70 city house prices changed: Tangshan and other 34 cities fell back two years ago, Zhengzhou returned to 5 years ago

Author:Jinan Times Time:2022.07.21

After the epidemic, the development of the property market in various places has also undergone profound changes.

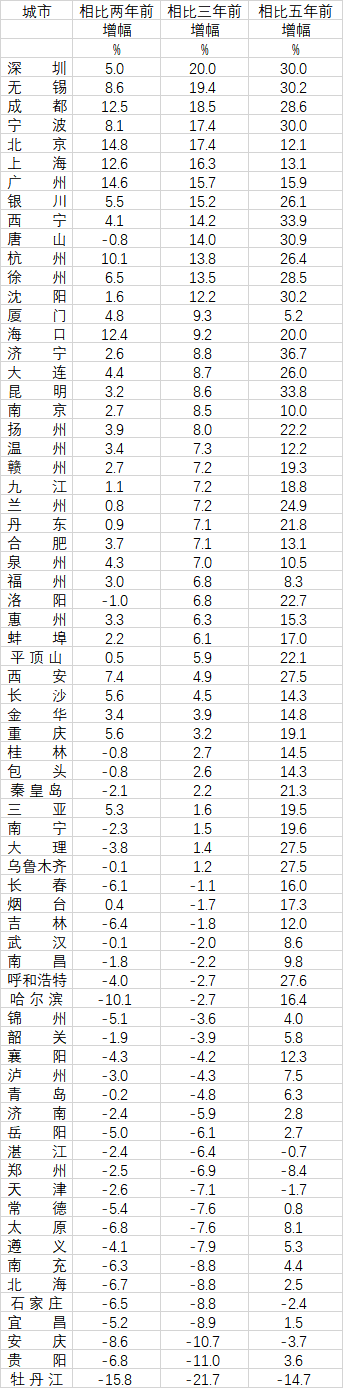

According to the changes in the sales price of 70 large and medium -sized cities in June 2022 issued by the National Bureau of Statistics and data in the same period of the same period of time, the housing prices in 34 cities including Tangshan have been lower than 2 years ago, in June 2020, 2020 The level accounts for nearly half of the 70 cities; house prices in 27 cities are less than 3 years ago, which is the level of June 2019. In addition, house prices in six cities including Zhengzhou have fallen back to the level 5 years ago.

It should be noted that the house price data released by the National Bureau of Statistics every month is a relative number of changes to reflect the overall changes and changes in housing sales prices. Due to the factors such as limited price, sales, and structural factors, in contrast, the second -hand housing market can better reflect the actual situation of changes in housing prices in various places.

Compared with the data in June 2020, the cities in the forefront of house prices in two years are Beijing, Guangzhou, Shanghai, Chengdu, Haikou and Hangzhou, covering the three first -tier cities in Beijing, Shanghai, Guangzhou, and provincial capital cities in three southern regions. Hotel market hotspot cities.

In contrast, 34 cities were below June 2020, including Wuhan, Qingdao, Tianjin, Zhengzhou, Jinan, Taiyuan, Guiyang, Harbin, Tangshan and other central cities and economic markets. Among the 34 cities, the top five of the decline were Mudanjiang (15.8%), Harbin (10.1%), Anqing, Guiyang, and Taiyuan.

Among them, Tangshan, the first economic city of Hebei, fell 0.8%compared to two years ago. In the 2020s of the adjustment cycle in the property market, Tangshan's house prices once led the country. In August 2020, the sales price index of Tangshan New House rose 15.4%year -on -year, and second -hand housing rose 14.6%year -on -year, ranking first in the country. However, due to various aspects of policies and housing enterprises, the area has gradually slipped into the property market.

Judging from the trend in the past three years, compared with June 2019, the 7 cities with the rise in house prices are Shenzhen, Wuxi, Chengdu, Ningbo, Beijing, Shanghai, Guangzhou, including four first -tier cities and the largest population of the provincial capital City Chengdu and two long triangle economic markets.

On the whole, after the epidemic, the role of emerging industries on the regional economy was further prominent. In recent years, emerging industries in developed areas such as the Yangtze River Delta and the Pearl River Delta have been very prominent, and the population has flowed rapidly. Especially young talents, the power of buying houses is more sufficient, and funds have further gathered to these areas.

Data show that 27 cities have second -hand housing prices less than 3 years ago, including central cities such as Qingdao, Jinan, Zhengzhou, Tianjin, Shijiazhuang, Taiyuan, Harbin, Nanchang, Wuhan, Changchun, Hohhot and other central cities. On the whole, the provincial and central cities in North China and Northeast China are more concentrated. In addition, some third- and fourth -tier cities in the northeast, central and western regions, especially southwest, and central and south are also concentrated.

58 Zhang Bo, Dean of the Branch of Anju House Real Estate Research Institute, analyzed the first financial and economic analysis. Some third -tier and fourth -tier cities in the Northeast, North China, and the central and western regions fell significantly. Gathering in the Pearl River Delta and other places. On the other hand, many third- and fourth -tier cities in the northern region are resource -exhausted cities, industrial movements, and labor population flow. This is not enough for long -term support for house prices.

Zhang Bo analyzed that these down cities have not been in a decline. In the years after 2015, many third- and fourth -tier cities in the central and western regions have also grown rapidly. Due to the rapid rise and insufficient support, the fundamentals of the city are not particularly solid. This has also led to the current regional differentiation. In the context, the fall of house prices in these cities will be more obvious.

Of course, falling is not just third -tier and fourth -tier cities. Some second -tier cities and new first -tier cities with more population flow are also obvious. Compared with June 2019, Zhengzhou's second -hand house prices fell 6.9%, Guiyang fell 11%, Tianjin fell 7.1%, Shijiazhuang fell 8.8%, Jinan fell 5.9%, and Qingdao fell 4.8%.

In the past five years, the sales price index of second -hand housing in 70 large and medium -sized cities changes

First Financial Reporter calculated and organized according to the data of the National Bureau of Statistics

Zhang Bo said that the fundamentals of some central cities are good, and there is no lack of development potential and motivation. It is only because the land supply is too large and the land selling too much some time ago. Especially in a new city in the city, the supply is too large, and now it takes a long time to digest inventory.

Taking Zhengzhou as an example, the reporter sorted out data from the website of the National Bureau of Statistics that the sales area of Zhengzhou residential commercial housing in 2020 was 30.2568 million square meters, second only to Chongqing ranked second in the country. This is already the sales area of Zhengzhou's residential commercial housing for three consecutive years of more than 30 million square meters. From 2010 to 2020, Zhengzhou's cumulative residential commercial housing sales area ranked fourth in major cities across the country, while Zhengzhou's current total population, urban population scale, and total GDP were all entering the top ten cities across the country.

Guiyang's situation is similar. Zhang Bo said that the development of the big data industry in Guiyang City itself has developed well and the population is also flowing. However, due to the large supply in recent years, especially the supply of new cities in the peripherals, it has also led to a relatively large downturn in housing prices.

It is worth noting that 6 cities are below the same period 5 years ago (June 2017), namely Mudanjiang, Zhengzhou, Anqing, Shijiazhuang, Tianjin and Zhanjiang.Among them, Mudanjiang is 14.7%lower than 5 years ago, and Zhengzhou is 8.4%lower than 5 years ago.Mr. Ma, who lives in Zhongyuan District, Zhengzhou City, said that at the end of 2016, a house in his family in the Central Plains could sell 1 million yuan and prepared a contract.Sell."I regret it for a long time, and now the rent is not easy to rent. I haven't rented it out for half a year."

(First Finance)

Edit: Zhao Shanshan

- END -

Henan Yuanyang | Drought and protecting seedlings, Dabin Town can withstand the "baking" test

Recently, the high temperature and rainy weather has made the work of drought resi...

Power Supply Company, Houkou District, Dongying City, State Grid: "Migraphic" inspection, escorting "Sanxia" electricity safety

Reporter Wang Shuai Correspondent Ding YifengOn June 15th, Hekou Company organized...