低 Battery revenue accounted for relatively low Pan Gang Titanium Titanium Council, prompting difficult to block the stock price soaring

Author:Public Securities News Time:2022.07.21

Affected by the continuous fiery concept of cymbal battery, since July, Pangang Vanadium Titanium (000629) shares have doubled. Recently, Pan Gang vanadium titanium continued to sign a commercial contract with Dalian Rongke on the commissioning processing and sale of the energy storage medium for the pyrine storage medium of allocated liquid flow batteries, which once again attracted the attention of market funds. In response, the company issued a prompt announcement on the 21st, saying that the scale of the transaction amount was about 500 million yuan, which accounted for a low proportion of the company's operating income. However, the market attention did not turn off, and the company touched the daily limit again on the afternoon of the 21st.

The stock price has reached a new high in ten years

The market shows that the stock price of Pangang Vanadium has entered a speeding up model since July, and the stock price has risen more than 100%. At the same time, the stock price has also set a new high price in the past ten years.

Up to now, the company's rolling price -earnings ratio is 38.81 times, the net net ratio is 7.68 times, and the company's "non -ferrous metal smelting and voltage pressure industry" rolling price -earnings ratio is 21.77 times, and the net net ratio is 3.13 times.

"Recently, the company's production and operation conditions are normal, and there has been no major changes in the company's internal and external operating environment. The company, the controlling shareholder and the actual controller do not exist in major matters that have not been disclosed by the company or are in major matters in the planning stage. During the fluctuations, the controlling shareholder and the actual controller did not buy and sell the company's stock. "Facing the change of the stock price, Pangang Vancanium titanium reminded investors on the 21st that the company's fundamentals have not changed significantly. The industry average is significantly different, and the stock price has increased in the short term. Pay attention to the risk of transaction in the secondary market.

In terms of performance, on July 9, Pan Gang Vancanium Titanium disclosed the semi-annual performance forecast in 2022. It is expected to achieve net profit of 1.040 billion yuan to 11.5 billion yuan in the first half of 2022, a year-on-year increase of 50.72%-66.66%; after deducting non-recurring profit or loss Net profit of 10.04 billion yuan-1114 billion yuan, an increase of 100.03%-121.95%year-on-year.

Decrease cost brings performance growth

In terms of policy, the National Energy Administration issued the "Twenty -five Key Requirements (2022 Edition) (2022)" (2022) (Solicitation Draft) "on June 29, requiring" medium and large energy storage power stations must not use ternary lithium batteries, sodium sodium, sodium, sodium "Sulfur batteries"; while 具 batteries have the advantages of high safety, long circulation life, low cost of life cycle, and complete and controllable resources, which are very promising in the field of energy storage.

In the first half of 2022, the average tax included the average tax inclusions of the five oxidation of the five oxidation (tablet), an increase of 19%year -on -year; the average tax included by titanium white powder (golden stone, East China) was 20677 yuan/ton, a year -on -year increase of 5.3 %. In this regard, Pan Gang Vanadium Titanium stated: "The company maintains a balanced and stable production, strictly implements cost reduction measures, and the price of vanadium titanium has increased year -on -year, and the reduction of costs has brought about performance growth."

It is worth noting that in September 2021, the company signed a strategic cooperation agreement with Lian Berong, and the two parties will cooperate in the production of the battery industry chain, co -construction of electrolyte factories and energy storage equipment production. In 2022, the company continued to sign a commercial contract with Dalian Rongke on the processing of processing and sale of the energy storage medium for the total liquid storage medium.

"If the contract can be implemented smoothly, according to the current price level of the current product market announced by the iron alloy online website, the scale of the transaction amount is about 500 million yuan, accounting for a low proportion of the company's operating income, and will not have a significant impact on the company's operating performance." Pan Gang vanadium titanium is expressed.

However, the market attention did not turn off. The stock price of Pangang Vanadium titanium once again impacted upwards, and it touched the daily limit in the afternoon. As of the close, the company's stock price was closed at 7.47 yuan/share, an increase of 4.48%. Everbright Securities Analyst Wang Zhahua believes: "The company currently has the world's largest product production capacity, and its raw materials have significant advantages. Benefiting from the development of the batteries, the value of the company's products is expected to be re -determined."

Reporter Zhang Yan

- END -

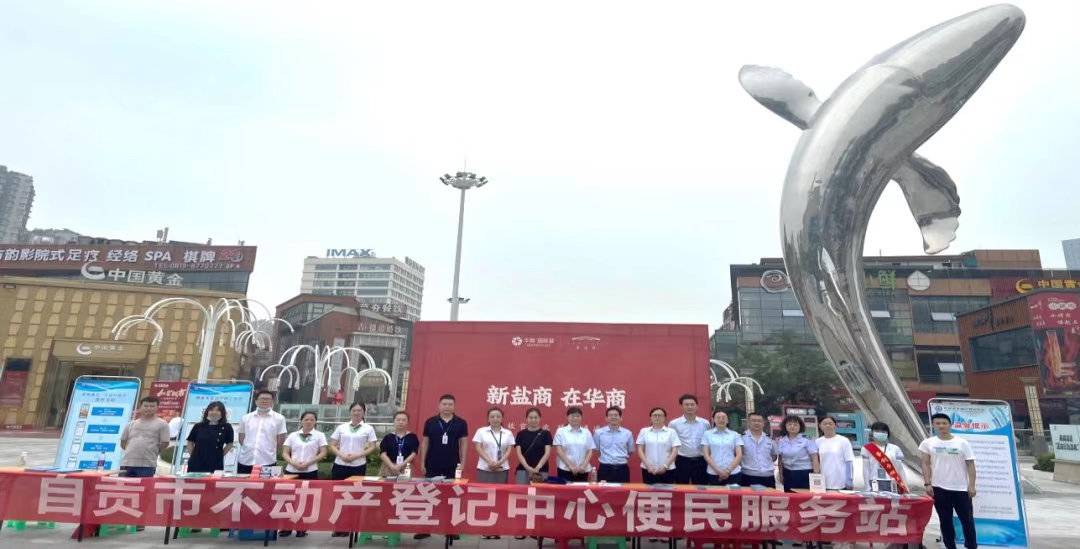

Sichuan Zigong's first real estate registration grassroots convenience service station was established at Hongqi Street, High -tech Zone

Cover news reporter Liu Ke ShengOn June 21, the Sichuan Zigong Real Estate Registr...

Suining Passing Mountain: Use the carrier of "Barba Movie" to make good use of it

Recently, the Bask Movies shown in residents such as Hanlin Mingyuan and other res...