How does the world's top fund managers deal with uncertain environments?

Author:Huaxia Times Time:2022.07.20

Taide Sids

The leadership and management of investment institutions need to be continuously implemented and improved in the normal market environment. However, every 10 years, the market will subvert any concepts about "normal", which tests managers during the period of stressful and uncertainty.

For the psychological challenges brought by stress, Michael Mobson described the following description:

When we feel stress, we shorten our field of vision; when we need long -term eyes, we start to be short. In real life, people usually pay more attention to bad things. Psychologically, long -term thinking and paying more attention to negative factors because of stress, from the perspective of investors, it is not a good thing.

Capital allocation strategy of special periods

The new coronary pneumonia's epidemic provides an observation case for how the chief investor responds to uncertainty. The new coronary virus has brought unprecedented challenges to the economic development of countries around the world and the health of the people. The chief investment officer will face the situation of unlimited home office, stock market fluctuations, and sudden suspension of global economy.

Under the guidance of their respective investment concepts, the chief investment officers soon formulated a guide to leadership and management facing uncertainty.

Mark Bomgatna borrowed a military narrowing language and needed an OODA cycle in response to a VUCA situation. Different chief investment officers are seeking similar paths in their own way.

The chief investment officer first needs to adapt to the new work scenario. Online exchanges have become the normal state of communication between internal teams, investment committees and managers. Investment teams are often small in scale, and team members are accustomed to traveling, which makes it easier to transform than large enterprises. The original remote dialogue and online communication are not much different.

Once the internal team is completed, the chief investment officer will pay attention to the liquidity of the investment portfolio. Most people are accustomed to evaluating the liquidity of the asset side of the balance sheet. Few people have considered the impact of the rapid rise in debt, and this virus is popular with some answers to unknown questions:

• When can the school be reopened? What does this delay on college income mean?

• With the decrease in travel, what are the needs of the foundation of the foundation?

• When the hospital concentrates on handling the new crown pneumonia, how does the original high -profit volunteer project sharp shrinking will affect income and profits?

• How can the income arrest affect the company's annuity account?

• How should the pension fund balance the retirement demand in the future and the current severe economic difficulties?

When the chief investment officer seeks investment opportunities in the market, he may have to consider the new variable of the company's potential income impact. They collected a lot of information from the fund manager to try to clarify the situation, calculate performance and evaluate risks. They read thirsty and communicate with various carefully selected experts to understand the possible problems and opportunities that may occur in the future.

Many conversations convey and confirm the original expectations. For some people, it sounds a new alarm, while others think it is a new opportunity.

Persist in the mission in the crisis

Great market fluctuations are a good opportunity for investors to adjust risks and expected income. Those institutions with sufficient technology and data system support quickly and have a firm grasp of the results, while those institutions without modern technical support will be significantly behind. It turns out that the accurate estimation of basic scenarios is particularly important when considering future opportunities.

At the same time, the action of experienced chief investors will be relatively slow. Andrew Gorden was not in a hurry, but wanted to understand whether he was focusing on the right thing. The epidemic caused a discussion on epistemology within his institution. The team members wanted to understand what they knew and how they knew. He was proud of his wisdom from his team from the past crisis, but also embarrassed by his failure to absorb the same lesson, especially the direction of investment portfolio and real world. The crisis will allow great leaders to re -understand themselves before taking action and re -examine their assumptions.

Before taking action, the capital configuration will turn to the fund manager they trust. Because the fund manager did not change the investment concept, they just balanced their holdings and reducing strong positions by increasing their holdings and reducing strong positions. The most important allocation funds will flow to the fund manager who has previously closed the purchase or a fund manager who is particularly good at a attractive field.

For all these steps, for the fund managers who have not entered the investment portfolio before, it is like opening the door of the shelter. But these actions are almost invalid, because at this time the code of behavior adopted by the chief investor is constant.

It is not until all the dust settled that the chief investment officer will start to find new investment opportunities. As the Chief Investment Officer of Oxford University Donation Fund Sandra Robertson said in mid -April 2020, the stock market rebounded quickly at that time, "it is too late for sale now, but it is too early to buy."

When capital configurations are preparing to find new fund managers, they will first look at the fund manager observation list. This list will inevitably include private equity funds or venture capital funds that have been closed before, leading private credit fund managers, and public fund managers who have been tracked for many years. There is a list of shopping lists that are prepared to be fully prepared to buy at any time when the assets are discounted. Finally, when the market fluctuates, capital configurations will also find some attractive tactical opportunities. During the new crown pneumonia's epidemic, if the ride of bankruptcy comes, the chief investor will pay attention to bad debt; if the interest difference is kept wide, it will pay attention to private credit; once people establish a new way of life and work, they can pay attention to different assets. Tourism and leisure industries in the category and potential opportunities in the real estate field.

Capital configurations have never imagined to rely on creating a list to deal with the new crown pneumonia's epidemic, but coordinate internal operations, collect information, evaluate liquidity and risk, monitor existing investment portfolios, tap new investment opportunities, maintain desire lists, and establish new new ones These affairs such as commission relationships will become a common action program for their mission in uncertainty.

Soon after turbulent and turbulent, the market rose again. Most of the actions led by the chief investment officers did not bring substantial investment portfolio adjustments, but these operations made them prepare for the next similar situation.

(The author is the president and joint investment officer of the President of Wall Street Disciples Partnership Fund, this article is taken from the book "Smart Fund Manager")

Editor -in -chief: Fang Fengjiao Editor: Cheng Kai

- END -

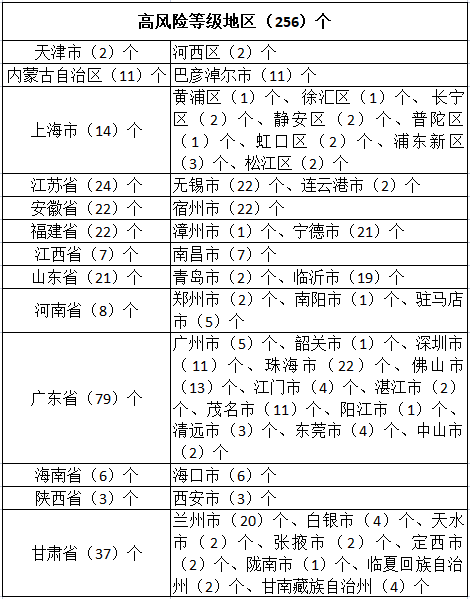

The latest and high -risk areas in the country are announced!Heilongjiang Provincial Centers for Disease Control and Control Reminder

At 0-24 on July 13th, a total of 86 new types of coronary virus pneumonia were rep...

up to date!Sri Lanka will hold a special meeting of party leaders, and the president has officially announced his resignation

According to CCTV News on the 11th, according to the Sri Lankan Prime Minister's o...