A network anchor evaded taxes and was fined 64.95 million yuan

Author:Voice of Zhejiang Time:2022.07.01

Source: Website of the State Administration of Taxation, Xinhua News Agency

The copyright belongs to the original author, if there is any infringement, please contact it in time

The Xiamen Taxation Bureau's Inspection Bureau handles the tax evasion case of online anchor Van Sifeng in accordance with the law

Recently, through the analysis of the Big Data analysis of the Xiamen Taxation Bureau, the Inspection Bureau of the Xiamen Municipal Taxation Bureau found that the online anchor Van Sifeng was suspected of evading taxes. With the cooperation of relevant tax authorities, it carried out tax inspections on it in accordance with the law.

After investigation, Versace Peak obtained sales revenue through live broadcasts from July 2017 to December 2021. It did not apply for tax declarations to pay less than 1.6789 million yuan in personal income tax in accordance with the law, and less than 1005,600 yuan in other taxes.

The Xiamen Municipal Taxation Bureau Inspection Bureau, in accordance with the relevant laws and regulations such as the "Personal Income Tax Law of the People's Republic of China", "The Management Law of the People's Republic of China", "The People's Republic of China Administrative Penalty Law", etc. A total of 6.495 million yuan. Among them, the tax that cooperates with the inspection and proactively pays is 726,800 yuan, with a fine of 436,100 yuan in a fine of 436,100 yuan; 113,700 yuan; tax evasion for false income and not being paid for false revenue was 1.8201 million yuan, and a 1.5 -fold fine of 2.730 million yuan was imposed. A few days ago, the Xiamen Taxation Bureau Inspection Bureau has delivered the decision to the tax administrative handling of tax administrative treatment to Van Sifeng in accordance with the law.

The relevant person in charge of the Xiamen Taxation Bureau's Inspection Bureau said that the tax department will further strengthen the tax and fees and tax supervision of employees of the online live broadcast industry in accordance with the law. Relying on the analysis of the big data of taxation, if the risk of tax -related risks, in accordance with the "reminder, urge to urge to urge The "five -step work method" of rectification, interviewing warnings, investigation, and public exposure "is dealt with, and continuously enhance the compliance of the tax law of employees in the online live broadcast industry, and promote the long -term standardized healthy development of the industry.

Site screenshot

- END -

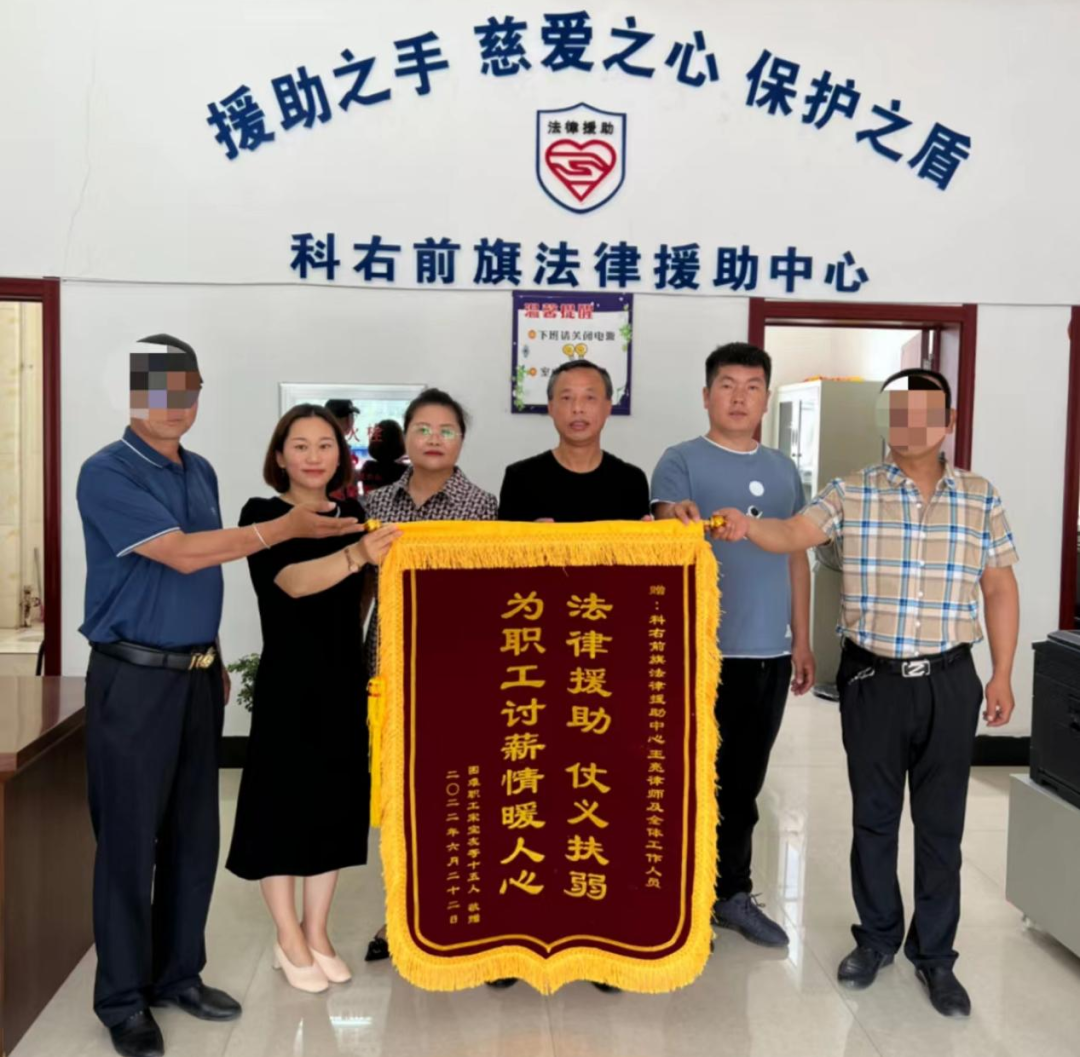

Legal assistance to support the weak

Legal assistance to support the weakConsultation for employees to warm people's he...

[Back to rectify pension fraud] This version of "Love You" is really affection!

NativegrandparentsLook at a little more lawCheaned and greedyA little more soberKe...