CSI 1000ETF Subscribe for the first day of total subscription over 20 billion

Author:Cover news Time:2022.07.22

Cover Journalist Zhu Ning

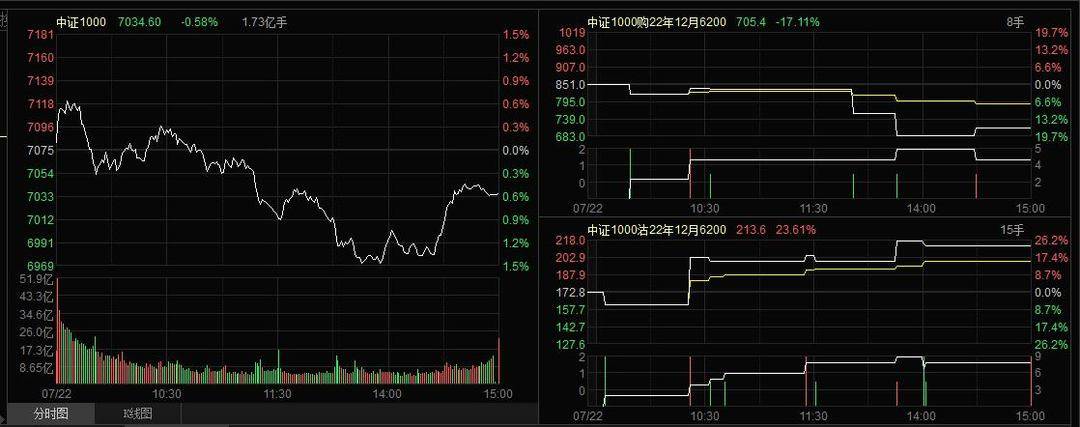

On July 22, the field of financial derivatives once again ushered in an innovative variety -the CSI 1,000 stock index futures and option transactions related contracts were officially listed. At the same time, a new batch of CSI 1000ETFs from the four -funded Fangda, Guangfa, Rich Country, and Huitianfu Fund Company was also released on the same day.

As of the close of the same day, the total scale of the 1000ETF subscription of the Wells Fund Fund reached about 7.95 billion yuan, which was close to the upper limit of 8 billion yuan.

The total subscription of more than 20 billion on the first day

According to the announcement, the upper limit of the raising scale of the above four CSI 1000ETF products is 8 billion yuan, and the raising period is from July 22 to July 26.

Data show that there are currently 36 tracking products of the CSI 1,000 index, including 3 ETFs, and in recent years, the scale of the CSI 1000 index fund has risen significantly. It is worth noting that with the approaching listing of the 1,000 -stock index futures and options of CSI, the existing CSI 1,000 index fund products have recently increased significantly.

According to Wind data, since the release of derivatives related notices on June 23, the market share of over 80 % of the Southern CSI 1000ETF has been active. As of now, the fund has obtained a net inflow of funds over 1.7 billion yuan during the year. It was a significant volume, and the increase in share over the year has almost doubled. Another Huaxia CSI 1000ETF has increased by 175%within three days.

Related information shows that as of the afternoon closing, the total scale of the 400ETF subscription of the wealthy foundation of China Corporation reached about 7.95 billion yuan, and the proportion was not triggered. The scale of 1000ETF also exceeded 5 billion yuan.

CSI 1000 Index reflects the current situation of small market value enterprises

The CSI 1000 index is composed of all A -share and eliminates the composition of the Stock Exchange 800 index. Performance.

The data shows that the medium digit of the stock market value of the CSI 1000 index is only 10.120 billion yuan, which is obviously obvious from the large mid -to -mid -plate broad -foundation index such as CSI 300 and CSI 500. From the perspective of the industry structure of the index, it is mostly concentrated in high -growth areas such as industry, raw materials, and information technology.

Statistics show that the CSI 1000 index is more focused on the new economic industry. At present, there are as many as 184 specialty new enterprises in the index, accounting for 18.4%. Whether it is absolute or relative, it is higher than the CSI 300 and CSI 500.

Judging from historical performance, as of the first half of 2022 (June 30, 2022), the cumulative yield of the CSI 1,000 index reached 599.6%, the annualized yield was 11.75%, and the annualized volatility rate was 31.31%. The yield rate is higher than the CSI 500 Index (11.24%) and the CSI 300 Index (8.95%), or it has the value of medium and long -term investment allocation. In addition, the net profit of the shareholders of the CSI 1,000 index belonging to the parent company's shareholders' net profit was righteous in mid -2020, showing a high growth in 2021.

It helps to improve the smooth operation of small and medium -cap stocks

For the significance of the introduction of 1,000 stock index options and stock index futures, reporters interviewed Zhou Maohua, Everbright Bank Financial Analyst. Management tools help enhance market operation stability, and enrichment of risk management tools will also enhance my country's capital market attraction.

At the same time, this stock index futures options are mainly small and medium -sized stocks, mainly in small and medium -cap stocks, which are generally large, and provide relevant risk management derivatives. On the one hand, it meets the needs of the market. On the other hand Run the smoothness. In addition, from the perspective of the capital market, the launch of derivatives can also help small and medium -sized market value listed companies to carry out direct financing, inject motivation for the development of the real economy, and promote the high -quality development of listed companies.

In the end, Zhou Maohua emphasized, but for ordinary investors, the professional literacy requirements of derivatives transactions are relatively high, and stock index futures options are leverage trading, which is easy to enlarge risks. Ordinary investors need to avoid speculative speculation risks as much as possible.

- END -

2022 ILC Hot Delivery -the impact of long -term albumin application on medical resources

For medical professionals for reading referenceThe medical community cooperated wi...

The cumulative investment in Chengcheng County's key transportation projects has completed a to

Weinan Daily reporter Han Le Correspondent Wei LifeiRecently, the reporter learned from Chengcheng County that this year, Chengcheng County focused on smooth flow, and proposed the goal of the year o