The letter approval is inaccurate, the executives are unreasonable, and the Weilong shares and the responsible person have been supervised and warned by the Shanghai Stock Exchange

Author:Red Star News Time:2022.07.19

Red Star Capital Bureau news on July 19, after the two vineyards in Australia were planned to be questioned by the Shanghai Stock Exchange, Weilong (603779.SH) received a decision on the Shanghai Stock Exchange on July 18. According to the Shanghai Stock Exchange, Weilong shares have illegal acts in terms of information disclosure, and the relevant responsible persons have been performing responsibilities and stock transactions respectively.

Penalty of the Stock Exchange

On January 27 this year, Weilong disclosed the performance forecast. It is expected that a loss will occur in 2021. The net profit attributable to shareholders belonging to listed companies is -210 million yuan to -250 million yuan, and non-net profit deducting non-net profit is -150 million yuan to to -150 million yuan -200 million yuan.

However, on April 19 this year, Weilong's disclosure of the performance trailer was corrected. It is expected that the net profit attributable to shareholders of listed companies in 2021 is -370 million yuan to -470 million yuan, and non-net profit deducting non-net profit is -320 million yuan to to-3.20 million yuan to to-3.2 billion yuan -4.2 billion yuan. Correction reasons for the previous calculation of the preview of the performance preview, and the evaluation of the fair value of the Australian subsidiaries on the merger date and the balance sheet date of the Australian subsidiaries has not been completed. It can fully consider the impact of consolidating the inventory, fixed assets and intangible asset evaluation impairment of the Australian subsidiaries on the company's consolidated financial statements.

On April 23 this year, Weilong officially disclosed the annual report that the net profit attributable to shareholders of listed companies in 2021 was -414 million yuan, and the non-net profit was -371 million yuan.

The Shanghai Stock Exchange believes that the company's annual performance is a major issue that investors are concerned, and it may have a significant impact on the company's stock price and investor decision -making. The company should make an objective and cautious estimate on the current performance based Full and targeted risk prompts. The disclosure of Weilong's performance trailer was inaccurate, and the difference in net profit of the mother's net profit and the net profit after deduction was 65.6%and 46.1%, respectively, affecting the reasonable expectations of investors. At the same time, Weilong shares issued a correction announcement until April 19, 2022, and the disclosure of the correction announcement was not timely.

In addition, according to the Shanghai Stock Exchange, on January 5 this year, Weilong disclosed that senior managers' centralized bidding reduction shares plan announced that the senior manager Wang Bing plans to The company's shares have not exceeded 598,125 shares by centralized bidding. From March 30 to April 19, 2022, Wang Bing reduced the company's shares by 40,000 shares through centralized bidding transactions. On April 23, 2022, the company disclosed the annual report of 2021.

The Shanghai Stock Exchange believes that Wang Bing's act of selling company stocks within 30 days before the annual report announcement constitutes a regular report window to reduce its holdings.

In this regard, the Shanghai Stock Exchange pointed out that the disclosure of Weilong's performance forecast information was inaccurate, and the disclosure of the announcement was not timely. The above behavior violated the relevant provisions of the "Shanghai Stock Exchange Stock Listing Rules". Huang Zuchao, then the company's then chairman, as the main person in charge of the company and the first responsible person in the information disclosure. At that time, Sun Yantian, then general manager, as the main personnel of the company's management decision -making decision. People, then Zhang Huanping, an independent director and the convener of the audit committee, as the main supervisor of the financial accounting matters, failed to work hard, and was responsible for the company's violations. The promise made in and and promised "Statement of Supervisors, Senior Management).

In addition, Wang Bing, as the company's then senior managers, reduced the company's shares in violation of regulations during the window period. His behavior violated the "Directors, Supervisors and Supervisors of Listed Companies and Supervisors of the China Securities Regulatory Commission's shares and its change management rules held by the company. The relevant provisions of the Listing Rules and its commitments made in the "Directors (Supervisors, Senior Management) Statements and Senior Managers).

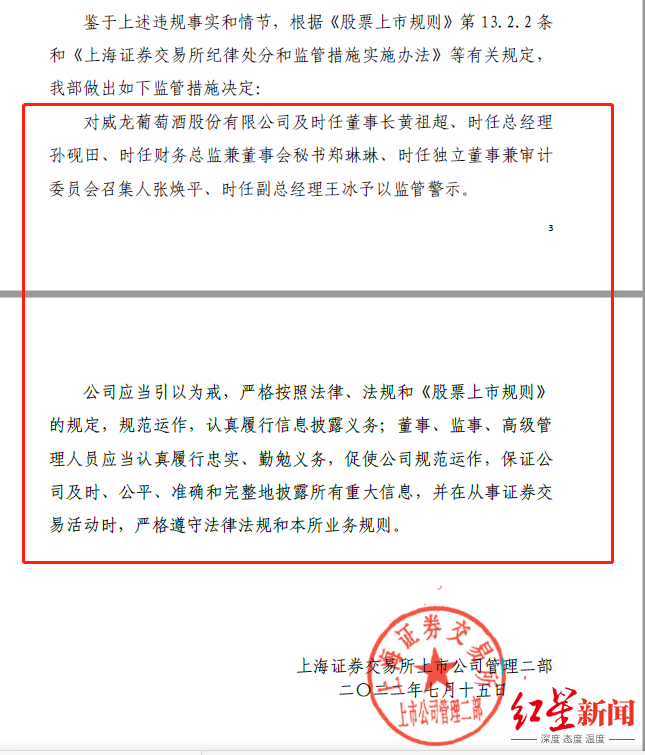

The Shanghai Stock Exchange decided that the time chairman Huang Zuchao, the then general manager Sun Yantian, the then chief financial officer and secretary of the board of directors Zheng Linlin, then the then independent director and the convener of the audit committee Zhang Huanping, and then the deputy general manager Wang Bing to supervise and warn.

On July 19, a staff member of Weilong's shares explained to the Red Star Capital Bureau that the warning penalty was due to the difference in the preview, and it was not a problem with the company's operations. "Due to the epidemic and other reasons, the accountant could not reach Australia to take stock of the performance of the subsidiaries last year, which led to the difference." The person said that the previous accountants would arrive at the scene for auditing. This happens. "

The Red Star Capital Bureau noticed that Weilong was punished by the Shanghai Stock Exchange in July 2020 due to inadequate approval.

Red Star reporter Deng Lingyao Li Chen

Editor Ren Zhijiang

- END -

Enterprises can report these behaviors!Anhui carried out illegal charges for enterprises in Anhui

In the field of transportation and logistics, we can charge fees in violation of r...

Celebrity Lecture Hall · Dialogue 丨 Peking University Archaeological Associate Professor Zhao Hao: The Chinese Civilization Source Project cannot be separated from the efforts and efforts of every scientific examiner

Cover Journalist Xun Chao Intern Zhou HaitongThe full name of the Chinese civiliza...