Interview with Langlang Li Wen: Green Finance's internationalization is not unidirectional, but also promotes the transformation economy based on the local area

Author:21st Century Economic report Time:2022.07.19

The 21st Century Economic Herald reporter Li Dchangyu intern Zhou Yiting Beijing reported that with the initiative of the international voluntary organization, the trend of unified standards and frameworks gradually formed, and the internationalization of green finance has become a hot issue for discussion. China's banking institutions have also set off a wave of joining international organizations and adopting international sustainable development initiatives.

According to statistics, as of the end of 2021, 4,935 institutions have joined the responsible investment principle organization (PRI) worldwide. (TCFD).

However, for financial institutions, it is just a one -way restraint mechanism to join international organizations and signing initiatives, or is it an endorsement method for enterprises to build social trust? How should Green Financial's internationalization understand? What efforts can financial institutions make in order to promote the development of green finance in my country? Under the advancement of green finance, how to solve the problem of traditional energy companies?

Recently, a 21st Century Business Herald reporter interviewed Li Wen, Dean of the Research Institute of Menglang Sustainable Digital Technology (Shenzhen) Co., Ltd. She revealed that in recent years, my country's financial institutions have actively joined the principles of the equator and international initiatives such as responsible banks, which is the trend of green finance. Many banks may have signed these two principles at the same time and declare that they support these principles. However, in the process of disclosing the actual environmental information, the work in accordance with the model requirements of the above principles still requires institutional construction and guarantee.

Li Wen believes that the internationalization of green finance is not blindly following the trend and one -way constraint. We must see China's positive efforts as a leading role. However, under the current boom of "signing an international initiative", financial institutions should also be based on the local area, actively promote the development of the transformation economy, change their own ideas, and make strategic plans to further move to green finance international.

Individual banks may not conduct environmental information disclosure in accordance with the principles

"21st Century": What is the difference between the principle of responsible banking and the equator?

Li Wen: Responsible banking principles (PRB) and equatorial principles (EPS) are promoting sustainable development, which are different.

Responsible bank principles were initiated by the United Nations in 2019. This principle aims to provide banks with a consistent framework from the macro perspective of international organizations. This principle requires banks to set goals on their most substantial fields on the basis of meeting the UN sustainable development goals and the Paris Climate Agree Sustainable development.

First of all, it is clear that this principle is the United Nations in promoting the important principles it considers it, stimulating banks to make greater contributions in promoting sustainable development in the future. Secondly, after setting the goal, the banking industry needs to cooperate with customers in accordance with the principles of responsible to practice this concept. In addition, banks must take the initiative to negotiate and interact with the stakeholders, and finally implement the sustainable concept into the corporate governance and corporate culture of the enterprise.

The equatorial principles were first released in 2003. The initial initiator of this principle was also adopted by the adoption. It was 8 banks in developed countries such as Barclays and the Netherlands. Therefore, the equatorial principle is the goal set by banks based on its own business needs.

The concept of Green Finance comes from the "Love River Incident" in the United States in 1980. In this incident, the government ignored environmental risks and insisted on developing real estate and led to major environmental pollution, which eventually lost 250 million US dollars. This also makes banks aware that risk exposure to environmental risks will transfer to financial risk exposure. Therefore, the United States has promoted the "Super Executive Act", and for the first time, it clearly clarifies the concept of green financial and related systems, that is, providing financing channels and methods for green development. As a result, the emergence of the equatorial principle is essentially providing environmental risk management and the principles of social risks. The equatorial principle is a set of guidelines for the banking industry, providing standards for the overall green financial business of banks.

"21st Century": Are these two principles compulsory?

Li Wen: All institutions involved in the responsible bank principles and equatorial principles are voluntary compliance principles, which also leads to lack of compulsory. Taking China as an example, most banks in my country may have signed these two principles at the same time and say they support these principles. However, in the actual environmental information disclosure process, individual institutions may have a situation that did not carry out work in accordance with the principle.

"21st Century": How to regulate the standards in the section of environmental information disclosure?

Li Wen: In promoting the development of green finance, how to regulate environmental information disclosure is extremely important. In 2015, the Financial Stability Council (FSB) composed of G20 member states set up climate -related financial disclosure working groups (TCFD). In 2017, the group released the first formal report, that is, "climate change related financial information disclosure disclosure disclosure guide". The report provides an overall disclosure framework around the four themes of governance, strategy, risk management, indicators and targets. Because the publisher of this report, the Council of the Financial Stability, was jointly established by the financial departments of various countries in the G20 member states, the "Guide to Disclosure of Climate Change Related Financial Information" is an extremely important reference for the formulation of relevant policies and standards for the government. In meaning, more and more countries will take this guide in the future.

At the same time, the People's Bank of China also officially issued the "Guidelines for Environmental Information Disclosure of Financial Institutions" in 2021. It is also a recommendation standard that may move towards semi -compulsory or mandatory constraints in the future. In addition, at the United Nations Climate Conference in 2021, it was initiated by the International Financial Report Guidelines (IFRS) and established the International Sustainable Development Standard Code (ISSB). The council has formulated a set of sustainable disclosure standards based on international financial standards. Many experts predict that this set of standards may become the internationally connected credit launch standard in the future. In my opinion, only the global sharing the same set of standards to disclose and standardize, the overall green finance will move towards internationalization.

Traditional energy companies in transformation are worth investing in

"21st Century": Under the advancement of green finance, how should the transformation of traditional energy companies solve it?

Li Wen: my country has a very large funding gap in green finance, but early technology is immature and may not have high returns. Therefore, it is necessary to guide investors to invest in this direction, but also require the country's supporting incentive policies.

In addition to investing in new energy industries such as BYD, more traditional energy is worth investing in the transformation, which is precisely where some Western investors are optimistic about the Chinese market. The West has seen huge dividends and investment space in traditional Chinese industries. For example, traditional energy companies such as PetroChina and Sinopec have begun to make clean energy such as hydrogen energy and step by step into the carbon trading market.

In the past two decades, the development of clean energy in China has been amazing. Since 2000, the proportion of clean energy consumption such as natural gas, hydropower, nuclear power, and wind power is rapidly increasing, and has increased from 9.5%in 2000 to 24.3%in 2020, providing a good foundation for my country's energy low -carbon transformation. However, as the most consumer consumer in the world, there is still a huge gap to achieve the goal of 2030 non -fossil energy reaching about 25%and 80%of the 80%in 2060. Where does such a large resource gap come from? Look at my country's energy resource endowment is rich coal, less oil, and poverty. Energy must meet the development needs of more than 1.4 billion people. In the future, the long -term development of urbanization and industrialization will require huge energy supply. In the short term A large amount of traditional energy is required.

In addition, fossil energy development, storage and transportation, and utilization are very complicated and huge industrial systems and industrial chains. Large -scale transformation will mean that a large number of industrial workers will face unemployment. The imbalance of local economy. Therefore, you cannot shout slogans and idealism, and cannot ignore the transformation of financial supporting the energy economic structure with a huge transformation and development demand in China such as a developed country like China.

In terms of my country's national conditions, in the process of traditional energy to green and low -carbon transformation, considering the strategic and technical level of considering the at the same time to support national energy security, local economic and social stability, industrial employment and other sustainable development goals. In this way, the fairness and sustainability of transformation finance can be achieved.

Therefore, traditional energy is still a very worthy field in China. Traditional energy requires sustainable transformation and the assistance of transformation of finance. Through scientific and technological innovation and development of new energy, the industry's low -carbonization and green sustainable development are realized. Sustainable development goals.

"21st Century": What is the role of financial institutions such as banks?

Li Wen: First of all, from the perspective of responsible banking principles (PRB), in September 2019, PRB was formulated and officially released by the UN Environment Agency. At that time, the total assets of 132 signed banks in the world exceeded 47 trillion US dollars, which was 1/3 of the global banking industry assets. As of the end of April 2022, 275 banks have adopted the principle of responsible banks, accounting for 45%of the global banking asset scale.

China has 17 banks adopting this principle, including large state -owned banks such as ICBC, Bank of China, Agricultural Bank, Postal Savings Bank, and joint -stock banks. The reason why the United Nations attaches so much importance to banks is because in the green financial sector, the most important green investment and financing tools and products at present are still mainly green credit and green bonds. Loans and debt issuance are the main business of banks. Taking China as an example, China is currently the world's largest market for green credit and the world's second largest market in the world. These two parts account for more than 90%of the entire green investment and financing business. Green loans accounted for 90%of them, and the proportion of "Nine One" was formed as a whole. Therefore, in the process of promoting the development of green finance, banks play a pivotal role.

"21st Century": In the context of the "double carbon" target, how should banks integrate green finance into the actual business?

Li Wen: The realization of the "double carbon" goal is a complex system and system engineering, because the emissions of carbon, whether it is scope, two, or three, or the industry. Essence China's energy consumption structure is mainly based on fossil energy and allows high energy -consuming industries to achieve transformation. It requires a series of innovation and adjustments such as science and technology research and development, technical equipment, process processes, and production models.

This is why everyone feels that the carbon is "hot" in the past two years, but at the real economic level, it cannot be "quickly integrated". As far as the financial industry is concerned, the evaluation criteria for good green finance have not yet been found, and there is still a phenomenon of "washing green and bleaching". From the perspective of the development of green finance in Europe and the United States, the development of green finance generally goes through three stages: the preparation period, transition period, and acceleration period, and then enter a substantial track. China is now in a preparation period. During this period, the transformation finance supports the transformation economy.

The "dual carbon" goal proposes that the national huge emission reduction tasks will eventually break down the industries or enterprises with high carbon rows, indicating that some traditional industries need to be transformed quickly or gradually withdraw from the historical stage. However, 70%of our country's energy comes from coal and oil, and it is impossible to shut down immediately and completely in the short term. Among them, there is a problem of industrial life cycle, and it also involves national energy security and national sustainable development strategies. Essence The development of my country's transformation economy means that the transformation of the traditional energy industry should not be adjusted with a one -way "reduction", but at the same time, we must take into account the people -oriented, inter -intergenerational resources, and the balanced development of local and national economic and social development as the balanced development of local and national economic and social and society as the balanced development of local and national economic and social. This is the overall planning of short -to -medium and long -term development goals and the interests of multi -interest related parties, and led scientific and technological innovation, give full play to the two driving forces of policies and markets, pushing the goal of "3060", scientific research planning, multi -scenario analysis and multi -scenario analysis and multi -scenario analysis and multi -scenario analysis and planning Simulation, fully consider various uncertainty risks, fully respect and cultivate the sustainable development and adaptation capabilities of key industrial enterprises.

"21 Economy": For financial institutions, what is the most urgent thing to develop green finance?

Li Wen: First, the change of ideas. Both the equatorial principles and the PRB principle, TCFD requires financial institutions' decision makers and management to have a clear attitude and public commitment to the development of green finance. The board of directors should promise to make strategic planning and business integration in accordance with the principles signed, and actively advocate the concept of sustainable development. In reality, this concept has not completely covered the levels of the company and financial institutions. It is important to make ideas deeply rooted in the organization.

The second is to formulate strategic planning. On the one hand, in the top -level design of financial institutions, the principle of green development and ESG elements must be truly included in strategic planning and investment decisions. On the other hand, the establishment of an institutional system, such as the establishment of the Sustainable Development Committee, the ESG Commission, etc., to provide organizational guarantee and transform green development to the financial system. Some financial institutions in my country have begun to explore positive. For example, financial institutions such as Industrial Bank, Huaxia Fund, and Southern Fund have considered ESG elements into the company's sustainable development strategic system, set up a special committee, and set up a special ESG team. Essence

Combined with China's local national conditions to develop green finance

"21st Century": How to understand the internationalization of green finance?

Li Wen: On the one hand, when talking about the internationalization of green finance, many people will equate it with China to learn from the West, or use Western standards to restrict Chinese financial institutions. In fact, on the other hand, China's green finance development has both localization and positive contributions to the world. It is also an embodiment of internationalization to see China itself as part of an internationalization. In the past 10 years, my country has made a lot of exploration as a supply side of global green financial policy and has made positive contributions. This may be a bit beyond our conventional understanding, but it is indeed a Chinese delegation. For the first time, it introduced green financial issues to the G20 summit, promoting the establishment of the G20 green financial research team, and promoting the international organizational mechanism internationally. Regardless of government promotion such as policy specifications and regulatory requirements, as well as market performances such as financial institutions' framework innovation, expansion of green bonds, and green investment, my country's practice in the field of green finance has positive significance globally. In addition, my country has formed a value trend, and investors are more inclined to invest in innovative products that are beneficial to the environment and ecology.

As a result, the target of the "double carbon" goal is not a change in a single environment, but the goal of the transformation and development of the entire country. Under the national policy of the construction of ecological civilization, the proposal of the "double carbon" goal clarifies how to cope with climate change to achieve a major change in carbon peaks, carbon neutrality, and this.

Therefore, the internationalization of green finance is not one -way to follow the principles of Western organizations and be restricted. China is an active participant, creator and even leader of Green Finance's internationalization. As the world's largest developing country, China is currently in a period of major historical changes. The largest carbon market in the world is facing the challenge of the entire economic and social development transformation. To understand the internationalization of Green Finance, we must first see the actual situation of my country and the global efforts that China has paid for sustainable development and transformation.

"21st Century": What can Green Finance International bring us?

Li Wen: First, to see that the sustainable transformation of the economy and society is not a single link of ESG. When the base of society is not sustainable, it will have a negative impact on GDP, environmental ecology, people's lives, and even social progress. The second is to observe the development of the top -level design of my country's policy. The "Eleventh Five -Year Plan" emphasized the energy conservation and emission reduction of the real economy; the concept of green finance began to appear in the "Twelfth Five -Year Plan", and the "Thirteenth Five -Year Plan" released a series of policy documents. From the signing of the Paris Agreement to the proposal of the "double carbon" goal, it can be seen that China's role in global climate change governance is changing. my country has gradually entered the main battlefield of common governance, showing a positive responsibility of a responsible power, focusing on the community of human destiny, and integrating climate change responsibility into the national strategy and financial system. Therefore, from the technical route, my country not only requires the transformation of the real economy, but also puts its attention to the front end of the commercial economy, namely capital and finance. The state hopes to transform from the financial green transformation to drive all investment and financing to serve the transformation, upgrading, and development of the real economy. The third is to think about how Chinese financial institutions have been founded to create the international development of green finance. In 2008, Industrial Bank became my country's first bank to sign the equatorial principle. Some companies that have "going out" and international financial cooperation earlier in China have already possessed their initiative and carried out active actions. In recent years, as the People's Bank of China and the China Banking Regulatory Commission vigorously promote the evaluation of green banking, the level of green financial practice of the banking industry has improved significantly. It can be believed that with the continuous advancement of the "double carbon" goal, with the advancement of my country's financial innovation and financial standardization, more and more financial institutions are exploring the innovative methods of green financial development, grasping the low -carbon and green development of the development of low carbon and green development New opportunities have made positive contributions to the international development of green finance.

- END -

There are echoing things in the echo, and there are the "12345 Citizen Hotline • Political Wind and Wind" in Dongchangfu District

On July 9, Mei Yongjie, member of the Standing Committee of the Dongchang Prefectu...

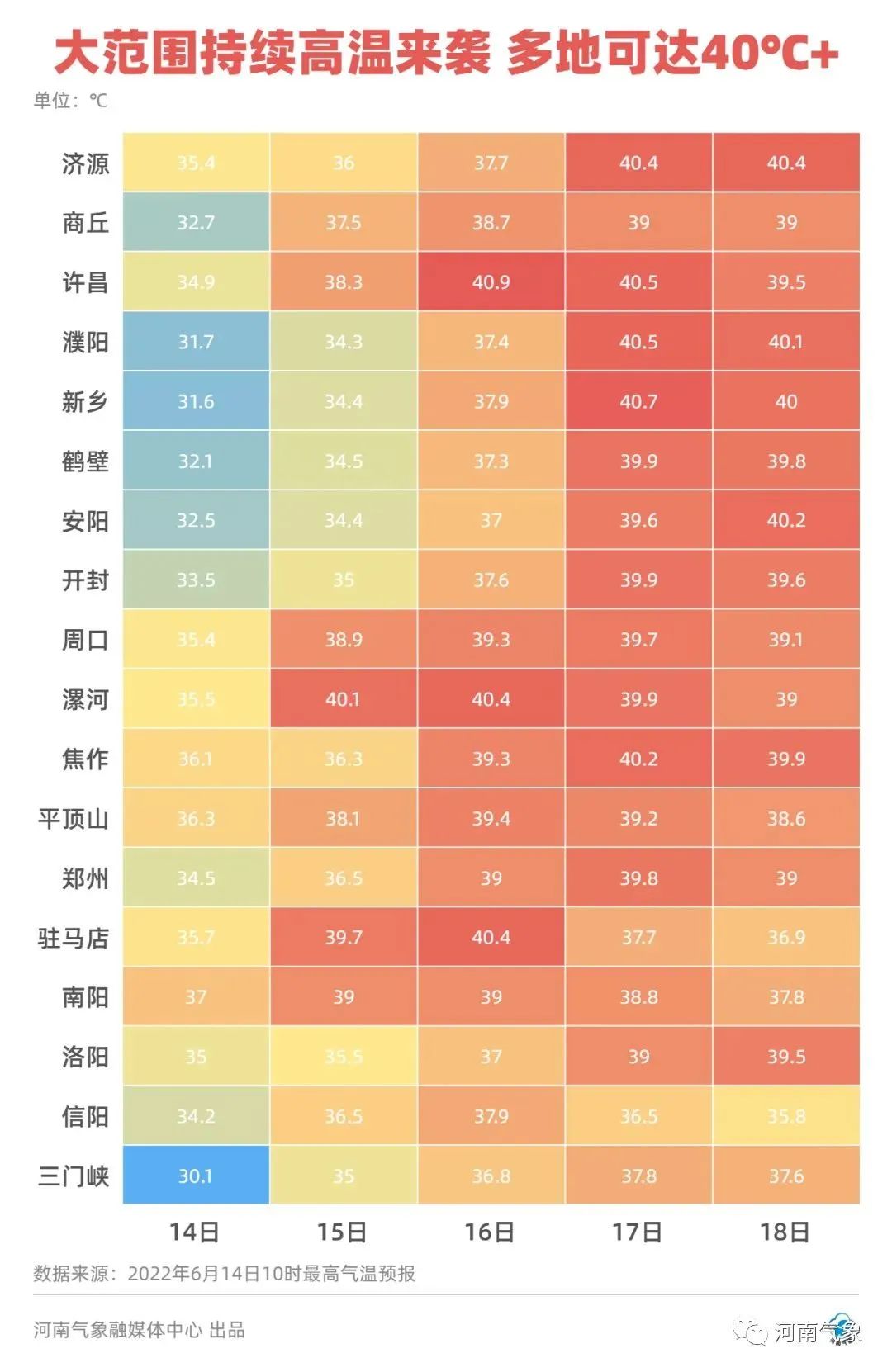

40 ° C hit!Henan Province today launched a high -temperature emergency response

A wave of strong convection weather has just endedA large -scale high -temperature...