There is another major case of fraud!"Sub -branch President" was sentenced to three years

Author:Dahe Cai Cube Time:2022.09.19

For two consecutive years, he was deceived by the same person by hundreds of millions of yuan.

A few days ago, the China Referee Book Network announced a criminal ruling show that a Rural Commercial Bank of Liaoning was deceived by 128 million yuan by the man in a certain junior high school culture by the name of the new replacement, using the name of others, providing false materials, etc. Losses 79.1583 million yuan.

After the scam was revealed, the first instance of the court was sentenced to 6 years in prison by the court for fraudulent loan, and Zhao Mou, the president of the relevant sub -branch, and the credit officer Zhang Mou also were sentenced to 3 years because of illegally issuing loans. In this regard, the three appealed. The bank employee Zhang also proposed in the appeal that the illegal mortgage mortgage was the illegal operation of the Rural Commercial Bank, and there was no performance of the duties of abuse of power or neglecting their duties.

What is the truth? Look at the details--

Two -year fraud loan 128 million

Heroes do not ask the source. Men who only have junior high school education can also control hundreds of millions of yuan of fraud cases.

The judgment shows that in 1968, Junior High School Culture was a legal representative of a certain agricultural facilities processing Co., Ltd. in Xingcheng City.

From July 2015 to September 2017, Tong Mou adopted the crime method of "fictional construction of greenhouse bases, more loans to build less sheds, and built sheds". In order to mortgage, three branches including the drug king branch of the Rural Commercial Bank, the base of the base of the base, and the Wanghai Sub -branch of the Rural Commercial Bank, a total of 10 greenhouse mortgage loans, the total loan amount was 128 million yuan.

Specifically, in July 2015, September 2015, and September 2017, I borrowed the name of the top celebrities in Yaowang Township Sub -branch and used the "top celebrity" to borrow the old and old ways to deceive the Yaowang Sub -branch loan. 12.6 million yuan;

In December 2015 and January 2016, the name of the company in the name of the company in the alkali factory branch used the name of its name to deceive the loan of 41.4 million yuan in the new and old way;

From December 2015 to March 2017, Pu Mou used the name of two cooperatives and borrowing the names of the top celebrities in the name of Wanghai Sub -branch to provide false materials and defrauded 74 million yuan of loans to the sea branch in the absence of approval.

According to the survey, Wu Mou should have built 448 greenhouses and 279 greenhouses. It was evaluated by Dalian Hongtai Ocean Resource Asset Price Evaluation Co., Ltd. The value of power is 2.3639 million yuan. It was unable to repay the relevant loans, resulting in the losses of the Rural Commercial Bank of 79.1583 million yuan.

The court of first instance believes that Tongmou deceived bank loans in the way of top -named loans and providing false information, causing particularly major losses to banks to constitute a crime of fraud. He was sentenced to 6 years in prison and fined 500,000 yuan, and ordered him to refund the victims of 79.1583 million yuan.

Sub -branch President plead guilty of the credit officer: not neglecting the duties

From the perspective of fraudulent method, Tongmou's method is not clever. Especially in the Wanghai Branch, it took 74 million loans in 4 times, and its behavior naturally received the support of the "inner ghost". The verdict showed that Zhao and Zhang, the two bank employees involved in the case, were the presidents and credit officers of the Rural Commercial Shipping Sea Branch, respectively.

The court pointed out that Zhao and Zhang, as a bank staff violation of the "Commercial Bank Law" and other relevant laws and regulations issued loans, and did not verify before the loan was issued. In the following, 74 million yuan was issued for Tongmou.

According to the "Commercial Bank Law", "commercial bank loans shall strictly review the borrowers' loan use, repayment capacity, repayment method, etc.". The actions of the two constituted a crime of issuing loans illegal. The court sentenced the two to three years in prison and fined 100,000 yuan.

In this regard, Zhao, the president of the branch, said that he had no objection to the crime of illegal loan issuance of the original judgment, but there was an objection to the identification of its "exquisite amount", which led to the serious sentence of the original sentence. And some loans have real collateral and interest, principal and additional greenhouses that have been repaid; requesting to be sentenced to probation. The defender proposed that Zhao's behavior was only "hair", no "put", and did not constitute a crime. The agricultural commercial bank of this case is a "point loan". Zhao is only an executor and believes that his behavior does not constitute a crime.

The credit officer Zhang and the defender proposed that the agricultural and commercial bank knew that the greenhouse did not exist, and took the initiative to help Pu to obtain a virtual greenhouse property certificate, which was the consequence of illegal loans of agricultural commercial banks that caused illegal lending. Zhang did not abuse his authority or neglects his duties, and his behavior and loan were issued in the sense of criminal law without the law.

In addition, Tong Mou also appealed that he did not cheat the subjective intentional intentional intention, did not implement the act of fictional facts, concealed the truth, and did not constitute a crime of fraud.

Court: Reject the appeal to maintain the original judgment

Can the courts change the judgment on the "shouting" of the two bank staff and the "shouting"? The answer is obviously no.

The Huludao Intermediate People's Court of Liaoning Province pointed out that in order to avoid the relevant provisions of the Rural Commercial Bank's loan application in order to achieve the purpose of fraudulent loans, many cooperatives were established to use the name of cooperatives for loans; or using the name of others to loans. During the loan process, the monthly income of fictional borrowers, fictional housing property rights and other means are deceived.

In the loan assessment session, in order to make the evaluation price comply with the amount of loans set in advance, the appraisal of the appraisal personnel will make the price high, thereby increasing the value of mortgage. The behavior of the deceptive loan caused the bank's credit funds to be in a huge risk, which caused the loan to eventually form a bad and caused a particularly major loss of banks. For the two bank employees, from the perspective of their duties, Zhang, as a creditman and loan investigation responsible for the Rural Commercial Bank of Sea Sub -branch, shall be in accordance with the regulations. Investigate and verify the mortgage.

As the president of the Rural Commercial Bank of Sea Branch and the responsible person of the Loan investigation, Zhao shall verify and evaluate the information provided by the investigators, re -test the risk, put forward opinions, and apply for approval of the shared authority in accordance with the prescribed permissions.

The court pointed out that Zhao and Zhang, as the staff of the bank, were responsible for the investigation and review of loan materials. In the process of performing their duties, the two knew that the mortgage of Laoshi's property rights certificate did not meet the provisions of the mortgage loan. It is seriously inconsistent with the actual situation and partially there are top -name loans. A survey report issued a loan to the borrower still issued a criminal composition of the crime of illegal issuance of loans to the borrower, which constitutes the crime of illegal issuance of loans.

In the end, the Huludao Intermediate People's Court of Liaoning Province rejected the three people's appeals and maintained the original sentence.

Responsible editor: Tao Jiyan | Review: Li Zhen | Director: Wan Junwei

- END -

[Summer public security strike "100 -day action"] Daqing Dragon and Phoenix Public Security "Four Find" promotes the "Hundred Days Action" for the initial results

Since the launch of the Hundred Days of Actions of the National Public Security Or...

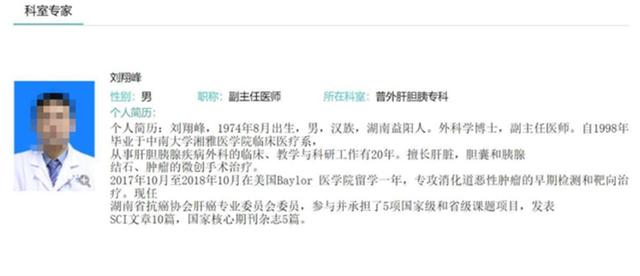

Thoroughly investigating Dr. Xiangya Liu Xiangfeng's responsibility, so that he can provide a deserved relief for the victims | Time Comment

Text/Bi YanRecently, there were news that Liu Xiangfeng, deputy chief physician of...