China release 丨 The national tax audit department has verified that 1645 households reserved 1645 households recovered and reserved taxes of 2.034 billion yuan

Author:Chinese network Time:2022.07.01

China Net, July 1 (Reporter Peng Yao) The State Administration of Taxation held a press conference on June 30. Jiang Wufeng, deputy director of the State Administration of Taxation Bureau, introduced that from April 1st to June 29th, the National Tax Audit Department It has been found to have 1645 tax refund enterprises, recovering 2.034 billion yuan in taxes, and 1.433 billion yuan in other tax losses.

As of June 29, the six departments have jointly crack down on 117 tax refund gangs, suspected of 89.3 billion yuan, recovered the tax refund of 967 million yuan in relevant enterprises, 1165 suspects arrested, investigated and dealt with black 14 intermediaries.

As of June 29, there have been 497 typical cases of tax refunds have been exposed across the country, of which 17 are gang cases.

On June 30, 2022, the State Administration of Taxation held a special press conference on the implementation of a new combined tax support policy. Photo Su Yucai of the State Administration of Taxation

On June 30, the State Administration of Taxation exposed three typical cases of fraudulent tax refund and export tax refund.

Anhui investigated and dealt with a case of retaining tax refund and export tax refund gang. Based on the analysis of the clues, the Tongling Tax Inspection Department jointly combined with the public security and investigation department to use a preferential tax policy to deceive the reserved tax refund and export tax refund criminal gang. After investigation, the gang set up an empty shell company, using VAT to levy a refund policy, and to open a dedicated VAT invoice tax for the inner and downstream enterprises of the gang, a total of 146 million yuan. And to defraud 147,500 yuan in tax refund and 5.7016 million yuan in export tax refund. The tax audit department recovered the retained tax refund of fraud in accordance with the law, and was imposed to be punished 2 times the fine in accordance with the relevant provisions of the "Administrative Penalty Law of the People's Republic of China" and "The Taxation Management Law of the People's Republic of China". At present, the criminal fact that the case is deceived by the export tax refund has been investigated by the public security and investigation department, and was transferred to the procuratorate for review and prosecution.

Tianjin investigated and dealt with a crowd of fraudulently to retain tax refund cases. According to the analysis clues, the Tianjin Tax Inspection Department jointly investigated and dealt with the public security and investigation departments to investigate and deal with the gangs to defraud the retention tax refund cases. After investigation, the gang controlled a number of shell companies to obtain a false value -added tax invoice in the virtual VAT invoices, and carried out false declarations and other means to defraud the tax refund of 610,900 yuan; Taxation total 870 million yuan. The tax inspection department's recovery of fraudulent tax refund shall be carried out in depth inspections on other enterprises suspected of using virtual invoicing for fraudulent tax refund. At present, the Public Security Economic Investigation Department has taken criminal compulsory measures against four criminal suspects to pursue an online pursuit of one criminal suspect.

Guizhou investigated and dealt with a decorative engineering company deceived tax refund cases. The inspection department of the Guiyang Taxation Bureau analyzed clues based on tax big data, and investigated and dealt with a case of cheating tax refund cases for the cheating tax refund of Guiyang Xiangding Decoration Engineering Co., Ltd. in accordance with the law. After investigation, the company did not confirm the operating income, reduce the amount of output tax, and conduct false declarations in accordance with regulations, and fraudulent tax refund was 5.7161 million yuan. The tax audit department recovered the retained tax refund that the company was deceived in accordance with the law, and was punished with a fine of 1 times the fines of the "People's Republic of China Administrative Penalty Law" and the relevant provisions of the Taxation Management Law of the People's Republic of China.

In addition, when the disciplinary inspection agency of the Shanxi Provincial Taxation Bureau conducted a "double investigation" when a case of deducting tax refund cases, it was found that the enterprise involved was actually controlled by Dai's family members of the former party committee and deputy director of a county tax bureau in Xinzhou City, Shanxi Province. In view of Dai, director of a tax office, in view of his original leadership, knowing that the enterprise had risk doubts, he still passed it in violation of regulations, causing corporate fraud to retain tax refund. Dai Mou and Lin Moumou were suspected of disciplinary violations. At present, the local tax department's disciplinary inspection agency has reviewed the above two people and will be held accountable for seriously in accordance with the law.

Jiang Wufeng said that while "fierce and deceived", tax departments at all levels carried forward the spirit of self -revolution, insisted on "strictly investigated the internal and wrong" inward, and seriously investigated and punished tax personnel to lose their duties and lose their duty, illegal and disciplinary, especially internal and external collusion. Tongtong cheating fraud to retain tax refund and other behaviors, and continue to increase the exposure of external exposure. At present, the tax personnel have been published internally and outside the inside and outside of the outside world, Tongtong fraud and retained tax refund cases have been announced. The law of the case and the warning of the case is based on the case of the case.

- END -

Kunming: Building a "firewall" to protect good care of the elderly

Recently, the reporter learned from Kunming's special action office of combating the special action fraud special action. Recently, the city's dot and line launched a full -coverage and anti -fraud...

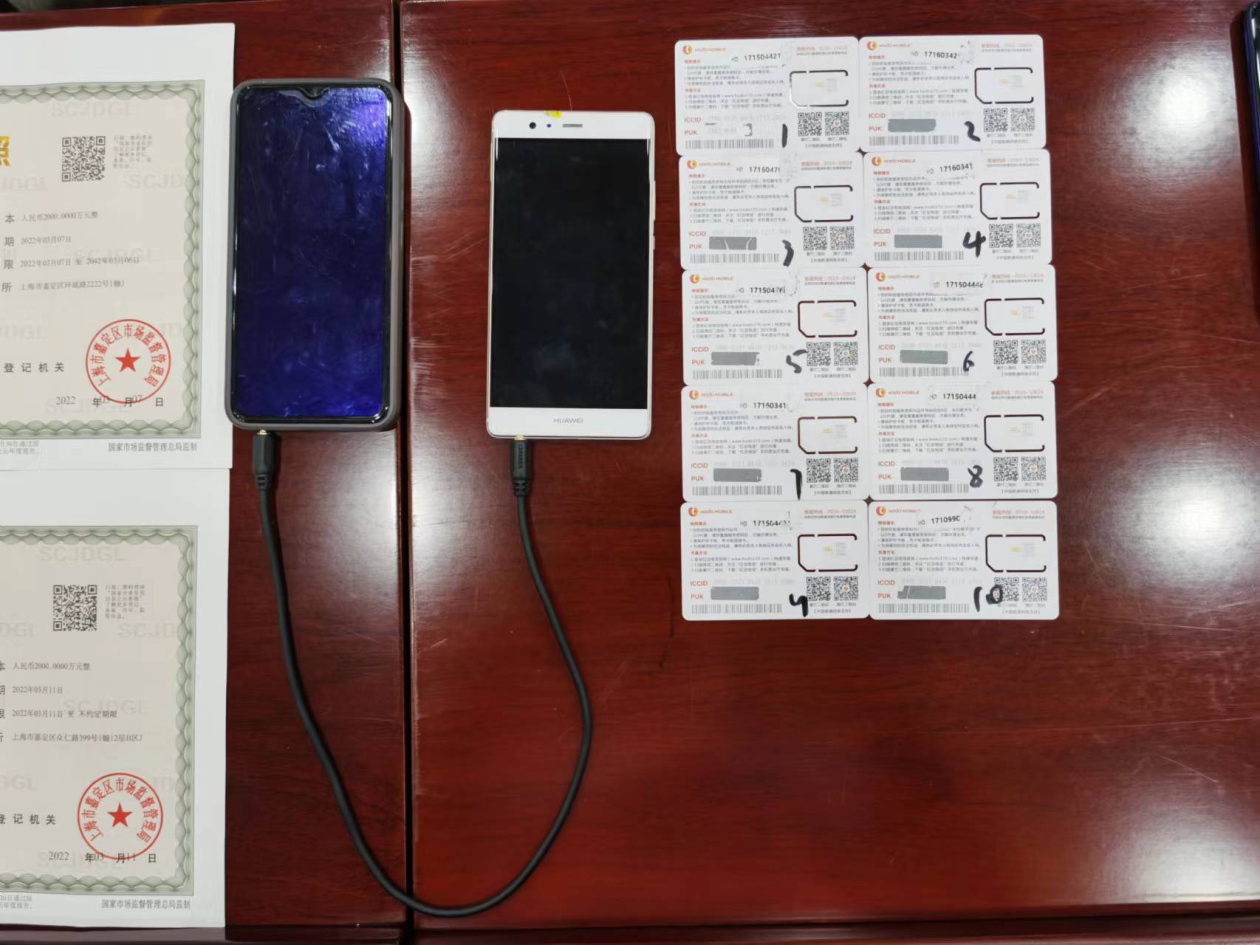

Turning overseas scam calls to local calls, 4 people called more than 50,000 calls within a month and were caught.

Only one data cable is needed, and the overseas phone can be transformed into loca...