The net profit of financial streets exceeds 80 %: In the first half of the year, the valuation of assets and assets was increased

Author:Daily Economic News Time:2022.07.21

At the end of March this year, Financial Street (SZ000402, stock price of 5.57 yuan, and a market value of 16.648 billion yuan) sold its Financial Street Litam Calton Hotel, which has also become the company's main profit point in the first half of the year.

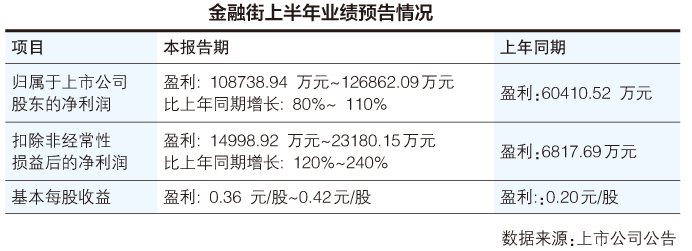

On July 14, the semi -annual performance forecast announced by Financial Street showed that it is expected to achieve a net profit attributable to shareholders of listed companies from January to June this year to 1.09 billion yuan to 1.27 billion yuan, an increase of 80%to 110%over the same period last year. Although the performance has increased significantly on the surface, the means of profit growth of financial streets is to rely on assets and asset assessments.

Financial Street Holdings told the "Daily Economic News" reporter, "For asset sales, the company does not have a continuous plan or behavior, it is one of the company's strategy."

90 % of the profit depends on the sale of assets

According to the performance forecast, the performance of the first half of the Financial Street can be described as excellent. The net profit after deducting non -recurring profit or loss reached 150 million yuan to 230 million yuan, an increase of 120%to 240%over the same period last year.

Regarding the reasons for the changes in the first half of the year, the Financial Street stated in the announcement, "First, the company's development and sales business has been steadily promoted, and the development and sales business income increases compared with the same period last year." The situation is unknown.

However, the reason for the second and third points in the later financial streets gives specific circumstances and amounts.

The announcement said, "Second, the company will be sold to Beijing Financial Street Investment (Group) Co., Ltd., which is co -owned by the company (company and a wholly -owned subsidiary Beijing Financial Street Liza Real Estate Co., Ltd.) held by the company. Its transfer income (non -recurring profit or loss) affects the company's belonging to the parent company's net profit of about 780 million yuan. "

In fact, as early as March 29 this year, the board of directors of the Financial Street passed a bill to sell the Litam Calton Hotel in Beijing Financial Street, and sold it to Beijing Financial Street investment for 1.08 billion yuan. On March 31, the company and the Financial Street Group have fulfilled the change of industrial and commercial registration of the equity transfer, as well as all equity and asset transfer work.

"Third, some office buildings, commercial and supporting parking spaces of the Shanghai Jing'an Rongyue Center project ... The company hire an independent third -party evaluation agency to review the fair value of its investment real estate. The company's net profit affects about 120 million yuan. "That is to say, the estimation of the financial street's assets is worth the corresponding improvement, and the part of the financial street will calculate the estimated increase in the net profit of the mother.

Compared with the net profit of the home mother in the first half of the two years, the two items were added in total. Compared with the net profit of the mother -in -law (1.09 billion yuan to 1.27 billion yuan), the proportion of the financial street's income in the development and sales business operations was worthless.

On the afternoon of July 20, the reporter of "Daily Economic News" called the financial street investor consultation phone as an investor. The strategy of holding a property will also adhere to the development of business and holding business in the later period, and will not walk with one leg. For asset sales, the company does not have a continuous plan or behavior. Some reasonable increases. "

The "selling" model has already opened up

It is worth noting that Financial Street has opened the road of "selling" a few years ago. According to the 2020 annual report, Financial Street has withdrawn from the CITIC City Blot, etc., and the recovery funds will be over 100 billion yuan.

By the first half of 2021, the net cash flow generated by the financial street operation activities continued to increase significantly to 4.266 billion yuan, while the same period of 2020 was -1.613 billion yuan. One of the main reasons for the change was to withdraw from Beijing Zhongxin City B plot and recovered. Fund occupation fee.

In January 2021, Financial Street plans to publicize 100%equity and claims of the wholly -owned subsidiary De Sheng Company through the Beijing Property Exchange. The starting price of the listing is 1.575 billion yuan. The center is located at No. 83 De Shengmen Waiwai Street, Xicheng District, Beijing, with a total construction area of about 229,500 square meters.

On September 24, 2021, Financial Street and Kelon signed the "Property Rights Transaction Contract" and submitted the Beijing Property Exchange for review. On September 26, 2021, the Beijing Property Exchange issued the "Certificate of State -owned Property Rights Transaction". According to the listing rules and conditions, the 100%equity and debt of the financial street transferred to Disheng Company to Kailong Company, the transfer price was 1.575 billion yuan Essence

As far as the real estate development business alone, the business status of the financial street shows clearer the first quarter report. In the current period, financial streets have only achieved a sales signing of 4.97 billion yuan and a sales area of 216,000 square meters. From the perspective of product types, the sales of residential products in Financial Street were 4.24 billion yuan; the signing of business products was 730 million yuan.

It can be seen that many financial street operating data in the first quarter is negative. For example, the net cash flow generated by operating activities was -2.39 billion yuan, and the same period last year was 4.61 billion yuan. At the same time, the net cash flow generated by investment activities in the financial street in the first quarter was -710 million yuan, which was 1.71 billion yuan in the same period last year; the net cash flow generated by fundraising activities was -2.41 billion yuan. Essence

On the afternoon of July 20, the real estate analyst Yan Yuejin told the "Daily Economic News" reporter through WeChat that the financial street has been stable in recent years. The company's asset quality is high and overall safety.In short, it is worthy of being able to have a good financial performance, but follow -up needs to continue to do a good job of maintaining a healthy and stable development of the main business."Daily Economic News

- END -

No matter how tired life, there will be a gentle dream

Although there are many difficulties in life, there are always unexpected surprises and hope of endless life.There is a saying good: Everything in the world is healing you, and no matter how tired lif

tragedy!A family of three in Shanghai accidentally fell into the river in Changxing Island, and the details made people sigh ...

Last night, a number of citizens reported that a family of three accidentally fell...