Service experience upgrade of bank financial lending business

Author:Everyone is a product manager Time:2022.07.20

Edit Introduction: In the current fast -paced, the handling of financial business has higher requirements for the financial industry. On the basis of efficiency first, we must also pursue a service experience. This article takes a bank's financial lending business as an example to analyze the idea of optimizing and upgrading its service experience. Let's take a look.

In today's pursuit of efficiency, consumers who handle financial business have higher requirements for the financial industry. Banks also continue to improve their service experience in pursuing service efficiency and service accuracy. This article takes a bank's financial lending business process and product architecture as an example to explore the road of bank service upgrades.

This service upgrade is mainly through the mysterious people's unannounced visits, competitive comparison, satisfaction survey, and user interviews, etc., and sort out the processing process and experience measurement of the financial lending business. Combining the characteristics and development direction of the product of the party, the service design is the core and the driver. Force, experience upgrade at the level of borrowing business service processes and product structure, and create a more temperature -based financial product lending experience.

1. Analyze the problems and clarify the direction

With the deepening of the research, we found that due to the diversity of loan products and the multiple levels of users, the borrowing business has obvious problems at the service experience level, including the cumbersome business processing process, the messy and offline channels, the multi -channel breaks, and the multi -channel fracture, and the multi -channel breaks, and the multi -channel breaks, and the multi -channel breaks. Business processing process and information opaque, user passive acceptance, etc.

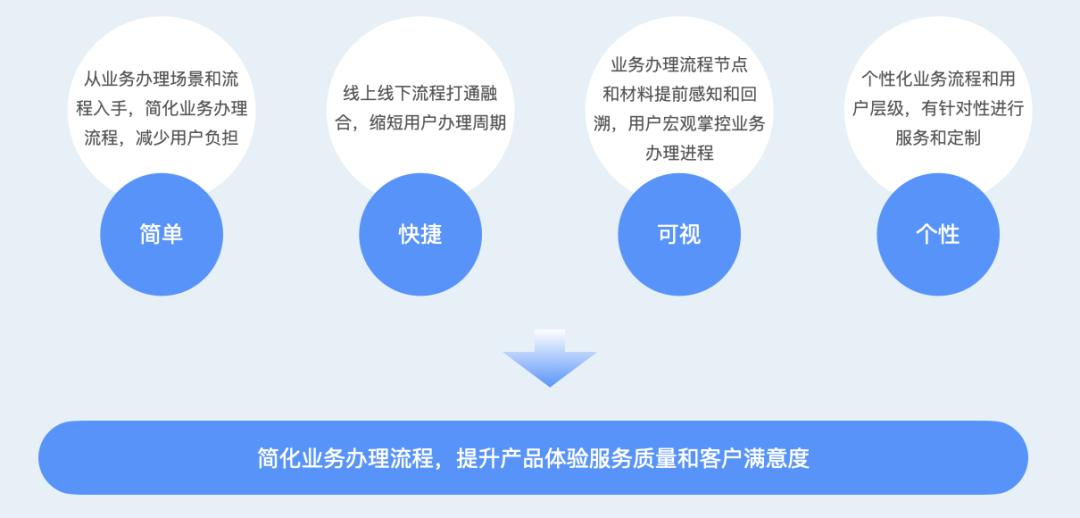

In this experience upgrade project, we analyzed and discussed the current situation. Multi -brain violence with Xingfang, experts, and KOL users, refining the four keywords of "simple", "fast", "visual", "personality", and divergent and thought about the two dimensions of "products" and "service". Provide direction and guidance for subsequent experience improvement and product design.

"Simple", we start with the scenario and process of business processing, simplify the processing process and user information entry of the loan business, and reduce user burden; Simple. On the "fast", the business processes and information sharing of offline and online will reduce the barriers to handling of different channels and shorten the user's processing cycle.

In the "visible", through the visual design of the business processing process and the user behavior trajectory, users can retrospective and perceive the handling nodes at any time.

"Personality", layered and labeling through user portraits, personalized services and business recommendations for users, and accurate marketing improves user satisfaction.

2. Sceneization to create intimate services

Each node handled by the loan business must take into account the most true needs of users and the services they want to get, which is the main point of service design. Corresponding to the bank's financial lending business, from the perspective of the behavior path of a lending user, it can be disassembled to customer acquisition-product introduction-application for handling-contract lending-repayment loan. Different stages correspond to different user psychological characteristics and the focus of loan business.

1. Touch customer acquisition

Whether it is a traditional industry or an emerging industry, it is always the first step when the new and new industries are ongoing. At this stage, enterprises should be seen by users through different channels and media, that is, where the target users are promoted.

At this time, we must pay special attention to the use of scenes. Our publicity and marketing must fit the actual scenes and needs of users, and to awaken a psychological state or needs of users through the scene. In short, at the moment when financial borrowing products are invited to users, whether there is accurate internal motivation and good expectations of "borrowing tomorrow's money, round today's dream":

Pre -spending a fee, add some decoration to the newly purchased small home, solve the urgent eyebrows of graduation rent, add a long -lasting set of sports equipment ...

Under the principle of security and credibility, the market -oriented marketing concept is rationally used, and accurate control of contacts, cooperative merchants, etc. Realize the success of users.

2. Product introduction

In most cases, the most important contact of the product introduction link is people, that is, the customer manager of the party. Therefore, the image of good online/offline customer managers, keen demand insight, and higher business level determine the height and satisfaction of the user experience in the product introduction link.

During the product introduction stage, it is necessary to solve the confusion and doubts encountered by the user in the product cognition stage through the customer manager, including the user's cannot be solved by itself, the product information is simple, the content is not accurate, and the product introduction entrance cannot be found or explained in detail that it cannot be reached. The reliability of information is afforded by the customer manager, and the information of the information.

To enhance the service experience at this stage, the contact link needs to do a good job of experience in the three aspects of users, customer managers, and explanation of text. Such as the ability to empower users to understand, familiarize with product and solve problems, improve the response speed and service attitude of customer managers, and improve product information (paper & electronic product text) transparency.

3. Application

The stage of "application for application" requires the close cooperation of the user and the customer manager, the high -dense information confirmation and feedback of the user, the collation and submission of the application materials, the clarification of the loan license (the application amount, the type of loan), the determination of the rights and obligations (the right to determine the rights and obligations ( Including the phase of repayment period, interest rate, repayment method, repayment restriction and supplementary description, etc.).

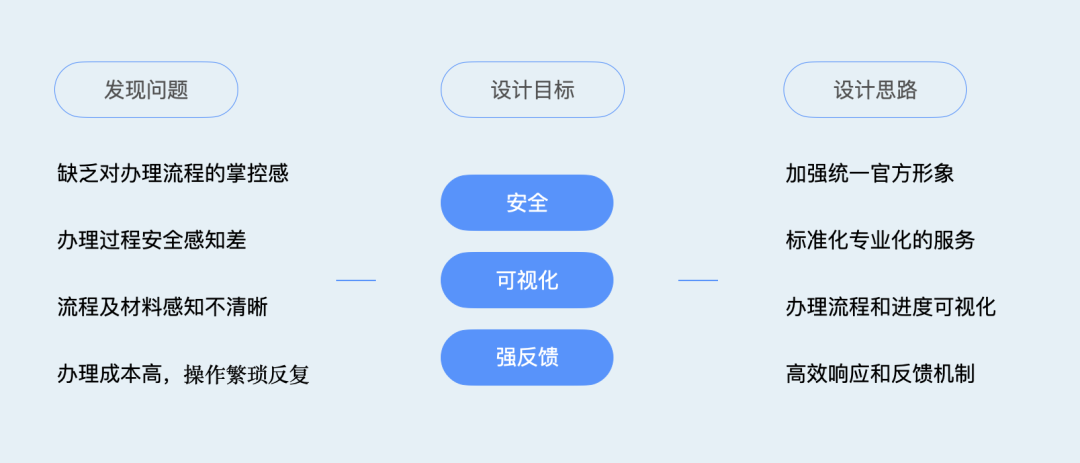

The availability of the business system (platform & customer manager) at this stage, and the values that indirectly conveyed, are important factor affecting users' experience in the entire process service experience. At this stage, the pain points of users include the lack of control of the entire process, poor security sense of the application process, poor sense of security, poor official certification, unclear perception of the application process and required materials, and high application operation costs. In order to solve the problems of various contact users in the "application processing" stage, the focus needs to do the three aspects of process design to improve the sense of security, strengthen visualization, and ensure strong feedback.

Specifically, first of all, you need to achieve the consistency and unity of various channels during the application process; the customer manager of online/offline docking can provide professional standard services; The list and instructions help to facilitate users to prepare and submit, provide offline multi -channel submission window; when users handle abnormal processing, there are professional staff to follow up and process them in time, feedback and answer users in a timely manner to help users better apply for bidding.

4. Signing loan

The sense of ritual and smoothness of the signing process, the etiquette and attitude of the signing staff, the readability, preservation of the loan contract, and the initiative to the user when signing, etc., all affect the user's emotional experience (tension-relaxation, embarrassment- Nature, cramped-soothing, worry-calm), which affects the user's perception and evaluation of the professionalism and safety of the entire institution.

The signing process needs to avoid excessive PUSH users as much as possible, arouse tension and passive adverse perception; avoid the open environment and pay attention to the protection of user privacy; matter. At the same time, it is necessary to inform users that the end of the contract does not represent the end of the transaction. Continuously follow -up and professional and timely consulting services to be opened to users all the time, which will effectively enhance user satisfaction.

5. After repayment loan

Users at this stage have a sense of stress and tension, but at the first repayment, hesitant, worry and grievances may be hesitant, worry and grievances due to unclear repayment information and cold attitude of the customer manager. Experience in the process affects the evaluation of the experience of the entire process.

As the "end point" session of the full -process user experience, we must pay more attention to the details and methods of user services at this stage, including reminding users to repay information and repay the way through SMS, WeChat, and APP. Do not disturb the user too much; the maintenance of post -loan relationships, such as the first repayment reminder, subsequent process notification, problem consultation response speed and feedback quality.

During the post -loan phase, the professional timely and timely nature of repayment and post -loan reminders, customer return visits and service processes notifications, and standardization processes of overdue management need to focus on attention.

By analyzing the "five processes+N contacts" of the bank's financial lending business, it is not difficult to find that: If you want a better user experience, you cannot just focus on how many functions, how rich the types are, and how detailed the help of the help book is. Waiting for a few one -sided service islands, but based on the experience scene, the user experience process is chained into a chain, and the "user -centric" service design concept is implemented at all contacts and stages. Point to experience safe, convenient and comfortable services.

Author: Li Mingming, the director of salt by ISAR.

Source Public Number: Yisa UXD College, focusing on user research and user experience design

This article is authorized by everyone's cooperation media @飒 飒 UXD, and is prohibited from reprint without permission.

The question map is from UNSPLASH, based on the CC0 protocol.

- END -

Northern for love, public welfare has you!Recruitment of legal aid lawyers in Taiyuan City

Shanxi Evening News (Reporter Li Xifang intern Duan Xiuqing) On July 13, the Taiyuan City Legal Aid Center issued an announcement to publicly recruit legal aid lawyers to the society to form a team of

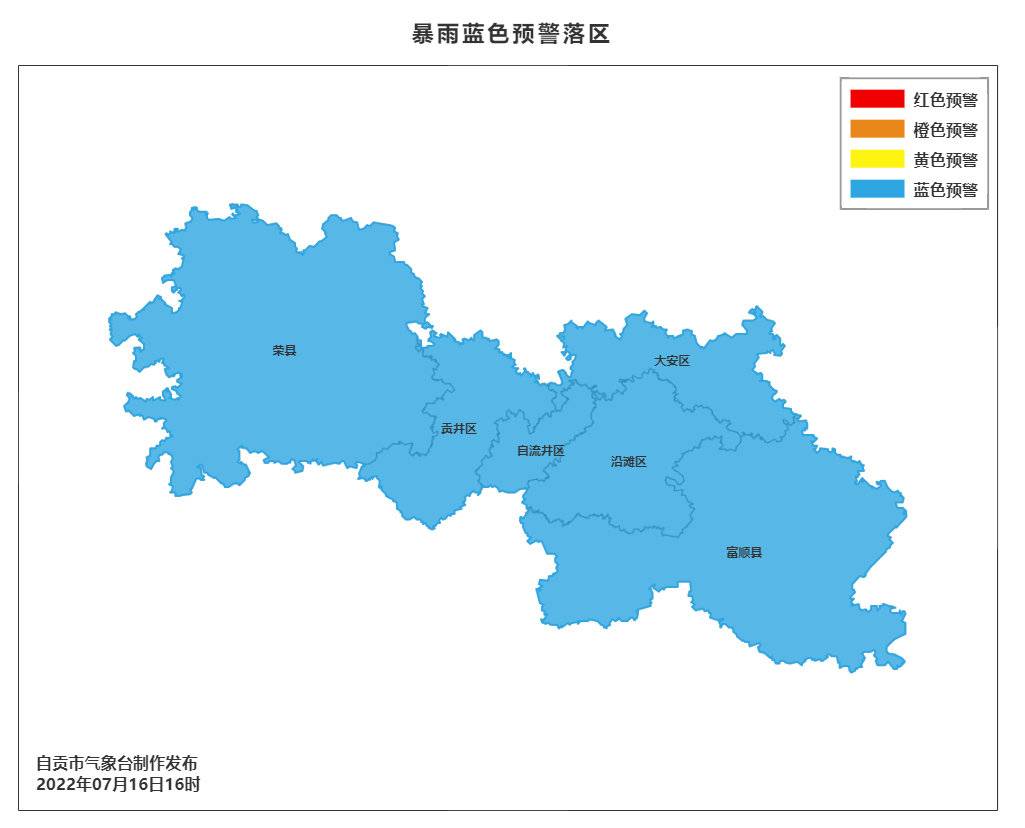

The heavy rain is here!Sichuan Zigong from the evening of the 16th to the evening of the 17th is expected to have a heavy rainstorm, and the extremely high temperature weather will end.

Cover news reporter Liu Ke ShengAt 16:40 on July 16th, Zigong City Meteorological ...