CSRC for investigation

Author:Global Times Time:2022.08.13

China Merchants Securities Co., Ltd. (referred to as "China Merchants Securities", 600999.SH, 06099.HK) was established by the Securities Regulatory Commission.

On the evening of August 12, China Merchants Securities announced that it received the China Securities Supervision and Administration Commission (referred to as the "CSRC") on August 12, 2022.

It was investigated that in 2014, China Merchants Securities launched Shanghai Feile Co., Ltd. (now Zhong'anke Co., Ltd., referred to as "ST Zhongan", 600654.SH) Independent financial advisory business work during the work of the independent financial advisory business. Laws and regulations such as the Securities Law of the People's Republic of China and the "Administrative Penalty Law of the People's Republic of China" and other laws and regulations, the China Securities Regulatory Commission decided to establish a case on China Merchants Securities.

China Merchants Securities stated that it will fully cooperate with the relevant work of the CSRC, and at the same time, the information disclosure obligations are strictly in accordance with the supervision requirements, and the company's operating situation is normal.

China Merchants Securities was accused of having a fault in the work of independent financial advisors

The CSRC was established by the China Securities Regulatory Commission.

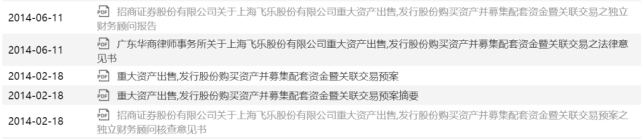

On February 14, 2014, the board of directors of Shanghai Feile Co., Ltd. ("Feile Co., Ltd.") reviewed and passed the "Shanghai Feile Co., Ltd.'s major assets of assets, issued shares to purchase assets and raised supporting funds and related transaction plans", etc. Essence China Merchants Securities accepted the commission of Feile and served as an independent financial adviser to the major asset reorganization. It provided independent opinions to all shareholders of Feile's shareholders on the transaction.

In May 2019, the CSRC made an administrative penalty decision on seven responsible persons including ST Zhongan. After investigation, Zhongan Care Technology Co., Ltd. included the "Banban Tong" project into the 2014 "Profit Forecast Report". When the project has undergone major changes, it is difficult to continue to fulfill the real and accurate information in time, resulting in providing ST provided to ST Zhongan's information is not true and inaccurate, and misleading statements have caused the reorganized asset evaluation value to be seriously increased. According to this, Annanzhong increased the shares of the evaluation value of the evaluation value, which seriously damaged the legitimate rights and interests of listed companies and its shareholders.

Subsequently, in July 2019, ST Zhongan announced that the company received a civil lawsuit issued by the Shanghai Financial Court from June 27, 2019 to July 11, 2019, and related legal documents issued by the Shanghai Financial Court. According to the "Notice of Responsive", the court has accepted 33 originally told the company's false statement responsibility dispute.

By May 2021, the results of the lawsuit disclosed by ST Zhongan showed that ST Zhongan needed to pay 228,000 yuan in the losses involved in two investors. Payment obligations shall bear joint responsibility within 25%and 15%.

It is worth noting that China Merchants Securities and Ruihua Accountants (special common partnerships) appealed to the Shanghai Senior People's Court (referred to as "Shanghai High Court") on the first instance. However, the Shanghai High Court believes that the professional opinions of China Merchants Securities in the financial advisory report obviously do not match the facts. It has fault in the process of reviewing the relevant materials involved in the "Banban" project and issuing professional opinions, which leads to its issued " Some of the contents of the Independent Financial Consultant Report are misleading. For investors' losses, China Merchants Securities shall assume liability for compensation in accordance with the law.

ST Zhongan Securities False Statement Responsibility Dispute Cases have not been judged

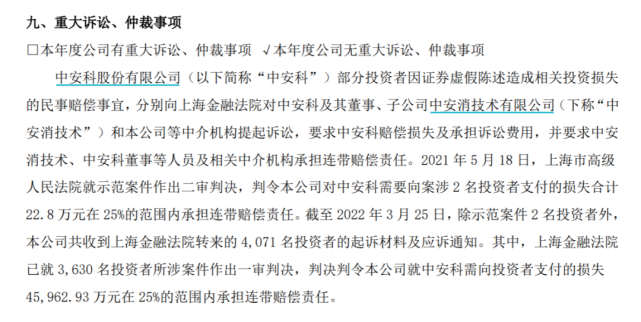

China Merchants Securities reported on the 2021 annual report that some investors in ST Zhongan made a lawsuit on the Shanghai Financial Court for civil compensation caused by the false statement of the securities of the securities false statement. responsibility. On May 18, 2021, the Shanghai Higher People's Court made a second trial judgment on demonstration cases, ordered that China Merchants Securities to pay 228,000 yuan in the loss of 228,000 yuan in the case involved in the case of China Securities. responsibility.

According to the 2021 annual report, as of March 25, 2022, in addition to two investors in the demonstration case, China Merchants Securities received a total of 4071 investors' prosecution materials and notice of response from the Shanghai Financial Court. Among them, the Shanghai Financial Court has made a first -instance judgment on the case involved in 3,630 investors, and the decision ordered the company to bear the liability for the loss of 459.6293 million yuan to the investor's loss to investors.

At present, the dispute over the false statement of ST Zhongan Securities has not been judged. According to the progress of the lawsuit disclosed by ST Zhongan on July 14, the company's false statement of false statements of the securities of securities expired during the period of related liability disputes in the case of liability disputes. It expired on May 27, 2022. As of the announcement date, the company has accepted the total of 6,480 cases of the relevant original statement of the false statement of the company's false statement in the case of the case of the case.

During the year, China Merchants Securities received multiple tickets

On August 9th, the official website of the Shenzhen Securities Regulatory Bureau also disclosed the decision to take a warning letter to China Merchants Securities.

After investigation, China Merchants Securities has three major problems in the process of investment banking business: First, the sponsor business has insufficient due diligence to the issuer's income confirmation, core technology, and research and development expenses.

The second is that in the bond underwriting business, individual projects have inadequate due diligence to the issuer's debt situation, external guarantee, debt repayment, related transactions, major arbitration, litigation and other major matters and other major matters.Third, in the asset securitization business, individual projects are not sufficient to perform due diligence in the credit level of primitive rights and custodians; due diligence reports that do not include due diligence investigations on important debtors;Insufficient, no major matters involving basic asset cash flow were found and temporarily announced.

In addition, on March 14th and May 16th, China Merchants Securities had two systemic abnormalities, and they were also adopted by the Shenzhen Securities Regulatory Bureau to order correction measures and adopted administrative supervision measures with alert letter by the Securities Regulatory Commission.

As of the close of August 12, China Merchants Securities A shares fell 0.22%to 13.84 yuan/share; H shares rose 0.8%to HK $ 7.52/share.

Source: Surging News

- END -

[Tongliao "Northern Xinjiang Blue Shield"] Tighten the "safety valve" to ensure that the "burning" is "burning"

In order to profoundly learn the lessons of the recent gas explosion accident, res...

The family is responsible for monitoring that there is a good teach for raising children

I just wanted to make some pocket money, but I didn't expect to violate the law. T...