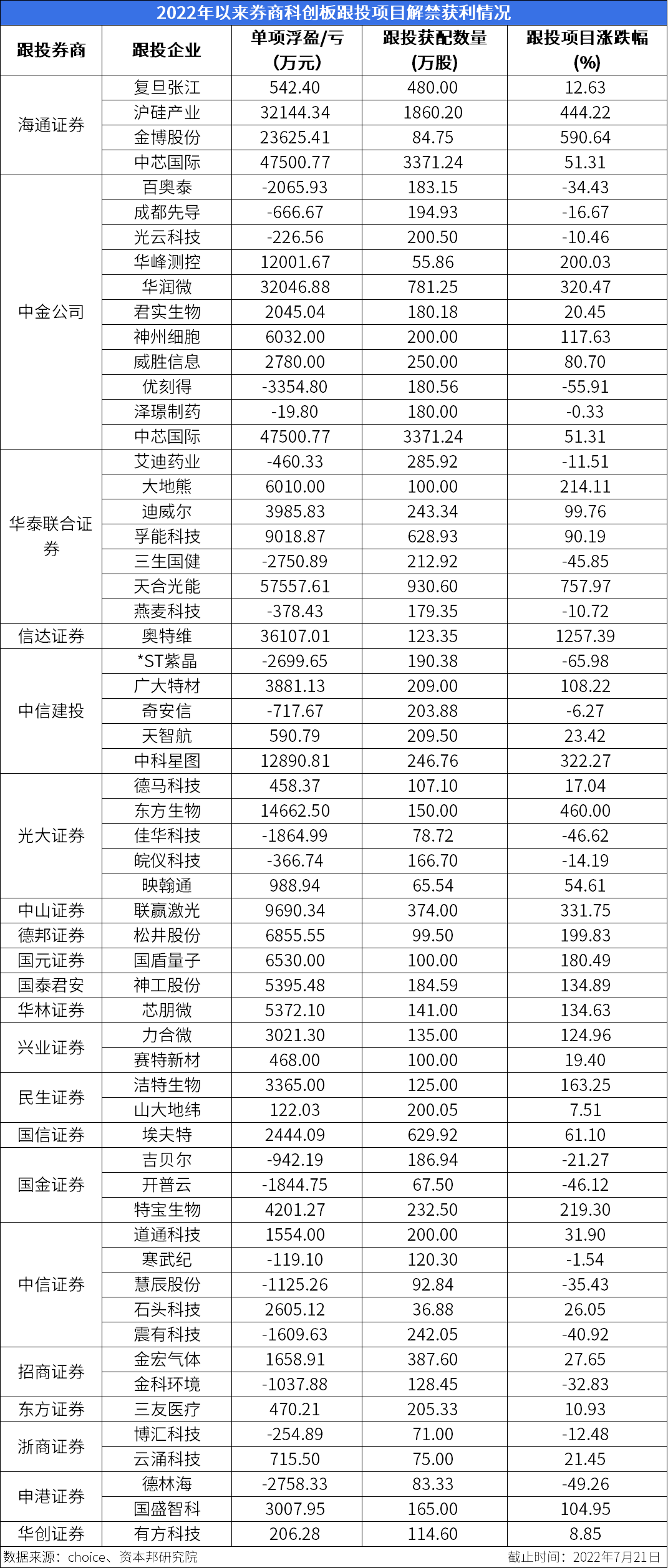

Choice statistics show that as of July 22, 2022, from the beginning of 2022 (that is, the starting time from January 1, 2020 to July 22, 2020, the same below) Science and Technology Board has a total of 70 projects. During the period, there were 32 brokerage companies participating in sponsor and investing in the investment business. At the beginning of the period, a total of 4.788 billion yuan of funds for investment subsidiaries followed by alternative investment subsidiaries.

Based on the closing price on July 21, 2022 (the same below), 70 unbroken stocks have increased since listing in 2020. The current stock price of 21 stocks has doubled compared with the issue price. As a result, It also created a net floating profit of 3.783 billion yuan for 32 brokerage subsidiaries.

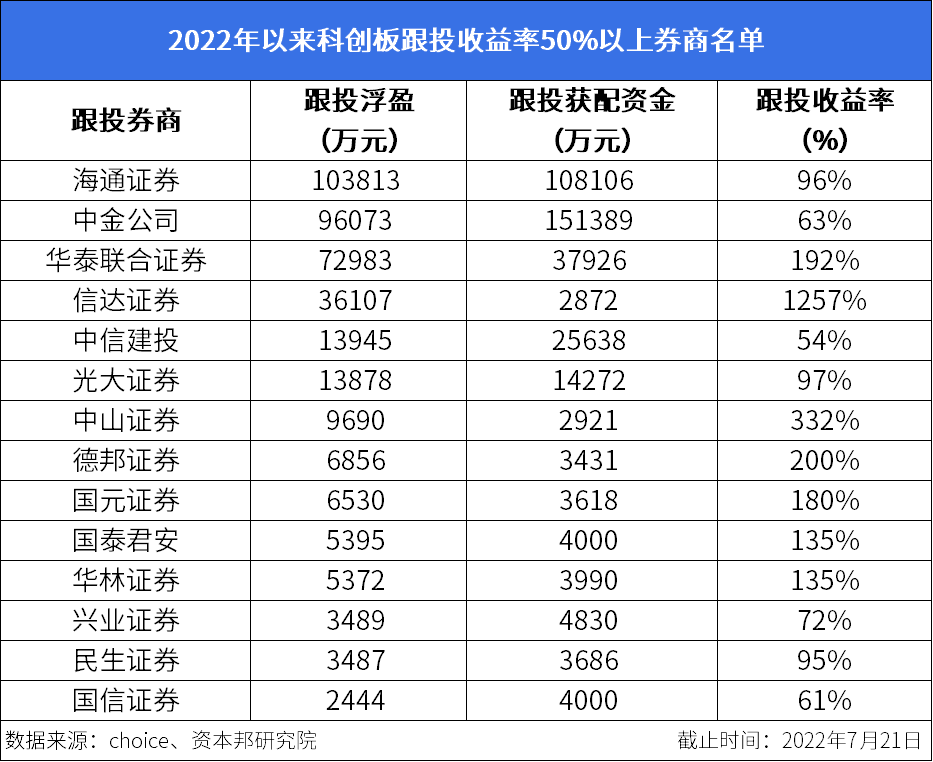

According to statistics, a total of 21 brokerage firms followed the accounts to achieve net floating profit. Six brokers have followed the net floating profit of more than 100 million yuan. Double, the highest yield, the Cinda Securities During the period, followed only a company with a company, but the follow -up profit was as high as 361 million yuan and followed the fourth income list.

Specifically, the six subsidiaries followed the parent company of the Boystock of Hytong Securities, CICC, Huatai United Securities, CITIC Securities, CITIC Construction Investment and Everbright Securities, respectively. The yuan, 961 million yuan, 730 million yuan, 361 million yuan, 139 million yuan and 139 million yuan.

Among them, Haitong Securities is currently the only floating profit exceeding 1 billion yuan broker. The current projects are all floating.

From the perspective of follow -up yields, nearly 1260%of Cinda Securities' follow -up yields are worthy of becoming a "dark horse" in the period of the investigation broker, which perfectly interprets the "small bloggance" on the science and technology board and investment project.

As the only "sponsor+follow -up" project of Cinda Securities, as of July 21, 2022, Ultra's stock price has increased from the issuance price of 23.28 yuan/share to 316 yuan/share, which has created 361 million yuan for Cinda Securities in one fell swoop Yuan's account is floating.

In the first half of 2022, the capital market was facing a frequent internal and external environment. Compared with many large securities firms that are more than sponsor projects but easy to step on, such as Cinda Securities generally only harvested a grain of innovation boards, The project is still not a small number of small and medium -sized securities firms that still achieve good yields.

According to observations, during the period, there were 7 brokerage companies including Cinda Securities, and there were 7 brokers with double investment rates. Except for Huatai United Securities participating in the "Sumulating+Following Investment" multiple science and innovation board companies, the remaining six brokers were only Harvesting a follow -up project, but the current accounts are all over 50 million.

Except for Cinda Securities and Huatai Joint Securities, the remaining five of the remaining 5 investment yields and follow -up profits are respectively. The same); Debon Securities followed 200%of the return yield, followed by the floating profit of 68.56 million yuan (Matsui shares); Gu Yuan Securities followed the investment yield of 180%, followed by the floating profit of 65.3 million yuan (Guildren quantum); Guotai Junan followed the following; Investment yields were 135%, followed by the floating profit of 53.95 million yuan (Divine Industry shares); Hualin Securities followed 135%of investment yields, and the Floating Duoying was 53.72 million yuan (Xinpengwei).

From "follow -up" to "making markets", securities firms and science and technology boards are "mutually beneficial"

In January 2022, the "Pilot Provisions of the Securities Company's Science and Technology Innovation Board Stocks (Draft for Soliciting Opinions)" (hereinafter referred to as the "Pilot Regulations" and "Shanghai Science and Technology Innovation Board Stocks' Implementation Rules for the Municipal Transaction Business (Draft for Solicitation) "(Hereinafter referred to:" Implementation Detailed Rules ") and other supporting documents should be launched in May and July this year. At the same time It will be implemented from the beginning of the day. If the opening of the science and technology board three years ago, the broker was required to force the intensive investment science and innovation board to make the brokerage sponsors' responsibility of the "watchman". In the past three years, the development of the science and technology board has undoubtedly consolidated the "mutual benefit" attributes between securities firms and sectors.

As far as the science and technology board is concerned, according to the analysis of Caitong Securities, there are currently more than 400 listed companies in science and technology boards, but there are problems of decreased liquidity and inter -stock differentiation. Because the science and technology board is a new share, once the "size is not" lifted, it will cause the turnover rate to decline rapidly.

According to the observation of CITIC Securities, in 2022, the average daily turnover rate of the science and technology board has been lower than the average level of the Shanghai Stock Exchange (0.88%) for the first time.

Therefore, CITIC Securities believes that the launch of the science and technology board at this time has obvious practical significance: doing the market system can enhance the liquidity of the science and technology board, improve the market price discovery function, and also help enhance the enhancement of enhancement Support for high -tech enterprises.

CITIC Securities predicts that the New Third Board of the market business system has been promulgated in 2014. According to the experience of the New Third Board market, the new third board selection layer continuous bidding transaction period accounts for about 28%. However, in the continuous bidding markets such as science and technology boards, the proportion of marketing transactions should be significantly lower than the New Third Board market. Based on this calculation, the average daily turnover rate of science and technology boards is expected to increase by about 10%-15%.

As far as brokers are concerned, BOC Securities believes that the market system helps to bring the business incremental increase in the business of the brokerage science board, enrich the customer service system of institutional customers and medium and high net worth customers, and revitalize securities firms to hold stocks with stocks to thicken profits. Making a market business also helps enhance the performance toughness of securities firms.

For example, Caitong Securities has analyzed that assuming that the market value of the securities firms is between 1%-4%, the total scale of the science and technology board is expected to be range from 50-210 billion yuan. Neutral assumptions have increased transaction volume after the introduction of market merchants (to 55 billion yuan/day), the market price difference is 0.5%, and the proportion of market transactions accounts for 20%. It is expected that the annual income income will be about 100-13 billion billion yuan. Yuan; calculated by 90%of the profit margin, the incremental profit brought about was about 900-11.7 billion yuan.

In addition, Zhejiang Business Securities also mentioned that the market transaction business can better serve the company's customers. Through a number of business linkages such as contracting with investment banking projects, strategic follow -up, research pricing, off -site option creation, etc., the customer service chain is extended. Helps promote the development of business lines such as investment banking, investment, wealth, research, promote the improvement of business collaboration and comprehensive service capabilities, and enhance the company's core competitiveness.

The brokerage science and innovation board has accelerated the market, and 17 securities firms have reported their business applications

According to previous Caitong Securities and Zhejiang Business Securities, as early as January 28, 2022, the Shanghai Stock Exchange had taken the lead in inviting 28 securities firms to mobilize and exchange science and technology board stocks for market transactions. Each broker also expressed positive willingness to participate in the market transaction business participating in the science and technology board.

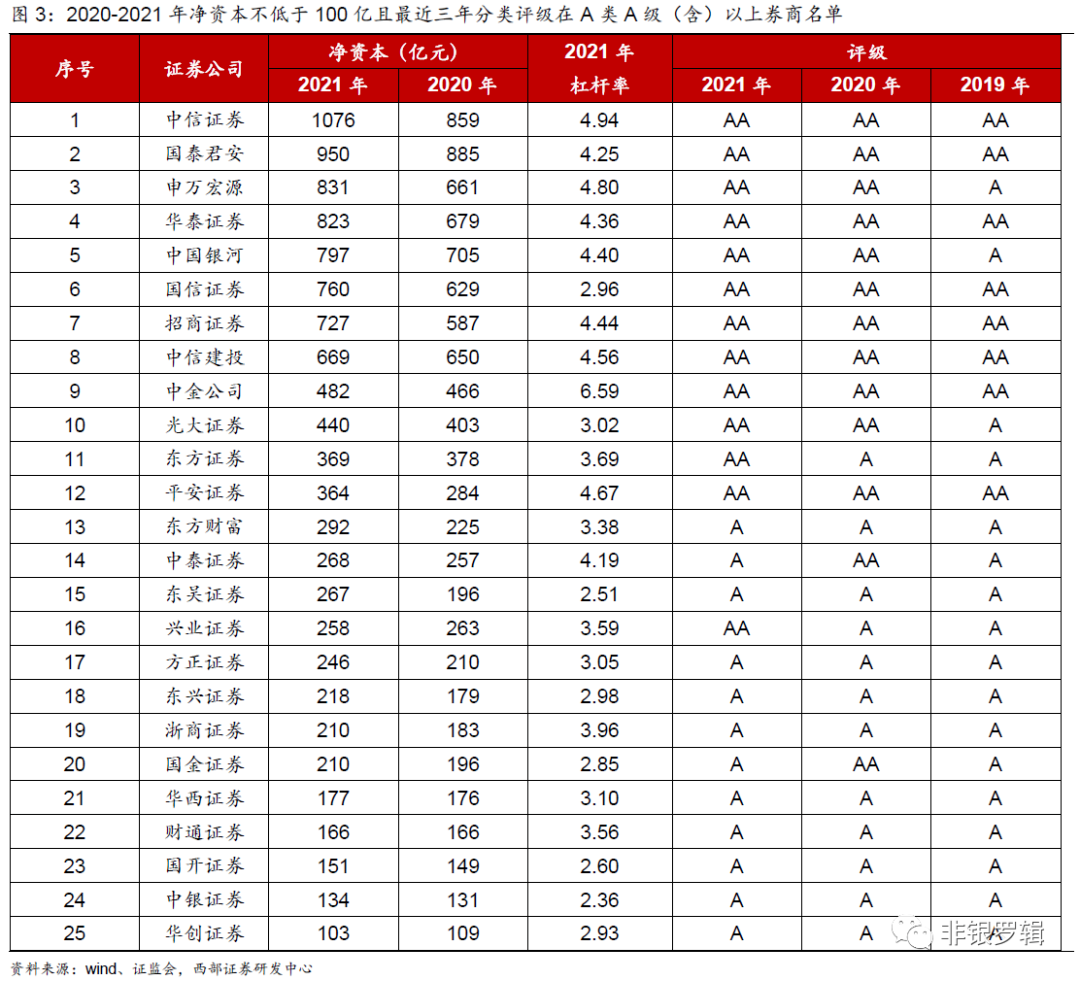

According to the requirements of the "Pilot Regulations", securities firms participating in the science and technology board still need to meet the net capital in the past 12 months, which has continued to not be less than 10 billion yuan; in the last 3 years, the classification rating has been classified as Class A (inclusive). The hard indicators of the strip.

At that time, based on the above two core requirements, Western Securities had screened 25 brokers to meet the current pilot science and technology boards to do the business qualifications.

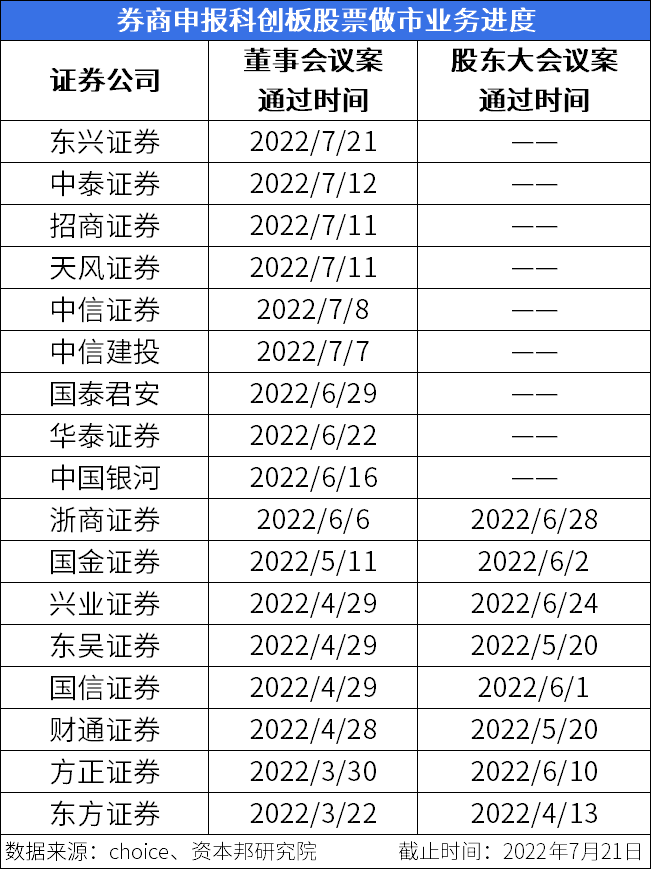

At the same time, the "Pilot Provisions" also requires that if a broker applies for the science and technology board stocks to be qualified for the municipal transaction business pilot, it shall also submit a resolution of the shareholders (large) or the board of directors to the shareholders (large) or board of directors to carry out the science and technology board stocks. document.

According to statistics, from March 23, 2022, Oriental Securities as the first application for participating in the science and technology board business to be obtained by the Directors' Association, and on July 21, the 17 securities firms applied for the science and technology board to do the marketing bill. The approved proposal of 8 brokerage companies has been reviewed by the shareholders' meeting.

The eight brokers who have been reviewed and approved by the shareholders' meeting are Zhejiang Business Securities, Xingye Securities, Founder Securities, Guojin Securities, Guoxin Securities, Soochow Securities, Caitong Securities, and Oriental Securities.

The remaining nine securities firms that have been approved by the board of directors include Dongxing Securities, Zhongtai Securities, China Merchants Securities, Tianfeng Securities, CITIC Securities, CITIC Jianhua, Guotai Junan, Huatai Securities and Milky Way.

According to Western Securities estimates, if the latest market value of the science and technology board is based, the pilot broker's subsequent market holding ratio will reach the prescribed upper limit (5%). It is expected that the market value of the securities firm will reach 269.5 billion yuan, accounting for the first quarter financial investment of the listed broker in the first quarter The proportion of assets is about 5.4%.

At the same time, considering factors such as vouchers and capital, Oriental Securities stated that considering that sufficient capital is required to meet the objective demand for large -scale development of the city business, if the net capital constraints are raised to 50 billion yuan, it actually meets this demand or actually meets this needs or There will be 9 brokers.

In addition, in the "Implementation Rules" released on July 15, it has also been clearly stated that encouraging qualified science and technology board stock sponsor or its parent company to provide a market business for its sponsored science and technology board stocks during the continuous supervision period.EssenceTherefore, head brokers with strong professional and capital capabilities may take the lead in getting the first batch of science and technology boards as cities to enter the market.postscript

At the beginning of the establishment of the science and technology board, the positioning of the science and technology board will be clearly positioned. It will be used as the pilot reform of the "test field" of my country's capital market and promoting a series of related system introduction and pilots. It is an important part of my country's capital market's comprehensive registration system.

Dongxing Securities believes that the science and technology board system marks the further maturity of my country's capital market system. The accumulated experience is expected to provide reference for the reform of other sectors trading systems and provide a paradigm for the comprehensive registration system of my country's capital market.As the core participants and the most direct beneficiaries of my country's capital market reform, the securities industry is expected to continue to enjoy the dividend of reform and will get greater development opportunities in the future.

Recomm

- END -

Rural Net Red 丨 Emoticon Queen Beanmei

In order to show the stories of rural characters, promote the new style of rural a...

Zhangzhou Nanjing: The word "Mountain" is done by the "Bamboo" article

In the past few days, in the production workshop of Nanjing County and Taizhu Indu...