Feng Mingyuan's fund management scale in the second quarter reached 42 billion!Focus on new energy, technology, high -end manufacturing

Author:Daily Economic News Time:2022.07.20

On July 20, the Fund Management of Feng Mingyuan, a subsidiary of the Cinda Australia Fund, announced that the 10 funds that have been managed in the quarterly, at the end of the period, the total net asset value of the fund has reached 41.992 billion yuan.

From the perspective of its heavy positions, it still focuses on the track stocks, and still focuses on emerging industries such as new energy, technology, and high -end manufacturing. Compared with the previous reporting period, the industry configuration has not changed much. Configuration of consumer industries such as products.

Feng Mingyuan's management scale has reached 42 billion yuan

From the manager of the Xin'ao New Energy Industry Fund in 2016, Feng Mingyuan has been in charge of 10 public fundraising funds. In the past 6 years, he has always approached the new energy industry around the technology stocks. It shows that the net asset value of its management has been close to 42 billion yuan.

On July 20, a number of funds under the Cinda Australia Fund announced the second quarter report. All the 10 products managed by Feng Mingyuan were revealed. From the perspective of the net asset value of the fund at the end of the period, the statistics of all shares have reached 41.992 billion yuan, an increase of nearly 6 billion yuan compared to the 36.392 billion yuan at the end of the first quarter.

Xin'ao Zhiyuan was a new fund established this year. Feng Mingyuan began to serve as fund managers on January 25. It has allocated heavy positions such as Ningde, BYD, Wuliangye, and pilot intelligence.

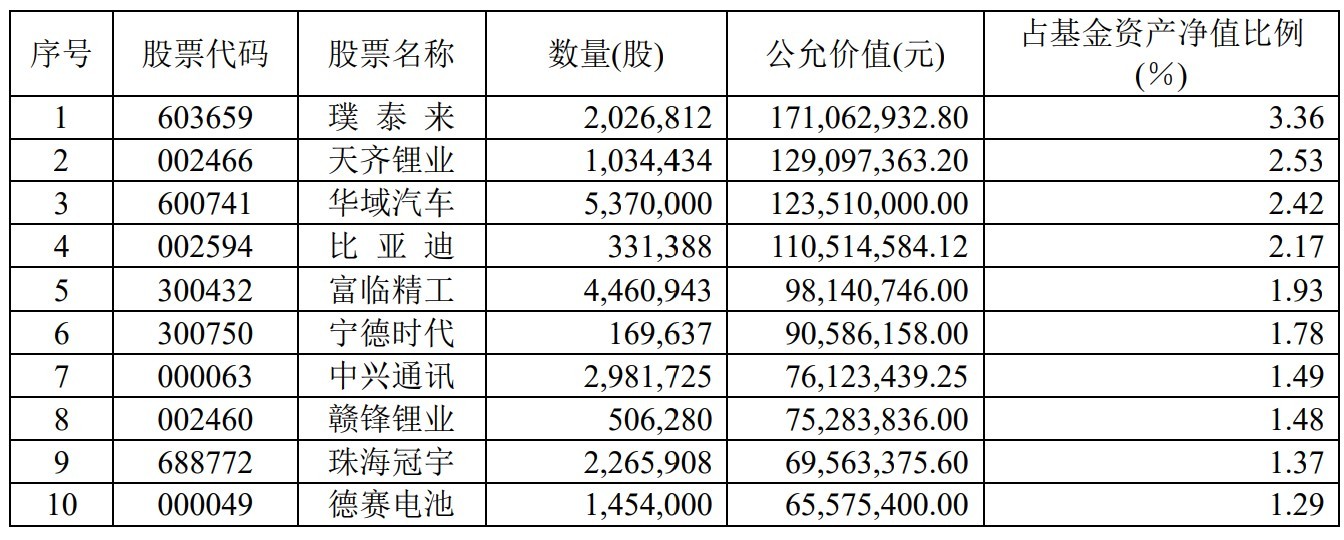

Note: Xin'ao Zhiyuan's three -year heavy positions statistics (second quarter of 2022) Source: Fund second quarter report

By the end of the second quarter, the overall allocation direction has not changed significantly, but the number of heavy stocks has decreased significantly, especially in Ningde Times, BYD, Wuliangye, Guizhou Moutai, etc. The sequence of heavy warehouses, the top ten heavy positions in the newly entered Dedai Battery, Zhuhai Guanyu, ZTE, etc.

Generally speaking, the targets of heavy warehouse stocks of the other nine funds are similar to Xin'ao Zhiyuan for three years. They still focus on emerging industries such as new energy, technology, and high -end manufacturing. Compared with the previous reporting period, the industry configuration has not changed much. Not configured Hong Kong stocks. In the quarterly report, he pointed out that looking forward to the future, a combination of economic weak recovery+abundant liquidity may be difficult to continue. The market will pay more attention to the quality of the fundamentals. High -quality stocks with a solid fundamental face have excavated investment opportunities from bottom to top.

Now I have left Ren'ao Essence Fund Manager

It is also believed that the Australian Fund announced on July 20 that Feng Mingyuan had left the Essence of the Nobunaga Essence Mixed Fund Manager on July 19. At the same time, Qi Xingfang was left in office. At this point, the number of funds managed by Feng Mingyuan returned to the number. The company said that the reason for the departure was internal adjustment, and the change procedures have been completed in the China Fund Industry Association in accordance with regulations.

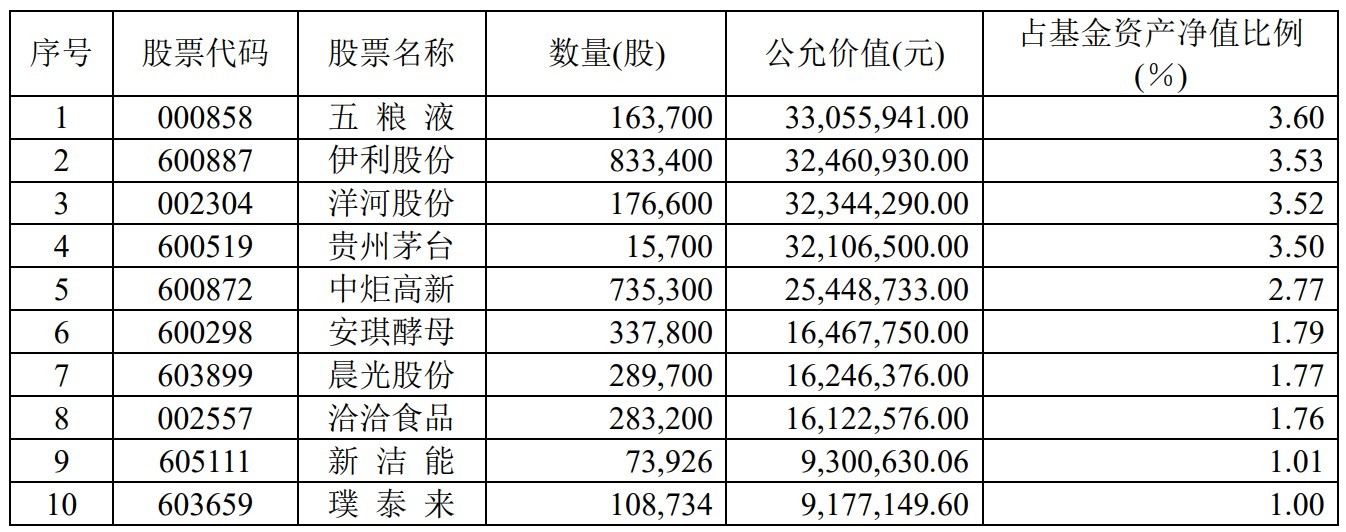

In fact, the Mixing Mixing of Xin'ao Essence is also the most differentiated among other Feng Mingyuan management funds. It is reflected in heavy warehouse stocks. The fund generally focuses on the mass consumer goods sectors such as white wine and food. Shares, Yanghe shares, and Guizhou Maotai are ranked in the top four heavy stocks.

Note: Source of Xin'ao Essence Heavy Warehouse (2022) Source: Fund No. 2 Report

According to reporters, most of the top ten heavy stocks are consumer segments. In the first quarter, the fund's heavy warehouse was still in the field of technology stocks. At that time, the Ningde Times, Hengxuan Technology, Yangjie Technology, Wentai Technology, Shengbang, and Minxin had faded out of the sequence of heavy warehouse stocks. It can be seen that it can be seen that it can be seen that In the second quarter, the fund's key investment direction has changed.

The fund manager also said that the configuration of consumer industries such as liquor and mass products was added during the season. Looking forward to the future, with the gradual control of the domestic epidemic, the trend of domestic consumption recovery is expected to continue, and it will continue to work on major tracks such as large consumption and high -end manufacturing.

It is understood that Zhang Jiantao, who is currently reserved, joined the Cinda Australia Fund Management Co., Ltd. in 2017. He has been a researcher and fund manager assistant to engage in investment research. Since April 2022, he has served as the manager of Xinta Australia's Essence Flexible Configuration of the Hybrid Securities Investment Fund Fund. The essence of Xin'ao is the first fund for its participation in management.

Daily Economic News

- END -

Wengyuan County Meteorological Observatory issued heavy rain red warnings [Class/particularly seriou

Wengyuan County Meteorological Observatory upgraded Wengyuan County Longxian Town and Wengcheng Town Rain Orange Early Warning signal at 04.48 on June 10, 2022 to red.Effective, the yellow warning sig

Organization Department of the Zibo Municipal Party Committee of the Communist Party of China: Forging a high -quality cadre team with the heavy responsibility of "walking in front and opening a new bureau"

In order to thoroughly study and propagate the spirit of the 12th Party Congress of the Provincial Congress and promote the continuous achievements of organizational work in the province, the Organiza