Overnight U.S. stocks ushered in the three major indexes of strong rebounds to collect more than 2% of U.S. stocks?

Author:Securities daily Time:2022.07.21

Our reporter Zhang Ying, a trainee reporter Chu Lijun

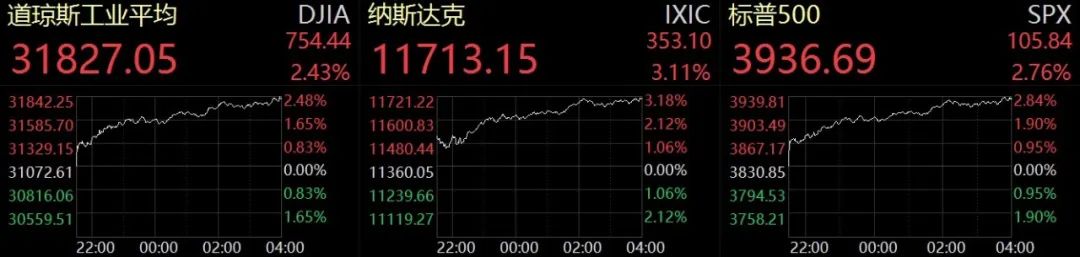

On July 19, local time, the three major indexes of the U.S. stocks opened high. As of the close, the three major indexes of the US stocks rose more than 2%, and the Dow Jones Index rose 2.43%to 31827.05 points; ; The Nasdaq index rose 3.11%to 11713.15 points; all three major indexes reached a new high since June 9.

In terms of individual stocks, US technology stocks rose 5.53%, Google -C rose 4.29%, Amazon rose 3.91%, Intel rose 3.9%, Apple rose 2.67%, Microsoft rose 2.08%; Chinese stocks rose and declined, and China stocks rose and fell. Iqiyi rose 9.72%, the good future rose 9.63%, Tuniu rose 8.62%, Xiaopeng Automobile fell 3.76%, the ideal car fell 4.72%, and the daily freshness fell 10.53%.

Regarding the market performance of the US stocks, Yin Xinxin, the founder of Benniu Investment interviewed by the Securities Daily, said that the U.S. stock market reported that the second quarterly reported that the overnight to stimulate the rebound of US stocks overnight, especially the major technological stocks overnight. The news shows that Buffett has further increased its holdings of oil stocks in the near future.

Regarding the US economy, Great Wall Securities stated that the US economy may continue to grow in the second quarter. If the negative increase in a consecutive quarter of consecutive quarters can judge that the US economy has entered a decline cycle, but inflation is still high and it is difficult to fall. Essence The economic growth rate in the United States in the first half of the year was more caused by the reduction of government fiscal expenditures. Although the growth rate of commodity consumption fell, economic indicators such as the growth rate of service consumption and unemployment rate were relatively strong. There is no policy that can maintain the stable economic growth and promote inflation to normal levels. The Fed with "controlling inflation" as the primary task can only stare at the price indicator. The federal fund interest rate is expected to remain at 4.75%-5%at the end of the year. In the second half of the year, the US demand may fall quickly, economic indicators have begun to decline, and the United States has entered a decline cycle.

Regarding the market outlook, Hu Peng, manager of Rongzhi Investment Fund, said in an interview with the Securities Daily that the United States is still at a high level, and the Fed continues to raise interest rates. U.S. stocks have experienced large adjustments. With the continuous deepening of adjustments, the recent fluctuations in U.S. stocks have increased, accompanied by rebound and repeated phenomena. After full adjustment, U.S. stocks may have bottomed out in advance, and the relative investment value has begun to prominent. In addition, this may also be a signal of U.S. stocks in the bottom of the economy. With the inflation of the United States, especially in the process of economic recession, the rate of interest rate hikes may be greatly alleviated. At present, U.S. stocks may have entered the time node that starts to gradually lay out on the left side. It is recommended to choose individual stocks that have been fully adjusted and future performance.

"Although the Federal Reserve’ s interest rate hike expectations have not yet dissipated, the short -term bottom of the US stocks has been basically proven. In the short period of time, it is optimistic about the overall rebound of the US stock market. "Yin Xinxin said.

Tianfeng Securities pointed out in its research report that although it is difficult to talk about the specific time of U.S. stocks in the short term, in the long run, after a sharp decline, science and technology growth stocks have fallen into a relatively reasonable and even cheap range, and estimated in the next cycle to estimate Elasticity is sufficiently elastic. In U.S. stocks, investors are advised to pay attention to cloud computing (Microsoft), leaders of parallel computing (Nvidia), Southeast Asian Games and E -commerce (SEA), the next generation of basic software (SNOWFLAKE), the beneficiary of the commercialization of the advertising industry video commercialization (TradedESK) and other companies. For Chinese stocks, with the coming of the financial report season, the actual performance of the quarterly report and the progress of the audit of China Stocks are worthy of attention.

(Edit Bai Baoyu planning Zhao Ziqiang)

- END -

Official spouse children classify forbidden business: strict control is true love

SummaryChinese Youth CommentThe external strict management combines the inner law ...

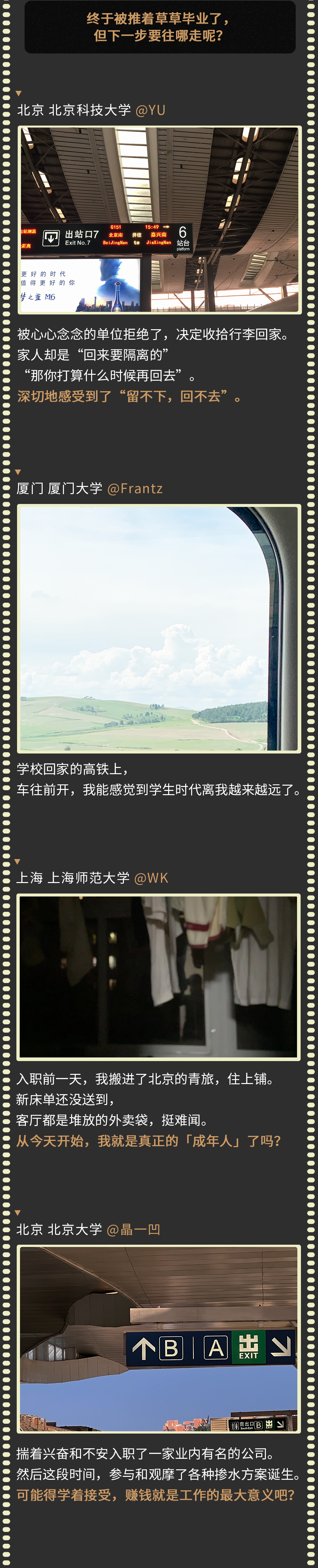

After waiting for 4 years to break up, wait for this P's photo

【Write in the end】When talking to them, I asked a question: If everything happen...