A -share diving!Foreign capital suddenly accelerated, what happened?

Author:Huaxia Times Time:2022.07.21

China Times (chinatimes.net.cn) reporter Shuai Ke Cong Chen Feng Beijing report

On July 21, with the acceleration of the northbound capital, the main index of the A -share main index dived sharply. The Shanghai Stock Exchange Index finally closed down about 1%, and once again lost 3,300 points, and more than 3,000 stocks closed down.

Market researchers interviewed by a reporter from the Huaxia Times believe that behind the A -share market's fluctuation adjustment, there are uneasy factors inside and outside, including local epidemic disturbances, and European and American central banks to raise interest rates. However, short -term market adjustment is not a change in trends, but a correction of the early trend, investors should continue to maintain confidence and patience.

A -share diving

On July 21, the three major indexes of the A -shares running lowered after opening, and the beginning of the market rebounded. The GEM index rose by up to 1%, and then fell quickly. In the afternoon, the main index continued to maintain a narrow range, but the unexpected diving occurred in the end.

As of the close, the Shanghai Stock Exchange Index fell 0.99%to 3272 points; the Shenzhen Stock Exchange Index fell 0.94%to 12455.19 points; the GEM Index fell 0.5%to 2751.41 points. In addition, the earliest science and technology innovation 50 index rose by nearly 3%in the early morning, and the tail set also fell sharply, and finally closed up 1.1%.

From the perspective of funds, A -shares' transactions throughout the day exceeded trillion, reaching 1018.5 billion yuan, an increase of more than 60 billion yuan from the previous day. Most of the stocks fell, and more than 3,000 stocks closed green, but there were still 85 stock daily limit, and there were only 2 stocks.

In terms of industry sectors, most of the 31 -year -old industries have closed down, and only the two industries of electronics and media rose slightly by 0.97%and 0.71%; coal, public utilities, non -ferrous metals and other industries fell ahead of 3.75%and 2.12%, respectively. , 1.97%.

In popular concepts, the increase in the concepts of fertilizers, silicon energy, salt lake lithium, coal concepts, corn and other concepts such as fertilizer, silicon energy, salt lake lithium, corn, etc.

Among the star stocks, there are also obvious signs of diving at the stock price of Moutai in Guizhou. As of the closing, the stock price of Moutai in Guizhou fell about 0.57%to 1939 yuan per share, and the market value shrunk to approximately 2.436 trillion yuan.

European and American central banks are about to raise interest rates

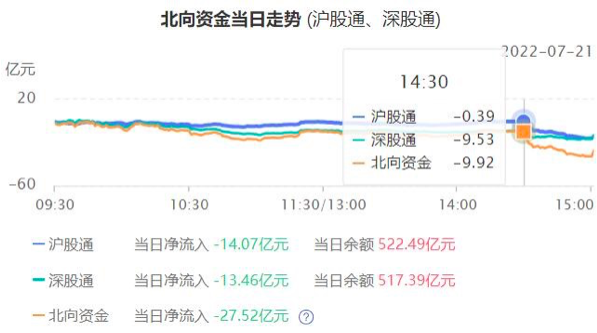

It is worth noting that in the process of diving in the end of A shares, the northern direction of the peripheral trend is significantly accelerated. According to the linkage data, as of 14:30, the net outflow of the northbound capital was only about 1 billion yuan throughout the day, and the net outflow rate increased to 2.75 billion yuan when closing.

"Behind the end of the market at the end of the market, it is actually in the process of recently the broad market." On July 21, Yang Delong, chief economist of Qianhai Open Source Fund, said in an interview with the China Times reporter. He believes that the reasons for the current market adjustment include the reflection of funds and the repeated campaign of market emotions in some areas. The reporter noticed that the coal sector led on July 21 was the only industry sector that rose in the first half of the year, and it rose more than 30%in half a year.

In addition, Yang Delong pointed out that there is an important factor behind the adjustment that the European and American central banks are about to raise interest rates and have a certain negative impact on the global capital market.

It is reported that at 20:15 on the evening of July 21, Beijing time, the European Central Bank will announce the interest rate resolution; then the European Central Bank governor Lagarde will hold a press conference of monetary policy. The European Central Bank has previously stated that because the inflation situation in the euro zone has not improved, it will start interest rate hikes in July, and this will be the first interest rate hike for the agency since 2011.

The Federal Reserve will also hold a conversation meeting on July 26-27 next week. The market generally expects that the Fed will raise interest rates by 75 basis points this time, and at the same time, it will not rule out the possibility of directly raising 100 basis points. With the rapid tightening of the European and American central banks, the global financial market will inevitably be affected.

The tide of the science and technology board is coming

Also much attention to the market is that on July 22, the science and technology board will usher in the third anniversary of the opening of the market. As the original shareholders' limited -sale of the stock market lock up the ban period, the science and technology board also ushered in a lot of pressure on the ban. The data shows that the first batch of 25 companies that landed on the science and technology board had a single -day lifting scale of more than 200 billion yuan.

According to the statistics of Xingye Securities, if the first -day lifting of the first -issued general shares and the first -issue institutions of the first day of listing, the scale of the lifting of the science and technology board is as high as 1016.6 billion yuan. Among them, the science and technology board lifting the ban in July was 273.3 billion yuan, which was the peak of the scale of lifting the ban in a single month in the past three years.

However, the reporter noticed that as of the evening of July 18, more than 10 science and innovation board companies had announced that the main shareholders "committed not to reduce their holdings for the time being" or "extended the lock -up period".

In the short term, Xingye Securities believes that the market is prone to fluctuations before and after the science and technology board concentrated on the ban, which is mainly affected by two potential factors. First, the reduction of shareholders after the ban will cause downward pressure on the stock price. Because the reduction of holdings usually lasts for a period of time, the stock price may show the characteristics of "yin fall"; the second is affected by emotional factors. Emotional heating, the decline in risk appetite leads to a decline in the stock price, but the emotional impact is mostly in the short term, and the stock price will also be dominated by rapid declines. As the emotions of sharpness are gradually digested, it will usually usher in a rebound.

"The market is worried about the lifting of the science and technology board, and we believe that the impact is limited." Wang Yang and Chen Hao of Zhejiang Shang Securities pointed out in the research report released on July 19th that the logic of not having to worry is to improve the profitability of the science and technology boardThe value of the value is low, and after the history of the repetition, the GEM "Dafi" lifted the ban, the willingness to reduce its holdings in the short -term shareholders is lower.Looking forward to the A -share market, Yang Delong told reporters that short -term market adjustments are not a change in trends, but a correction of the early trend.With market adjustments, some risks have also been released in advance.After the Federal Reserve's interest rate hike is over, A shares are expected to usher in a chance to rebound, and investors should continue to maintain confidence and patience.

Editor -in -chief: Ma Xiao Chao Editor: Xia Shencha

- END -

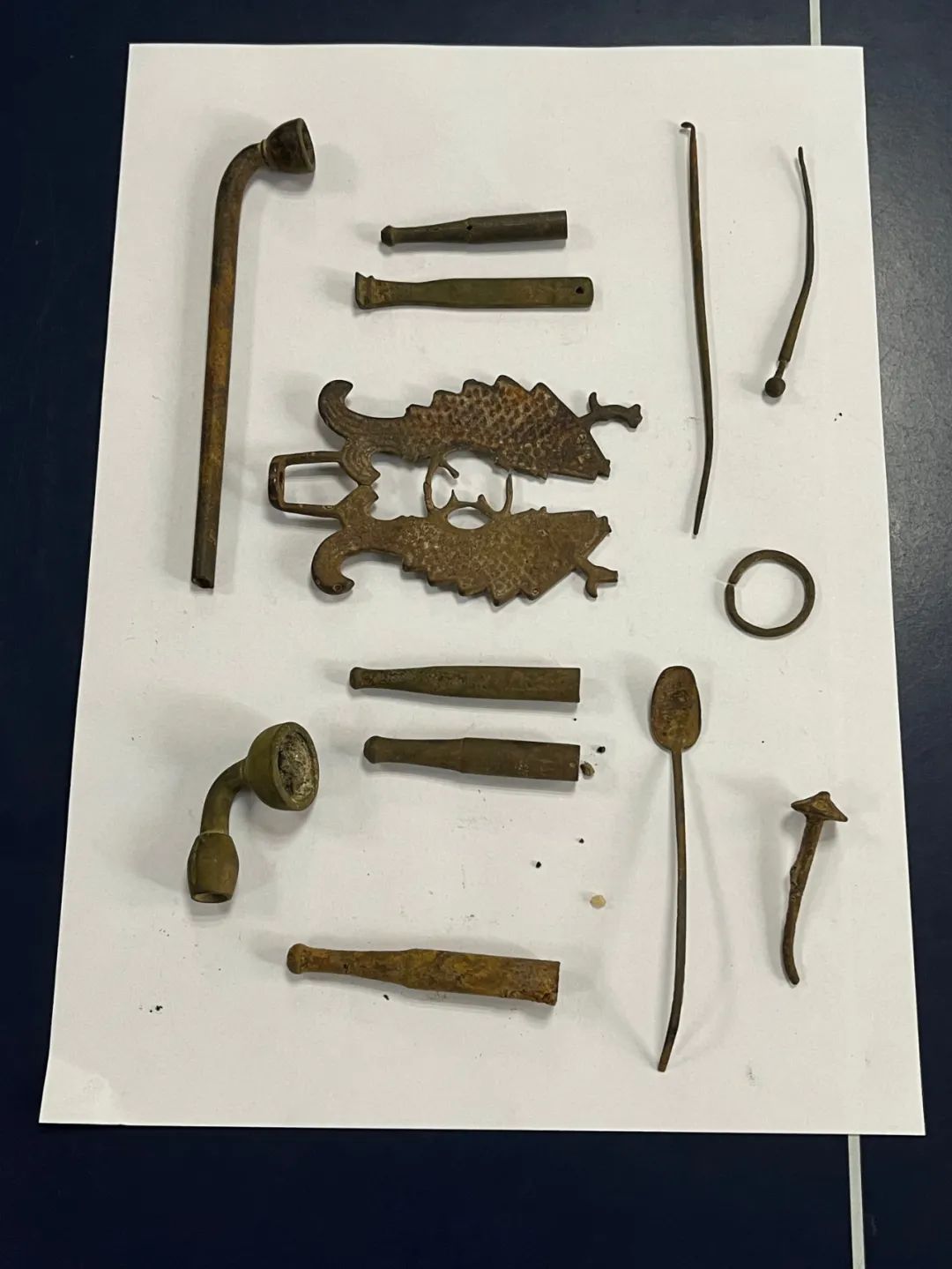

Jingdezhen Police promoted drowning on the side of Changjiang, and unexpectedly harvested a group of "cultural relics"

One in the Tang Dynasty Kaiyuan Tongbao, five ancient coins in the Song Dynasty, a...

Digital rural promotion ambassador Chuan Xiangqiuyue: imagine the new countryside in the future, every village has an information library

Cover reporter Xiong YingyingOn June 24, the First Digital Rural Innovation Design...