The first anniversary of the opening of the carbon market in the country: strictly investigating fraud, trading still owe fire | Focus analysis

Author:36 氪 Time:2022.07.18

The horn has sounded for one year. The establishment of the carbon market across the country means that for the first time from top to bottom from top to bottom to the enterprise, the market -oriented method of "quota" and "carbon prices" is used. Forcing enterprises to explore low -carbon transformation at the business level.

Wen | Qiu Xiaofen

Edit | Su Jianxun

Source | 36 carbon (ID: carbon_36kr)

Cover Source | Vision China

Since its launch on July 16, 2021, the "National Carbon Market" has launched its first anniversary.

According to data from Shanghai Environmental Energy Exchange, as of July 16, 2022, the national carbon market transaction volume reached 194 million tons, with a cumulative turnover of 8.49 billion yuan -it has become the largest carbon market in greenhouse gas discharge in the world. Manage control of 40 % of the country's total carbon emissions.

Carbon reduction is always a serious proposition for developing countries. The domestic carbon market is naturally an important and arduous attempt. The industrial revolution has brought about improvement of production efficiency, but on the other side of the efficiency, whether economic development and carbon emissions can achieve a subtle balance.

The horn has sounded for one year. The establishment of the carbon market across the country means that for the first time from top to bottom from top to bottom to the enterprise, the market -oriented method of "quota" and "carbon prices" is used. Forcing enterprises to explore low -carbon transformation at the business level.

So, what is the transcript in the year when the national carbon market was launched? According to the Ministry of Ecology and Environment, during the performance cycle of 2021, 2,162 appliance companies were included in consideration, and the market performance rate reached more than 99.5%; carbon prices also climbed from 48 yuan/ton to the highest 62 yuan/ton of 62 yuan/ton. Essence

To build a set of precisely running national carbon market mechanisms, it is quite complicated. With the performers of last year, some shortcomings can also be exposed, such as data fraud and market activity.

But there was no turning arrow in the bow. A small "carbon price" will set off many butterfly effects in the industry. Taking Europe as an example, the high carbon price in the carbon market is the biggest driving force for the exit of coal. Due to the high carbon price, European coal power plants have a rapid decrease in power generation. They have to consider green transformation and use other renewable energy -the change of energy structure.

The European story model will be repeated in more regions. Next, the national carbon market will expand the scope to incorporate the control of the eight major industries and increase the linkage with other tools, such as CCER (Chinese certification voluntarily reduced displacement). A low -carbon change is quietly happening.

The quota is like "food stamps", the market is not active enough

The quota on the carbon market is like a "food stamp", which represents the total amount of carbon dioxide allowed by enterprises. In the first anniversary of the operation, a major highlight of the national carbon market is how to improve market activity to a greater extent.

There are two types of trading methods in the carbon market, one is the community protocol transaction, and the other is the listing agreement transaction. The difference between these two transactions is that the listing agreement transaction is to obtain the quota "food ticket" through the transaction system submitting or buying the listing declaration method; In the case (more than 10 tons), the two parties of the transaction conduct transaction through the trading system.

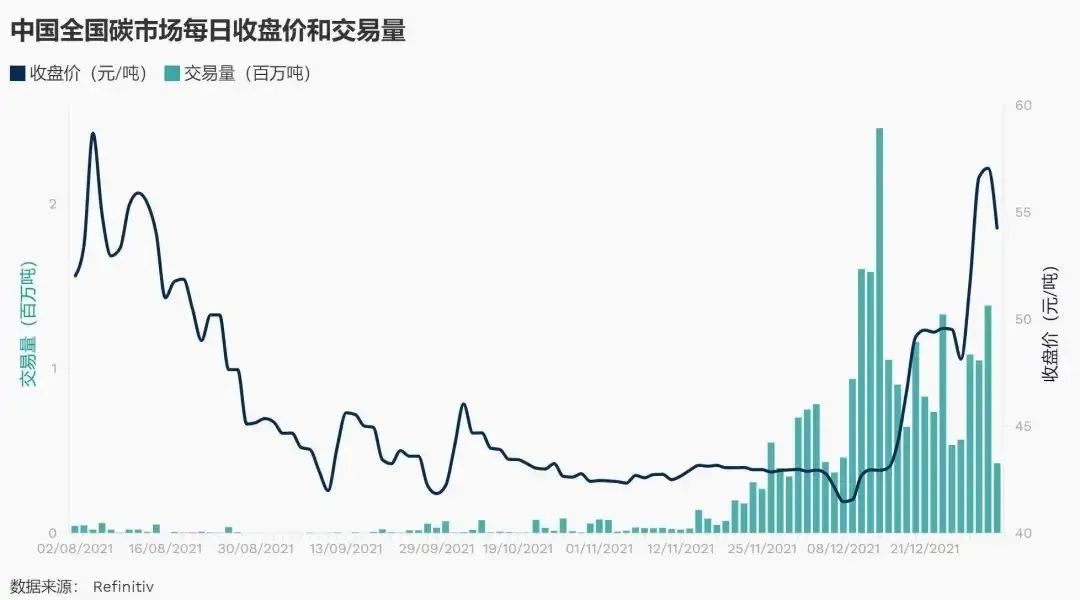

China's carbon market closing price and transaction volume trend data Source: Refintiv

The number of commodity agreement transactions is an indicator to determine whether the carbon market is active. A report from the Beijing Institute of Technology Energy and Environmental Policy Research shows that the cumulative transaction volume of the large agreement in the carbon market in the country is five times that of the listing agreement, and the two are 83%and 17%, respectively. Compared with the market trading system, the national carbon market is generally a market with a low degree of activity.

The proportion of listing agreements is lower, which means that during the first performance period, most enterprises have obtained the quota grain tickets normally, and they can easily achieve their performance by trading on the market. For example, although some companies have earned a lot of money by wealthy quotas. For example, there were news that Jingneng Group obtained more than 400 million yuan in revenue through the sale of carbon emissions in 2021, but more companies actually tended to tend to tend to There is a quota instead of taking it to the market. Some people in the industry said to 36 carbon that there are also considerations that the quota issuance may be tightened in the future, and the carbon price will rise.

The total amount of quota issuance and the dongtius quota make the overall activity of the carbon market is not high. "Give you 5 pounds of food stamps. At the end of the last year, there were 4 pounds that I didn't finish it. The quota was relatively rich, and the transaction volume was small. It is our own food stamps, and we don't need so many market services. "The aforementioned industry people gave a vivid example.

From the turnover rate (transaction volume: the total amount of the distribution), it can also be seen that this is currently only about 3%of the national carbon emission right trading market -lower than many regional carbon markets, and the European carbon market The turnover rate reached an amazing 400%.

And only the activity of the carbon market is greater, and the quota is a market -oriented tool. This "invisible hand" can be truly reflected on the direct impact of the control.

Another industry person told 36 carbon that with reference to the European carbon market, the domestic carbon market should increase activity, and in the future, more types of transactions can be considered. For many years, the EU carbon trading products are diverse, with different transactions such as auction, spot, options, and long -term, and different products also correspond to the needs of different stages of the enterprise. For example, the auction is applicable to the first -level market, and the spot futures options are set up in the secondary market to meet carbon risk management that needs different needs. In addition, the spot is real -time delivery, and the futures long -term contract is delivered at the agreed time. European Energy Corporation will also complete the discharge targets with a variety of carbon financial products according to their different time and business needs.

The aforementioned person said that the carbon market in the country should be hot. On the one hand, there are too many grain stamps, and more product supply must be provided. The CCER in the future is a tool for providing value -added and flow to the carbon market. Market -level participation. Therefore, a major highlight of the national carbon venue is also when the CCER project approval can restart.

In addition to the quality of the data, there are still those that need to be improved

In the first year of the carbon market, another major controversy was that data fraud occurred.

The documents previously published by the Ministry of Ecology and Environment present different data fraud methods. For example, the "China Carbon Energy Investment" company has appeared to guide the production of false coal samples. If you are not in place, the inspection work passes through the field, and the conclusion of the verification of "Qingdao Sinuo New Energy" is obviously incorrect.

In addition to the causes of the first performance cycle, there are objective reasons such as the cause of subjective interests, as well as objective reasons such as institutional design and supervision capabilities.

The data quality of the carbon market is fair, authentic, and compliance is the cornerstone of the carbon market.

An industry person told 36 carbon that the data has become the most concerned issue at the moment. The consequences of data fraud are that the provinces and cities issued a notice last year and re-calculated the issuance of the quota in 19-20 years. The progress slows down. "

At the National Carbon Market Construction Working Conference held on July 13, Zhao Yingmin, deputy director of the Office of Carbon Dafeng Carbon and China Leading Group and Deputy Minister of Ecological and Environment, said that the next step is to focus on data quality management and accelerate the improvement of the system Construction of mechanisms to establish and improve the daily management mechanism of the quality of carbon market data.

In addition to promoting the quality of carbon market data from the institutional level, An Li, general manager of the Tianjin emission right exchange trading business department, believes that the national carbon market will have some room for improvement in the future of information disclosure, capacity building, and local pilot integration. Essence

First of all, the national carbon market has only been announced from the results of the verification to the performance of the contract. It is only about two months, and the performance time to the enterprise is relatively short -therefore, in the performance period of last year, the transaction also had congestion. In the last month of the performance period last year, the volume and turnover of the single month in December accounted for nearly 70 % of the annual proportion.

Secondly, the carbon market is in the early stage, and the construction of the company's own capabilities is still not keeping up. For example, in the first performance cycle, the company failed to buy a quota due to lack of experience and failed to buy a quota before the end of the performance. For most enterprises, it is also difficult to obtain the national carbon market fundamentals at present, and it is not convenient for enterprises to make decisions.

Looking forward to the future, Anli said to 36 carbon that in the future, the carbon market may consider extending the time of performance transactions and strengthen information disclosure capabilities, such as publishing the list of performance companies.

The relationship between the future of the national carbon market and local carbon pilot is also a matter of concern for the industry.

At present, the pilot areas of Shanghai, Tianjin and other regional carbon markets have been operated for eight or nine years. An Li believes that the national carbon market in the future can also be studied with existing systems to jointly cultivate and develop the trading market; In the region, she said that in the future, it can give full play to the role of 8 existing national carbon market capacity building centers to enhance the carbon market participation capabilities of these enterprises.

36 The official public account of its subsidiary

I sincerely recommend you to follow

Here is a "share, like, watch"

- END -

Chen Zuzhao, the most beautiful family in Guigang: turns "wasteland" into "rich land", the secret is here

SummerThe cold and refreshing lemon tea is more matched with summerLemon harvest i...

On the afternoon of June 21

On the afternoon of June 211. On the afternoon of June 21, the Taikang Exam Area in the 1322 test site simulation exercises were successfully completed and completed in an orderly manner.2. This after