Real estate companies need to take multiple measures to "turn over" debt repayment peaks

Author:Securities daily Time:2022.07.07

Wang Lixin

Housing companies ended for half a year. According to Kerry data, the sales amount of TOP100 real estate companies in the first half of the year achieved a sales amount of 3056.46 billion yuan, a decrease of 50.3%year -on -year. A significant increase of 61.2%.

On the whole, due to multiple factors, the real estate market was not in good results in the first half of the year. Some housing companies blindly expand leverage and are trapped in debt dilemma, leading to the decline in credit and market confidence or reasons for relevant real estate companies. In particular, the issue of 100 billion yuan in debt issues expired in July and August need to be resolved. In a certain sense, these pains must be experienced.

It should be noted that the importance of stabilizing real estate to "stable economy" is self -evident. The reasonable housing demand of "residents has their own houses" and "residents excellent houses" remains to be met, and its market space is still promising. To this end, since March, the country has frequently released positive signals, optimizes the relevant policies of the local property market, activates market demand, and meets reasonable financing of housing enterprises. As relevant policies have gradually implemented, the property market has gradually stabilized, and the sales data of real estate companies in June can be seen.

In the market, the market began to warm up. The real estate enterprise must refuse to "lie down" and strengthen the "hematopoietic" function as soon as possible.

Specifically, the first is to seize the market window period and accelerate the pushing back to the cage funds. The restoration of its own "hematopoietic" function is the optimal decompression channel for real estate companies. At present, the market activity of many key cities in the first -tier cities, the Yangtze River Delta region and the Bohai Rim region is increasing. Housing companies need to adjust the supply system as soon as possible, actively push the goods with effective and compliant marketing methods, and return cash.

The second is to try multi -channel financing. Since the beginning of this year, multiple departments have expressed their support for the reasonable financing needs of real estate companies. Since then, state -owned enterprises and state -owned real estate companies have successively issued debt financing to drive the industry's financing scale to rise; private real estate companies such as Longhu Group and Country Garden have issued billions of yuan in credit bonds.

Third, multi -party contacts transfer their assets. Although handling assets has limited cash flow to housing companies, it is also one of the effective means of incarnation. Perhaps, under the setting of repurchase conditions, housing companies can seek buyers and transfer asset debts to avoid greater negative impacts caused by debt defaults.

In addition, the capable real estate companies can also make the following attempts: First, try mergers and acquisitions loans. This year, the regulatory authorities have repeatedly emphasized that financial institutions have carried out a steady order of mergers and acquisitions in an orderly manner. There are many opportunities for market mergers and acquisitions, and housing companies with advantages in finance can work here. Second, seek financing opportunities in the field of green finance. Since April, the Central Bank and the CBRC have repeatedly mentioned financial support for green low -carbon economic activities. In the real estate field, they can seek green special debt financing opportunities in green buildings and green health real estate. Third, housing companies that match business can pay attention to the financing trend of domestic public offering REITs development and affordable rental housing. On May 27, the CSRC and the National Development and Reform Commission proposed to make policy support for the promotion of affordable rental housing REITs. At present, many housing companies such as Vanke and Longhu Group are deployed here. In the future, they may be able to activate light asset -type activation of holding heavy assets by setting up affordable rental housing REITs.

It may not be easy to overcome the peak of debt repayment, and it takes time to recover in the industry. However, for the real estate market in the second half of the year, it may not be too pessimistic, the signs of stability and stability of the market have now appeared, the industry is in a state of marginal repair, and future development can still be expected.

- END -

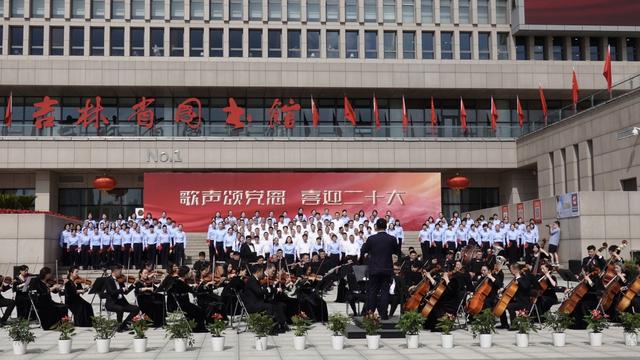

"Welcome to the 20th National Congress, sing and praise the party's grace" outdoor symphony chorus event was held in the Jilin Provincial Library

On the occasion of July 1st, on the morning of June 30, the Welcome Twenty Congres...

Guangzhou Provident Fund Center issued a suspension of business announcements

On June 24th, the Guangzhou Housing Provident Fund Management Center (Guangzhou Provident Fund Center) issued an announcement that due to the needs of the annual epoch of the housing provident fund,