The stock price rises!What is the leader of the new energy of the porcelain, what is the chemical leader?

Author:Financial and economic Time:2022.07.19

Wen | No rust bowl

Inside the new energy battery, a war around the element cycle table has begun.

In the past half a month, lithium in the capital market has become a "new" metal, but it is 钒.

On June 29th, a "Key Requirements to Preventing Power Production Accidents" issued by the National Energy Administration's comprehensive department, "钒 batteries" that have been farewell to the main stage for many years, re -pulled back to investors' vision.

This requirement clearly mentions that medium and large -scale electrochemical energy storage power stations must not use ternary lithium batteries and sodium sulfur batteries, and should not be used to use power batteries. As a power storage device that takes into account safety and efficiency, it is undoubtedly usual.

On July 5th, the concept of batteries broke out in full. The overall increase of the sector exceeded 9%. The leading climbing steel vanadium (000629.SZ) 3 days 3 boards.

At the same time, the "titanium pink" industry separated by a wall, including medium -nuclear titanium white (002145.SZ), and Jinpu Titanium (000545.SZ) and other enterprises, also rose sharply because of the extraction of waste in waste.

As of the afternoon of July 19, the stock price of China Nuclear Titanium White has risen by more than 40%compared to a month ago.

Why is the battery sector hot? Why do titanium companies follow the wind?

This article will be interpreted from the three perspectives below:

1. Why is the battery and titanium companies favored repeatedly?

2. What restricted the industrialization of the 的 battery?

3. The prospects of titanium white powder enterprises?

Capital found "the perfect battery"

Objectively speaking, the popularity of 的 batteries cannot be separated from the overall upward trend of the new energy industry.

However, as many experts have pointed out, the core topics of the new energy industry are not "power generation", but "energy storage".

The root cause is the problem of "electrostatic peak". The summer night in our country is the peak time of electricity. The peak problem must rely on the "energy storage" link in the middle.

At present, the world's mainstream energy storage methods are pumping water storage, that is, the power station of the peak period is to the water station, from the downstream pump to the upstream, and wait until the peak of electricity.这一模式虽然可行,但并不是每个地区都有建设水电站的地理和财政条件,因此,在水电站这样的“巨型充电宝”之外,再搭配一系列“中小型充电宝”——也就是Chemical battery energy storage devices are very necessary.

This is why the battery can be on fire. Compared with the concepts of energy density and operating costs, the primary factors considering building large chemical battery storage stations are safe. The advantages of 钒 battery are also obvious. In summary, it is:

"It can be installed than it is safe; it is safer than it, it can be installed without it."

Compared with other chemical batteries with complicated ingredients, 钒 batteries can be said to be a "clear stream" in the battery industry.

钒 Battery technology principle

The positive is extremely stingy, the negative electrode is 钒, and the electrolyte is also a cricket. The entire battery is the existence of the chemical process of absorbing and release electron in the price conversion. The technical principles and ingredients of the battery can be said to be "clear and bottom."

On this basis, the battery also has a series of advantages of long life, closed operation without pollution, no selection requirements, fast startup speed, and high charging efficiency.

Not only that, in a macro perspective, the battery has an advantage that the lithium battery can never compare -reserves advantages. my country ’s lithium resource reserves account for only 7%of global reserves, while the reserves of tadpoles account for 42%. The rich reserves are not only self -sufficient, but most of them are easy to extract vanadium titanium magnetite.

Therefore, in terms of security, convenience, cost, and strategic consideration, the battery is a major "preferred" of future energy storage, which is also the reason for the market for the concept of the cricket battery.

According to the estimates of Zhejiang Business Securities, it is expected that in 2025, the cumulative installation of the 钒 battery will reach 4.3GW, and the 5 -year CAGR will reach 112%, and the industry market will be broad.

So, why does the concept of battery -related concepts drive the daily limit of titanium companies?

The answer is still unable to turn around. Like the symbiotic relationship between 钛 and titanium in nature, at present, my country's titanium pink powder enterprises and 钒 companies are essentially different branches in the same industrial chain.

Like the corporate enterprise, the titanium -white powder enterprises are used to make titanium dioxide raw materials, including vanadium titanium magnetite, and high titanium residue obtained after purifying the mineral. There is an inevitable existence.

On July 7, Longbai Group, a titanium white powder company, mentioned in response to investors' questions that the company's chloride titanium pink powder waste acid can be used to extract 钒.

At the same time, the nuclear titanium white in another major leader of the titanium pink industry also issued an announcement saying that the company intends to set up the establishment of a pupa material company to jointly promote the development of ore resources, the manufacturing of the electrolyte, and the implementation of the related supporting industries. At the same time, the two parties will also study the plan for pilot demonstrations of nuclear titanium white 2GW source network lotus storage projects.

According to the industry's views, the transformation of titanium companies has a greater "innate advantage", which is specifically to develop the re -use advantage of by -products and the indicator advantage of the EIA.

From this perspective, in the moment when the enterprise has been singing high, capital has favored titanium enterprises, which does not seem to be surprising. Who will "hit" the price of the 价格?

However, in this wave of rising batteries, how many cakes can titanium companies eat, it is actually unknown.

As mentioned in the previous article, the demand for raw materials from technical principles to raw materials is clear and clear. In the future, the industry competition of 钒 batteries is actually a battle around metal.

Different from the quotes of the three major metals of lithium, cobalt, manganese, and lithium at the same time, the battery market is basically "the world can get the world."

As of 2021, the domestic yield output exceeded 50,000 tons, and the corresponding five -oxidation two 钒 output was more than 110,000 tons, accounting for about 70%of the global total output. Steel strength, toughness, ductility and heat resistance. It is reported that the 钢 alloy steel is widely used in the production and construction of oil/trains, buildings, bridges, rails and other production.

From this perspective, although the current domestic production is high enough, the part of the battery is almost there. Therefore, with the expansion of future infrastructure demand, and the implementation of the industrialization of the cymbal battery, the importance ,it goes without saying.

This also means that the first round and long -term dividend of the industry must belong to the head enterprises of the industry chain. Specifically, it is the holder of the ore ore and the holder of the 钒 extraction technology.

Different from the extensive distribution of common metal elements, at present, my country's extracted mines are mainly distributed in Panzhihua and Hebei Chengde, Sichuan. Among them, the reserves of the Panzhihua area in Sichuan account for 87%of the domestic proven reserves. The rest, including Gansu Province, where the central nuclear titanium is located, the main distribution of the ore is stone coal. Although this type of mineral rational is simple and easy, the resource utilization rate is poor and there are extremely serious environmental protection issues. At present, it is basically basically basically. Prohibited.

"The clever woman is difficult to cook without rice", there is no ore, no cricket, no matter how big dreams, they are just talking on paper.

As mentioned in the Everbright Securities, the important factor in restricting the industrialization of battery battery is the shortage of supply.

So, how much can titanium companies provide in this cycle?

The answer may not be optimistic. First of all, in principle, 钒 is just a waste acid product for titanium -titanium -to -titanium dioxide. It is a by -product and only has the ability to extract and produce. The fluctuation of the demand for titanium powder may be difficult to guarantee.

On the other side, the ability to produce titanium companies is also limited. Take the Titanium White Powder Giant Longbai Group as an example. In 2021, the total output of the company's titanium pink was 817,200 tons, and the corresponding wastewater containing a total amount of 3,000 tons, and these crickets could not be extracted.

Correspondingly, the output efficiency is really not high, but considering that the Longbai Group has the largest vanadium titanium magnetite ore with Panzhihua, there may still be room for business changes and transformation to produce crickets in the future.

In contrast, China Nuclear Titanium White, a company in Gansu, is even more embarrassing in the status of the concept of battery battery.

A paper published by the Jinzhou Iron Alloy Group in June 2002 shows that the average content of the elemental element in titanium ore generally fluctuates about 0.2%-0.1%, and the titanium residue is 55%, and the 69%slag rate rate is calculated. The actual 400 tons of titanium dioxide production capacity corresponds to the output of 1 ton of 钒. Considering the efficiency of the use of wastewater, according to the production capacity of the medium nuclear titanium white in 2021, its current yield is unlikely to exceed 800 tons.

The size of the capacity of the 钒 battery has a very simple mathematical relationship with the amount of demand and the demand of the 钒. The demand for 1GW 钒 battery is 10,000 tons. According to this number, the new energy power generation project of the 2GW "Source Network Lotus Storage" invested by China Nuclear Titanium White, maybe it remains to be discussed.

From this perspective, most of the titanium companies that hold ores are not held. In this wave of industrialization of batteries, it is destined to be only a "accompanying runner", and the huge demand for market resources cannot be undertaken.

What is the prospect of titanium white powder?

Of course, this does not mean that titanium white powder companies are completely worthless.

In fact, even if it is not a hot spot for batteries, the titanium pink industry itself is worthy of optimism. As a kind of inorganic chemical pigment, titanium pink powder has been widely suitable for coatings, inks, paper, plastic rubber, chemical fiber, ceramic and other industries.

Earlier, the research report released by Northeast Securities pointed out that benefiting from the decrease in the production capacity of foreign titanium pink and the rapid development of the economic development of developing countries in Southeast Asia, the overseas demand of titanium pink powder increased rapidly, and the export growth rate in 2020 reached 21%.

Considering the needs of the upcoming wave of infrastructure, it can be said that the titanium pink industry is entering the "prosperity cycle".

On April 26, China Nuclear Titanium Black disclosed the 2021 annual report. During the reporting period, the company realized operating income of 5.374 billion yuan, an increase of 44.64%year -on -year; net profit attributable to mothers was 1.217 billion yuan, an increase of 156.03%year -on -year, all of which hit a record high.

At the same time, China Nuclear Titanium White also disclosed the first quarterly report of 2022. The company achieved operating income of 1.489 billion yuan, an increase of 20.52%year -on -year; the net profit attributable to mothers was 300 million yuan, an increase of 4.61%year -on -year.

Behind the growth, an important reason is that the supply of gold and red stone -type titanium pinks in China Nuclear Titanium White is in short supply, and the sales price has increased significantly year -on -year. Different from ordinary industrial products, the proportion of titanium pink industries has a large proportion of the right to speak upstream. Globally, the "Cartel" of the head titanium white powder enterprises has been firmly controlled by the pricing power of titanium pink. According to incomplete statistics, in 2021, the price of titanium pink rose 10 times a year.

It can be said that even if it is honest with the titanium white powder, the value of medium -core titanium white is still worthy of market optimism.

Unfortunately, this company frequently "interacts" new energy in the announcement, and uses the resources in the wastewater to first officially announce the green circulating industry economy of "sulfur-phosphorus-iron-titanium-lithium", and said that it is necessary to build iron phosphate. The lithium production base, and the Weili entered the battery industry chain.

This series of announcements of the "good" new energy will undoubtedly exhausted the market along the "good" new energy announcement.

From a more macro perspective, the leading chemical leaders must rely on "touching porcelain" new energy to attract the popularity of the capital market. This incident itself may also reflect the current "deformity" preference for new energy for the new energy sources.

- END -

"Healthy Life Green and Non -toxic" -An Yuzhou Court launched the "6.26 Anti -Drug Day" publicity activity

June 26 is the 35th International Anti -Drug Day. The Yuzhou People's Court organi...

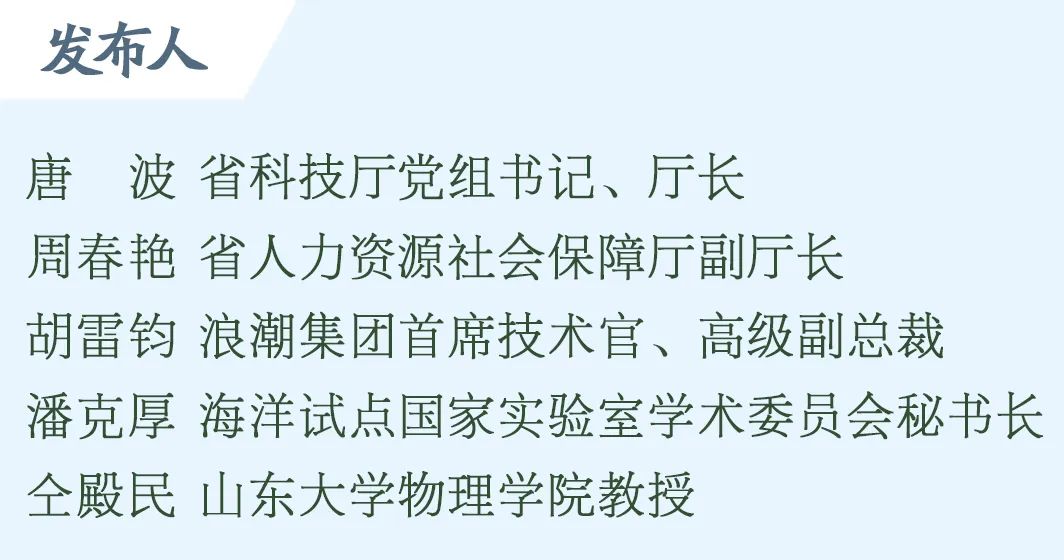

Shandong: Focus on strengthening key technologies in the industry and accelerate the realization of high -level technology self -reliance

This morning, the Provincial Government News Office held the third session of the ...