[Case of the case] Vehicle wading claims to cause dispute judges to patiently mediate disputes

Author:Huanghua Court Time:2022.07.04

In summer, the rainy season gradually enters the rainy season. Whether it is inland or coastal areas, the "watching the sea" has been opened. Dark rain brings inconvenience to people's travel, and some vehicles will turn off the heat when wading. In this case, how can the vehicle damage the owner of the vehicle to protect their legitimate rights and interests? When looking for the insurance company, when is the most important thing to report? Recently, the Huanghua Court concluded a dispute over a vehicle wading accident insurance contract. Because the owner did not report the case in time, the insurance company refused to claim the claim.

In July 2021, when Zhang drove under the viaduct of the Huanghua City Development Zone, due to the heavy rainfall caused the water under the bridge, the vehicle suddenly turned off when the vehicle passed here. At the place of the accident, I plan to take the car after the water level decreases. However, the next day, it was found that the vehicle was seriously damaged. After Zhang dragged the vehicle to the repair plant, he reported to the insurance company where his vehicle was located, but the insurance company refused to claim the claim on the grounds that Zhang did not report the case as soon as possible. Zhang Mou complained the insurance company to Huanghua Court on the grounds of insurance contract disputes.

After receiving the case, the undertaking judge carefully understood the case, and contacted the parties on both parties for the first time. After determining that the parties did not have the willingness to mediate, they started the vehicle loss appraisal process in time. After evaluation of the plaintiff's vehicle engine damage, it needs to be maintained. Spark plugs, cylinders, starters and other components need to be replaced due to severe damage. After deducting the residual value, the vehicle loss assessment amount is 12,546 yuan.

After the appraisal results came out, the judge of the trial was trying to do the communication of the parties on both parties, but the two sides still insisted on the trial and in accordance with the legal procedures, the case opened as scheduled. During the trial process, the defendant's insurance company insisted that the plaintiff had not reported the case as soon as possible, which caused the cause, nature, and loss of the cause of the accident, so they were not liable for compensation. The plaintiff believes that as an insured, he has the right to get compensation after the accident. The dispute between the two sides could not be.

While appease the emotions of the two sides, the judge has re -compared the reporting recording, the damage of the vehicle, and the weather conditions at the time of the accident. Before the accident, it was indeed a continuous rainfall weather, and many components of the plaintiff's vehicle. The damage is also consistent with the diversion of the vehicle. However, the plaintiff did not report the right to report the case as soon as possible. The defendant's insurance company had the right to investigate the scene of the accident as an insurer. As a result, some losses could not be determined. According to the law, they could not bear the liability for compensation. However, on the other hand, according to the existing evidence, it can also be confirmed that the damage to the vehicle has a causal relationship with the wading accident, and the insurance company should pay a certain amount of insurance. After clarifying the case handling of the case, in order to completely resolve the dispute between the two parties and avoid the appeal after the judgment, the judge decided to continue to increase the mediation.

"Although this incident says that the insured has fault, the vehicle is indeed damaged because of the rain. The existing evidence can also prove that part of the damage is met in the compensation conditions of the wading accident. As an insurance company, we should be an insurance company. Take out more sincerity, everyone is more considerate and more understanding. "" The insurance law clearly stipulates that the insurer or the beneficiary knows that the insurer should be notified in time after the insurance accident occurs. Losses, the insurer does not bear the liability for compensation. You should understand these regulations when you are insured. At that time, because you did not report the case to the insurance company in time, they did not have the way to determine whether some losses were caused by the vehicle's wading. The amount of the amount was given one step, and the matter was settled as soon as possible. "After a few true persuasion, the plaintiff agreed to make concessions on the amount, and only claimed to the defendant 10,000 yuan. On June 30, the defendant's insurance company would the money once at once once. Sexual payments were paid to the plaintiff, and the case has been successfully concluded.

【Judge's saying】

Article 21 of the Insurance Law of the People's Republic of China stipulates that the insurer, the insured, or the beneficiary knows that the insurer shall be notified in time after the insurance accident occurs. If it is intentional or not notified in a timely manner due to major faults, the nature, cause, and loss of insurance accidents are difficult to determine. The insurer does not bear the responsibility of compensation or paying insurance money to the incomparable part. Knowing or knowing that insurance accidents should be in time. According to the law, after the insurance accident occurs, the insurance company should be reported to the insurance company in a timely manner. In this case, the plaintiff in this case is because the obligation to report the notice in a timely manner is that the insurance company cannot conduct on -site investigation, and the nature, cause, and loss of the accident cannot be determined. This is not conducive to maintaining the legitimate rights and interests of the insured person.

At present, the flood season in 2022 has arrived, and the vehicle's wading accident has been frequent in many places. Here we remind everyone that you should first ensure your personal safety after the accident. Perform the obligation of timely notifications stipulated in the law, which not only protects the insurer's right to know, is also convenient for the future to better safeguard their legitimate rights and interests.

- END -

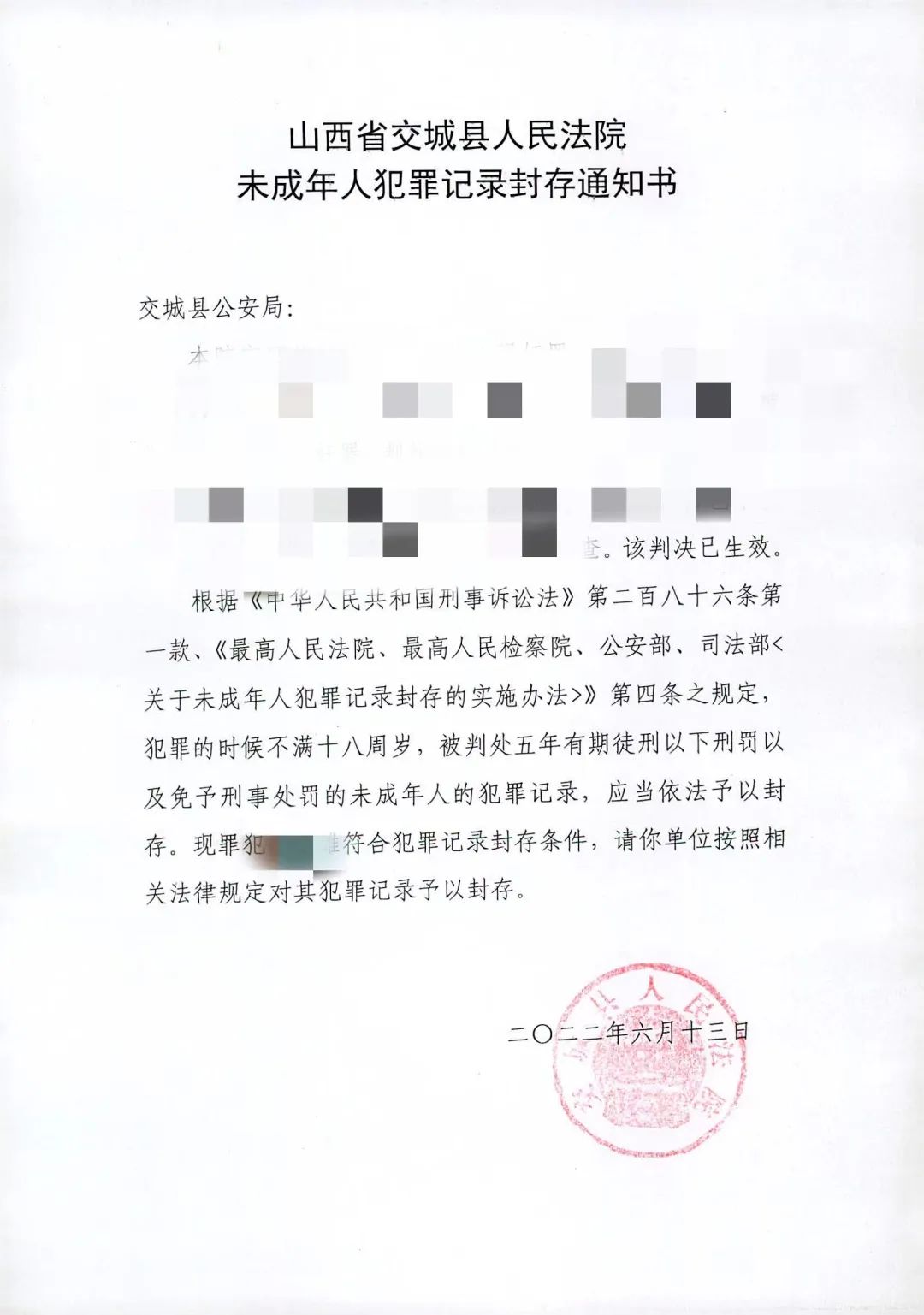

The Luliang Court issued the first notice of sealing of criminal records of minors

In order to effectively protect the legitimate rights and interests of minors, and...

Capture 19 people involved in fraud and 35 cases of solving the case

In order to effectively curb the high incidence of telecommunications network frau...