Innovation of the boost pot!Ten billion private equity boss Wang Chaoyong was forced to execute 550 million yuan, Xinzhongli responded late at night

Author:Daily Economic News Time:2022.08.04

Every reporter Li Peipei every editor Zhao Yun

On August 4, a reporter from "Daily Economic News" learned that there was another heavy news from the venture capital circle -the former tens of billions of private equity Wang Chaoyong (the real name Wang Chaoyong, the following is called Wang Chaoyong) and him The first -hand letter was listed as the executed person again, with a total of 554 million yuan.

According to information from China Executive Information Disclosure Network, Wang Chaoyong has been listed many times before, and in early July, it also received a restricted consumption order from the Shanghai First Intermediate People's Court, which was restricted to high consumption.

As a well -known figure in the China Investment Circle, Wang Chaoyong was once known as "Wall Street Prodigy", "Godfather of China Venture Capital", "Investment in the Grand Crocodile" and so on. And after all of this, at the end of 2021, he suddenly lost contact (announced that he had cooperated with the public security organs to investigate).

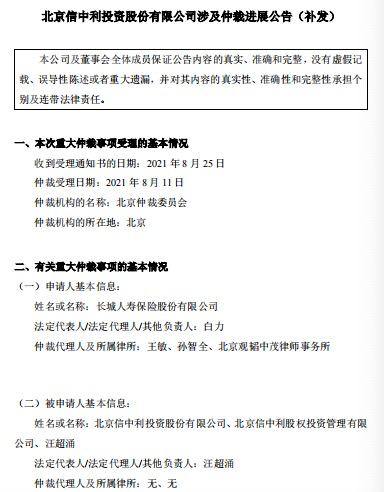

In this regard, Xinzhongli urgently issued an announcement and explanation involving the progress of arbitration, saying that the Beijing Arbitration Commission was received on June 10th (2022) Beijing Arbitration No. 1537 on June 2, 2022 Arbitration decision. As the businessmen failed to sort out the documents received in time due to resignation and transfer, the company failed to disclose the notice of the lawsuit in time, and is now supplemented.

Every time a reporter called Wang Chaoyong's call, he prompted to transfer to the call to remind the business.

The bandwchrier is classified as the executed person again

Following the previous "lost contact" storm, Wang Chaoyong has recently become the focus of attention to the creation of the venture capital because he was listed as the executed person.

Recently, China Executive Information Disclosure Network shows that Beijing Xinli Investment Co., Ltd. and its founder and legal representative Wang Chaoyong added a newly executed information. The executive court is the Beijing First Intermediate People's Court. On the day, the target was 554 million yuan.

It is worth noting that whether it is Xinli Liman or Wang Chaoyong himself, he has been listed many times before, and Wang Chaoyong has been restricted many times.

In a July Shanghai First Intermediate People's Court, we saw that on June 23, the applicant's execution of the applicant of the case of the case of the case of Shanghai Zhe Peng Asset Management Co., Ltd. applied for the implementation of other contract disputes in Wang Chaoyong. I did not fulfill the payment obligation determined by the effective legal documents during the period specified by the execution notice, and the court decided to take the restrictions on consumption measures.

Qixinbao data also showed that on August 2, Nobel Xinli added two new equity frozen information, and the freezing period was as of the end of July 2025.

Caishali Emergency Announcement: The price of 500 million yuan was transferred to the Great Wall Life Life Payment Partnership.

Private equity bosses were forced to execute 550 million yuan, which can be described as "a stone stirring thousands of waves." On the evening of the 4th, Xinzhongli emerged an announcement and explanation involving the progress of arbitration, saying that the Beijing Arbitration Commission was received on June 10th (2022) Beijing Arbitration Decision No. 1537 on June 2, 2022 Essence As the businessmen failed to sort out the documents received in time due to resignation and transfer, the company failed to disclose the notice of the lawsuit in time, and is now supplemented.

According to the announcement of this reissue, the applicant for arbitration is Great Wall Life Insurance, and the respondent is Beijing Xinli Investment Co., Ltd., Beijing Xinli Equity Investment Management Co., Ltd. and Wang Chaoyong. The two parties have previously signed the "Partnership Share Transfer Agreement", agreed that the three applicants to transfer the Great Wall Life Insurance to the Great Wall Life Insurance to the Great Wall Life Insurance Zhongli Yongxin Investment Management Partnership (Limited Partnership) (hereinafter referred to as Yongxin Fund) Partnership share.

According to the arbitration decision made by the Beijing Arbitration Commission, the transfer price of 500 million yuan from Beijing Xinzhongli Investment to the Great Wall Life Insurance Payment Partnership shares and paid overdue payment liquidated damages. Differential supplementary funds and so on. The total execution target is 554 million yuan.

Xinzhongli also stated in the announcement that in response to the above -mentioned arbitration decisions, the company recently negotiated with the relevant matters related to the Great Wall Life Insurance, and will also seek negotiation and promotion of other implementation solutions. At the same time, Xinzhongli will recently submit a dismissal procedure to the court, and does not perform application applications to safeguard the company's legitimate rights and interests. "The demands of this arbitration of Great Wall Life Insurance Co., Ltd. are mainly the fund withdrawal, which will not affect the fund itself, and it will not affect the company's normal production and operation activities for the time being. It will be able to meet the applicant's exit needs. "

According to the China -China Union Kaixinbao data, Yongxin Fund was established in June 2017 and recorded in May 2019. The registered capital and actual payment capital are 1.82 billion yuan. company. Great Wall Life Insurance is one of the funds of this fund, with a shareholding ratio of 27.4725%. In addition, the fund has 6 LP, one of which is Soochow Life Insurance, which is 200 million yuan and 10.9890%of the shareholding ratio. Essence

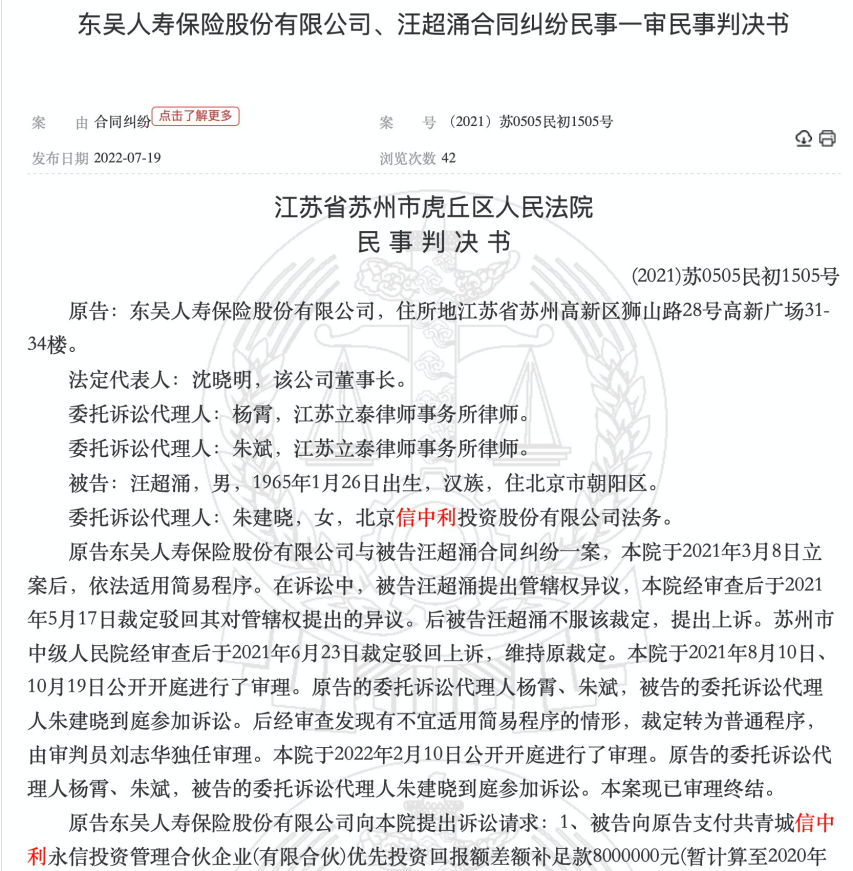

Every reporter inquired the referee document network that in March and April of this year, the People's Court of Huqiu District, Suzhou City, Jiangsu Province made a civil judgment and civil ruling for the first instance of civil junior institution on Soochow Life Insurance and Wang Chaoyong contract disputes. Wang Chaoyong paid Soochow Life Insurance to give a priority return to the return of 24 million yuan and late funds, and ruled that the applicant's applicant Wang Chaoyong Bank's deposit was 17.8018 million yuan or seized and seized its corresponding value.

In a temporary announcement in July, Xinzhongli also disclosed the lawsuit information with AVIC Trust, showing that the court ruled that it had an acquisition price of 617 million yuan in the property share price of AVIC Trust Payment Partnership.The announcement also shows that the lawsuit is still in the appeal stage.If you push the time further, you can also see more Litigation and arbitration information disclosed with investment institutions and companies this year.Wang Chaoyong returned to China in the early 1990s and founded Xinli in 1999. The latter was one of the earliest institutions in China to engage in venture capital and private equity investment. It was listed in the New Third Board in October 2015."Wall Street Prodigy", "China Venture Capital Godfather" and "Investment in the Grand Crocodile" are all labels that have been posted on Wang Chaoyong.And when the hustle and bustle disappears, all signs show that everything is no longer.

Daily Economic News

- END -

Steal with fakes to steal the basement of high -end communities!Taiyuan Police reminds: Do not store valuables in the basement, and make up doors and windows on weekdays

Step in advance and enter the basement after the technology is unlocked. In the meantime, the thief also worked hard to use the prior preparations to prepare the fake noble tobacco and alcohol, and ad

"Li Jian Guarding Lei" enters the campus to take care of the "youth you"

The Hunan Rule of Law News (correspondent Jiang Bowen) In order to protect the hea...