The results of the science and technology innovation board achieved leapfrog development in the breakthrough

Author:Securities daily Time:2022.07.22

◎ Diverse and inclusive issuance and listing conditions meet the financing needs of different types of science and technology enterprises at different types of science and technology enterprises

◎ Promote institutional innovation from many aspects such as mergers and acquisitions, reorganizations, and re -financing, and form an experience that can be replicated and promoted.

◎ More flexible equity incentive mechanisms, retaining and attracting a large number of core talents for the development of the enterprise, which is favored by enterprises

◎ The inquiry transfer system meets the demand for innovative capital exit, avoid reducing its impact on the market, and realizes the orderly "relay" of long -term investors and venture capital investors

◎ Release the stock business rules and supporting business guidelines for the science and technology board stocks to improve market liquidity, stability and pricing efficiency

Reporter Wu Xiaolu Xing Meng Meng Ke

On July 22, the science and technology board ushered in the third anniversary of the opening of the market. In the past three years, the science and technology board has gathered 437 "hard technology" companies (excluding two new companies listed on July 22), with a total market value of over 5.5 trillion yuan, serving the national innovation -driven development strategy. Over the past, the science and technology board company has high -quality and high -quality prices, and the market operation has been stable. In the past three years, a number of innovation systems of science and technology boards have been fruitful, and the results of the "test field" of the registration system reform are bright.

"The science and technology board that runs stable for three years shows the phased results of the reform of the capital market registration system." Wang Delun, chief economist of Xingzheng Asset Management, said in an interview with the Securities Daily that from the perspective of financing, a group of high -quality high -quality high -quality The rapid realization of listing and development of science and technology enterprises has contributed significantly to economic transformation and upgrading; from the perspective of investment, the number of science and technology board companies has grown at a high speed and excellent quality. The leading company in the sector has become the core asset of the entire market. The first pilot registration system has provided valuable experience for promoting the reform of the entire market registration system.

Registration System "Test Field" high -efficiency service science and technology enterprise

Purchase and move. The science and technology board is based on serving the "hard technology" enterprise, implemented the registration system with information disclosure as the core, and tailored to science and technology enterprises to customize listing, issuance pricing, mergers and acquisitions, reorganization, re -financing, and equity incentives. "Growth provides fertile soil.

In the past three years, the science and technology board has run these systems from theoretical to practice, summarizes experience and continuously improved in practice, forming an institutional system with a higher concentration with China's new economic development characteristics. road.

The diverse and inclusive issuance conditions meet the financing needs of science and technology enterprises of different types of science and technology enterprises at different types of science and technology enterprises. According to data from the Shanghai Stock Exchange, as of July 21, the science and technology board has accepted a total of 818 single IPO project applications, and the registration is 457. The 437 companies were listed, with a total IPO fundraising of more than 630 billion yuan, with an average of 1.456 billion yuan per fundraising (excluding the Code of Ceremony of the Beijing Stock Exchange to the listed company), of which 4 fundraising exceeded 10 billion yuan.

From the perspective of listed enterprises, 39 unburrelated enterprises (9 have been picked U), 8 special equity architecture companies, 5 red -chip companies, and 16 fifth standard enterprises (with repeated calculations). In addition, it also includes the first Bei Stock Exchange to the board to the board (May 25, 2022) -ganning Code Defense.

"Open and inclusive issuance and listing conditions and transparent and efficient review arrangements with information disclosure as the core, which continues to introduce a large number of high -quality science and technology innovation enterprises for science and technology boards, forming a clear agglomeration effect, and then better serve the high -quality development of the real economy. . "Zhu Jiandi, chief partner of Lixin Accounting Firm, said in an interview with the Securities Daily reporter.

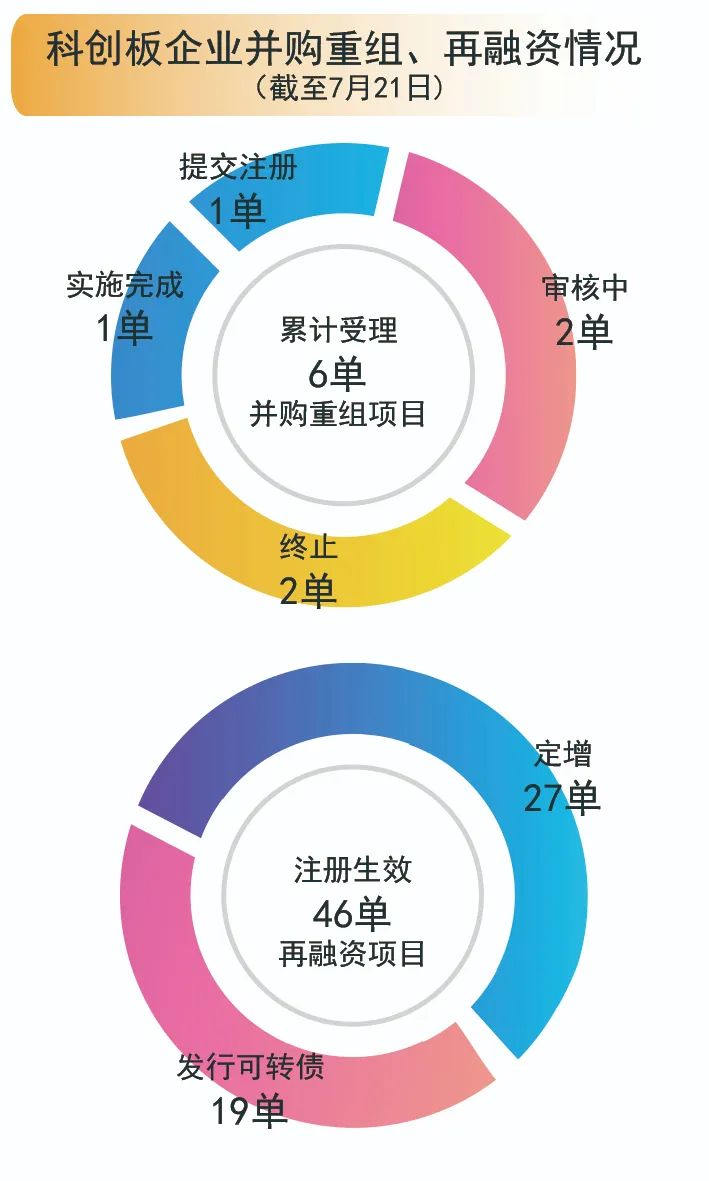

The innovation operation of mergers and acquisitions, reorganization, re -financing, and equity incentives has stable operations and good results, forming experience that can be replicated and promoted. As of July 21, the science and technology board has accepted a total of 6 mergers and acquisitions and reorganization projects. Huaxing Yuanchuang has been implemented. Wald has submitted the registration on July 11. In addition, 2 orders are terminated, and 2 orders are in the audit. Single refinancing project, 46 single registrations take effect, 27 orders are fixed increase, and 19 orders are issued convertible bonds.

The flexible and diverse equity incentive mechanism of the science and technology board is favored by enterprises. As of the end of June this year, a total of 242 science and innovation companies have launched a 310 single -equity incentive plan, accounting for 56%of the total number of science and innovation board companies, mainly concentrated in the new generation of information technology (especially integrated circuits), biomedicine and high -end equipment fields. Essence More than 90%of the company chose the second type of restricted stock as an incentive tool, with an average discount of 46%, and the awarded shares accounted for an average of 1.84%of the total share capital.

In addition, the role of the intermediary agency under the registration system is becoming more prominent. Since the reform of the registered system of self -employment board, the regulatory authorities have released a number of rules one after another, and put forward key tasks from the three dimensions of supervision, institutions, and markets to further urge intermediary agencies to return their due diligence.

According to Wind information data statistics, as of July 21, 59 securities firms participated in the science and technology board IPO project sponsors, of which five brokerage sponsors had more than 40 orders.

"The design of the science and technology board system has changed the role of intermediary agencies, and the liability of pre -investment, middle, and post -investment and the growth of the science and technology board company will help solve the overpassed packaging before the listing of the enterprise and the old illness after the listing of the market. Multi -recurrence and other issues, carry out the care of the enterprise throughout the life cycle, and then improve the corporate 'votual "." Wei Fengchun, chief economist of Chuangjinhexin Fund.

According to the reporter's understanding, the Shanghai Stock Exchange is actively exploring a set of "full -process, full -link" sponsorship quality evaluation system, and evaluating content covers counseling acceptance, issuance and listing review, continuous supervision and other project sponsor full chain cycles. The "growth" situation comprehensively reflects the quality of the sponsor's practice, prize and punishment, and promotes the formation of a good market ecology. Generally speaking, in the past three years, the science and technology board has adhered to the original intention of the plate positioning and construction, improved the system rules and systems, strengthened the market -oriented restraint mechanism, and achieved phased results in reform, which met expectations. Base.

R & D investment exceeding 230 billion yuan "hard technology" background color show

"With the help of the science and technology board, the company has initially completed the strategic layout at home and abroad through its own development, external mergers and acquisitions, etc., and take the lead in achieving large -scale sales of 300mm large silicon wafers in China." For the reporter of the Securities Daily, thanks to the empowerment of capital, the company broke through the key core technology and broke through the situation where the domesticization rate of 300mm semiconductor silicon wafers was almost zero and promoted the process of "autonomous controlling" of key semiconductor materials production technology in my country. Essence

The case of Shanghai Silicon Industry is a microcosm of the innovation and development of science and technology board supporting enterprises.

In the past three years, the science and technology board has absorbed a group of "hard technology" enterprises in the field of "card neck" technology, as well as benchmarking enterprises with key core technologies, so that a group of enterprises still at the stage of high R & D investment can use their capital forces to use capital forces. Increase investment in scientific research and enhance corporate innovation capabilities.

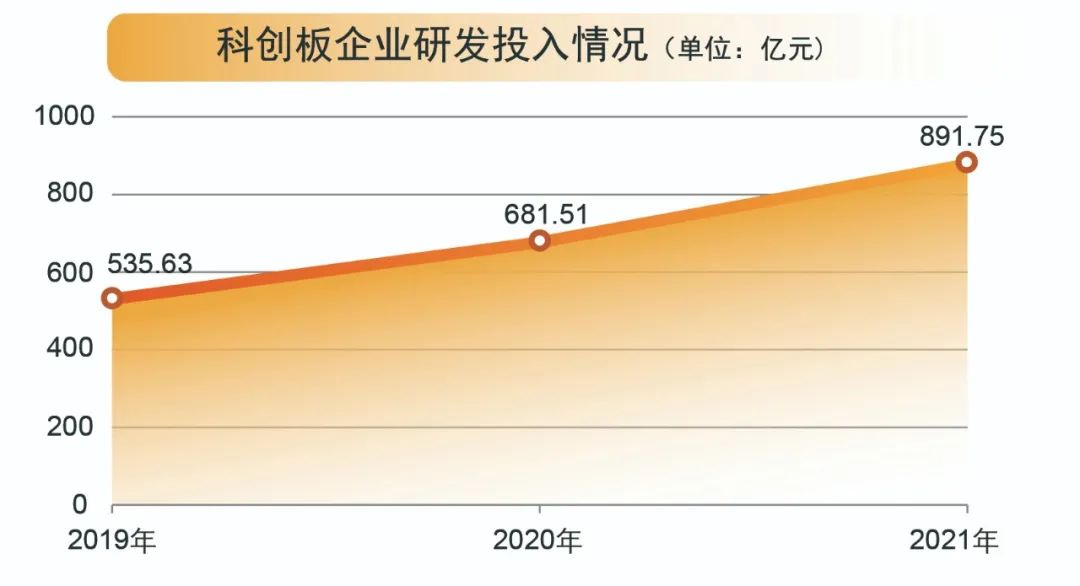

According to the Flush iFind data, as of July 21, the investment in the research and development of science and technology board enterprises increased year by year. The total investment in R & D in 2019, 2020, and 2021 was 53.563 billion yuan, 68.151 billion yuan, and 89.175 billion yuan, respectively. In the first quarter of this year, 437 companies invested a total of 21.388 billion yuan. The total investment in R & D is over 230 billion yuan.

In addition, the number of patents is also a major sign of science and technology. According to the Flush iFind data, as of July 21, the statistical caliber was calculated by the company that a total of 8,7663 patents were obtained by the company's 437 science and innovation boards, with an average of 204 per company; The company reaches 155 pieces.

The science and technology board has become a gathering place for high -tech enterprises and strategic emerging enterprises, and the industrial agglomeration effect is significant. As of July 21, there were 62 companies in the field of science and technology board integration circuit, accounting for the "half of the country" of similar listed companies in A shares; 93 biomedical industry companies, becoming the mainstream listing of companies in the field of biomedicine; 99 high -end equipment manufacturing industries The industrial chain of photovoltaic, power batteries, industrial robots and other industrial chains have begun to take shape.

"The establishment of the science and technology board has strengthened the promotion of the financial market in the transformation and upgrading of the real economy. The development of high -tech industries has accelerated and accelerated, and more and more science and technology enterprises with competitive and compliance with listing conditions have been given." Chief of Chuancai Securities In an interview with the Economist and Director of the Institute, Chen Li said in an interview with the Securities Daily that the science and technology board guided funds to concentrate on the high -tech field, providing further cutting -edge enterprises with strong research and development capabilities and strong growth, providing further corporate companies Financing support meets the development needs of science and technology enterprises, provides support for the development of new technologies in enterprises, and provides a support for the problems of the "card neck" field in the country. It has strengthened the financial support of the real economy and promoted the improvement of my country's multi -level capital market system.

Li Qiosuo, managing director of the Research Department of CICC Corporation, told a reporter from the Securities Daily that the science and technology board has become a gathering place for Chinese science and technology leading enterprises. Progressive technological innovation companies, the characteristics of high -growth, high R & D investment, and high net interest rates of the main listed companies are significant, and match the inherent requirements of long -term value investment.

In addition to the "hard technology" label, science and technology board companies also show high growth. From 2019 to 2021, the compound growth rate of the operating income of the Science and Technology Board Company was 28%, and the compound growth rate of the net profit of the mother was 70%. As of July 21, 42 science and innovation board companies have released the semi -annual performance forecast of 2022, of which 29 companies have pre -honored performance, accounting for nearly 70 %.

Li Wei said, "The IPO raised funds have become the combustion agent of the company's development. The company's continuous investment in research and development has brought about continuous breakthroughs in technical processes such as staged, cutting throwing, extension, and SOI. Development brings greater potential and space. "

Tian Lihui, dean of the Institute of Financial Development of Nankai University, told reporters of the Securities Daily that in the context of continuous deepening reform of the capital market, the science and technology board should continue to play a good role in the "test field" and further optimize and improve institutional construction, further improve further improvement The support for "hard technology" enterprises has continued to promote the high -quality development of the science and technology board market.

Reform has not been poverty -stricken to innovate

In the past three years of the opening of the science and technology board, it has been seeking new, new, and breakthroughs in the new China, and a breakthrough in the development.

"As the first pilot of my country's registration system reform, the science and technology board has achieved major breakthrough achievements in the past three years." Gui Haoming, the chief market expert of Shen Wanhongyuan, told the Securities Daily that it is mainly reflected in three aspects: one is diversified The listing conditions have improved the tolerance of the sector; the second is the continuous and perfect distribution pricing mechanism to improve the market -oriented level of the sector; the third is to use information disclosure as the core to give the selection right to the market, which improves the vitality and market risk tolerance. Since its establishment, the science and technology board has adhered to the positioning of the sector, and has established a new stock inquiry, pricing, and distribution mechanism with institutional investors as the main body, creating inquiry transfer systems, landing as a city business system, and accelerating the formation and effective circulation of innovative capital.

Since the optimization of the new shares in the new shares of the Science and Technology Board in September 2021, the early stage of the "holding price" problem of "holding the price" has basically been solved, and the price efficiency of new shares has rebounded significantly. Dong Zhongyun, chief economist of AVIC Securities, told reporters of the Securities Daily that the new inquiry regulations need to delay the issuance of issuance by improving the proportion of high prices and dismissing the price to break through the "four minimum low value" , Promote the balanced game of both parties to buy and seller, curb the acting of prices, and promote the price of issuance to be more marketable.

The first inquiry transfer system for the science and technology board, meet the demand for innovative capital withdrawal, avoid reducing the impact market, the minimum transfer price can be hit by 50 %, and the orderly "relay" of long -term investors and venture capitalists. As of the end of June, there were 24 shares of the Science and Technology Board of 24 companies that reduced their holdings and deposit certificates through inquiry transfer. The average ratio of the total share capital is 2%. The average inquiry base price is 85%of the average price of the first 20 trading days, with a total turnover of 13.2 billion yuan, which better meets the demand for the withdrawal of innovative capital.

It is worth mentioning that, on the eve of the third anniversary of the opening of the science and technology board, the Shanghai Stock Exchange issued the science and technology board stock as the market trading business rules and supporting business guidelines, and made more specific and detailed transactions and regulatory arrangements for the market transaction business. In mid -May of this year, the CSRC officially issued the "Regulations on the Pilot of the Stocks of the Securities Company's Science and Technology Innovation Board as the Municipal Transaction Business", which provisions on the conditions and procedures of the municipal business standards and procedures, and after the supervision of the event.

"On the third anniversary of the opening of the science and technology board, the market business system creates liquidity through continuous bilateral offer, stimulates market vitality, and promotes the high -quality development of science and technology boards." Dong Zhongyun said.

On July 22, the first batch of 25 listed companies of the Science and Technology Board of Science and Technology Board lifted the original shareholders' limited sales of the shares. As of July 21, 11 company controlling shareholders, actual controllers, and major shareholders announced their voluntary extension of the lock -up period or promised not to reduce their holdings. The corresponding market value reached 85 billion yuan, accounting for the first batch of 25 companies on July 22. More than 40 %.

"The flexible transaction arrangement and inquiry transfer system helps better meet the differentiated trading needs of different investors. Price efficiency. "Zhu Jiandi said.

"Through a series of institutional innovation, the science and technology board opened in the past three years, providing financing support for scientific and technological innovation enterprises, laying a good foundation for the comprehensive implementation of the registration system, and helping my country's economic transformation and high -quality development." Dong Zhongyun said.

Reform has not been poor. Talking about how the science and technology board adheres to the innovation background and deepen market reform, Zhu Jiandi believes that in terms of institutional innovation, the science and technology board can consider continuing to optimize the listing standards and review arrangements, enhance the flexibility of re -financing arrangements, and further enhance the science and technology innovation board Appeal. In terms of product innovation, the science and technology board can consider further strengthening cooperation with all parties of the market, and promote the innovation of ETF product, including the supply of financial products such as scientific and technological innovation, ESG green dual carbon.

Gui Haoming believes that the science and technology board needs to give full play to the decisive role of the market in the allocation of resource allocation, check the entrances and exit, and attract more eligible high -quality companies to listed financing. At the same time, it should also promote inferior enterprises The good market ecology of "there is a way to go and can go out and go out".

In the three -year journey, the science and technology board will be sailled again, raising the sails of innovation, consolidating the foundation foundation, enriching the supply of products, attracting more science and technology enterprises, and forming a strong joint force to promote the development of scientific and technological innovation.

Looking forward to the future, the "experimental field" function of the science and technology board will continue to play, and continue to write a new chapter in the reform and innovation and development of the domestic capital market.

- END -

Fujian Provincial Hydrological Water Resources Survey Center issued a blue warning of mountain flood

The Fujian Provincial Hydrological and Water Resources Survey Center issued the risk of mountain flood disasters in the blue warning of the flood disaster risk on June 09, 2022: According to the forec

Actress husband died by thunder!On the beach

According to the US Broadcasting Corporation on the 7th,July 3, local time,America...