Press the soldiers!The LPR quotation in July was "unchanged as scheduled", and more than 5 years of LPR decline still existed in space

Author:Broker China Time:2022.07.20

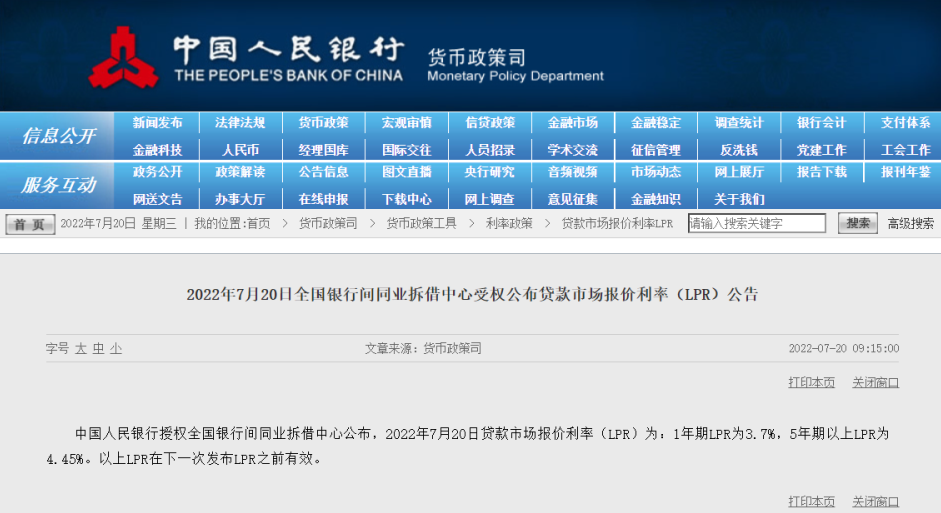

The People's Bank of China authorized the National Bank of China Interbank Borrowing Center to announce that the loan market quotation interest rate (LPR) on July 20, 2022 was: one -year LPR was 3.7%, and the LPR of more than 5 years was 4.45%. It means that LPRs have remained unchanged for 1 -year and 5 -year LPR.

Experts point out that, from the perspective of bank capital costs and the balance of supply and demand in the loan market, the LPR offer in July lacks the driving force of low -reduction, which is also in line with general expectations. Next, considering the stable operation demand and stable growth pressure of the real estate market, the LPR quotation of more than 5 years may still be moderately lowered at the same time as the MLF interest rate is stable.

LPR quotation that meets the expected July

Since LPR was formed on the basis of the interest rate of the medium -term borrowing (MLF), and the central bank continued to do 100 billion yuan for one -year MLF on July 15th, the winning interest rate was 2.85%remained unchanged. There is no change, so the 1 -year and 5 -year LPR quotation in July remains unchanged in accordance with the market's general expectations.

In addition to the unchanged foundation of pricing, Wen Bin, chief economist of Minsheng Bank, also pointed out that the downward pressure on the net interest difference between banks since the second quarter has further increased, resulting in the shortage of LPR quotes in the short term.

The main regulatory indicators released by the China Banking Regulatory Commission in the first quarter of 2022 showed that the net interest margin of commercial banks in the first quarter was 1.97%, a decrease of 0.11 percentage points from 2.08%in 2021. Wen Bin further pointed out that since the second quarter, under the effect of increasing the contradiction between credit supply and demand, increasing deposits, and lowering the interest rate of the first home loan loan and significantly lowered the LPR quotation of more than 5 years, the newly issued corporate loan interest rate and mortgage loan interest rate adjustment adjustment The decline is large, and the decline in deposit interest rates is lower than the loan interest rate. The net interest margin of commercial banks is expected to show a downward trend.

Dongfang Jincheng chief macro analyst Wang Qing also said that the LPR quotation of more than 5 years in May will significantly reduce the 15 basis points, which will digest the April RRRC and set up a market -oriented adjustment mechanism for deposit interest rates to a certain extent. Voltage drop. As a result, LPR quotes in July meet the general expectations of the market.

LPR decline in more than 5 years still has room to survive

According to Zou Lan, the director of the Department of Monetary Policy of the People's Bank of China, at the National New Office conference held by the National New Office held by the People's Bank of China, at present, the 7 -day repurchase of weighted average interest rates (DR007), which is currently at a 7 -day repurchase of deposit institutions, is currently at about 1.6%, which is lower than the public. The market operating interest rate and liquidity are kept at a more reasonable and slightly more slightly more and slightly slightly more level. From January to June, the corporate loan interest rate is 4.32%, a year -on -year decrease of 0.31 percentage points. Essence

Wen Bin said that from the 1 -year LPR quotation, the current level of 3.7%is low. The interest rate level is lower, and even the pricing of some regular deposits forms upside down. In this case, if you continue to guide the 1 -year LPR reduction, it is easy to exacerbate the arbitrage behavior of the enterprise and deviate from the original intention of the policy.

However, experts generally believe that if the subsequent economic recovery is not as good as expected, the restoration of consumption and investment is weak, and the future LPR interest rate may still have room for reduction, of which more than 5 years of LPR reduction probability is greater.

Not only is it the demand for steady growth, many experts point out that the real estate market recovery process is still slow. At present, mortgage releases are still weak. It is necessary to continue to reduce interest rates and relax the regulatory policies.

Yan Yuejin, the research director of the Think Tank Center of the E -House Research Institute, believes that the mortgage interest rate has room for further reduction. In particular, the mortgage interest rate of some cities has not moved in the lowest direction, and in the third quarter, it is still an important period to reduce the interest rate of mortgages. But for some adjustments that have been adjusted before, it will remain unchanged in the third quarter. There is room for further stability and recovery in the real estate market. The low interest rate superimposition of various types of loose housing purchase policies will still help promote the development of the real estate market.

The second half of the year will still focus on wide credit

Regarding the monetary policy in the second half of the year, Zou Lan said recently that in the future, the People's Bank of China will comprehensively consider the fundamental conditions such as economic growth and the situation of prices, and reasonably match monetary policy tools to maintain reasonable liquidity and abundance, and further promote financial institutions to reduce corporate financing costs. In order to consolidate the economy to resume the creation of a suitable monetary and financial environment.

Wu Chaoming, deputy dean of the Caixin Research Institute, believes that in the second half of the year, it is necessary to balance the multiple goals of employment, stabilizing prices and stable exchange rates in the second half of the year. It is expected that the total tone is expected to maintain stability and looseness, and the core focuses on broad credit. Stabilizing real estate financing and cooperating with fiscal force to support credit expansion. It does not rule out the possibility of continuing to decline and asymmetrical LPR interest rates of more than 5 years, but the probability of comprehensive interest rate cuts is small.

In Wang Qing's opinion, considering the global economic slowdown in the second half of the year, the possibility of my country's export growth rate fluctuates downward, and real estate will run low for a period of time. In addition, domestic consumption restoration may be slow, and the policy surface is in the direction of steady growth. It will maintain high continuity, and the possibility of retreating or even turning is very small. As a result, the focus of monetary policy operations may be to stabilize policy interest rates, focus on guiding the actual loan interest rates to decline, continue to reduce the cost of financing of the real economy, and consolidate the economic restoration momentum with wide credit.

Responsible editor: tactics

- END -

Citizen calls to reflect the "bare" pavement?4 mango trees arrangement

Text/Yangcheng Evening News all -media reporter Fu Chang correspondent Yi Peng, Li...

Henan Provincial Children's Hospital launched the "Red Club for Medical Program" activity

Henan Children's HospitalStart the Red Club for Medical Plan activity, the first s...