Financial empowering the countryside "Guangdong Answer": The balance of agricultural loans in the first half of the year was 1.99 trillion yuan, an increase of 12.7% year -on -year

Author:21st Century Economic report Time:2022.07.20

Southern Finance and Economics All -Media Council Reporter Guo Xiaojie Guangzhou Report

On July 20, the Guangdong Provincial Department of Agriculture and Rural Affairs and the Guangzhou Branch of the People's Bank of China held a press conference on financial institutions to support the rural revitalization action plan to introduce the policy deployment and implementation of major financial institutions in Guangdong Province on comprehensive promotion of rural revitalization. Essence

According to Liang Youqiang, a second -level inspector of the Guangdong Provincial Agricultural and Rural Affairs Department, in December 2021, the General Office of the People's Government of Guangdong Province issued and implemented the implementation of the "Implementation Opinions on Financial Supporting the Comprehensive Promoting Rural Revitalization". Subsequently, eight financial institutions including the National Development Bank Guangdong Branch, the Guangdong Branch of the Construction Bank, the Postal Savings Bank Guangdong Branch, and the Provincial Agricultural Credit Association have formulated the "Rural Revitalization Action Plan" to comprehensively promote the comprehensive promotion of the countryside for Guangdong's financial support to comprehensively promote the countryside Revitalize the foundation of a solid policy and system. Since the implementation of the supporting operations of the "Implementation Opinions" and the supporting operations of 8 financial institutions, the Guangdong Provincial Agricultural and Rural Affairs Department, the Guangzhou Branch of the People's Bank of China, and various financial institutions have solidly and steadily promoted the work 100 million yuan, an increase of 12.7%year -on -year.

Innovate farming financial products to help rural revitalization

In recent years, major financial institutions have increased the development and support of farming financial products.

The Postal Savings Bank Guangdong Branch provides comprehensive financial services for the majority of agricultural business entities, and has developed "Chenpi Loan", "Litchi Loan", "Luo Fei Fish Industry Loan", "Nang Pharmaceutical Industry Loan", "Production and Management Loan" around Guangdong's characteristic industries innovation. Waiting for credit products.

According to Li Gang, deputy governor of the Guangdong Branch of the Postal Savings Bank, the "Speed Loan" product launched by its customers only needs to operate online through mobile banking or WeChat banking, and the loan amount can be generated as soon as 10 minutes. It is the most popular financial service rural revitalization product (gold award) from 2020 to 2021.

Deng Jing, deputy governor of the Guangdong Branch of Construction Bank, introduced that in recent years, focusing on policy hotspots such as the safety of the food safety and characteristic agricultural development of cultivated land, CCB has innovated the launch of "reclamation loans", "Hui Agricultural Loan", "Industrial Chain Loan", "Agricultural Bald Lancer" E -loan "" A number of special credit products. The bank focuses on the "rural revitalization product packages" and online "Yu Nong Fast Loan Product Pack" focusing on the implementation of financial product innovation. At present, the number of product packages has exceeded more than 20.

In addition, CCB Guangdong Branch fully connects 11 newly established vegetable industry parks in Guangdong Province, formulated the "Prefabricated Cuisine Industry Comprehensive Financial Service Plan", and jointly established the "Guangdong Camellia Camellia Industry Alliance" with the Guangdong Forestry Bureau and signed it. The cooperation agreement has launched the "Camellia Industry Financial Services Product Pack" to provide batch credit support for the development of the province's camellia industry.

Zhuo Kai, deputy governor of the National Development Bank Guangdong Branch, said that as a financial institution in Guangdong, the National Bank of China focuses on implementing rural construction actions, promoting agricultural modernization, and consolidating and expanding the results of poverty alleviation. The direction is fully exerted. During the "Fourteenth Five -Year Plan" period, the rural revitalization loan will be put in 100 billion yuan. In addition, the Provincial National Bank of China also set up a special loan for spring plowing and farming to support the daily operations of agricultural enterprises, ensure food safety and important agricultural and sideline products, and the successful development of agricultural production. The wholesale of the Agricultural Credit Society provides a 1-3 years of overall credit to support the "three rural" small and micro enterprises with accurate drip irrigation.

There are more than 800 supporting small financial products developed by the Rural Credit Cooperatives in Guangdong Province, with a cumulative investment scale of more than 100 billion yuan. During the "Fourteenth Five -Year Plan" period, the Guangdong Rural Credit Cooperative Union will plan to invest more than 1 trillion yuan in credit funds to fully support rural revitalization.

Comprehensively enhance the coverage of financial services

Rural regions are widely regional, and improving financial services coverage is a basic long -term project.

Deng Jing said that in terms of service channels, CCB has a "Yu Nongtong" service point, 10,000 village committee service points, and 5,000 smart terminals of "Yu Nong Tong". On the one hand, the basic financial services functions of the service point of deposit, loan, foreign exchange, payment, and investment are enriched; CCB also deepen party building work into rural financial services and use party building as a "media". "In the event, the grassroots party branch of the entire bank carried out pairing co -construction with the 1,323 administrative villages in the province in accordance with the principles of" one branch, one village ".

The Postal Savings Bank Guangdong Branch relies on the layout of urban and rural areas to radiate financial services to all villages and towns. According to Li Gang, the deputy governor of the bank, the current postal savings have a total of 1926 business outlets in the province (excluding Shenzhen), of which a total of 1079 outlets in rural areas, accounting for over 56%, and serving individual customers exceeding 70 million million yuan , Effectively solve the blank problem of financial services in counties, villages and towns. The bank also created the exclusive "agricultural and rural" credit service team. The number of financial services in the province accounts for 13%of the total number of employees of our employees, extending credit services to the "last mile".

The Guangdong Agricultural Credit Association has further promoted the "Guangdong Rural Finance (Inclusive) Households" project, and implemented the "one branch, one special, all -in -one, one platform, one letter" as its core rural financial basic project to build " Village and Village Political Affairs+Households Financial "rural service pattern. The bank invested 19,800 government service machines in the "Cantonese self -service" government, providing 2111 government services and 17 financial service projects, and dispatched 14,200 rural financial specialists to enter the province's administrative villages to provide services. %Of the administrative villages carried out 77.6 billion yuan in "Credit Village Credit", effectively expanding the coverage of rural basic financial services, and initially established a "one game of chess, urban and rural network" financial service network, creating "village -to -village government affairs+households' financial finance "Rural service pattern. Wu Weimin, a member of the Party Committee and Deputy Director of the Rural Credit Cooperative of Guangdong Province, said that the Provincial Agricultural Credit Association is a wide range, familiar with the current situation of rural areas, agricultural special changes, and peasant needs. , Tailoring to promote the innovation of financial service products, realize the localization of financing products, chain, improvement, mass, and digitalization, and effectively support the development of industrial revitalization.

- END -

From 0:00 on July 7th to 18:00, there were 5 cases of new local infections in Linyi.

Today, 0 to 18:005 cases of new local infections in LinyiFrom 00:00 on July 7, 202...

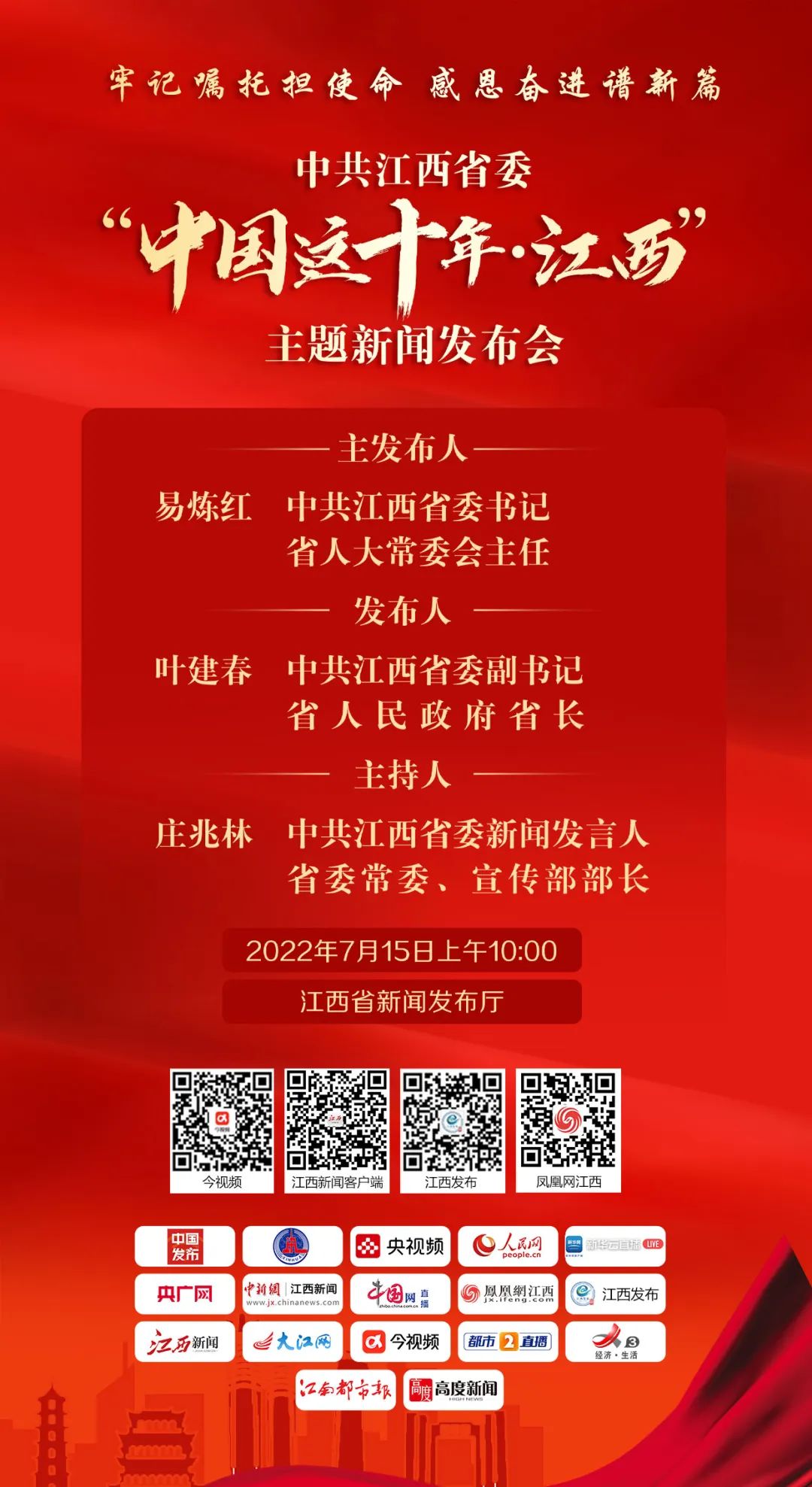

The theme press conference of the "Ten Years of China · Jiangxi" theme press conference of the Jiangxi Provincial Party Committee of the Communist Party of China will be held tomorrow

At 10 am on July 15th, the Jiangxi Provincial Party Committee of the Communist Par...