When uploading a bank card to "Online Loan Platform", the man hung up the call from the police ...

Author:Qilu Yiyi Time:2022.09.26

Reporter Zhang Guotong

While "online loan", a man in Texas received a fraud warning from the police. However, the men who were alertly determined that they had encountered the "fake police" and immediately hung up the phone. Not only that, he also uploaded his ID card and bank card to the "online loan platform". I did not expect that when men's withdrawal, they encountered big trouble.

I received a call from the police when I got an online loan

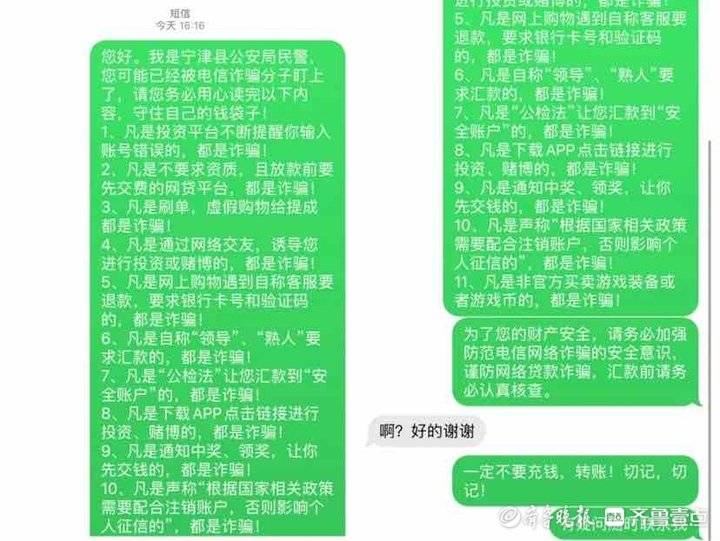

Recently, the Ningjin County Public Security Bureau of Shandong Province received a warning of the National Anti -Fraud APP. Mr. Zhang, a resident of the district, may be encountered by telecommunications network fraud. The police immediately called Mr. Zhang to understand the situation.

"I know, some policemen promoted me, I understand, how could I be deceived?" Mr. Zhang said on the phone that although he was urgently needed for funds for business, he would definitely go to a regular institution loan.

"If you talk about the specific address, our police officers come to verify the situation with you." In the communication between the two parties, the police constantly instructed Mr. Zhang to be vigilant and also proposed to verify the situation. Essence

After worrying about Mr. Zhang being cheated, the police sent a text message to Mr. Zhang, reminding him of the carelessness.

However, what I didn't expect was that half an hour later, Mr. Zhang took the initiative to contact the police, "Hello, it is fraud, what should I do?" Mr. Zhang said.

Exposed funds weeks, the result is almost deceived

It turned out that when Mr. Zhang browsed on the Internet that day, he saw a loan advertisement under the slogan "Fast loan, simple procedures, and low interest rates". Due to poor business circulation, Mr. Zhang, who was trying to loan, immediately opened the link provided by the webpage and downloaded a borrowing app. As a result, when the information was registered, Mr. Zhang received the police's early warning call, but at the time he didn't care and quickly hung up the phone.

Subsequently, Mr. Zhang applied for a loan of 20,000 yuan online on the APP, and uploaded his ID card and bank card number according to the system prompts.

After some operations, the system showed that the loan was successful. However, an accident occurred in the lending to account. The interface popped up: the withdrawal funds were frozen.

Subsequently, the APP customer service told Mr. Zhang that his loan had arrived, but because the card number he entered was error, Mr. Zhang must first remit with the company's account of 6,000 yuan to open membership permissions, and then the loan can be withdrawn. Otherwise, not only do you need to repay each month, but also deemed to be fraudulent, which will be "handled" by the public security organs. At this time, Mr. Zhang, who had doubts, called the loan platform customer service phone. After finding that he couldn't contact the other party, Mr. Zhang suspected that he was deceived.

After the incident, Mr. Zhang remembered the police phone he had just received, so he immediately called back and rushed to the Public Security Bureau for consultation.

Police timely disposal of insurance

"I have uploaded my ID card and bank card, what should I do?"

"Don't worry, you call the police in a timely manner, and now the money is still safe." The police said that Mr. Zhang encountered online loan fraud. The scammers used fraud software to steal the personal information of the victim and loan in the name of the victim. After that, the scammers also used excuses such as paying fees and thawing fees to trick the victims for transfer.

Subsequently, the police instructed Mr. Zhang to deal with the loan matters in a timely manner, deleted relevant software and text messages, and blackmail the liar's contact information.

"Before we called you to remind you, why would you still be on it?" After the processing, the police asked Mr. Zhang why he hung up his phone.

"I have accepted anti -fraud propaganda. Everyone said that many scammers pretended to be a public prosecution law for fraud. When you said that it was a police officer, I felt that you were a scammer." Mr. Zhang said embarrassed.

Reveal the online loan scam: pay the money first

In this incident, the online loan fraud encountered by Mr. Zhang refers to the suspect that the suspect imitates a regular loan platform and establishes a false online loan platform. When the victim applies for a loan, he promises that there is no mortgage, low interest, and fast loan, and then let the victims enter the designated bank card on the grounds of viewing the bank's flow or charging a deposit or a fee, thereby cheating the money.

When performing fraud, the scammers will contact the market loan through WeChat, QQ, and telephone. When the victim agrees to the loan, the victim is required to download the loan app registration information, and then lead the "handling fee", etc., to deceive the victim to remit on the designated account. Until found to be cheated.

Therefore, the general public must go to a regular financial institution in handling loans. Remember that regular financial institutions such as banks will not require borrowers to pay various fees such as handling fees, insurance premiums, and thawing fees before lending.

At the same time, once you find that you are deceived, pay attention to collecting evidence such as relevant transfer records, chat records, and call 110 or go to the police station to report to the police station as soon as possible.

News clue report channel: Download the "Qilu One" app, or search for the WeChat mini -program "Qilu One Point", 600 journalists in the province are waiting for you to report online!

- END -

Shijiazhuang typical case notice

1. Xingtang County Hebei Yaojun Building Materials Co., Ltd. illegally occupied th...

Police notified the latest progress in Tangshan's beating case

Data-nickName = China Youth Network Data-ALIAS = YOUTHZQW Data-Signature = Youth T...