Such a big short!Mysterious Hedie Fund earn 220%in half a year!

Author:China Fund News Time:2022.07.20

China Fund reporter Ivan

Wall Street never lacks legend.

Before the flagship fund of Cathie Wood, "Sister Wooden Sister", in 2020, with the betting of the "subversive innovation" stocks, we earned 180%of the World War II; Global) has also brought huge income to investors because of a big bet on technology stocks, and the annual yield of 2020 is as high as 48%.

However, the god of luck does not always care for the same person. The old -love growth stocks suddenly "not fragrant" due to various factors this year. "Sister Wood" fell down the altar, and its flagship fund removal over 70%from the high point, and Tiger Global has also loses $ 17 billion.

The so -called "Feng Shui turns", the New York Mysterious Hedge Fund Coltrane earned 223%in half a year, and the "wealth password" behind it was actually the darlings of the short market -star technology growth stocks!

As soon as the news came out, Wall Street was boiling. But Mandeep Manku, who manages this hedge fund, looks quite calm. The fund manager from the countryside of northwestern England told the media interviewed to him that Coltrane's return this year only reflects a short time, and long -term performance is the most important. From the beginning of 2012 to June this year, the average annual yield of the fund was 19%.

Coltrane's official website seems to reflect the low -key style of the fund manager. When checking the hedge fund website, the reporter found that the website was very concise and the content was very small. There was only one "contact" page marked the company's address and contact information.

(Source: Coltrane Asset Management)

The management scale has shrunk by 80%

Before entering the media conservation light from the 223%yield of 223%, Coltrane has experienced a difficult time, and its strategy of short -heading technology stocks is not effective.

According to the Wall Street Journal, at the end of 2020, Mandeep Manku made a "A BIG Contran Bet" to its investment portfolio -he decided to shift from the popular cheap European company to short -term United States. High -growth star technology stocks.

In response to this strategy, he said in a speech to customers in September 2020 that the transaction price of many American technology stocks in the market at that time had exceeded 10 times that of their own income. In this case, the ending is "ended" to investors.

However, the ending of that year was bad for Manku. At the end of 2020, technology stocks did not decline, driving US stocks to rebound. As of December 16 of that year, the revenue of the three Apple, Amazon and Microsoft accounted for all the rewards of 16.6%of the S & P 500.

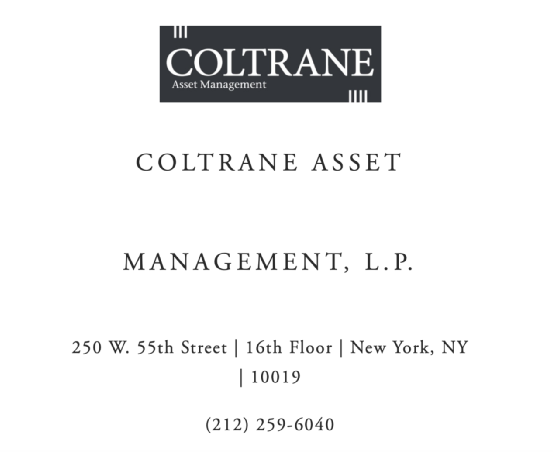

COLTRANE, who was short -term technology stocks, suffered a devastating blow and lost 56%in that year. Although COLTRANE's performance rebounded 19%in 2021, as of January this year, its asset scale fell to less than 200 million US dollars, a full 80%of the management scale of $ 1 billion during the previous peak.

(COLTRANE position scale changes: Whalewisdom)

But the reversal opened later.

As the Fed has opened up the largest interest rate hikes, the disturbance of geopolitical situations, and the uncertain economic prospects of the United States from 1995 to 2001, which has been opened in the past 30 years, it is similar to the Bubble of the Science and Technology Board from 1995 to 2001. Began to break. As of the close of the Eastern Time on July 19, the Nasdaq index, which focuses on technology stocks, has plummeted by more than 26%, and Manku, who is still short after 56%of the huge losses, finally ushered in his highlights -COLTRANE’s The performance has risen.

According to the media quoted people familiar with the matter, as of June this year, COLTRANE's income soared 223%, one of the hedge funds with the largest income increase this year.

Two years insisted on short -headed technology stocks

Coltrane has made great profits so far this year.

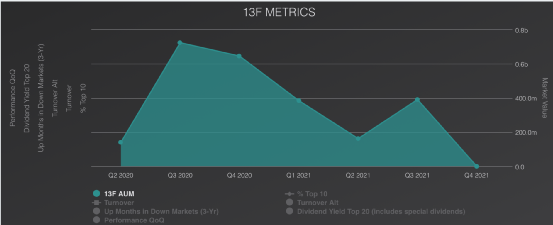

Specifically, Coltrane successfully bet on the stock price of beneficiary stocks such as Netflix and Peloton.

(COLTRANE's short bet stock, this year's trend source: Wall Street Journal)

In addition, according to a person familiar with the fund, COLTRANE's short -term betting betting on Carvana, a second -hand car retailer, which has plummeted by about 90%of the stock price this year, also made a lot of money for it -the transaction contributed 9%of the fund's income this year's revenue this year Essence

Manku's success was not achieved overnight, and he and his team have lasted his short bet for two years. With the decline of the stock price of the leading technology stocks, Coltrane obtained a large return by buying the options, and circulated in and out in the transaction, which increased the betting. Manku once told customers that the high -speed growth of these star technology companies during the global epidemic will not continue as expected by their management team and shareholders. In a rapidly growing company, a large number of internal transactions are also an obvious signal.

"Those who know the prospects of these companies are being withdrawn from their capital," Manku told customers. In fact, the data research company's INSIDERSCORE analysis showed that as of the early December 2021, 48 senior executives of US $ 200 million were cash out, which was almost four times that of the average number of people from 2016 to 2020.

Low -key and focused fund manager

Stuart Roden, former board chairman of the European Hedge Fund Lansdowne Partners, said that Manku is a fund manager of Convice. He did not give up at a wrong time. This is very rare.

"In our bank, many of the correct fund managers could not persist in the end. In this case, if the fund was terminated or investors withdrew it," Roden said.

This persistence can not be done by every fund manager. If you look closely at Manku's growth experience, you can find that this may not be accidental.

Manku is 38 years old and is from rural areas from northwestern England. He had a strong interest in stocks and valuations as early as high school. In high school, he was active on the Internet for stock analysis, and opened an account with his mother's name to invest in himself and his friends.

Even when he was 16 years old, he published an article in a magazine published in 2000 to comment at the time of the shares bubble at the time. He wrote that "the resolution of safely is difficult, because it needs to re -underestimate some of the high -tech stocks that have been obviously overvalued and sacrifice their income and performance to change to sustainable growth."

After the short -term work of THIRD POINT, a top hedge fund, a top hedge fund in London's Deutsche Bank and the legendary investor Daniel Loeb, Manku founded Coltrane in 2012 with less than 50 million US dollars in the initial stage.

Manku's friend described him as a low -key and focused person, thinking that he was more concerned about his records, not the size of the fund. He settled himself in the fund headquarters of Europe in New York, USA, not London to avoid collective thinking (Crowd-Think).

In addition, it is interesting that the name Coltrane comes from Manku's favorite American Saxor player John Coltrane.

Manku said in a statement: "Success is to find a method that conforms to its own world view, and consistently persistence, keeping it down -to -earth and calm. We are still at the beginning of the journey, but we have learned some valuable lessons."

Edit: Joey

- END -

[On the field of hope] Wake up the willow shade samples of the "Sleeping" village art revitalizing the countryside

A garden of Liuyin Town under the perspective of aerial photography. Data map Xinh...

Xiangjiang Laobutou Station Super Police, Xiangjiang No. 2 this year, the flood formation

Hunan Daily, June 22 (All media reporter Feng Yongcheng Correspondent Hou Haowen) As of 8:00 on June 22, the water level of Xiangjiang Ganliu Laobutou Station reached 104.11 meters and the police were