How to grow steadily?The infrastructure "picks the beam" again

Author:China News Weekly Time:2022.07.22

The current steady growth policy ideas are clear

That is, expand effective investment

After China's economic data was released in the first half of the year, the growth of infrastructure investment data met the expectations of the outside world.

From January to June, the cumulative year -on -year growth rate of infrastructure construction (full -caliber) was 9.3 %. In a single month, in June, infrastructure investment (full -caliber) increased by 12 % year -on -year, an increase of 4.1 percentage points from 7.9 % in May, a significant increase in growth.

At present, the policy of steady growth is clear, that is, expanding effective investment. The executive meeting of the State Council held on June 2nd deployed a policy bank of 800 billion yuan in policy banks to support the growth rate of infrastructure investment; the State Association held on June 29th that the issuance of financial bonds will raise 300 billion yuan, which will play a performance, which will play a place to play a performance. Increasing investment and lever, theoretically, it can leverage 1.5 trillion yuan of investment.

Some analysts believe that to ensure that the economic growth goal of about 5.5 % this year should be achieved, the growth rate of infrastructure investment needs to reach twice the level of this growth rate. It is generally believed that as the epidemic prevention and control situation improves and the project enters the actual stage of construction, the growth rate of infrastructure investment in the second half of the year will still rise.

On May 25, the construction staff of Anhui Power Transfer Engineering Co., Ltd. operated at the construction site in the Yangtze River. Picture/Xinhua

In this round of infrastructure investment, local governments also need to make more balances in short -term and long -term benefits, broader social benefits and more direct economic benefits, maximize leverage private investment, and avoid the last round Government debt issues. Some economists lamented that when China began to build a highway in the 1990s, it was difficult to understand the outside world. Later, I realized that the significance of that round of infrastructure investment in attracting the industry. "Now it is necessary to find it like the highway project of the year. Investment in the same infrastructure project. "

Under the requirements of moderately advanced construction, China is ushered in another round of strong infrastructure investment cycle.

How to transform debt speed into project speed?

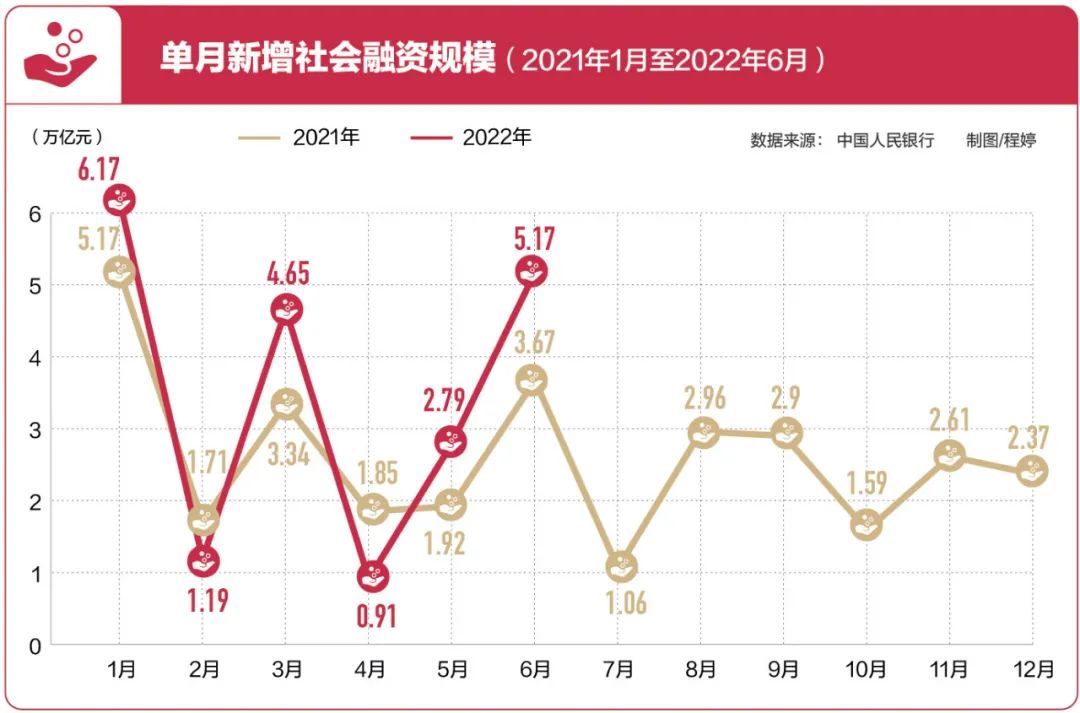

The rapid issuance of special debt issuance in 2022 shows the urgency of infrastructure investment.

Special bonds, that is, local government special bonds, some scholars in the field of fiscal told reporters that because they are not included in the fiscal deficit, in recent years, they have gradually become the main source of investment in infrastructure investment. The annual issuance amount has been issued by more than 3 trillion yuan each year since 2020.

This year, the central government arranged a new special debt scale of 3.65 trillion yuan, which was basically the same as last year, but coupled with 1.2 trillion yuan in last year, it means that the special bond available funds reached 4.85 trillion yuan. More importantly, the pace of issuance is obviously advanced. The State Council's 33 stable economy policies and measures issued by the State Council requested that the new special debt in 2022 must be basically issued before the end of June, and strive to use it basically before the end of August.

"This year's new special debt has been issued in the first half of the year." Wen Laicheng, Executive Director of the Executive Director of the Institute of Finance and Financial Investment and Financing of Zhongcai-China Cover, told China News Weekly. Compared with last year, special bonds were issued faster. The role of promoting infrastructure investment is relatively obvious.

The construction machinery industry is also regarded as the "barometer" of infrastructure investment. "The industry in short supply in 2009 is abound. It is subject to production capacity. The construction party often needs to contact several suppliers to buy a tower crane. Lu Ying, deputy secretary -general of the China Construction Machinery Industry Association, still remembers the hot scene of the industry in 2009. The industry leading enterprises have entered the expansion cycle for a time. The number of workers in Sany Heavy Employees rose from 22,000 in 2009 to 52,000 in 2011.

"In the first half of this year, the sales volume of major engineering machinery products did decrease significantly, with a decrease of 100,000 units in half a year. The overall situation in January and February was acceptable. The monthly and June rise, especially in June, improved, but it is difficult to complete the reversal in one month. "Lu Ying told China News Weekly that this was a bit gapd from the progress of infrastructure investment perception.

He explained that some of the reasons are that the actual work of many projects has not been fully launched, and it needs to be prepared in the early stage, rather than starting the work immediately after the funds are in place. The actual start is half. "

Wen Laicheng introduced that the results of the audit previously showed that the special debt funds were relatively prominent, and the idle time may exceed one year. "The main reason is that the quality of some storage projects is not high. For example, some projects have not been able to complete the approval in advance, resulting in difficulty starting after the funds are in place, causing delay. There are many departments participating in the approval of infrastructure projects. For example, there are more than a dozen departments participating in the approval. "

"The situation in the second half of the year must be better than the first half of the year." Although it is more optimistic about the situation in the second half of the year, Lu Ying has remained cautious about the stimulus of the new round of infrastructure to the construction machinery industry. "Today, the total scale of construction is higher, and the effect of 10 trillion yuan in incremental funds to the surrounding industries may not be so obvious.

Another problem is to invest. Some traditional infrastructure projects are considered saturated. Where is the new round of infrastructure?

"Infrastructure direction can be divided into ideal orientation and reality." Qiao Baoyun, Dean of the Public Finance and Policy Research Institute of the Central University of Finance and Economics, believes that infrastructure investment in infrastructure that meets the high -quality development goals and helps to achieve industrial transformation and upgrading is naturally ideal. Infrastructure investment is given priority to the ability to drive employment. "If an infrastructure project belongs to the ideal direction, it is difficult to create more employment and income in the short term. It may have a limited effect on the" stable economy ", which is equivalent to taking medicine for patients to treat diseases. Invoicing and reality. "On June 14, Zhengji High -speed Railway Puyang to the provincial bonus section prefabricated bridge pier prefabricated field. Picture/Xinhua

"In short, infrastructure projects need to be able to solve employment problems immediately. Workers can only consume after getting wages, and play their role in promoting the positive operation of the economy. This means that even if some infrastructure projects have poor economic benefits and even economic benefits. It is also necessary to invest. "Qiao Baoyun said that some ideal investment projects may require more fund purchase equipment, and it is difficult to achieve more employment immediately. Local governments will not give priority to such infrastructure projects.

"Infrastructure investment is currently discussing the relationship between traditional infrastructure and new infrastructure. From the perspective of funding, traditional infrastructure projects occupy the majority." Wen Laicheng told China News Weekly that traditional infrastructure has been saturated and not accurate. As a developing country, the per capita possession of infrastructure is still a large gap compared to developed countries, which means that there is still room for traditional infrastructure.

According to Zhang Bin, deputy director of the Institute of World Economics and Political Sciences of the Academy of Social Sciences, in the past five years, China's infrastructure investment scale hovers at 17 trillion to 18 trillion yuan, divided into three categories: the maximum volume is in water conservancy, environment, and public The facility management industry, the scale of 8 trillion to 9 trillion yuan; followed by transportation, transportation, warehousing, and postal industry, including "iron public machines", the scale is 6 trillion to 7 trillion yuan; the third is "electric heating water gas ", Scale 2 trillion to 3 trillion yuan.

Scholars in the aforementioned fiscal field said that the construction of the corridor and urban renewal are easily thought of. "This kind of investment is a real choice. Most of them are civil engineering projects. They do not need to have specific technologies to quickly attract employment."

In June, the State Council issued the "Implementation Plan for the Renewable Update and Transformation of Urban Gas Pipelines (2022-2025)", which requires updating the aging of urban gas, water supply, drainage, and heating pipelines. It is clear that by the end of 2025, the gas pipeline network of about 100,000 kilometers is to be transformed. From the perspective of short -term goals, the Ministry of Housing and Construction stated that before the end of June this year, the census and evaluation of the city combustion pipeline will be completed. Before the end of the year, we will strive to start the transformation of about 20,000 kilometers and complete the investment of 50 billion yuan.

Some officials of the Urban Municipal Management Department explained to reporters that the state's currently proposed that the gas pipe network transformation also has a practical demand for safety. Some cast iron pipelines are easily leaked when they are rusted, causing accidents. Obviously, the existing actual needs such as the gas pipe network transformation, and the infrastructure project that can also form a physical workload in the short term has become the focus of this round of infrastructure investment, and it is not easy for such projects to quickly obtain economic benefits.

On May 7, in the digital command hall of the smart city in Yongchuan District, Chongqing, staff used the comprehensive ecological and environmental smart supervision platform for monitoring and analysis. Picture/Xinhua

Social benefits and economic benefits

The executive meeting of the State Council held on June 15 specifically mentioned that the underground comprehensive pipe gallery is the city's "Lizi" project, with great investment potential and strong driving ability. The eleventh meeting of the Central Finance and Economics Committee held before has clarified the five major infrastructure key areas, including "urban infrastructure and other urban infrastructure such as underground pipe galleries."

Underground comprehensive pipe galleries refer to public tunnels that are used in municipal pipelines such as electricity, communication, radio and television, water supply, drainage, heat, gas, gas and other municipal pipelines in urban underground.

"One of the important reasons for the construction of the central push push corridor may be that it has a large investment volume, which has a driving effect on upstream and downstream industries such as construction, materials, informatization and monitoring equipment. It is said that the construction cycle of two to three years can solve some employment problems at least. "Xiao Yousong, Director of the Municipal Division of the Suzhou City Administration, told China News Weekly. On the contrary, the large investment volume is also the biggest problem facing the construction of the current corridor.

In 2015, the State Council promoted the pilot construction of the comprehensive pipe corridor nationwide. Suzhou was one of the first 10 pilot cities, and the construction tasks of pilot projects were completed by the end of 2017. Driven by the construction demonstration of pilot projects, since 2017, in the construction of new cities such as Taihu New Town and Industrial Park Headquarters Base in Wuzhong District, and the construction of underground comprehensive pipe galleries combined with some road renovation projects.

When participating in the pilot in 2015, Suzhou had prepared a special plan for underground comprehensive pipe galleries, with a planning length of about 87 kilometers. Up to now, Suzhou has been built more than 41 kilometers, and more than 18 kilometers under construction. "The special plan for preparation at the time was an ideal state." Xiao Yousong said frankly.

The actual construction of the kilometers is less than the planning of 2015, and economic benefits are important constraints.

"Underground comprehensive pipe corridors are more in combination with the development of new city." Xiao Yousong told reporters that if only 1 kilometer pipe gallery is built, the benefits are relatively limited. The pipe gallery is also divided into different levels of main corridors and support corridors. The supporting corridor is connected to specific users. If all can be buried underground, there will be a better scale effect in construction and subsequent operations. Therefore, in the construction process, it will tend to have the preliminary network conditions. Even if the new city is still in the process of development, the pipe gallery will be built first, and the follow -up access will be more convenient. On May 25, the construction site of the bridge system of the Tongziyuan Double Bridge of the Gui South High -speed Railway Bridge. Picture/Xinhua

According to the investment estimate set by the Ministry of Construction, the construction cost per kilometer construction cost is 50 million yuan to 170 million yuan, while Suzhou has built and in the construction pipe gallery, with a cost of 80 million to 120 million yuan per kilometer. Xiao Yousong told reporters that when preparing a special plan in 2015, the corridor of more than 80 kilometers was costly calculated by more than 100 million yuan per kilometer. "At present, the total investment exceeds 6 billion yuan, and the city has an average annual investment of 89 billion yuan."

Compared with investment, the pipe gallery is difficult to bring direct economic benefits. "If you simply invest and produce the project, the pipe gallery project must not be eased." Xiao Yousong told reporters that the construction of the pipe gallery considers its public attributes. "After some pipelines enter the corridor, it will release land resources. For example, 110,000 thousand. Voltage, 220 kV high -voltage power lines need to set up a high -voltage tower, pass through the area, and even the land within a certain range of surroundings cannot be developed. The benefits brought by the release of land resources, improving urban landscapes, saving subsequent pipeline maintenance costs may be difficult to direct directly Quantitative. "

At present, the gallery projects in Shanghai, Xiamen and other places in China generally adopt a full government investment, and then collect the pipeline unit of the pipeline of the corridor, but this model is difficult to alleviate the government's financial pressure.

Suzhou Urban Underground Comprehensive Pipe Corridor Development Co., Ltd. (hereinafter referred to as "Suzhou Pipe Corridor Company") was established in 2015. It is led by the municipal urban investment company. The right to operate, Suzhou Pipe Corridor is mainly responsible for the investment and financing construction and subsequent operation management of these corridors.

"As a platform, the Suzhou Pipe Corridor can financing and absorbing shareholders' investment. After the construction of the pipe corridor, 75 % of the total cost will be subsidized by fiscal, and 25 % of the corridor will collect the corridor and the operation and maintenance fee." Xiao Yousongsong Frankly, the pioneer entry fee of the Suzhou urban pipeline corridor is calculated at 25 % of the construction cost of 80 million yuan to 120 million yuan per kilometer. The fee is 400,000 to 800,000 yuan per kilometer per year, and the entrance fee and operation and maintenance fee are jointly borne by the entrance pipeline unit. "The pipeline corridor operated by the Suzhou Pipe Corridor is 30 % to 40 % of the revenue and maintenance fee, which is relatively high. The willingness to enter the corridor is not high, but the pipe gallery cannot be vacant after completion. Therefore, some galleries simply invite pipeline units to enter the corridor for free. "

In the case of subsequent stable cash flow, the government obviously wants to slow down the pressure brought by the financial investment at one time.

The aforementioned pipe corridor construction company said to reporters for example that there are some high -voltage power lines distributed in Taihu Lake in Wuzhong District, Suzhou City. When building the pipe corridor, it issued a bond financing of about 1.5 billion yuan through local state -owned companies.

He believes that it is difficult to attract private investment such as a pipe gallery project that is difficult to generate stable cash flow. More trades are traded by state -owned enterprises, and then the government finance is paid to the government. To ease the government's financial pressure.

The aforementioned pipe corridor construction company admitted to reporters that some coastal cities have felt the pressure brought by the construction of the pipe gallery, but the cost settlement of each aspect is relatively stable.

How to leverage incremental funds

Xiao Yousong said that due to the public product attributes of the integrated pipe gallery, it is recommended to guide the mid -level level and give certain financial support. In the pilot opened in 2015, Suzhou received a reward of about 900 million yuan. "But there was no new award -to -fund arrangement afterwards."

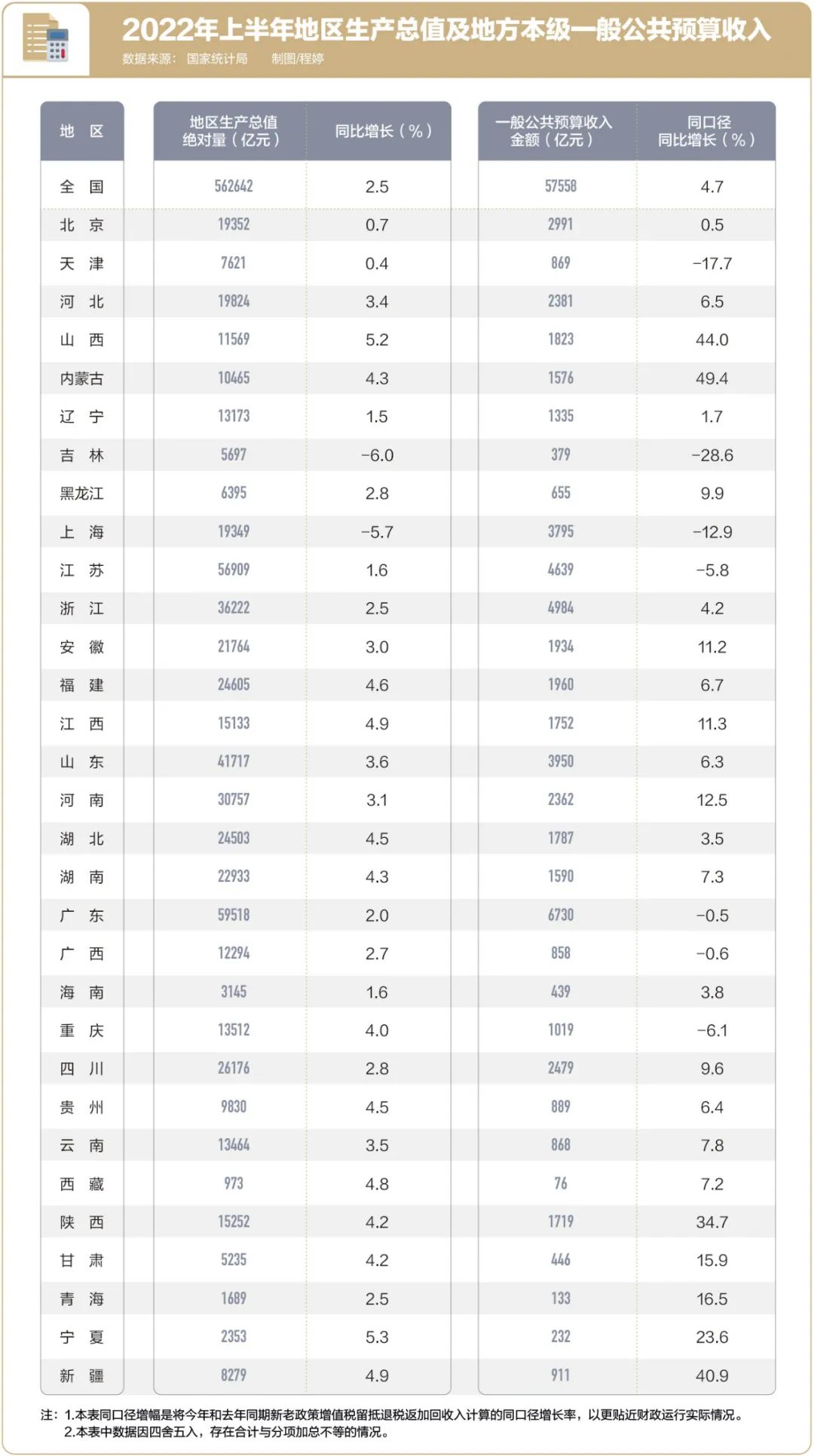

The question from where money comes from is first from the financial difficulties facing the current local government. The land auction market is sluggish, and the land transfer income of local governments has begun to decline sharply. In the first five months of 2022, the total transfer income of state -owned land use rights was 1.86 trillion yuan, a year -on -year decrease of nearly 30 %. In the context of the economic downturn pressure this year, some places in the first half of 2022 even a double -digit decline in public budget revenue.

Another factor comes from strict control of hidden debt. According to the statistics of economist Li Xunlei, although infrastructure investment is led by the government, from the perspective of the source of funds over the years, the proportion of parts other than fiscal funds is more than 70 %, which is mainly related to the platform or project company investment and financing activities.

"Governments at all levels can retain a small amount of investment and financing platforms as policy tools. The source of funds for government infrastructure investment should be bonds, especially special bonds." Wen Laicheng said.

However, there are certain restrictions on the use of special debt. Hebei, Hunan, Hainan, Chongqing, Qinghai and other provinces have pointed out in this year's budget report that the project reserves are insufficient and the preliminary preparations are not sufficient, resulting in insufficient budget implementation progress, and there is a phenomenon of "money and other projects". For example, Qinghai bluntly stated that there are fewer projects that meet the requirements of special bond financing and earnings.

At the end of 2021, the Ministry of Finance also stated that a problem that has been plagued in the past two years is that the project reserves are insufficient or the reserves are not in place, which is the key to transforming investment demand into effective demand. Wen Laicheng said that the infrastructure project invested by the government may be public welfare. With the increase of the issuance of the special debt, finding a project that meets the income requirements has become a difficult problem. More than 70,000 projects were reserved in two batches, and the reserves were ample.

Feng Na, a senior researcher at the Government Investment and Financing Research Center of China Construction Political Research Group, told China News Weekly that the support of special debt funds in agriculture, forestry and water conservancy and social undertakings should be innovative. At present, project income in rural water conservancy and social undertakings is relatively low and it is difficult to achieve coverage. However, it is also a project that protects people's livelihood in the current economic environment. It is recommended that the income of land funds outside the scope of projects is recommended to balance.

"In order to cope with economic fluctuations, the government increases investment. There are two sources. One is from the financial government's finance, such as government bonds, and the other is local government bonds. It is expected that some special bonds of 2023 will be issued in the second half of the year. Possibilities. "Qiao Baoyun said that special bonds are fiscal instruments in normal times and invest in projects that can produce profitable in the future, rather than fiscal instruments that specifically respond to economic fluctuations. Compared with, national debt can be used to cope with economic fluctuations more directly. "After the central government issued government bonds, the transfer payment can be solved by the realistic problems facing local governments, such as the salary of civil servants."

Since the second quarter of this year, the sound of issuance of government bonds has always existed, but the central government has always maintained cautiously, but has more choosing financial methods to replenish increment.

After the Executive Meeting of the State Council on June 1, 2022, the State Council clearly increased the credit quota of 800 billion yuan and supported infrastructure construction at the end of June. Major projects, including new infrastructure, or bridge the capital of special debt projects.

According to the central bank's introduction on July 1, the 300 billion yuan mainly invested in three types of projects: First, the five major infrastructure key areas of the 11th meeting of the Central Finance and Economics Committee, including network infrastructure such as transportation and water conservancy energy, information technology logistics, etc. Industrial upgrading infrastructure, underground pipe corridors and other urban infrastructure, high -standard farmland infrastructure, national security infrastructure, national security infrastructure; second, major scientific and technological innovation and other fields; third, other projects that can invest in special bonds of local governments.

On June 29, the reservoir of Changlong Mountain pumping power station in Anji County, Huzhou City, Zhejiang. Picture/Xinhua

"In China, financial means, such as issuing loans through policy banks, to a certain extent with financial means such as issuance of government bonds, in this case, they may not seek re -issuing government bonds through the National People's Congress." Qiao Baoyun explained that the two methods may bring the same capital increase, but the government bonds can solve the problem or solve the problem, and can be clearly clarified to specific projects and regions as needed. consider.

How is new infrastructure more?

Although the new infrastructure and traditional infrastructure are still different in the investment amount, the new infrastructure is undoubtedly an area where this round of infrastructure investment is worthy of attention.

Some infrastructure investment areas have combined new infrastructure and traditional infrastructure, such as urban renewal also contain investment in the field of smart cities.

"It is obvious that there are more and more smart city projects in recent years. At the beginning, it is concentrated in the coast, or the economy is relatively developed. Zhang Guozhen, vice president of Tang Technology, told China News Weekly that the current problem is specific direction and how to form efficient returns, and is still exploring how to combine it with urban infrastructure construction.

Zhang Guozhen believes that, like some "iron public machines" projects, the benefits of smart cities are difficult to measure simply by economic returns. Some smart city projects may make residents' lives more convenient, but some projects play a subtle role. Serving decision management, residents may not be able to feel intuitive immediately. "For example, the transportation sector of smart cities, the traffic management center of many cities can mobilize the city's traffic resources. Through the smart management system, it can effectively prevent further deterioration with the increase in traffic."

"Intelligent construction is inseparable from the existing software and hardware infrastructure of the city, especially the foundation of informatization. For example, data needs to be pulled, which depends on the establishment and interconnection of public databases. The obstacles have been eliminated, and the central and western regions are also getting better. Based on this, the artificial intelligence algorithm can mine the value in the data, and at the same time, Shang Tang can also empower these intelligent capabilities to the specific lines, such as transportation, education, emergency, etc. , Meet the needs of urban management. "Zhang Guozhen told reporters that the current investment and financing model of smart city projects is not significantly different from some traditional infrastructure projects. Some platform companies may have been engaged in civil construction in the past, and now they also participate in smart city capacity building. After the construction is completed, the government can buy services. At the same time, the platform company can also output these capabilities to other economic entities to bring some commercial opportunities.

Unlike some smart city projects that improve government governance capabilities, some other new infrastructure projects are difficult to decide by the government. Instead, it is more dominated by enterprises. In the absence of private investment, this is also the resistance of new infrastructure to make greater contributions. On March 16th, inspection robots conducted technical debugging in the underground comprehensive pipe corridor in the Tianjin Dongdao Road, comprehensive pipe gallery and affiliated engineering PPP projects undertaken by Tianjin. Photography/Magazine reporter Wu Yu

"In the past two years, private investment in PPP projects is not active. At present, private investment occupies only about 30 % of PPP project investment. One of the important reasons for the weak enthusiasm of private investment is that the maximum period of the PPP project is 30 years, but the current National Development and Reform Commission and the China Development and Reform Commission and The Ministry of Finance's departmental rules and regulations. "Wen Laicheng said that this year's PPP project has begun to recover, but it is difficult to contribute to driving this round of infrastructure investment. There are only dozens of new projects per month in the first half of the year. Essence

Improvement depends on the establishment of specific business models. China Reserve National Energy (Beijing) Technology Co., Ltd. (hereinafter referred to as "China Reserve National Energy") CEO discipline has clearly felt that the willingness of banks to loans to new energy storage projects has increased recently. The orientation has been clear. "

In the energy storage market, the technology of pumping storage power stations is mature, occupying the largest market share, and new energy storage technologies such as air, flywheel, and electrochemical chemistry have developed rapidly. As of the end of 2021, the domestic market proportion of pumping storage had fallen below 90 % for the first time.

In December last year, the 100 -MW advanced compressed air storage power station in Zhangjiakou was connected to the grid. China Reserve State Energy is the equipment provider of the project. Discipline told "China News Weekly" that compressed air storage is a long -term large -scale energy storage technology. The characteristics of the project are the larger the scale of the single -machine equipment, the lower the unit cost and the higher the efficiency. Large, it belongs to a typical heavy asset project, but the cost of unit capacity is low. The 100 -meter system is 1,000 yuan to 1200 yuan/kWh, which is basically equivalent to the cost of mature pump storage power stations.

"Zhangjiakou project belongs to the first set of systems. The core equipment is independent research and development. The first set of equipment needs to be opened to bring additional costs when processing. The system cost reaches about 700 million yuan. The investment amount is 500 million to 700 million yuan. "Disciplinary said that the return on the return on the energy storage power station of the air is about 5 to 15 years, but the life expectancy of the power plant can reach more than 30 years. The income is still higher.

Discipline said that one of the important problems facing new energy storage is that the new energy storage power price policy is not completely clear. "Pickled water storage power stations are relatively smooth at bank loans during the construction period, mainly because the state's electrical price policy for pumping energy storage power stations is clear, and capacity and electricity prices are included in the transmission and distribution price according to the yield. Stable. But the current energy storage power price mechanism of new energy storage power stations is not completely clear, which depends on the follow -up as soon as possible. "

The cost of private enterprises is relatively high, and it is difficult to hold heavy assets for a long time. Some private enterprises choose to invest in the project startup period and construction period, and transfer it to state -owned enterprises and central enterprises after a certain stage. Compressed air storage power stations are more held by state -owned enterprises and central enterprises from power generation or grid -side side. Discipline said that recently, some state -owned enterprises and central enterprises have the willingness to invest in compressed energy storage power stations.

"New infrastructure is also divided into different levels. Some areas may have a wide range of economic benefits, that is, people can benefit from it, but it is difficult to focus on a specific project. This kind of new infrastructure should also be led by the country. Based on this, some may have some. The new infrastructure project can focus on specific projects, and can explore the business model of income. This part of the project can be implemented by various market entities. There is still a vague area between the two. . Therefore, new infrastructure needs to be placed in specific application scenarios to review. "Qiao Baoyun said that the most important point of attracting private investment is to improve expectations. The recycling cycle of infrastructure investment costs is long, so it has a great relationship with expectations.

Send 2022.7.25 Total Issue 1053 "China News Weekly" magazine

Magazine title: How to "pick the beam" again

Reporter: Chen Weishan ([email protected])

Capture: Xiao Ran

- END -

Luzhai County Meteorological Orange Orange Early Warning signal [level/severe]

Luzhai County Meteorological Observatory continued to issue a heavy rain orange warning signal at 14:49 on June 10, 2022: At present, strong against Liuyun Troupe is affecting our county and gradually

The party flag fluttered at the grassroots level 丨 "The party class has lectured": infiltrate the human heart, "calcium supplementation soul"

Xinhua News Agency, Harbin, July 1st: The party class has a lecture: infiltrate pe...