Jiuquan Taxation Bureau has launched a series of "first -handed processes" series of activities

Author:Jiuquan Daily Time:2022.07.19

"Walk" while "walking" often

Jiuquan Taxation Bureau has launched a series of "first -handed processes" series of activities

The tax payment process is smooth, the service efficiency is high, and the policy is promoted. In order to further promote the preferential tax and fee preferential policies, it is faster and more accurate to benefit the taxpayer's payment, the Jiuquan Taxation Bureau has actively launched a series of activities of the "first -handed process". The person in charge of the Municipal Taxation Bureau entered the tax service department. Through the process, sitting on the window, and solving problems, it promoted the implementation of policy implementation, dredging the process of obstruction, optimizing the process of processing, and re -improvement of service quality.

The speed of tax handling of the first perspective

"How long does it take to apply for business? Are there any troubles in the process of taxation? How about the service quality and efficiency of the window personnel ..." Not long ago, the tax service department of the tax bureau of Suzhou District, the Municipal Taxation Bureau is responsible for While the person's "incarnation" tax guide, while answering tax related consultations for taxpayers, inquires and records the taxpayer's taxation experience and tax -related demands. The person in charge of the Municipal Taxation Bureau follow -up of the operation process of tax consultation, queue collection, form filling in forms, information acceptance, business approval to document delivery, etc., experience the speed of tax -related business in an all -round way, check the problems, see the shortcomings, find the gap, find the gap, find the gap, Essence

"Old man, do you have a smooth business just now? Are you satisfied with the" Old Window "set up by the tax department?" At the window of the tax zone of the Municipal Administrative Service Center, the person in charge of the Municipal Taxation Bureau will be declared to just complete the existing housing transaction. Old man Hua Mujun asked.

Subsequently, the person in charge of the Municipal Taxation Bureau participated in the tax side business of the Electronic Taxation Bureau, and experienced the interconnection of the "Fast Wine" e -government service platform and the Electronic Taxation Bureau. In the experience, on -site office coordination solves the problem of poor access between the two platforms.

"Dual identity" experience service temperature

In the business processing area of the tax service office, the person in charge of the Municipal Taxation Bureau turned into a window clerk, and the application for the value -added tax refund business submitted by Jiuquan Blue Sea Trading Co., Ltd. was accepted on the spot. Log in to the "Golden Three" system, enter the enterprise information, review related data ... The service of the person in charge of the Municipal Taxation Bureau has been evaluated by Xu Juanjuan, the tax staff of the enterprise.

Adhering to the simultaneous advancement of discovering problems and solving problems is the first principle of the Municipal Taxation Bureau to carry out the "first -handed process" activity. In the early "walking process", the person in charge of the Municipal Taxation Bureau found that some taxpayers affected the efficient handling of tax refund due to insufficient data preparation and poor business process connection. Guidance on processes, optimizing the configuration of the post. Soon after, the tax bureaus of Suzhou District relying on the "handling" government service brand, it derived the tax refund "handling Sudu" tax brand to further optimize the taxpayer's taxation experience. promote.

In response to the problems discovered by the "walking process", the Municipal Taxation Bureau insisted on the establishment of reforms and reforms that can be resolved immediately. It cannot be resolved immediately in the rectification ledger, continuously followed up and questioned, and effectively optimized and upgraded by promoting management and service in response to problems in response to problems. Essence

Listen to taxpayer satisfaction

Gansu Electric Investment Changle Power Generation Co., Ltd. is the only large -scale armal power generation enterprise in Guazhou County. At the same time, it is in line with the value -added tax increase to reserve tax refund and reserve tax refund policy. Encountered "bottlenecks". After understanding the situation, the person in charge of the Municipal Taxation Bureau went to Guazhou County to communicate and do and promote the follow -up process. Under the collaboration between the provincial, municipal and county -level finance and tax departments, the two retained tax refund funds accurately dropped accurately. bag.

Soon after, the person in charge of the Municipal Taxation Bureau went to Gansu Electric Investment Changle Power Generation Co., Ltd. again to discuss and exchange with corporate legal representatives and financial personnel, understand the production and operation of the enterprise, reserve tax refund effects, and to block the difficulties of the company's existence. And tax -related risks give opinions and suggestions from the perspective of taxation.

"Tax refunds' 'timely rain' has provided us with strong support for our production and operation. With the careful escort of the tax department, we are full of confidence in future development." Pre -service, efficient approval, follow -up questions.

In Gansu Jinfeng Wind Power Equipment Manufacturing Co., Ltd., the person in charge of the Municipal Taxation Bureau went to the enterprise production workshop to understand the production and operation status of the enterprise, and asked the enterprise to encounter difficulties encountered in the aspects of tax -related business, taxes and feed policies, and solicited opinions and suggestions.

At the Jiuquan Green Energy Cloud Computing Co., Ltd., the person in charge of the Municipal Taxation Bureau discussed with corporate personnel. After learning that the enterprise had applied for three times to enjoy the VAT tax refund policy with a cumulative value of more than 21 million yuan, he asked for inquiries on policy propaganda counseling, follow -up implementation, tax refund approval, and follow -up services.

"Real tax preferential tax policies have effectively alleviated the stability of the enterprise's job stability and ensured the normal operation of the enterprise. At present, we have launched the second phase of the Jiuquan Cloud Computing Big Data Center project construction related work." Say.

Take the process, excellent services, do practical things, and improve quality. In the next step, the Municipal Taxation Bureau will further optimize the "first -hand -run process" mechanism, and strive to do three articles: "improvement, improvement, quality improvement, expansion and deepening". Really send high -quality services to the heart of taxpayers. (Pan Mingrui)

Editor in charge: Tian Xue

- END -

[Centennial Action] Shanghai Anti -Fraud Center reminds: Internet fraud has been concerned about the "summer file", and the free game skin may be a fraud routine

Summer is a high incidence of adolescent cyber fraud cases. When the God Beast in ...

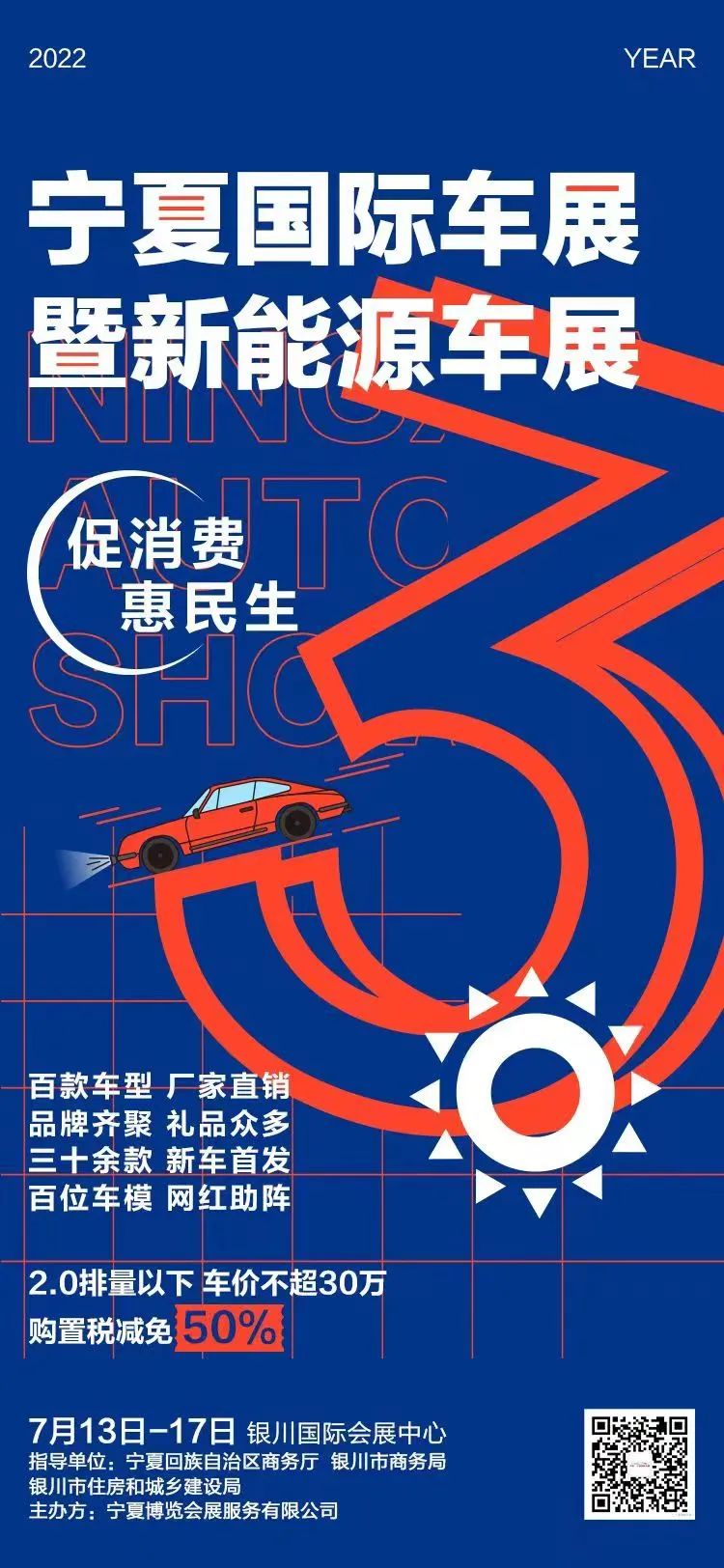

Diffusion | Yinchuan people come to the auto show quickly!There are subsidies to buy a car!

I plan to buy a car recently? You can't know this news! Save tens of millions of y...